What is a comprehensive insurance?

Contents

Full coverage helps cover the cost of damage to your vehicle when you are involved in an accident that is not caused by a collision. This may interest you : Is car insurance really necessary?. Comprehensive coverage covers losses such as theft, vandalism, hail and the beating of an animal.

What is the difference between full coverage and comprehensive insurance? The difference between full coverage and comprehensive insurance is that full coverage is a state auto insurance that includes comprehensive insurance and collision insurance along with the minimum requirements of the state. Comprehensive insurance covers damage to a car other than non-accidents, such as theft or arson.

What’s the meaning of comprehensive insurance?

Comprehensive insurance is coverage that helps you replace or repair your vehicle if it is stolen or damaged in the event of a collision. Read also : Which is a type of insurance to avoid?. Comprehensive coverage, sometimes called “non-collision”, usually covers damage from fire, vandalism, or falling objects (such as trees or hail).

Is comprehensive insurance good?

Comprehensive insurance is considered a good investment because it is cheaper than other car insurance and covers events that are beyond your control as a driver. A good rule of thumb is that if the cost of comprehensive insurance exceeds 10% of the value of your vehicle, you may want to consider giving up.

What is insurance class 11?

Insurance is a contract between the insured and the insured, where the insurer agrees to repair the loss of the insured in the event of an event by taking into account an ordinary payment called a premium.

What are the 4 types of insurance?

The different types of general insurance are motor insurance, health insurance, travel insurance and home insurance.

What are the main types of insurance? Don’t be afraid … We’ll share everything you need to know about each of these types of insurance.

