Why Do Drivers Want More Car Insurance?

Is it a good idea for drivers to buy more than the minimum insurance?

The minimum amount of auto insurance could leave drivers with far less protection than they need

Contents

- 1 The minimum amount of auto insurance could leave drivers with far less protection than they need

- 2 Drivers can help protect themselves with additional coverage

- 3 Ensure you are selecting the right car insurance coverage

- 4 How can I lower my car insurance premiums?

- 5 What are the 3 types of car insurance?

- 6 When you purchase all five basic types of auto insurance in a single policy it is called?

- 7 What are three factors that impact your health insurance premiums and why?

There is a simple reason why it is often the best financial choice for drivers to buy more insurance than is required. See the article : Car insurance costs determined on the basis of an assessment News pressrepublican.com. In fact, it may be wiser to buy more insurance, as the insurance required is actually too low to protect the driver’s property.

If the driver buys the minimum amount of insurance, it is likely that any type of serious accident will cause more damage than the insurance pays. Responsible insurance covers harm to others. If the driver causes a major accident and injures several people – especially severely – the victims of the accident may pursue a claim for more damages than the insurance would cover. The driver may be left out paying extra out-of-pocket expenses.

That is not the only case where there is a significant loss if the person has only the minimum insurance. If the driver buys liability insurance only, the policy will only cover the damages caused by others. But many other things can go wrong. The car could crash, for example, or be damaged by snow. Or it could be an accident caused by someone else with very little insurance to pay for the loss.

Drivers can help protect themselves with additional coverage

If the driver wants to be protected from this other potential source of great loss, it is necessary to purchase additional insurance which is not usually required. This may include accident insurance that pays for the repair or replacement of a lawyer’s car when it goes wrong, comprehensive insurance that covers the cost of theft or injury not related to the accident, and uninsured or uninsured driver who pays for the injury. This may interest you : 2022 Car Insurance Overview – Forbes Advisor. caused by the driver who caused the accident but who has adequate insurance.

Finally, every driver should consider the potential for loss if they buy only the minimum insurance, and seriously consider buying more than the minimum order to get the full protection they need.

Ensure you are selecting the right car insurance coverage

Car insurance is something that most people do not think about regularly. While there are several factors that drive people to change car insurance carriers, it is important to educate yourself to make sure you choose the right insurance. Proper coverage means you do not have to pay for unwanted insurance and you do not have to take out insurance which makes sense for your personal situation. While pricing is a big issue, we also consider other factors such as customer service and claim process when choosing what we think are the best car insurance providers.

Below is a list of other things you can do to reduce your insurance costs. This may interest you : Responsibility Vs. Comparison of car insurance with full coverage.

- Shopping around …

- Before you buy a car, compare insurance costs. …

- Ask for more deductions …

- Reduce car insurance. …

- Buy from your homeowners and car insurance for the same insurance. …

- Maintain a good record …

- Take advantage of short distance discounts.

Are you fined for terminating car insurance? Cancellation fee: Many car insurance companies do not charge a cancellation fee, but some do charge a fee of $ 50, or something called a “short rate”, which is 10% of the remaining amount you agree to pay during the policy period.

Can you cancel vehicle insurance at any time?

Most car insurance policies say you can cancel your policy at any time. You only need to send a written notice including the cancellation date. It is always a good idea (and in most cases conditional) to notify your old insurance when you move to a new insurance policy.

Are promo codes legitimate?

Legal coupons will always come from a legitimate source. Fraudulent coupons circulating on Facebook or appearing in your email may seem real, but they will not come from the official social media site, website, or email account of the company.

What is the code for promo?

Advertising codes are a combination of letters and numbers that contain a unique code. This code can be accessed on ecommerce to get a discount on a product or service such as free shipping. It is a marketing strategy that gives customers another reason to buy.

Can you hack promo codes?

The expert can force the code in the site by trying all the alphanumeric values for a specific length (usually 4 to 10 characters). Simply put, this technique is feasible but is strongly dependent on the processing power available.

How do I unsubscribe from Mutuelle France?

