What is raising the prices of car insurance?

DALLAS (CBSDFW.COM) – The next time you go shopping or upgrading your auto insurance – there is a good chance you will end up paying more.

Matthew Montemayor is already paying a lot for gas and now, auto insurance too.

“I think my insurance from last year to this year has gone up by another $ 100,” he said. “I think I’m paying around $ 380 a month just for a car ride.”

“I have heard from my big companies and they are raising prices for car insurance,” DFW Insurance Services Owner James Baker said.

Baker Company is the site directory for top insurance agents in the North Texas area. He said within the board, locally, prices have risen to 10-15%.

“Rising prices are just beginning, but there is a lot going on behind the scenes before the crisis starts,” he said.

“So there are still a lot of issues that are increasing prices,” Baker said.

In its 2022 The State of Auto Insurance report, The Zebra, an insurance comparison site based in Austin, stated that you can:

Baker recommended using a telematics program that gathers information about your driving habits. There are several available in the app form on your phone.

“Make a 90-day driving mode, show the company that you are a safe driver and get a reduced tax on that,” he said. “I have companies where you can get up to 30%.

By next year, Montemayor said he was making a change.

“I really think I will try to pay for the first six months ahead,” he said. “Maybe I’ll be comparing prices and seeing if I can get any degree by doing a preventative driving course.”

Raised in Richardson, Erin Jones is proud to call North Texas home.

Contents

- 1 Why is my monthly premium so high?

- 2 What does cost of insurance mean?

- 3 Which of the following could cause your premiums to increase?

- 4 Why do married people pay less for car insurance?

If you have any type of insurance – be it your home, car or health – chances are you have received a letter improvement bill and asked yourself, “Why did my insurance premium go up?” While some premium increases can be attributed to cross-the-board level rises, which happens when insurance and the country … See the article : Many Michigan drivers drop unlimited no-fault insurance – but rates slow down.

What are five factors that affect your monthly income? Other factors that can affect your car insurance premiums, your driving habits, population and covers, limits and exemptions you choose. These may include things like your age, anti-theft items in your car and your driving record.

The average national premium in 2020 for one closure is $ 488 per month, for family closure, $ 1,041 per month, according to our study. See the article : Etap Nigeria has acquired 1.5 million uniforms to facilitate the purchase of car insurance. The Bronze Plan may be best for you if your main goal is to protect yourself financially from the high cost of serious illness or injury and at low cost.

What is a reasonable amount to spend on health insurance?

A good rule of thumb for spending money on health insurance is 10% of your annual income. Thus, there are many factors to consider when considering how much to spend on health insurance, including income, age, health status, and eligibility restrictions.

How much does the average couple spend on insurance?

Health Insurance The average annual coverage for 2019 was $ 7,188 per year, or $ 599 per month. But what if you want a program that also provides sharing to your spouse and children? The average family income is $ 1,714 per monthâ € ”which is $ 20,576 annually.

How much does the average American spend on health insurance 2020?

In 2020, the national average for health insurance is $ 566 per person and $ 1,152 per family per month.

How can I reduce my monthly premium for health insurance? On the same subject : Budget Insurance Launches High-Risk Driver Insurance Plan – PR Newswire APAC.

- You have no control over when you get sick or injured. …

- Determine if you qualify for tax credit. …

- Select HMO. …

- Choose a program that has a high deductible. …

- Select the system that corresponds to the health care account. …

- Related Items.

Putting safety tags in your car and leaving small complaints are just a few ways you can reduce your annual expense. You can reduce your auto insurance premium by adding the deductible component, which you pay if you do so. But, pay as much as you can.

In exchange for health insurance, insurance premiums for you each month. According to a recent Health Survey of ACA plans, in 2020 the average national health insurance premium for the AACA program is $ 455 per person and $ 1,152 per family.