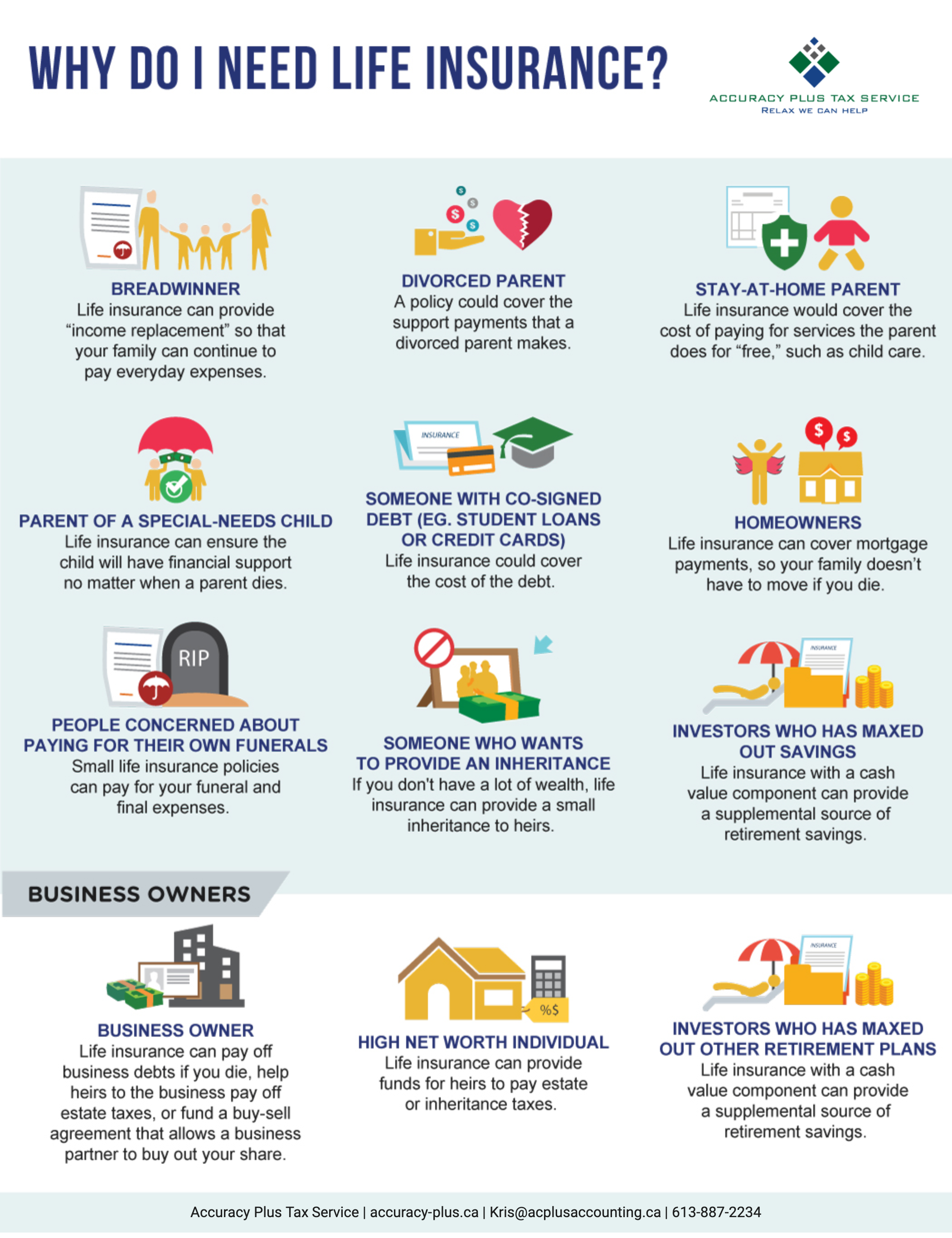

- Life Term Insurance. …

- Car insurance. …

- Homeowners ‘/ Renters’ Insurance. …

- Health insurance. …

- Long Term Disability Insurance. …

- Long Term Insurance. …

- Protection from Identity Theft. …

- Umbrella politics.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are all five types that everyone should have.

What are the 5 parts of an insurance policy?

Each insurance policy has five parts: declarations, insurance agreements, definitions, exclusions and conditions. Many policies have a sixth part: guarantees. Use these sections to review policies as guidelines. Examine each part to identify its key provisions and requirements.

What are 4 main types of coverage and insurance?

Bottom line. Most experts agree that life, health, long-term disability, and auto insurance are all four insurance policies you need. Always check with your employer that coverage is available as soon as possible.

What are the 6 main types of insurance?

Six car insurance coverage is common: self-liability coverage, uninsured and underinsured drivers coverage, comprehensive coverage, collision coverage, medical payment coverage, and personal injury protection. Depending on where you live, some of these coverage are mandatory and some are optional.

What are the 3 types of insurance?

Next, we will look more closely at the three most important types of insurance: property, liability, and life.

What are the five major types of insurance?

Bottom line Home or property insurance, life insurance, disability insurance, health insurance, and auto insurance are all five types that everyone should have.

What is insurance its type?

Insurance policies may cover medical expenses, vehicle damage, business losses, or travel accidents, and so on. Life insurance and General insurance are the two main types of insurance. General insurance can be categorized into several types of policies.

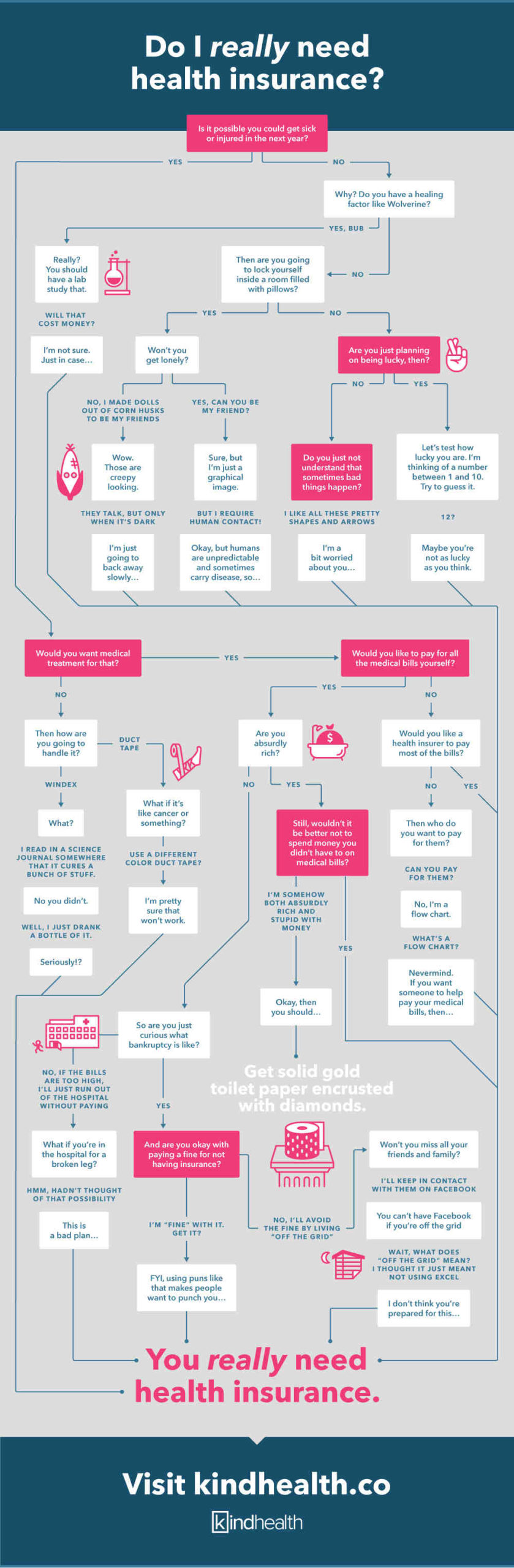

Why insurance is needed?

Need for Insurance Insurance plans are beneficial for anyone who wants to protect their family, property / property and themselves from financial risks / losses: insurance plans will help you avoid medical emergencies, hospitalization, illness and treatment and pay for the necessary medical care. the future.