You can cancel the policy anyway, but it is best to do it on a folded registration paper. Where there is an online contract, all you need to do is send an e-mail, to which the insurer will respond, although you will need to monitor it to make sure there are no delays. .

How do I cancel my French car insurance?

What documentation do I need to abolish car insurance in France? If you sell your car in France, you will need to send a Declaration de Cession signed by both parties to your insurance company. You should write ‘Vendue’, as well as the date and time of sale of Carte Grise (French log).

Is French car insurance valid in UK?

Do I need car insurance to drive a foreign driver in the UK? Yes, valid car insurance is a legal requirement in the UK, even if you are just visiting.

Can you cancel car insurance in France?

Cancellation of contract and change of provider Because car insurance in France is mandatory, the policies will automatically renew after the first 12 months and will do this every year until you cancel. When you sign a contract, you have 14 days to cancel it without being fined.

What are the 3 types of car insurance?

The three types of car insurance offered worldwide are liability, comprehensive insurance, and accident insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured driver / insurance, but are not available in every state.

What is the minimum type of car insurance? Liability insurance-only is the cheapest type of car insurance for most drivers. It is cheaper because it only covers the cost of harming or injuring others you are at fault for.

What is the most basic car insurance coverage?

While different governments order different types of insurance and there are several additional options (such as differential insurance) available, most basic car policies include: liability for personal injury, personal injury protection liability, property damage, collision, complete and uninsured / driver.

What is basic insurance on a car?

Basic car insurance is a policy that includes only liability insurance. It helps cover the damage you can do to other people and their property. This may include medical bills, property repairs or legal violations. Almost every state has a minimum car insurance limit for their drivers.

What is the lowest level of car insurance?

Full car insurance is the minimum car insurance plus accident, full and PIP (unless your state requires it). No state requires drivers to carry an accident or comprehensive insurance, but those who can, may qualify.

What are the 5 basic types of auto insurance?

The most popular types of car insurance include liability, conflict, personal injury protection, uninsured and uninsured driver, comprehensive, and medical payments.

What are the 3 components to automobile insurance?

Most car insurance policies consist of three main components: liability insurance liability insurance, liability liability insurance liability insurance and insurance not covered by car / insurance.

What three types of auto insurance coverage are the most important to have?

Now, there are a lot of different types of car insurance. The most important are responsibility, full coverage and conflict. I will call it the Big Three. Think of them as the basicsâ € ”the cover you canâ & # x20AC; & # x2122; t be able to do without.

