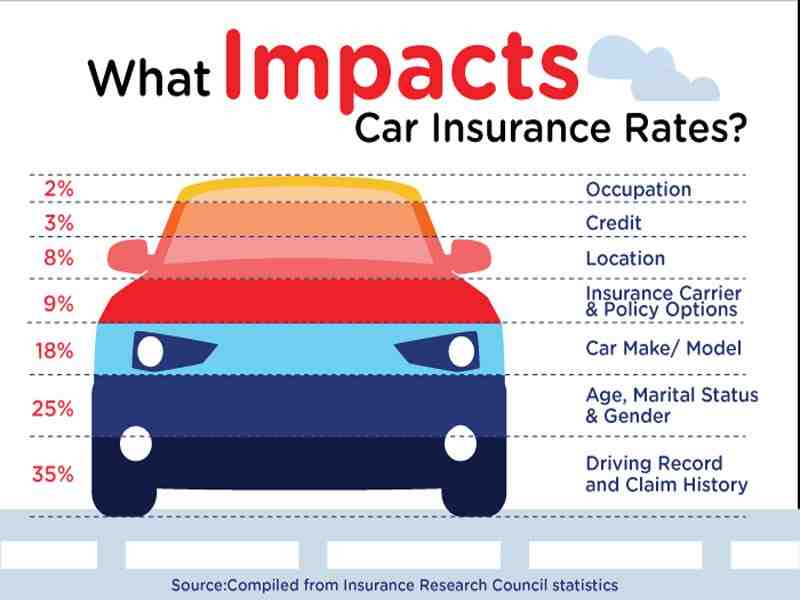

Some common factors that insurance companies evaluate when calculating your insurance premiums are your age, medical history, life history, and credit score. Insurance companies also employ actuaries or statistics to get a better idea of the number of insurance premiums they should charge a particular client.

Do insurance companies try to trick you?

Contents

- 1 Do insurance companies try to trick you?

- 2 What is a car insurance premium?

- 3 What are 3 insurances that everyone should have?

- 4 How do car insurance companies know about previous claims?

Often, the insurance company offers you a lowball solution to deceive you into believing that it is the most you are entitled to. On the same subject : Florida car insurance among the most expensive in the United States. While this offer may seem tempting at first, insurance companies almost always offer you only a fraction of what your case actually costs.

How do insurance companies know if you lied? Number of Accidents in the Past While it may be tempting to lie to a new insurance provider about your driving record, there is a good chance they will find out the truth. Insurance companies check your driving record after submitting an application for coverage.

Can insurance investigators lie to you?

Can Insurance Adjusters Help You? Yes, insurance adjusters are allowed to lie to you. In fact, many are even encouraged to do so. On the same subject : Shreveport car insurance is up 25 percent this year, according to the study. An adjuster can tell you that their driver is not responsible for the accident when they know they are.

Can insurance agents lie to you?

Generally, yes. If an insurance company knowingly lied to a client, it can often be held liable for any emotional or punitive damages suffered by the plaintiff.

What happens if insurance finds you lying?

Insurers may deny coverage upon request if they find that the information you have provided is incorrect. Since lying on an insurance application is a form of fraud, you may also face civil penalties, such as fines, community service, and even jail time, depending on whether your insurer charges charges.

How do you scare insurance adjusters?

The best way to scare insurance carriers or adjust them is to have a lawyer by your side to fight for you. Don’t settle for less.

Do insurance companies try to get out of paying?

Insurance companies will seek to reduce or eliminate payments for injuries caused by the actions of an insured person. To see also : Car insurance costs are now higher for many Michigan drivers than in 2019 – and less fair for Detroit drivers. After being injured, the victims of the accident want nothing more than to go through the traumatic experience.

Do life insurance companies try to get out of paying?

Often, however, life insurance claims are denied for a variety of reasons. Quickly, a life insurance claim can be paid, denied, or delayed. So, yes, life insurance companies can deny claims and refuse to pay and if you’re here, there’s a chance you’ll be in the same situation.

Can an insurance company refuse to pay out?

Unfortunately, you may have a valid claim, and the other driver’s insurance company refuses to pay for it, you need to follow it up or even involve an insurance lawyer. Some insurance companies are paying benefits slowly but eventually settling the claim.

Why do insurance companies refuse to pay?

Insurance claims are often denied if there is a fault or liability dispute. Companies will only agree to pay you if there is clear evidence that their policyholder is to blame for your injuries. If there is any indication that their policyholder is not liable, the insurer will deny your claim.

Do insurance companies cheat you?

