What is collision insurance and what is covered?

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions have no influence on the opinions or assessments of our editors.

There will be more than 5.25 million car accidents reported by police in the United States in 2020, according to the latest data from the Bureau of Transportation Statistics. It’s more than 14,000 car accidents per day.

While it’s a lot of car accidents, we’re going to see a higher number this year. That’s because there has been a 22% decrease in car accidents reported by police in 2020, largely attributed to fewer miles driven during the early stages of the pandemic. It is likely that crashes reported by police will return closer to the average of 6.6 million annually from 2015 to 2019.

And then there are unreported accidents, such as your minor fenders in food parks and drivers accidentally returning to a pole.

All this to say, car accidents are quite common. And if you want car insurance coverage to replace or repair your car after a car accident, you need collision insurance. Without this type of optional coverage, you could be stuck paying thousands of dollars out of pocket.

What Is Collision Insurance?

Contents

- 1 What Is Collision Insurance?

- 2 What Does Collision Insurance Cover?

- 3 What Collision Insurance Doesn’t Cover

- 4 How Does the Collision Insurance Deductible Work?

- 5 How Much Does Collision Insurance Cost?

- 6 Do You Need Collision Insurance?

- 7 Best Car Insurance Companies 2022

- 8 What If Another Driver Crashes Into My Car?

- 9 Collision Insurance FAQ

- 10 Compare Car Insurance Quotes

- 11 Is it cheaper to insure an older car?

- 12 Does car insurance cover the car or the driver progressive?

- 13 When should you drop full coverage on a car?

- 14 Is collision part of full coverage?

Collision insurance pays to replace or repair your car after a car accident, minus your deductible. On the same subject : How much does Car Insurance cost per State?. This is typically an optional coverage, which means you will have to pay extra to add collision insurance to your auto insurance policy.

If you have a car loan or lease, your lender or leasing company will make it more likely that you will need collision insurance.

What Does Collision Insurance Cover?

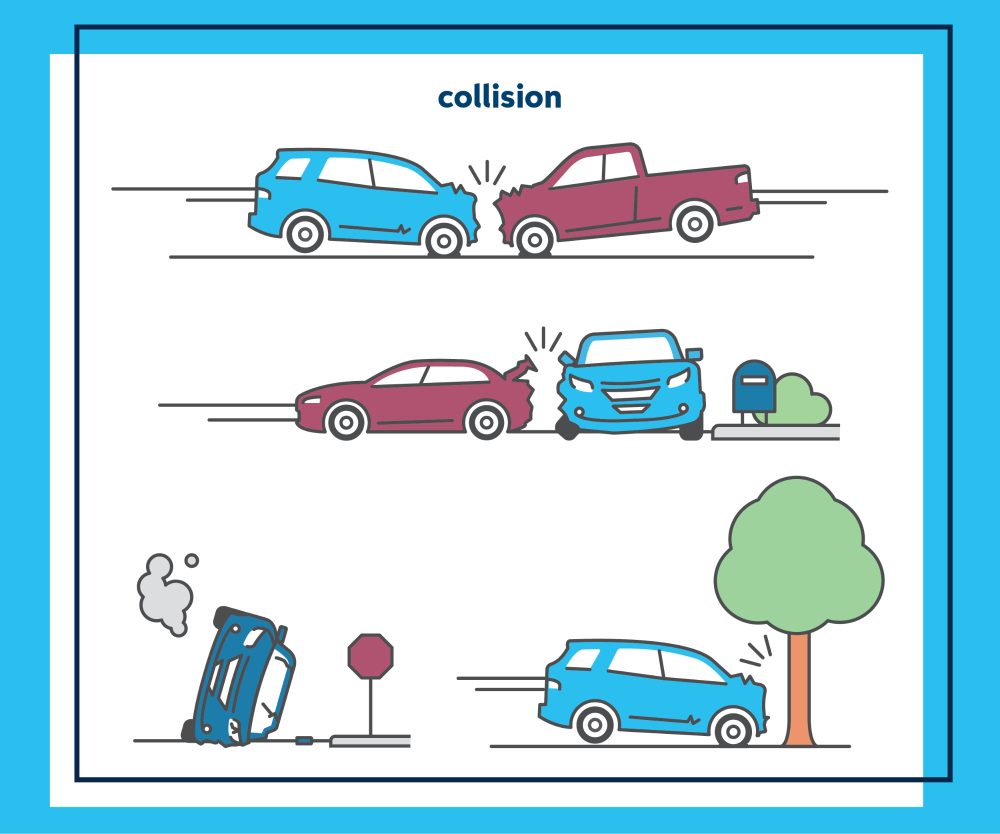

Collision insurance covers car repair bills if your car is damaged in an accident or pays to replace your car if it is fully damaged in an accident, such as: See the article : Car insurance costs are now higher for many Michigan drivers than in 2019 – and less fair for Detroit drivers.

