Why is AAA insurance so expensive?

Why are all my car insurance quotes so high?

Contents

- 1 Why are all my car insurance quotes so high?

- 2 How do you beat a car salesman at his own game?

- 3 Is Triple A worth it Reddit?

- 4 Is Costco Auto Program price negotiable?

Common causes of overpriced insurance rates include your age, driver’s record, credit history, coverage options, which car you drive and where you live. Anything insurers can associate with an increased likelihood of having an accident and claiming compensation will result in higher car insurance premiums.

Why is car insurance so expensive now? But the pandemic continues to move the industry, so insurance costs are now expected to increase this year. See the article : Florida car insurance among the most expensive in the United States. Lack of supply chain and manpower, high demand for new and used cars, increasing reckless driving behavior, and even natural disasters have created the perfect storm for price jumps.

Why is my insurance so high all of a sudden?

Recent Accident or Claim If you have made previous claims or been involved in other accidents, you are more likely to see your rates rise. This is because the number of damages and accidents in your records affects how risky the insurance company considers you. On the same subject : How auto insurance claims are deposited. However, you should always apply, even in the event of a minor accident.

Why did my insurance increase so much?

Because car insurance is designed to pay for post-accident costs â € ”including property damage and medical costs â €” anything that increases these costs is likely to increase rates. Insurers must ensure that they have sufficient funds to pay damages, so that when inflation hits, it affects car insurance rates.

Why did my car insurance go up out of nowhere?

Car accidents and traffic offenses are common explanations for increasing the insurance rate, but there are other reasons why car insurance premiums are rising, including a change of address, a new vehicle, and claims in your zip code.

Why am I getting so many car insurance quotes?

Accident history, speeding fines and DUI can obviously increase your car’s insurance rates, but you’ll also get higher insurance prices if you don’t already have a driver’s license. To see also : Which car insurance plan is best?. If you don’t drive often, you may want to consider car-based insurance as a way to reduce your insurance costs.

Are car insurance quotes accurate?

Car insurance prices are as accurate as the information you provide. The more accurate the information you are willing to share about yourself, the closer your insurance offer will be to the actual price of the policy.

Why do insurance quotes increase?

Car accidents and traffic offenses are common explanations for increasing the insurance rate, but there are other reasons why car insurance premiums are rising, including a change of address, a new vehicle, and claims in your zip code.

Why is there so many car insurance ads?

Companies are competing for customer loyalty, trying to prevent consumers from switching to another provider. Car insurance providers run several campaigns at once to entertain viewers, making the brand seem both desirable and reliable, and the best choice when buying a new policy.

What do you do if your car insurance is too high?

What you can do to lower car insurance rates

- Drive carefully. If you avoid trouble on the road and do not cause any serious damage to your insurer, your rates may fall over time. …

- Increase your credit score. …

- Go to class. …

- Arrange your insurance policies. …

- Shop around.

What are some things that can cause your insurance to go higher?

Some of the factors that can affect your car insurance premiums are your car, your driving habits, demographic factors and coverage, restrictions and deductibles that you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

How do you beat a car salesman at his own game?

10 Tips For Negotiating How To Beat The Sellers In Their Own Game

- Learn dealer words. …

- This year’s car at last year’s price. …

- Working replacements and rebates. …

- Avoid false fees. …

- Use accurate numbers. …

- Keep sellers in the dark about financing. …

- Take advantage of the home field. …

- Monthly payment trap.

Is Triple A worth it Reddit?

If it’s $ 99, then yes, it only pays off for DMV services. It’s cheaper per month than the roadside assistance offered with my insurance, plus I wouldn’t have to contact my insurance company if I use it.

Why is Triple A so cheap? AAA is so cheap because the company offers a wide selection of discounts that almost everyone can get. The AAA minimum coverage policy costs an average of $ 66 per month, and AAA premiums can be made even cheaper by using discounts such as a full payment discount and a security inspection discount.

Why is Triple A so good?

AAA not only provides assistance to stuck drivers, but also offers discounts on car rentals, vacation packages, mobile services and much more. Depending on where you live and the level of coverage you choose, an annual AAA membership can range from about $ 52- $ 170.

Is Triple A still worth it?

AAA roadside assistance pays off if the driver has multiple cars, an older car or a car with frequent mechanical problems. AAA roadside assistance can also be valuable if the driver plans to use AAA discounts frequently or wants wide coverage on the road.

Is Triple A reliable?