The main way insurance companies deceive people is by offering lowball recovery amounts after car accidents. Instead of providing full coverage, companies will offer lowball amounts in hopes that customers will take the bait and sign the deal.

What percentage of insurance claims are false?

According to insurance fraud stats from the Property Casualty Insurers Association of America, at least 10% of payments made by insurers are based on fraudulent claims.

Do insurance companies make mistakes?

Insurance companies often make mistakes for their own benefit so that they do not have to pay policyholders what they should receive. However, policyholders were known to make mistakes because they did not know better.

Can insurance drop you for lying?

Intentionally lying to your insurance company is a form of fraud, and can result in fines, community service, or even jail time. If you lie to your insurance provider, you may be denied coverage, quoted higher rates, or face penalties such as fines, community service, or even jail time.

Your insurance premium is the amount you agree to pay for the detailed coverage in your policy, which is usually the same amount as the quote you received. If you are wondering how to determine what your annual premium will be, it is best to get a quote.

What is an insurance premium and how does it work? Everyone knows insurance costs money, but one term that may be new when you start buying insurance is “premium”. Typically, the premium is the amount paid by a person (or business) for policies that provide car, home, health, or life insurance coverage.

What is it? Premium is the amount of money your insurance company charges for the plan you choose. It is usually charged monthly, but can be charged in a number of ways. You must pay your premium to keep your coverage active, regardless of whether you use it or not.

| Factor | Annual premium | Monthly premium |

|---|---|---|

| Premium amount | Bigger | Smaller |

| Discounts | Possible | Not available |

| Number of Payments | 1 per year | 12 per year |

Monthly premiums vs. are paid once a month, on the date of your billing cycle. While premium sharing is better for some budgets, missing payments may risk expiring the policy. With annual premium payments, you pay only one lump sum to your insurer each year.

If you need to make a claim on your insurance you will be charged a deductible, which can be confusing as you are already paying your premium. The difference is that your premium is a regular expense that you pay monthly, quarterly, or annually, depending on the arrangement you have with your insurance company.

Definition of premium (Entry 1 of 2) 1a: reward or compensation for a particular act. b: a sum above a regular price paid mainly as an incentive or incentive. c: an advance of or in addition to the face value of any bond that may be called a six per cent premium.

Definition: A premium is an amount paid periodically to the insurer by the insured to cover his risk. Description: In an insurance contract, the risk is transferred from the insured to the insurer. To take this risk, the insurer charges an amount called a premium.

An insurance premium is the amount of money that an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover health, car, home and life insurance. Once it arises, the premium is income for the insurance company.

The average national cost of insurance is $ 65 per month for minimum coverage, or $ 785 per year. Your rate will vary depending on where you live, what type of coverage you have and your driving history.

The national average premium in 2020 for one coverage is $ 448 per month, for family coverage, $ 1,041 per month, according to our study. A Bronze Plan may be right for you if your main goal is to protect yourself financially from the high cost of illness or serious injury and still pay a modest premium.

Is 100 a month for car insurance good?

$ 100 a month for good car insurance? The average annual rate for 100/300/100 total coverage and $ 500 crash and deductible is $ 1,758. That’s about $ 146.50 a month. So if you are able to find a policy for less than that amount, such as under $ 100, it will be considered an affordable rate.

| Post | 2021 | Percent change |

|---|---|---|

| California | $ 426 | -2% |

| Colorado | $ 351 | 2% |

| Connecticut | $ 580 | 0% |

| Delaware | $ 540 | 1% |

What are 3 insurances that everyone should have?

Tenant insurance offers reassurance to tenants in case their personal property is damaged due to covered losses.

- Long-Term Disability Insurance. …

- Life Insurance. …

- Health Insurance. …

- Homeowner Insurance. …

- Car Insurance.

What insurances do most people have? Of the health insurance coverage subtypes, employment-based insurance was the most common, covering 54.4 percent of the population for some or all of the calendar year, followed by Medicare ( 18.4 percent), Medicaid (17.8 percent), direct purchase coverage (10.5 percent), TRICARE (2.8 percent), and Department of …

What is Assurance Maladie in France?

“Assurance Maladie” pays the healthcare professional directly for the appointment or medical procedure. Pharmacists can use the “third party payment” system, which means that the patient does not pay the full advance payment if they show the health insurance card (“Vitale card”). ).

What is the CPAM in France?

CPAM means Caisse Primaire d’Assurances Maladie, and is the level of the local department of the national health insurance administration. Unless you are already working in France, you will need to live here for three months to establish a residency before applying.

What is France’s healthcare system called?