What Collision Insurance Doesn’t Cover

Collision insurance does not cover: On the same subject : A woman calling NBC 6 responds after car insurance doesn’t pay off.

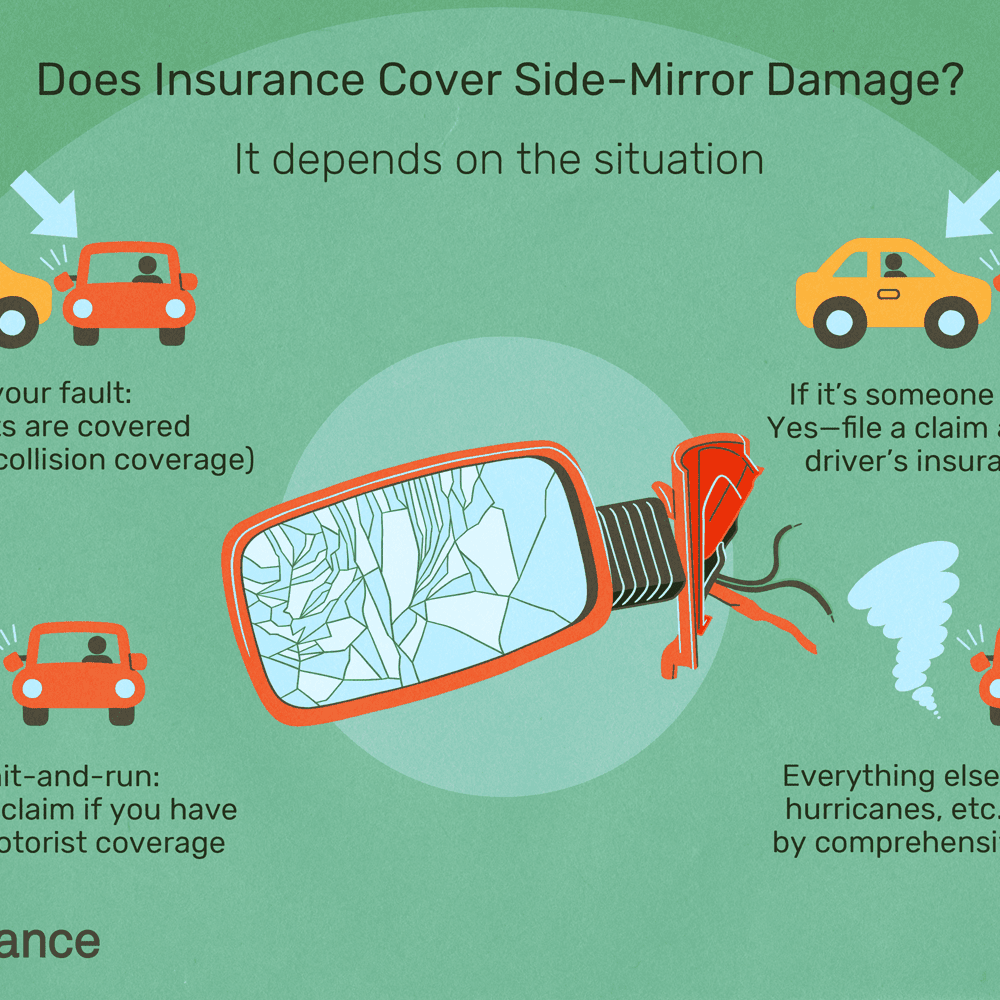

If you want coverage to repair or replace your car for problems such as car theft, flooding, fires, hail, falling objects (such as a tree branch) and encounters with animals, you need to buy complete insurance. Complete insurance is usually sold with collision insurance and is typically required if you have a car loan or rent.

Related: Does full car insurance cover this?

How Does the Collision Insurance Deductible Work?

Your car insurance deductible applies to collision insurance claims. The insurance deductible is the amount that is deducted from an insurance credit check. For example, if you have a $ 500 deductible and your car repair bills after a car accident are $ 3,000, get an insurance check for $ 2,500 ($ 3,000 – $ 500 = $ 2,500) .

When you buy collision insurance, you can choose your deductible amount. Deductible amounts can range from $ 100 to $ 1,000 or higher, with $ 500 being a fairly common choice. If you choose a higher deductible, you will generally pay less in car insurance rates. That’s why your insurer will pay less if you file a collision insurance claim.