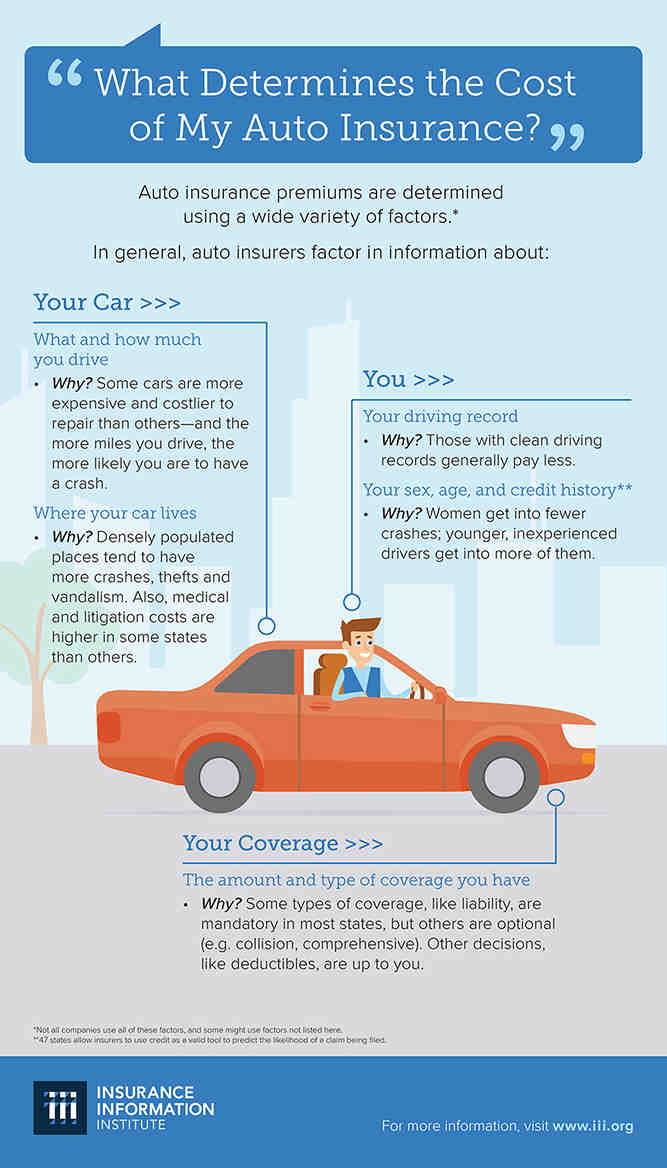

What 3 factors determine the cost of your auto insurance?

The main factors influencing the cost of car insurance are state insurance requirements, age, and car insurance. The more insurance you need to buy in your state and the more expensive your car is, the more you will pay for car insurance.

What are the most important types of car insurance?

The most popular types of car insurance include liability, conflict, personal injury protection, uninsured and uninsured driver, comprehensive, and medical payments.

What is the best car insurance type to get?

Comprehensive car insurance provides the highest level of insurance available. If you own a new or expensive car, or often travel with expensive technology or car parts, this may be the type of policy for you. Complete insurance usually covers: Damage to someone else’s car or property.

What type of insurance is most important for driving?

Car liability insurance is mandatory in most states. Drivers are legally required to purchase at least the minimum amount of liability insurance set by state law. Liability coverage consists of two parts: Liability for personal injury can help you pay for injuries related to another person if you have an accident.

When you purchase all five basic types of auto insurance in a single policy it is called?

When all five basic types of car insurance are purchased in one policy, it is called comprehensive insurance.

What is the difference between public and private insurance? Quick take: What is the difference between completion and conflict? Comprehensive provides coverage of events beyond your control that are not caused by an accident, such as weather, vandalism and theft. Coverage coverage is injury from a car accident or other object.

What are the 5 basic types of auto insurance?

The most popular types of car insurance include liability, conflict, personal injury protection, uninsured and uninsured driver, comprehensive, and medical payments.

What are 4 main types of coverage and insurance?

Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have.

What is basic auto insurance called?

Basic car insurance is often called liability insurance. Requirements vary by state, but basic car insurance can be divided into two major types of liability insurance: personal injury and property damage.

What is the most basic car insurance coverage?

While different governments order different types of insurance and there are several additional options (such as differential insurance) available, most basic car policies include: liability for personal injury, personal injury protection liability, property damage, collision, complete and uninsured / driver.

What is a comprehensive insurance?

Comprehensive coverage helps cover the cost of damaging your car when you are involved in a non-accidental accident. Complete coverage covers losses such as theft, vandalism, hailstones, and beatings of animals.

What is comprehensive insurance example?

Complete covers that damage your car due to something other than an accident. For example, complete can cover fire damage, theft, vandalism, tornadoes, floods, falling objects, etc. It does not cover technical damage, normal tears, or repairs.

What is the difference between full coverage and comprehensive insurance?

The difference between full coverage and full insurance is that full coverage is a car insurance policy that includes both comprehensive and conflict insurance with state minimum requirements. Comprehensive insurance covers car damage from things other than accidents, such as theft or fire.

Five factors can affect the monthly plan fees: location, age, tobacco use, plan segment, and whether the plan covers those who depend on it. FYI Your health, medical history, or gender may not affect your insurance coverage.

What are the three reasons for the increase in the cost of health care in the United States? Five factors contribute to rising health care costs in the United States: (1) overcrowding; (2) older people; (3) changes in the spread of disease or events; (4) an increase in the number of times people use health care services; and (5) increasing the cost and strengthening of services.