Like other European Welfare States, France has a universal healthcare system. This is largely funded by the government through a national health insurance system.

Do I need a mutuelle in France?

To cover all the € 40, you will need a 200 per cent mutual reimbursement. And the same goes for all medical treatment. Note that more expensive mutuelles will pay back 400 percent.

What does PUMA mean in France?

Universal health protection (PUMa), a system for expatriates residing in France.

Who is entitled to CMU in France?

The main function of the CMU (couverture maladie universelle) is to grant healthcare rights to French and others who have been living in France for at least three months in a stable and legal manner, to whom they are not entitled through paid work, self. employment or being a state pensioner.

Do I need a Mutuelle in France?

To cover all the € 40, you will need a 200 per cent mutual reimbursement. And the same goes for all medical treatment. Note that more expensive mutuelles will pay back 400 percent.

How do I register with CPAM in France?

To register, you will need the Cerfa (Declaration de Choix du Médecin Traitant) form. Both you and your doctor will need to fill it out and sign it. The doctor will also need to stamp it to make it official. Once this is done, send it to your local CPAM office.

What is the difference between PUMA and CPAM?

Expatriates retired from the EEA who are covered by their S1 health insurance are not part of the PUMA, as they are covered directly by their country, with the administration of their coverage carried out by the local health authority. (CPAM). They do not pay any PUMA fees.

Who is eligible for PUMa in France?

The French universal healthcare system (PUMa) guarantees coverage of healthcare costs for all individuals who: are working, or. have been living in France (including Guadeloupe, French Guiana, Martinique, Reunion Island, Saint Barthelemy and Saint Martin) on a stable and continuous basis for at least 3 months.

What is CPAM France?

CPAM means Caisse Primaire d’Assurances Maladie, and is the level of the local department of the national health insurance administration. Unless you are already working in France, you will need to live here for three months to establish a residency before applying.

What is the PUMa system in France?

The PUMa applies to all people who work in France, or who are resident in France on a stable and regular basis. PUMa offers health care coverage in case of illness or pregnancy without any extra paperwork. This system replaced the universal health coverage (CMU) scheme in 2016, making coverage simpler to obtain.