How Much Does Collision Insurance Cost?

Nationally, the average annual cost for collision insurance is $ 381, according to the National Association of Insurance Commissioners (NAIC). See the average in your state below.

Average annual cost of collision insurance by state

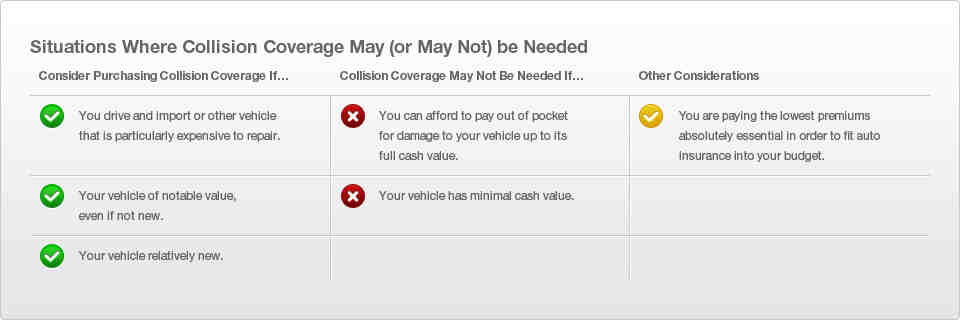

Do You Need Collision Insurance?

If you own your car, collision insurance is an optional coverage, which means you don’t have to buy it if you don’t want to. If you have a car loan or rent, you will probably need to buy collision insurance. This is because your driver or leasing company wants to protect your financial investment if your car is involved in a car accident.

But even if you don’t need to buy collision insurance, it’s worth considering. The national average collision claim was $ 4,601, according to the latest data from the NAIC. If you have caused a car accident and you do not have collision insurance, you do not have coverage for your car repair bills. And if your car is considered a total loss, you will have to pay out of pocket to replace it.

Related: Solves total car insurance problems

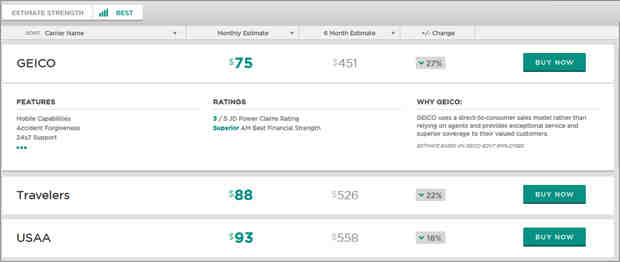

Best Car Insurance Companies 2022

With so many choices for car insurance companies, it can be difficult to know where to start to find the right car insurance. We evaluate insurers to find the best car insurance companies, so you don’t have to.

What If Another Driver Crashes Into My Car?

If someone crashes into your car, you have two choices:

Make a claim on your own collision insurance

Your collision insurance will pay for your car repair bills, minus your deductible. If your car repair bills were $ 3,000 and you have a $ 500 deductible, you will get an insurance check for $ 2,500.

If the other driver is at fault for the accident, your insurance company may be able to get a full or partial reimbursement of your deductible through a process called “subrogation”. Laws for this process vary by state and could take a year (or longer) to resolve.

Make a claim against the other driver’s liability insurance

If the car accident is the fault of the other driver, you can make a claim against their liability insurance. You have to deal with the insurance of the other driver. This process can be a bit complicated depending on the state where you live. That’s because some states have comparative negligence laws for car accidents, which attribute a certain percentage of blame to each driver.

For example, the other driver’s insurance company might decide that their driver is 75% at fault for the accident and you have 25% at fault. In this scenario, the other driver’s insurance company could only pay for 75% of your claim. So if your car repair bills were $ 3,000, you would have to get an insurance check for $ 2,250 ($ 3,000 x 75% = $ 2,250) before your deductible is deducted. Details of how the blame is shared vary by state.

Related: Complicated matters of determining fault after a car accident

Collision Insurance FAQ

When should you drop collision insurance?

Some car owners give up collision insurance when their vehicle reaches a certain age or mileage. The idea is that an older vehicle or a high kilometer has depreciated to the point that the maximum payment for a collision insurance claim (the depreciated value of your car minus your deductible) will be very low and worthless. not the cost of collision insurance at the time.

For example, if you pay $ 400 a year for collision insurance, and your deductible is $ 1,000, you may want to consider dropping your coverage if the value of your car is less than $ 1,400.

But there is no golden rule when it comes to abandoning collision insurance. Some car owners prefer the peace of mind that comes with collision insurance, especially if they don’t have the financial means to repair or replace their car out of pocket.

