Why Texans’ car insurance rates are rising

AUSTIN (KXAN) — “I’m just tired of spreading my money left and right,” said Jasan Gibbons.

Sitting in his guitar workshop, ATX Guitarworks on Jones Road, he realized it was becoming increasingly difficult to keep running.

He faces a potential rent increase at his store and believes the economy is affecting his customers.

“You have to set priorities that prioritize pretty low. So, the people who come through the door are sometimes few and far between,” he said.

Gibbons is also seeing a surge in personal bills. His car insurance rose nearly 25% when he renewed his policy about two months ago.

“Like ‘I don’t think so,'” he recalled thinking. “I have no records. I’ve never had a parking ticket. I’ve never had a ticket.”

Gibbons said a Progressive insurance agent told him the increase was due to inflation.

Rich Johnson of the Texas Insurance Council said it was the biggest factor driving rates up in the industry this year. He said Texans are seeing a 20% increase on average.

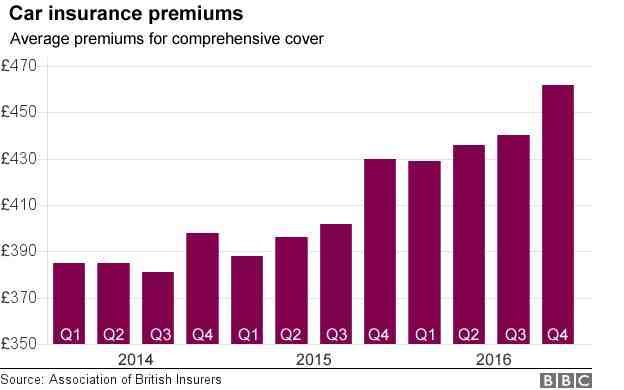

Johnson said that although interest rates have risen steadily since around 2017, it is a bigger increase than usual.

“During the pandemic, we’ve seen used car prices skyrocket. These are costs that are covered by insurance in the event of damage or a total loss. And we really haven’t seen those prices drop too much,” Johnson said.

Joe Lamping, the owner of Flamingo Automotive on Guadalupe Street, said he saw repair costs increase by 10-15%. He also pays his crew more.

“You need a living wage to live in this city,” he said.

According to insurance company Progressive, demand for auto technicians exceeds supply by 5:1, which also drives up labor costs. Lamping said repair times were also up.

“There are problems in the supply chain, we find that parts that were readily available are not always available when we need them,” Lamping said.

He said more people are also getting repairs as supply chain problems and inflation have discouraged them from buying new cars.

“We’re seeing a shift from our customers who are considering buying new cars and wondering if we can keep that car driving for a few more years. Most of the time we can do that,” Lamping said.

He said people would usually want a new car once they hit 100-120,000 miles. Now his customers are trying to get closer to 200,000 miles or more.

This year, Lamping said they are seven to nine days behind on repairs. In previous years it was two or three days.

Inflation costs, labor costs, supply chain and repair delays — Johnson says these are all factors behind the rising rates.

“If your car is in the shop, say five days longer than it was three years ago, that’s five extra days your insurance company will pay for that rental vehicle,” Johnson explained.

He also said that the rise in catalytic converter thefts will factor into your insurance rate.

“The latest statistics are from 2021, there were around 15,000 thefts of catalytic converters, as opposed to 2019 where there were around 3,400. That’s a huge increase,” Johnson said.

He said prices for catalytic converters “have skyrocketed” because of the presence of minerals like platinum in them.

“The precious metals in it are mined abroad, some of them in Ukraine and around Russia,” he said.

According to Johnson, stolen converters not only cause headaches and costs for customers, but also for insurance companies because they usually represent a covered loss.

“And not only are you replacing that catalytic converter, you have to go in that car and saw it off. So those are repairs that you have to do on top of the cost of the actual catalytic converter,” he explained.

Kelley Blue Book, an automotive company, said replacing a stolen catalytic converter and repairing car damage caused by a theft can result in an insurance claim of $3,000 or more.

“I probably ride 4,000 miles a year, max,” said Gibbons, who has no plans to race with Progressives again. “Well, I don’t know, it’s just another example of things getting out of control.”

It means spending less money on food and entertainment, including his childhood passion for playing the guitar.

“I’m tired of just paying and paying and paying and… feeling helpless,” Gibbons said.

Tips

Contents [hide]

- 1 Tips

- 2 How can you lower your car insurance?

