“Although you do not need to keep a full supply on your vehicle after it has paid off, you may want to consider keeping it. However, your car insurance will depend on your budget, the condition of the vehicle, and whether you can afford to pay for maintenance on your loss.

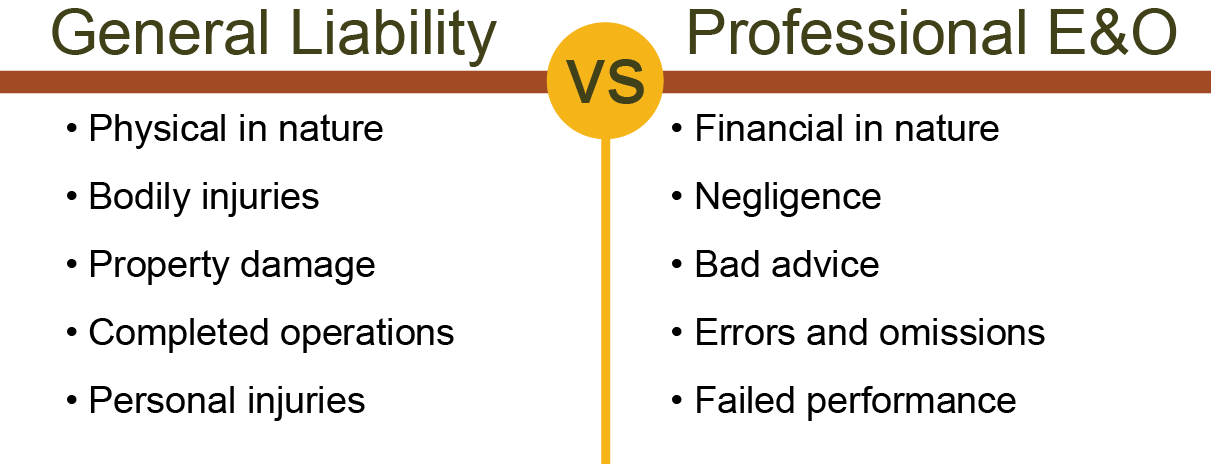

What are the two most common types of liability coverage?

Contents

The three main types of liability insurance are: To see also : 7 Types of Car Insurance and Coverage.

- Overall liability.

- Professional accountability.

- Employer liability.

What are the two most common liability insurances? It is important to note that there are two types of liability insurance: physical injury and property damage.

What is common liability insurance?

There are different types of insurance you can get to help protect your business from liability claims. Read also : Who owns Geico?. Common business liability insurance covers: General liability insurance to help cover claims that your business has caused physical injury or property damage to someone else or their property.

What is the most common liability?

Slip and fall hazards: Slips and falls accidents are the most common type of site liability claim. These can occur when a property owner or manager is unable to properly maintain pavements, stairs or parking lots.

What is typical liability insurance?

Liability car insurance covers the cost of personal injuries and damage to property after an accident that is found to be your fault. With this coverage, your insurance company will pay the bill for other parties’ medical costs and other vehicle or property repairs.

What is the most common liability?

Slip and fall hazards: Slips and falls accidents are the most common type of site liability claim. This may interest you : Another pain point for US drivers: Car insurance costs. These can occur when a property owner or manager is unable to properly maintain pavements, stairs or parking lots.

What is liability only insurance?

The Liability Only Policy covers any legal liability you may incur solely as a result of damage or loss to third parties – including death, injury, and / or property damage in the event of an accident involving your insured vehicle .

What is the name of liability only? Car insurance is liability insurance only covering third party damage or injuries to property in the event of an accident. The term “liability car insurance only” is used to distinguish between policies that have basic cover and those that have collision insurance and comprehensive coverage.

What does it mean to have liability only?

Liability simply means that you only insure bodily injury or damage to someone else’s property. If you are at fault in an accident your insurance will cover the other party’s vehicle and their potential injuries.

What does liability actually cover?

Liability insurance helps pay medical and legal fees if you are held legally responsible for someone else’s injury, or damage to someone else’s property. Drivers are required to carry liability insurance in nearly every state.

Is it okay to just have liability?

You should only have liability insurance if the annual cost of full insurance is more than 10% of the value of your car. At that point, the extra coverage may not be worth the extra cost of paying for more than just liability insurance.

What is an example of a liability insurance?

Physical injury includes any injury to a third party, such as a customer or client, that occurs in your business. For example, if a customer enters your flower shop, slips on your wet floor and breaks his leg, your general liability insurance can help cover the cost of his medical bills.

What are the three 3 main types of insurance?

We will then examine in more detail the three most important types of insurance: property, liability and life.

What are 4 main types of coverage and insurance?

However, there are four types of insurance that most financial experts recommend we all have: life, health, car, and long-term disability.

What are the five types of general liability exposures?

Five types of liability are covered: property, operations, products, completed operations and contractual liability.

Whats the difference between liability and full coverage?

The difference between liability and full coverage is that liability will cover damage to other vehicles or injuries to other people from accidents you cause, while full insurance also covers your own vehicle.

At what point is full coverage not worth it?