Keep in mind, if you have a car loan or lease, it’s more likely that you need to have collision insurance and can’t afford your coverage.

Is collision insurance required by law?

Collision insurance is not required by law. But if you have a loan or lease, your lender or leasing company will probably need to have collision and full insurance. That’s why they want to protect their financial investment from problems such as car accidents, car thefts, floods, fires, hail, animal encounters, vandalism and falling objects.

What is the difference between collision and comprehensive insurance?

Collision and full insurance are often sold together, but the two cover car repair and replacement for different types of problems.

For example, collision insurance covers car accidents, such as crashing into another vehicle or guardrail, but it does not cover your car if it is stolen. If you want insurance for car theft and other types of problems, such as vandalism, fire, hail, floods, falling objects, and encounters with animals, you need to add comprehensive insurance to your policy.

Compare Car Insurance Quotes

Compare Car Insurance Quotes

Is it cheaper to insure an older car?

Get Car Quotes Like $ 63 / Month, Compare Free Rates, and Pay Menu For Car Insurance

Get Car Quotes Like $ 63 / Month, Compare Free Rates, and Pay Menu For Car Insurance

Do older vehicles cost more to insure?

Older cars are cheaper to insure than newer cars, everything else is the same. An old insurance policy is more expensive to insure mainly because old insurance policies are less valuable, so an insurer does not have to pay as much in case of a total loss.

Is it cheaper to insure a new or old car?

Why is my insurance higher on an older car? Do older cars cost more to insure? Your rates for full coverage or a collision coverage on an old car may be lower than what you paid for those same covers on a new car that is worth more. That’s because it would have less coverage (lower “coverage limits”) on an older car.

Does car insurance cover the car or the driver progressive?

Consider repair and replacement costs: Older vehicles may cost more to insure, because they can be more expensive to repair due to hard-to-find parts. Consider how much you need to spend to make repairs to your older car.

When should you drop full coverage on a car?

Most of the time, insuring a new car is more expensive than insuring a used car. While this can be a deciding factor for many drivers, there are other costs that come with cars in addition to insurance – monthly loan payments, registration and fees, maintenance and fuel costs.

As long as you give them permission to drive your car, then they must be covered. Their policy extends to your car and covers them the same way as if they were driving their car. Damage caused to other vehicles, property, or even injuries is covered.

When should you not get full coverage?

You must leave full coverage insurance on your car when the cost of insurance is equal to or exceeds the potential payment if a covered event occurs. You may also want to leave full coverage if you want to pay for repairs out of pocket, or if you prefer to replace your vehicle if it is damaged.

What is the number 1 concealer in the world?

What happens when you have full coverage? So what does full car insurance cover? In most cases, it includes liability, full and collision coverage. A complete collision will protect you and your vehicle if you come into an accident. If you are found to be at fault for an accident.

What is full coverage concealer used for?

The 10% rule says you can consider giving up full coverage insurance when the first annual meets or exceeds 10% of the market value of your car. For example, if your car is worth $ 4,000, paying $ 400 or more for full coverage might not be worth it to you.

What is the best full coverage concealer?

The best overall: Nars Radiant Creamy Concealer nicknamed the best by makeup artists and beauty fans, the award-winning formula does everything from contouring and highlighting to color correction.

- It is the definition of complete coverage. So while you can hide dark circles, hyperpigmentation and any imperfections on the skin, it’s still creamy enough to wear under the eyes while looking (and feeling) comfortable all day long. Create a complete look worthy of TikTok with the concealer, if that’s what you’re going for.

- The best full coverage concealers for a flawless finish

- SISTAR COSMETICS Is The Skin Perfecting HD Concealer. …

- TARTEâ „¢ Double Duty Beautyâ„ ¢ Shape Tape Contour Concealer. …

- SMASHBOX COSMETICS Studio Skin Concealer. …

- TRISTIC Mini Concealer Pencil. …

Is it worth it to have full coverage?

JULEP Cushion Complexion Concealer. …

Should I have full coverage on a paid off car?

YENSA BEAUTY SKIN ON SKIN BC Concealer.

Is having full coverage insurance worth it?

Reasons to Maintain Full Coverage If you have a new car model, you probably want to keep full coverage even if you bought it without a loan. Having proper insurance protects your investment in your vehicle and prevents a large out-of-pocket expense if an accident occurs.

Is collision part of full coverage?

Conductors who have repaid their loans are no longer required to provide full coverage. If their budgets have been tightened due to payment for full coverage, then they should have decreased their coverage and premiums. Conductors can bear the costs of a replacement.