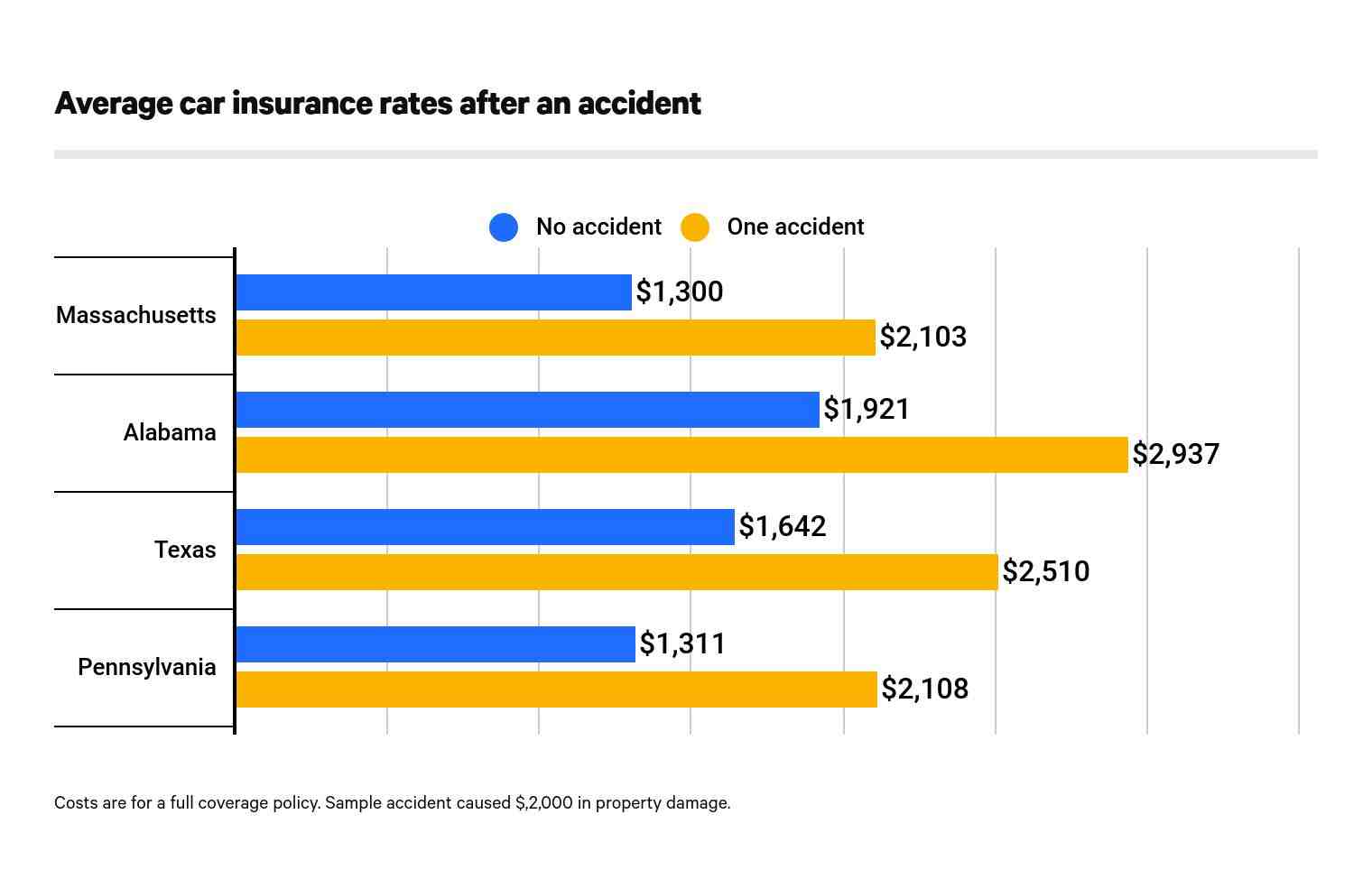

How do car insurance companies know about previous claims?

There are a few ways to check your claim history. It may be best to ask your existing car insurance provider for details of any claims you have made in the past. This information may include the date of any claim, the type of claims, how much was paid, and details of any injury.

What database do car insurance companies use? Each time you make a claim for car insurance or homeowners insurance, your insurer adds the accident to the CLUE or A-PLUS report. These databases are run by external agencies – LexisNexis for CLUE and Verisk Analytics for A-PLUS. If your insurer is a customer of both, you can use both reports.

Do insurance companies talk to each other about claims?

Answer provided by While car insurance companies do not speak directly to each other, they share information. All car insurance companies can access your claim history through a database called the Comprehensive Loss Underwriting Exchange (CLUE). They will also use other similar statistics to assess your risk.

Do insurance companies report to each other?

Yes. There are specialized consumer reporting agencies that collect information about the insurance claims you have made on your property and casualty insurance policies, such as your homeowners and homeowners insurance policies. -car.

Do insurance companies contact each other after accident?

After a car accident, you may receive a phone call from the other driver’s insurance company, no matter how clear the other driver was through the crash. Even in situations where you are at fault, the other driver’s insurance company may still contact you.

Should you talk to the other insurance company?

It is always best to let your insurance company handle all matters directly with the other insurance company involved in an accident claim. You are not required to discuss any details of the claim with the other insurance company. This is especially important when it comes to personal injury claims.

How do insurance companies know my information?

Insurance companies will ask for personal information such as your Social Security number and date of birth to confirm your identity. They may also want to know what your salary is because they may limit how much insurance you can get based on your annual earnings.

How do insurance companies get my information?

There are specialized consumer reporting agencies that collect information about the insurance claims you have made on your property and casualty insurance policies, such as your homeowners and homeowners insurance policies. -car. They can also collect driving records.

Yes, insurance companies share information. Most insurance companies â € œsubscribeâ € to service and purchase reports one at a time for underwriting and pricing purposes. Motor vehicle records and CLUE reports are most commonly pulled by insurance companies when determining rates.

How do insurance companies gather data?

Property and casualty insurance companies are collecting data from telematics, agent interactions, customer interactions, smart homes, and even social media to better understand and manage data. relationships, claims, and their subscription.

Can insurance company see previous claims?

Insurers can check the driver’s claim history using C.L.U.E. if the driver wants a quote. Claims history information is important for insurance companies because drivers with a history of claims, especially fault claims, pose a greater risk to insurers.

Do insurance companies know about past claims?

Yes, it is true. Insurance companies share claims information in a database called the Comprehensive Loss Underwriting Exchange (CLUE) to help them assess the risk of a claim when applying for a policy.

How long do claims stay on CLUE report?

Requests generally remain on a CLUE report 5-7 years from the date of filing.

Yes, insurance companies share information. Most insurance companies â € œsubscribeâ € to service and purchase reports one at a time for underwriting and pricing purposes. Motor vehicle records and CLUE reports are most commonly pulled by insurance companies when determining rates.