If you have any type of insurance – be it your home, car or health insurance – you may have received a letter improvement bill and asked yourself, â € œWhy have my insurance premiums gone up? € While some increase in premium may be due to board-board rises, it happens when insurance and the country …

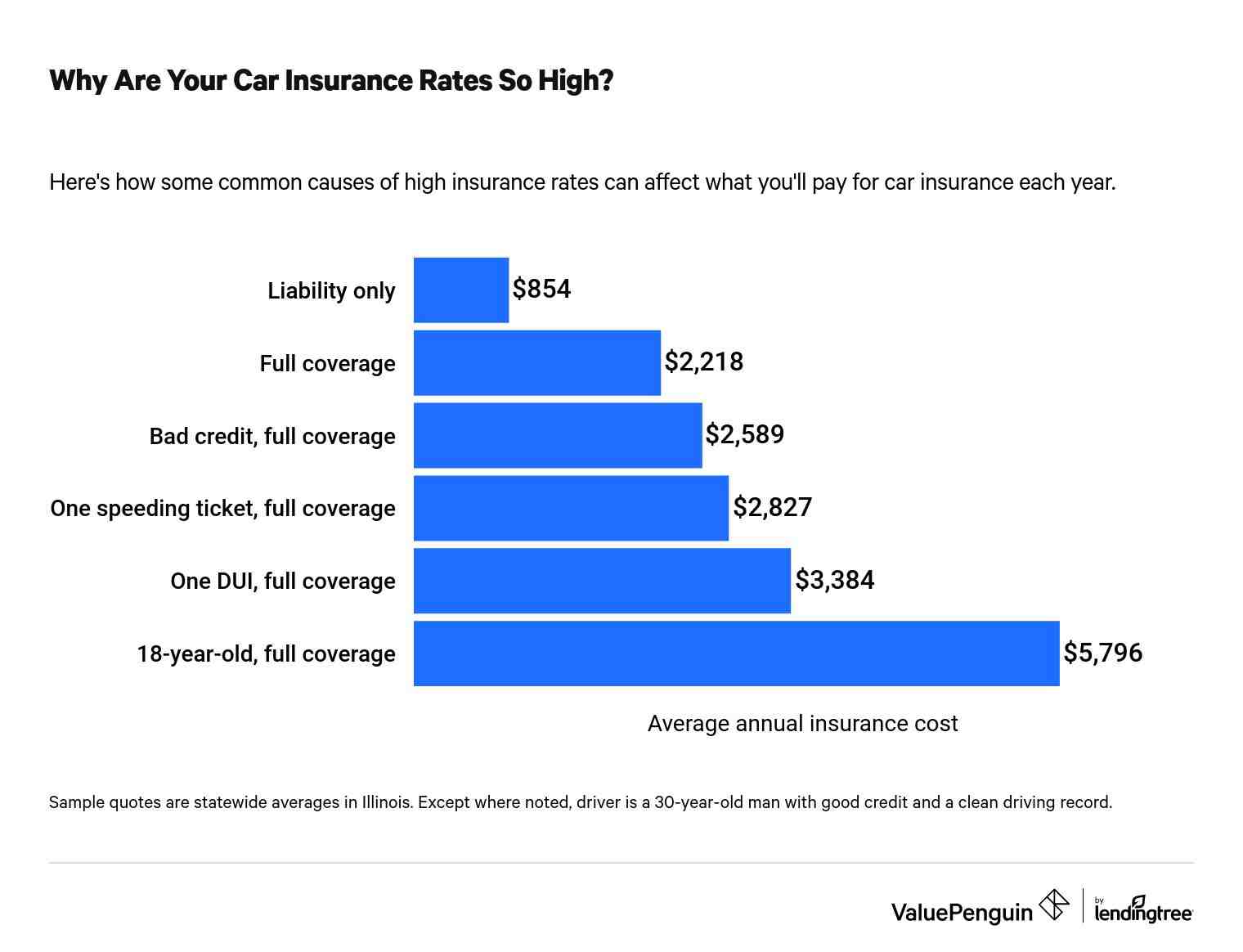

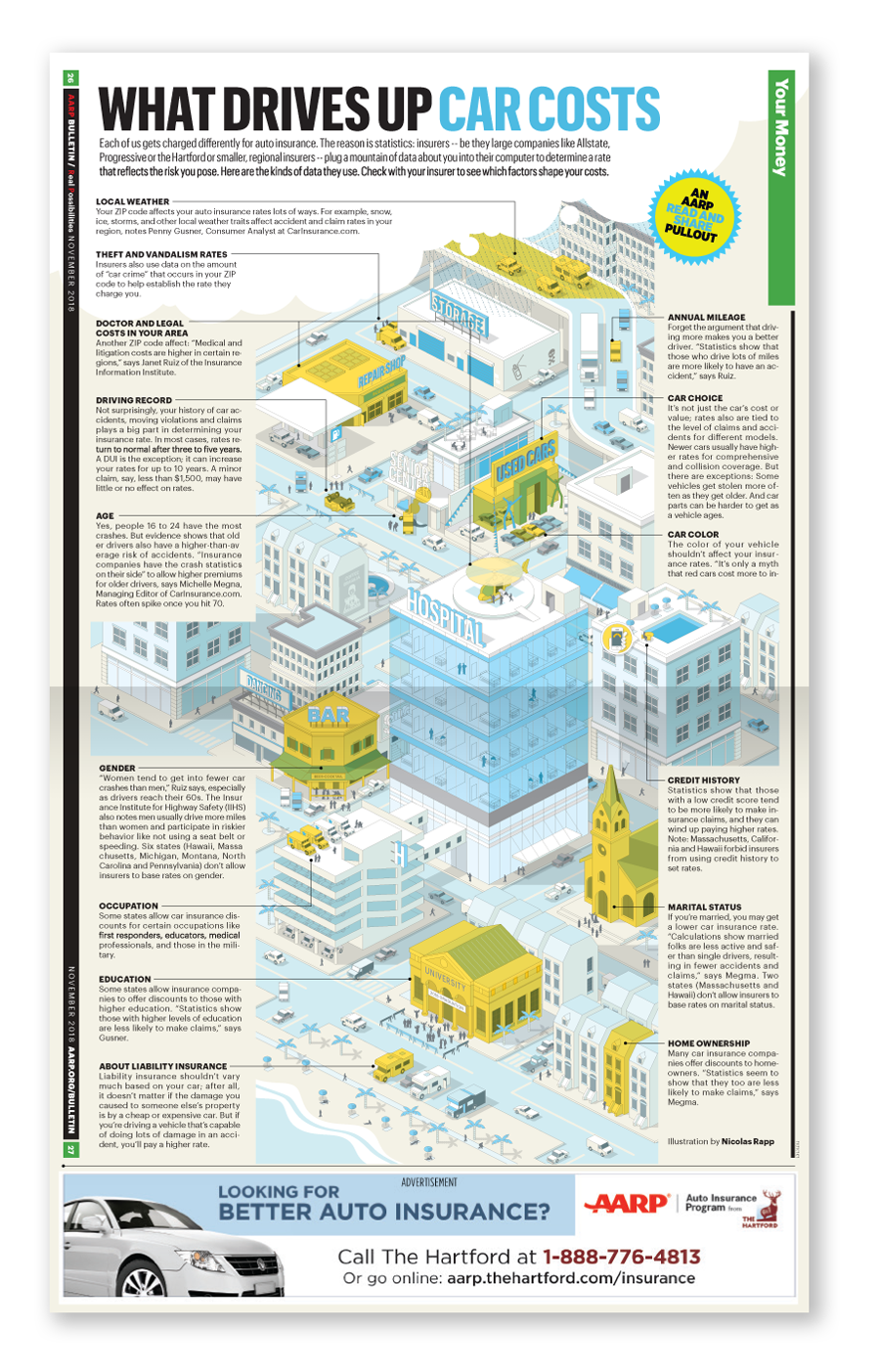

There are a number of reasons why your car insurance is higher than you would like – including having a bad driving record, a history of complaints, and a bad credit history. Also, if you are driving too much, you are driving a car that is said to be unsafe, if you have children in your policy, you may see an increase in prices.

The most common causes of high cost of insurance coverage include your age, driving record, credit history, lock options, the car you are driving and where you live. Anything that insurers can attach to an increased chance that you will be in an accident and file a statement will result in over car insurance.

Car accidents and traffic violations are commonly described as increasing insurance rates, but there are other reasons why car insurance costs go up including change of address, new car, and statements in your zip code.

What does cost of insurance mean?

Insurance price (COI) compensation provided by an insurance company in an indexed universal life insurance policy (IUL) to file death claims. They apply to & quot; emergency & quot; part of the death benefit and comes from the modern age of insurance and the risk class that is working for the insurer.

Is the cost of insurance the same as the premium? Insurance is the amount that an insurance company charges for the insurance you buy from. The cost of insurance is the cost of your insurance.

Why is the cost of insurance important?