- 3 Will car prices go down with inflation?

- 4 Does credit score affect car insurance?

- 5 Is 300 a month a lot for car insurance?

Johnson suggests calling your auto insurance company to check your deductibles. On the same subject : Which car insurance plan is best?.

“Maybe you have too much cover on your car,” he said. “If you have a student, do they have good grades? Take a defensive driving course, pay the $75 or something, you might save a few bucks.”

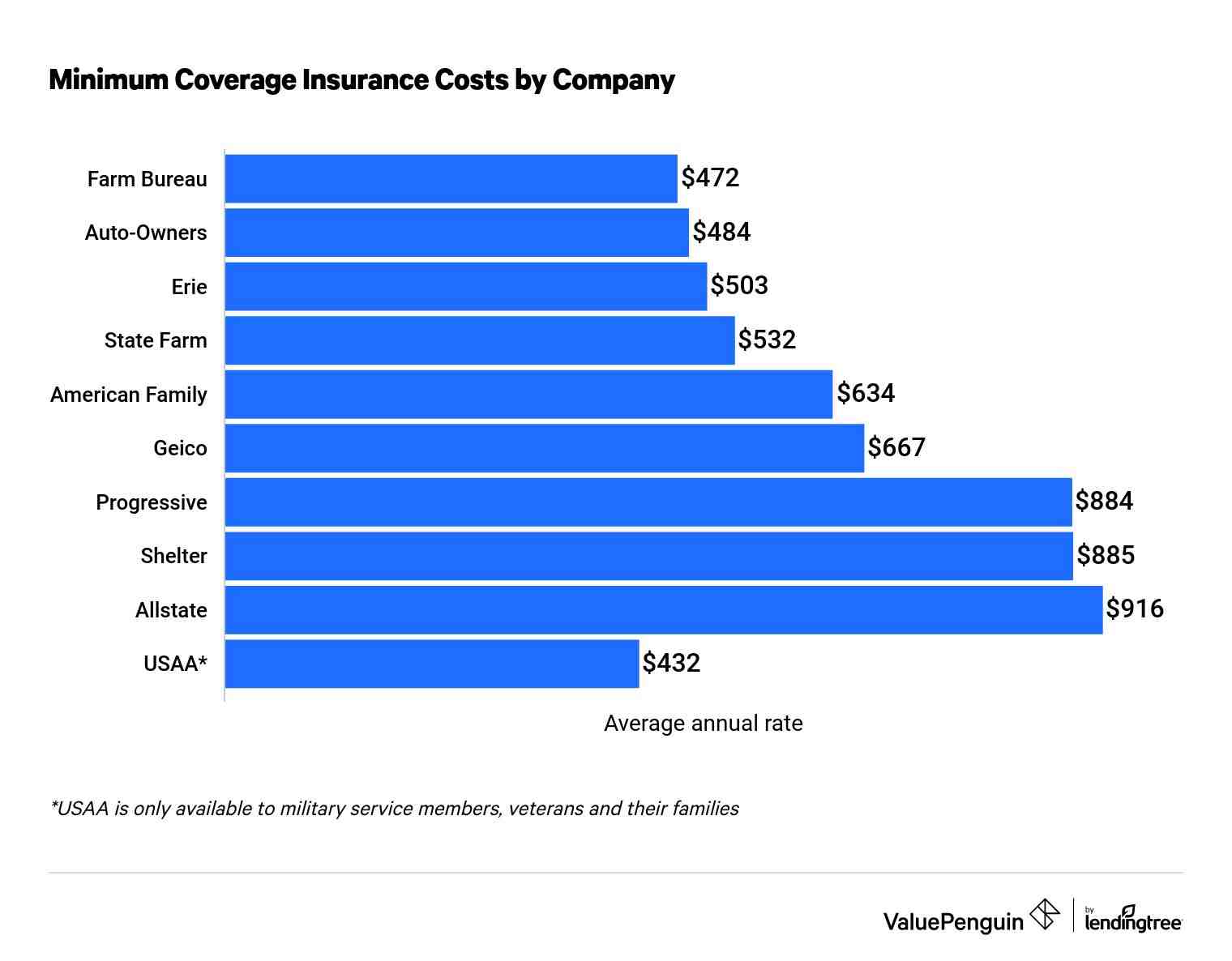

Johnson said Texas also has a large and competitive insurance market.

