Does GEICO really save you 15?

Contents

- 1 Does GEICO really save you 15?

- 2 Who owns GEICO?

- 3 What is GEICO digital pay?

- 4 How long does GEICO check take?

Moreover, in many countries even a quota of 25% percentile may be cheaper than the average GEICO price. However, as this analysis shows, GEICO can honestly claim that it saves you over 15% on your car insurance. Read also : Which is a type of insurance to avoid?. And if you only need 15 minutes to get a discount, that’s the story for another day.

Can switching to GEICO really save you 15% or more on car insurance? GEICO proudly reciprocates to those who give so much to their country. Active employees, retired from the army or members of the National Guard or reserves may be entitled to a discount of up to 15% on certain car insurance coverage.

Did you know that in 15 minutes you can save 15% or more on car insurance?

GEICO. A fifteen-minute call can save you fifteen percent or more on car insurance. This may interest you : Can GEICO save you 15 percent or more on car insurance?. GEICO. Fifteen minutes could save you fifteen percent or more.

Can GEICO save you 15 percent or more on car insurance commercial?

Geico’s marketing strategy through Geico ads can save you 15% or more on car insurance.

Is GEICO’s slogan true?

Geitz’s famous slogan, “Fifteen minutes could save you 15% or more on car insurance,” said his gecko mascot, is now part of American culture. In 2020, he announced the transition to a new slogan: “GEICO: The right service, the right savings”.

Does GEICO take 15 minutes?

GEICO’s GEICO customer service promises to help customers save up to $ 500 in 15 minutes if they sit down to get an offer online or by phone. The company delivers when it comes to low rates with decent coverage.

Can 15 minutes really save you 15 percent?

Although GEICO claims that fifteen minutes can save you fifteen percent on insurance, this only applies to certain drivers who change insurance companies. This may interest you : Does GEICO increase rates?. … The best way to save money on insurance is to compare online shopping for free offers.

Does GEICO really take 15 minutes?

Although GEICO claims that fifteen minutes can save you fifteen percent on insurance, this only applies to certain drivers who change insurance companies. Finding out if GEICO is really saving you money or not depends on your driving record and the type of coverage you need.

Does 15 minutes really save you 15 or more on car insurance?

What does 15 minutes save you 15 or more?

Common words used in GEICO advertising include “15 minutes could save you 15% or more on car insurance” and “trust 75 years.”

How much money does GEICO save you?

Of course, one of the fastest ways to save money is to switch car insurance to GEICO. After all, it only takes 15 minutes to get an offer, and new GEICO customers say they save an average of over $ 500 a year.

Is GEICO really the cheapest?