A good rule of thumb is that when your full annual payment equals 10% of the value of your car, it’s time to stop the service. You have a large emergency fund. If you have no savings, car damage could leave you in serious strain.

Is liability-only a good idea?

Even if your car is paid for, you should only buy liability insurance if your vehicle is still worth a lot or you are not in a financial position to pay for repair or replacement. Liability insurance alone could also be dangerous if you live in a high traffic area where your vehicle is more likely to be damaged.

What does full coverage usually cover?

Fully insured car insurance is a term that describes having all the major components of car insurance including Physical Injury, Property Damage, Uninsured Motorist, PIP, Collision and Comprehensive. You are usually legally required to carry about half of those covers.

Does engine size affect car insurance?

The size of your vehicle’s engine is one of the factors insurers use to calculate the cost of your premium. Vehicles with lower engine capacity are cheaper to insure than high-power vehicles. The insurance industry uses a system called ‘group rating’ to assess the likely insurance costs for different vehicle models.

What 4 features affect your car insurance rates? Factors that may affect your car insurance premiums include your car, driving habits, demographic factors and the coverage, limits and deductions you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

Does engine type affect insurance?

Yes, engine size affects insurance because insurers take into account specific vehicle details when setting car insurance prices. For example, a car with a larger, more powerful engine is generally more expensive to insure, as it is associated with faster and more dangerous driving.

Does the engine type make a difference in car insurance?

The Engine, Not the Car The difference is clear. The car’s engine power is directly linked to the insurance quotes you get. A car with fewer cylinders is most likely to have lower insurance premiums attached to it.

Does engine swapping affect insurance?

Vehicle modifications are therefore dangerous – you will not have insurance for mods, engines or tranny replacements.

Are v8s more expensive to insure?

Mustang Insurance: How Much It Costs And What Makes Your – This is about $ 500 higher than the national average for a car (4) â € ¦Variable-powered vehicles, such as a V8, will cost more to insure them than a vehicle with them. smaller engine.

Does insurance go up with horsepower?

There’s no denying that the type of car you drive plays an important part in your insurance premiums. Higher horsepower rates, in particular, can significantly increase your rates and may even generate higher deductions as well.

What is full coverage on a car?

Full coverage refers to a collection of covers that cover liability insurance as well as additional types of insurance, such as collision insurance, comprehensive insurance, MedPay, and personal injury protection.

What is the difference between full and comprehensive provision? The difference between full and comprehensive insurance is that full insurance is a car insurance policy that covers comprehensive and collision insurance along with basic state requirements. Comprehensive insurance covers damage to a car due to things other than accidents, such as theft or fire.

What does full vehicle coverage mean?

Fully insured car insurance is a term that describes having all the major components of car insurance including Physical Injury, Property Damage, Uninsured Motorist, PIP, Collision and Comprehensive.

What does full coverage on a vehicle consist of?

Fully insured car insurance is a term that describes having all the major components of car insurance including Physical Injury, Property Damage, Uninsured Motorist, PIP, Collision and Comprehensive. You are usually legally required to carry about half of those covers.

Is full coverage really full coverage?

When people talk about “full guard” car insurance, they often refer to a combination of covers that help protect a vehicle. But, there really is no such thing as “full coverage” for your car. State law requires some coverages (like car liability).

What is the difference between full coverage and?

To simplify, liability insurance covers damage you do to others, while full insurance policies cover your liability and property damage to your own vehicle. Our guide will help you understand the difference between liability and full insurance cover and decide how much protection is right for you.

Is it better to have full coverage?

Typically, it is advisable to purchase full insurance car insurance. Liability insurance will not cover compensation for your own vehicle after an accident where you are at fault. Nor will it include compensation for theft, vandalism or acts of nature.

At what point is full coverage not worth it?

A good rule of thumb is that when your full annual payment equals 10% of the value of your car, it’s time to stop the service. You have a large emergency fund. If you have no savings, car damage could leave you in serious strain.

What is the difference between full coverage and basic coverage?

Full coverage insures you better than basic coverage. This coverage usually includes a more robust set of car insurance policies. Taken together, these policies offer a more complete coverage, compared to minimum basic insurance coverage that states require, and typically include: Comprehensive insurance.

What does it mean to have full coverage?

Many car lenders, agents and dealers describe “full coverage” car insurance as liability along with inclusion and collision. Your lender may use the term “full coverage,” but that simply means that they require you to carry comprehensive and collision, along with anything your state mandates do.

Is full coverage really full coverage?

When people talk about “full guard” car insurance, they often refer to a combination of covers that help protect a vehicle. But, there really is no such thing as “full coverage” for your car. State law requires some coverages (like car liability).

Is it worth it to have full coverage?

Minimum liability insurance is often cheaper, but full insurance protects you from the cost of damage to your car, not just others. If your current car is worth more than the combined cost of a full insurance policy and is deductible, full insurance may be worth the money.

What exactly does full coverage mean?

Fully insured car insurance is a term that describes having all the major components of car insurance including Physical Injury, Property Damage, Uninsured Motorist, PIP, Collision and Comprehensive. You are usually legally required to carry about half of those covers.