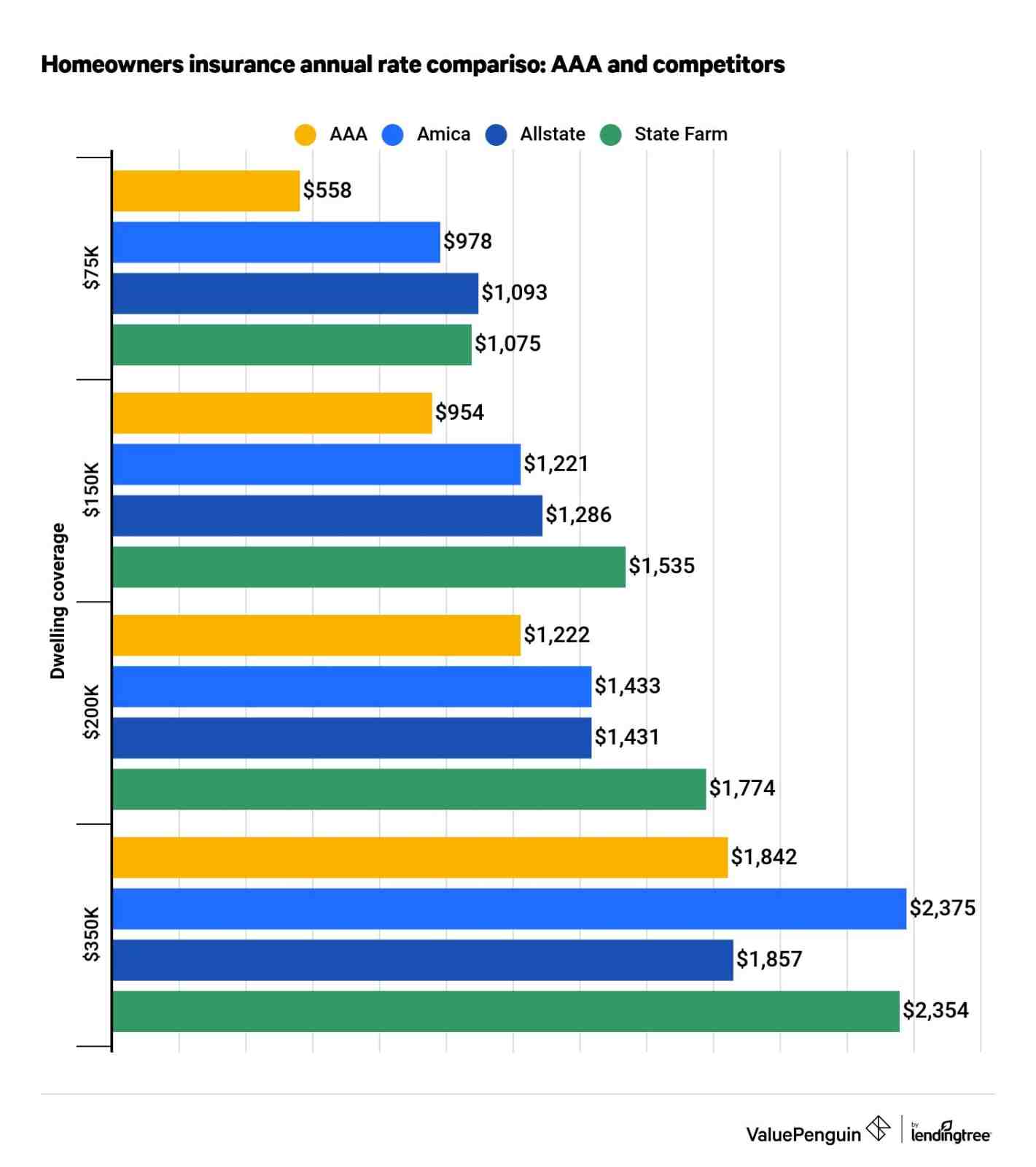

AAA is a pretty good insurance company that has built a reputation for providing its members with reliable policies at affordable prices, with the help of generous discounts. In addition to car insurance policies, homeowners and life insurance, AAA offers coverage for boats, motorcycles, pets and more.

Is Triple A still worth it?

AAA roadside assistance pays off if the driver has multiple cars, an older car or a car with frequent mechanical problems. AAA roadside assistance can also be valuable if the driver plans to use AAA discounts frequently or wants wide coverage on the road.

Is AAA overpriced?

AAA is so expensive because it doesn’t write its own insurance policies. Each regional AAA club operates independently and sells insurance policies signed by different agencies, so rates can vary significantly.

Can you negotiate with AAA?

AAA Auto Buying offers a hassle-free experience and discounts through its authorized dealers. But there may be a processing fee and a membership is required for the purchase.

Can I buy AAA and use it right away Reddit?

The benefits of a basic AAA membership are available to members immediately upon joining. Plus and Premier service takes effect 7 days after payment for registration or upgrade.

Is Costco Auto Program price negotiable?

One of the best parts of buying through Costco Auto is that you don’t have to haggle around the price. Prices have already been agreed for you. You can’t see the final price on the Costco website; however, once you make a decision, you can see the Costco price list only for members for the vehicle you want.