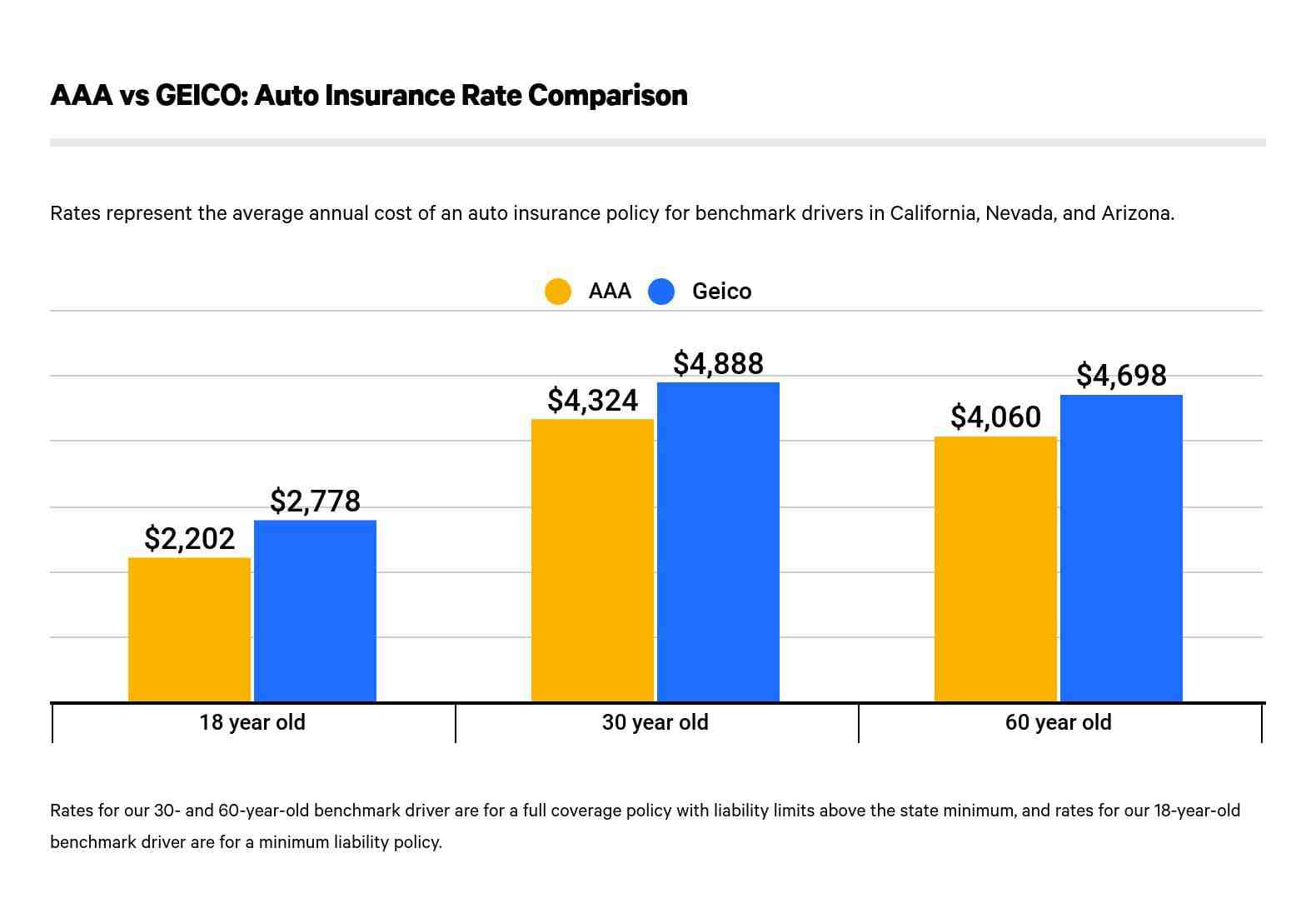

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for the minimum liability policy. It is 35% cheaper than the national average. The average cost of insuring a car with minimal coverage in California is $ 604 a year, or $ 50 a month.

How much do people save with GEICO?

Car insurance. Of course, one of the fastest ways to save money is to switch car insurance to GEICO. After all, it only takes 15 minutes to get an offer, and new GEICO customers say they save an average of over $ 500 a year. At GEICO, we work hard to keep rates as low as possible.

Is it worth switching to GEICO?

Yes, Geico is a good car insurance company for most drivers. Our annual car insurance rate study found that Geico is one of the cheapest car insurers in the country, ranked second on our list of cheapest insurance companies, and manages to keep premiums low while still offering good customer service.

Who owns GEICO?

GEICO is a wholly owned subsidiary of Berkshire Hathaway that by 2017 provides coverage for more than 24 million motor vehicles owned by more than 15 million policyholders. GEICO writes private passenger car insurance in all 50 U.S. states and the District of Columbia.

Is Geico owned intact? Intact Financial Corporation completes acquisition of JEVCO Insurance Company.

Is Geico an American company?

The Civil Servants Insurance Company (GEICO / ˈɡaɪkoʊ) is a private American car insurance company based in Chevy Chase, Maryland. It is the second largest auto insurer in the United States, after State Farm.

Is there GEICO in Canada?

Geico Insurance does not operate in Canada. They do not offer insurance policies to the Canadian market. However, American drivers with Geico car insurance are covered when driving in Canada. Your coverage is valid in Canada.

Where is the GEICO headquarters?

Is GEICO owned by Allstate?

No, Geico is not owned by Allstate. Geico is a wholly-owned subsidiary of Berkshire Hathaway, which is a public company owned by its shareholders, while Allstate is a completely separate public company.

What is GEICO digital pay?

Online payments: Pay your insurance bill by check, debit card, credit card or Apple Pay. You can also store your account information online to facilitate future payments. GEICO Express Services: You can easily make a payment without having to log in. You can also do things like access to ID cards and more.

How does GEICO issue payment? “When will I get my money?” GEICO will usually send you a payment as soon as possible after the accident investigation is completed. GEICO allows payment digitally or by mail. This will cover repairs to your car, less any deductible.

How long does it take GEICO to process a payment?

Apply to a protected insured service center. Provide your current account information. Your bank will process the payment within five business days. (The transaction will appear on your bank statement as “GEICO PYMT.”)

How do I make a payment to GEICO?

Payment by phone: Call (800) 932-8872 and use our automated system to pay your bill. You can also store your account information in our system to facilitate future payments. Bill Payment Service: Pay your GEICO bill electronically via your bank’s online bill payment service.

Why does it take so long for insurance to pay out?