“We have hundreds of companies that underwrite insurance. So… the most important thing we tell people is to shop. Go online … have an insurance agent shop for you, shop on your behalf from multiple companies,” he said.

Lamping said if you plan on keeping your current car longer than intended, try to allocate a maintenance budget for it.

“Things always wear out, things always need maintenance and replacement. So we’re really trying to get our customers into a maintenance program where we can leave the budget and planning to them, and that way we can keep this car and maintain it and make it a solid, reliable means of transport for many years to come,” he said .

How can you lower your car insurance?

Here are some ways to save on car insurance1 This may interest you : Insurance increases after ticket for failing to stop on a school bus.

- Increase your deductible.

- Look for discounts that you qualify for.

- Compare car insurance quotes.

- Maintain a good driving record.

- Participate in a driving safety program.

- Take a defensive driving course.

- Explore payment options.

- Improve your credit score.

Should car insurance go down every year? Does car insurance decrease over time? Yes, car insurance decreases over time. You may find that your car insurance rates drop as you get older or have teenage drivers on board. And you may get discounts if you buy insurance for three to five years with the same company.

Is Progressive insurance really cheaper?

Is Progressive good car insurance? Progressive’s average auto insurance premiums are only slightly below the national average. See the article : Class-action lawsuit claiming Geico overcharged for auto insurance to move forward. But compared to the other insurers in our list of the best auto insurance companies of 2022, Progressive’s average rates are relatively expensive.

What are factors that cause car insurance to be high?

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

Several metrics go into the price of an insurance premium, including age, state and county of residence, and coverage.

Factors that determine the premium you pay for your car include your gender, age, marital status, where you live, and a financial background check. These factors play a role as statistics collected by insurers show that they affect the likelihood of accidents or other incidents.

Will car prices go down with inflation?

While new car prices fell -1.4% in September from the all-time high in August, they are likely to stay elevated until the end of 2022 as inflationary pressures persist, before easing slightly in 2023.

.

Does credit score affect car insurance?

Your credit rating is an important factor in determining the rate you pay for car insurance. Better credit often gets you a better interest rate, and worse credit makes your coverage more expensive. Bad credit could more than double insurance premiums, according to a nationwide analysis of top insurers.

Is 300 a month a lot for car insurance?

Yes, $300 a month for auto insurance is expensive. The average cost of auto insurance ranges from about $60 per month for minimum state coverage to $166 per month for full coverage, although individual auto insurance rates vary based on factors such as driving habits, age, and location.

How much is the insurance for a 300,000 car?

Is $100 a month good for car insurance?

It’s definitely possible to get liability insurance for less than $100 a month. This is the minimum coverage required by most states and is generally the cheapest way to insure your vehicle.

How much is car insurance in Texas per month?

Compared to drivers nationwide, Texas drivers are estimated to pay $149 more than the national average cost for auto insurance. According to Bankrate’s annual study of reported premiums, Texas drivers pay an average of $1,868 a year, or $156 a month, for comprehensive insurance.

Why is car insurance so expensive?

The combination of densely populated urban centers, high healthcare costs, expensive auto repairs, and the state’s severe weather and natural disaster risks all contribute to California’s higher than average insurance premiums.

Is 200 a month too much for car insurance?

Yes, $200 a month for auto insurance is pretty expensive, especially for the minimum coverage. The average cost of auto insurance ranges from about $60 per month for minimum state coverage to $166 per month for full coverage.

Is 100 too much for car insurance?

A good minimum liability insurance is 100/300/100. Keep in mind that many insurance companies offer much higher levels of coverage, with 250/500/250 being the policy options available from multiple insurance companies across the country.

What is the 80/20 rule in car insurance?

Is 100 month too much for car insurance?

Is $100 a month good for car insurance? Yes. The average cost of a monthly auto insurance premium, based on a 2022 report by Insure.com, is $140 per month. $100 a month for auto insurance is below average and cheaper than what most people pay.

Is 100 dollars a lot for car insurance?

It’s definitely possible to get liability insurance for less than $100 a month. This is the minimum coverage required by most states and is generally the cheapest way to insure your vehicle. In fact, the average rate for minimum state insurance is $511, or about $43 per month.

What is the normal monthly payment on car insurance?

The national median cost of auto insurance is $1,630 per year for 2022, according to NerdWallet’s rate analysis. That equates to an average car insurance rate of about $136 per month.