Protection from high medical costs Health insurance offers significant financial protection in the event of a serious accident or illness. People without health care meet these prices. This can sometimes lead to uninsured individuals in deep debt or even in bankruptcy.

What does insurance provide and why is it important to have?

Health insurance offers financial protection in the event of a serious accident or illness. For example, a broken leg can cost $ 7,500. Health coverage can help protect you from high, unexpected prices.

Why is the cost of healthcare important?

The cost of medical care is a major factor behind US healthcare costs, accounting for 90 percent of usage. These resources reflect the cost of caring for those with chronic or chronic illnesses, the elderly and the increasing cost of new drugs, methods and technologies.

Why is insurance so important?

Insurance is a valuable asset. It can help you to live life with less stress knowing you will get financial help after an accident or accident, helping you recover faster.

What is cost of insurance based on?

The high cost of life insurance is based on two underlying concepts: death and interest. A third shift is the costly costs that a company adds to the cost of a program to cover operating costs for selling insurance, depositing payments, and paying off debts.

What is insurance based on?

Premium. The price of a policy is its price, which is usually expressed as a monthly price. Payment is determined by insurance based on your personal or business risk, which may include borrowing.

What is cost of insurance life insurance?

The average cost of living insurance is $ 27 per month. This is based on data provided by Quotacy to a 40-year buyer, a $ 500,000 term life policy, which is the most popular length and quantity for sale. But life insurance rates can vary greatly between employers, insurers and policy types.

How much does a $10000 life insurance policy cost?

How Much is the 10000 Life Insurance Policy per month? The cost of $ 10000 life insurance policy will be $ 30 – $ 200 per month. The amount you pay each month depends on a number of factors, including age, gender, and medical history.

What is the meaning of cost of insurance?

Insurance price refers to the amount of premium expected to cover future benefits. As such, it does not include payroll profits and profits.

What is the cost of a $500000 20-year term life insurance policy for someone in good health?

What is the $ 500,000 Term life insurance policy? In 2021, the average monthly life insurance policy of $ 500 to 20 life insurance for a healthy non-smoker smoker is $ 28 at the age of 30; at the age of 40, it is $ 39; at the age of 50, $ 93.

-Your age: younger drivers with less experience and pay higher premiums. – Your mileage: the more miles you drive, the higher the premium. -Your drivingâ € TM record: people with poor driving records pay more than people with good driving records.

What are the factors that affect premium? What are the most important factors in choosing your life insurance rates?

- Age. Age is one of the main factors influencing the cost of life insurance. …

- Gender. …

- Height and Weight. …

- Medical History. …

- Family History. …

- Smoking and Tobacco Use. …

- Work and Interests. …

- Lifestyle Things.

If your debt falls due to an increase in debt, lower interest rates, missed or late payments, excessive debt inquiries, or some other reason, your insurance company may choose to increase your earnings to protect you.

Generally, if you make a statement about your insurance against a certain amount due to an event that seriously affects you, insurance will increase your premium by another percentage.

These reasons may include filing a new application or having a traffic violation added to your driving history, adding or changing a car, increasing or changing the driver and increasing the amount of your lock.

Why do married people pay less for car insurance?

Because married drivers are considered to be financially sound and secure drivers, they often pay less for car insurance. On average, a married driver pays $ 96 less per year for car insurance than a single driver, widow or divorced person.

Is it better to get married to car insurance? According to Balance, insurance companies consider married couples to be safer drivers than their counterparts. Single drivers often drive recklessly and get into an accident, but this is not the only reason why married drivers get better auto insurance prices.

Why is car insurance cheaper for married couples?

Marriage affects the prices of your car insurance because insurers consider married couples to be financially stable and less likely to cover than single drivers, and lower prices accordingly. Insurance covers the same drivers for the same driver, offering both parties the same price.

Is it more expensive to add spouse to car insurance?

Adding your husband or wife to your car insurance may increase the amount you pay, but it should be cheaper than having two different rules unless your partner has a bad driving history. Couples often pay lower prices per person because research shows they are less likely to file complaints.

Is it better to be married for car insurance?

Carriers will almost always give you a break from car insurance for marriage, because married people are considered safe by security guards. But the biggest potential saving will come from overdue design if you insure your two cars on one rule.

Is car insurance less if you are married?

Getting married can make a huge difference in your car. Couples often pay less for car insurance than single people.