Insurance companies can conduct an extensive accident investigation to determine guilt and liability. This is one of the reasons why insurance companies may need a lot of time to pay.

How long does it take for an insurance payment to go through?

Most insurance companies pay their claims within 30 days Most insurance companies set goals to pay accepted damages within 30 days of receiving the original claim. Within those 30 days, the company should assign a case request controller, review the facts, accept or reject the request, and make a prompt payment.

Does GEICO pay claims well?

Geico’s claims process is also more in line with the industry average. The company received a score of 881 out of a possible 1,000 points in J.D. Power’s 2021 car satisfaction study (average was 882). This is 10 points more than Geico scored in the same 2020 study.

Does GEICO cut you a check?

GEICO pays receivables by issuing a check to cover their estimate of the repair, less any deductible amounts. Checks are sent by mail within 48 hours of the completion of the accident investigation.

How long does it take GEICO to pay a claim?

The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.) Like most things in life, it works best when everyone is playing nicely and collaborating.

How fast does GEICO settle claims?

We can’t pretend that the process of claiming a car insurance is fun, but we can promise to make it as carefree as possible. In fact, your request can be resolved in just 48 hours. We are proud to offer you personal attention 24 hours a day.

Does GEICO send you a check?

GEICO pays receivables by issuing a check to cover their estimate of the repair, less any deductible amounts. Checks are sent by mail within 48 hours of the completion of the accident investigation.

Does the insurance company send me a check?

If the payment for the car insurance claim came from your insurance company, you may receive a check written for you and the approved car repair shop. Car insurers typically issue double-sided checks to reduce the chances of funds being used for anything other than the intended repair.

Can I get a check from GEICO?

“When will I get my money?” GEICO will usually provide you with a check as soon as possible after the accident investigation is completed. This will cover repairs to your car, less any deductible.

Why would my insurance company send me a check?

Insurance companies can send a check as a tactic to avoid paying higher compensation for your injuries. Often, when you cash a check from an insurance company, you waive your right to any future claims or compensation.

How long does GEICO check take?

Checks are sent by mail within 48 hours of the completion of the accident investigation. If you experience an accident, you can initiate the GEICO claim process by submitting a claim online at geico.com or by calling (800) 841-3000 at any time. Receivables representatives are available 24/7.

How long does it take to check insurance to get to you? After successfully resolving an accident claim, most insurance companies will send checks within 30 days. The usual wait for a settlement check after resolving a claim is one to two weeks. In some situations, however, it may take months for the insurance company to send your check.

How long does it take to get a refund check from GEICO?

Geico does not specify a refund processing time on its website. It can take up to 30 days to receive a refund if you paid by check, which is usually the slowest way. If you used a debit or credit card to pay for the policy, you can get a refund within one or two weeks.

How do I get reimbursed from GEICO?

We will reimburse you based on your coverage limit. Requests for compensation can be sent by e-mail to towingrefund@geico.com or by fax to (866) 954-3761. Or call us at (800) 522-7775 if you have questions about compensation.

Will GEICO refund money?

If you have paid your insurance premiums in advance and then decide to cancel before the policy expires, Geico will usually refund all the unused portion of the policy. Be sure to contact Geico to see how much refund you should receive and when you should receive it.

How long does it take for an insurance claim check to clear?

Since many car accident checks are issued by banks of insurance companies outside the state, it may take some time to check. In most cases, the deadline for the bank’s settlement is 7 working days, but in some cases it can be 10 days.

How long does it take to get insurance money from a claim?

It usually takes 30 days for insurance to pay off after a car accident. Most car insurance companies try to resolve accident claims as soon as possible, which usually leads to a payment within a month of filing the claim.

Can I deposit a check from insurance claim?

Yes, you can cash a car insurance check and do what you want with the money as long as you fully own the car and meet all legal requirements. If your car is rented or financed, the check will probably be paid to you and the pawnbroker, so you will need their signature before you can cash it.

How long does it take for a settlement check to clear in the bank?

Confirmation of the check After your lawyer receives the check, he usually keeps it in a trust or escrow account until it is cleared. This process takes about 5-7 days for larger alignment checks.

How long does GEICO take to payout?

The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.) Like most things in life, it works best when everyone is playing nicely and collaborating.

Why is my car accident settlement taking so long from GEICO?

Many times it takes months for these settlements to arrive, and there may be an unnecessary struggle over guilt and responsibility, as well as a debate over the amount of damages sought. Geico is one such insurance company that is known for taking a long time to settle claims.

How long does it take for an insurance claim to payout?

It usually takes 30 days for insurance to pay off after a car accident. Most car insurance companies try to resolve accident claims as soon as possible, which usually leads to a payment within a month of filing the claim.