How many claims before your insurance drops you?

Contents

- 1 How many claims before your insurance drops you?

- 2 How many times we can claim bumper to bumper insurance?

- 3 How long does GEICO take to investigate claims?

- 4 Can I claim twice for an accident?

How many car insurance applications can be submitted per year? There is no limit to how many applications you can submit. This may interest you : Will Geico lower my rate?. However, most insurance companies give up on you as a client after three claims over a period of three years, regardless of the type of claim.

How many claims can you have before State Farm rejects you? State Farm, the largest national insurer of households, gives up customers in some states when they file only two claims in the same number of years.

Can insurance drop you for too many claims?

You can lose car insurance if you have more claims in recent history. This may interest you : Which is a type of insurance to avoid?. If you have more than one accident caused by guilt, you have the best chance of being dropped by the insurance company.

How many claims can you file before your insurance gets canceled?

Use your insurance carefully. Submitting more than three applications over a three-year period may put you at risk of your car insurance policy not being renewed or revoked.

How many auto insurance claims is too many?

While there is no limit to how many car insurance claims you can make per year, you will find that most car insurance companies will let you know that your policy could soon be rejected if you make two claims within two years. After you file your third claim, there is a chance that your insurer will cancel.

Can an insurance company drop you for too many claims?

In most cases, when too much damage is done in a short period of time, insurers will choose not to renew your policy, instead of suddenly revoking it. It’s not a great situation to be, but it’s relatively better than being kicked out.

Will Geico Drop me after 2 accidents?

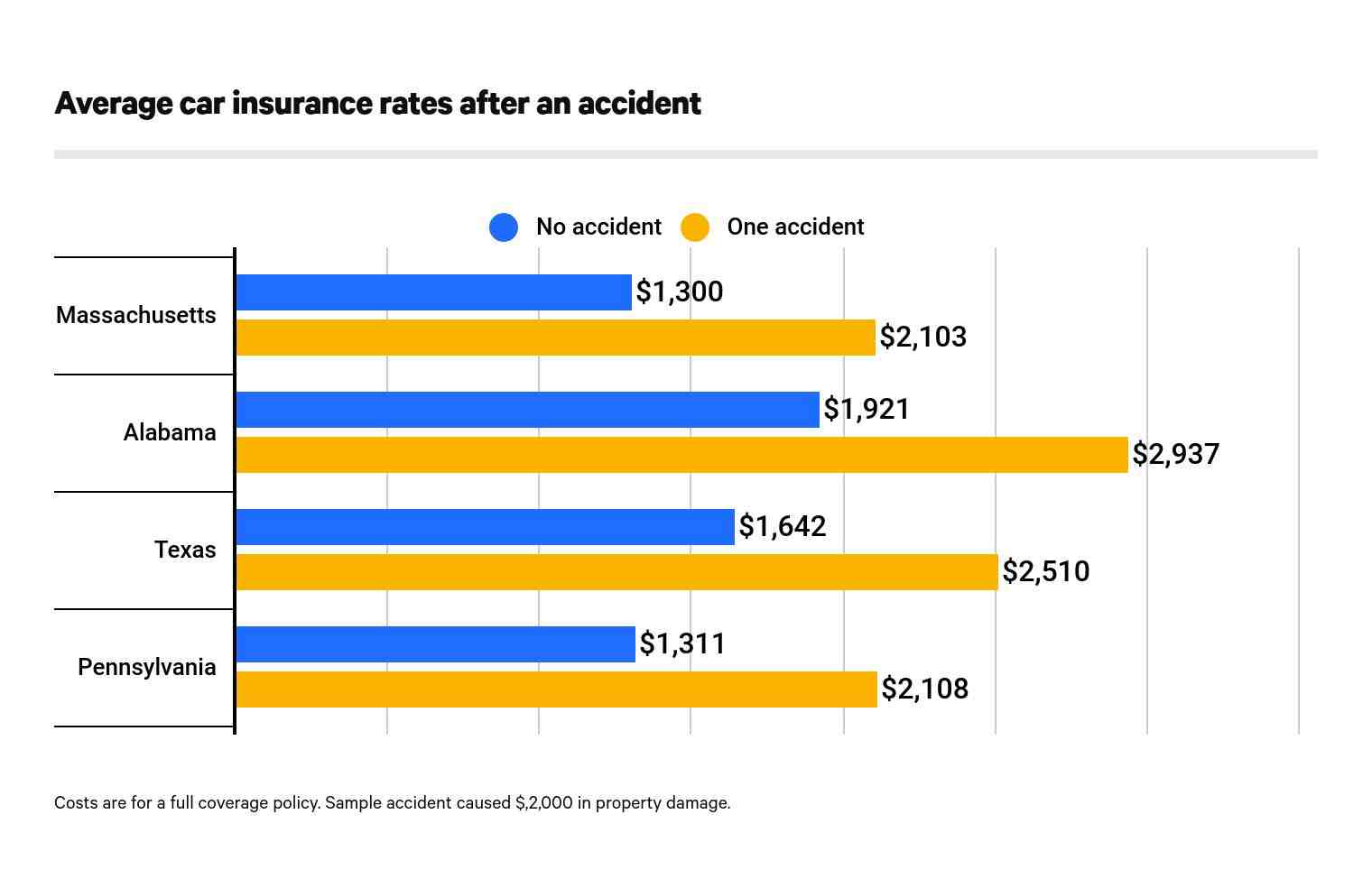

Geico insurance will increase by about 45% after your first accident resulting in compensation of $ 750 or more. This may interest you : Does Geico go up after 6 months?. If this is your second accident in less than three years, your insurance will increase at least twice, depending on the total cost of the damage.

How many accidents can you have before GEICO drop you?

â € œGEICO and most other standard carriers have a rule of three years and 36 months. If you have three or more fault accidents within 36 months, your policy will not be renewed. If all of your accidents happened within three years, you may need to buy a new carrier before the next renovation.

Can GEICO cancel after accident?

With Accident forgiveness on your GEICO car insurance policy, your insurance rate will not rise as a result of your first accident. We waive the surcharge associated with the first accident through no fault of the driver eligible on your policy. GEICO pardon in the event of an accident is according to the policy and not according to the driver.

Will my insurance Drop me after 2 accidents?

Both standard and non-standard insurers can dismiss you if you have too many accidents within a certain time frame. Every accident you claim can affect your insurance rates and whether you can renew your policy or get a new policy.

How many insurance claims are too many?

Generally, there is no set amount of home insurance claims you can make. However, two claims over a five-year period could cause an increase in home insurance premiums. More than two requests in the same period can affect your ability to find coverage and even lead to policy cancellations.

How many claims can you have before an insurance company can cancel you?

Use your insurance carefully. Submitting more than three applications over a three-year period may put you at risk of your car insurance policy not being renewed or revoked.

What happens if you make a lot of claims on your insurance?

The higher the number of applications submitted, the more likely it is to increase the rate. Apply too much – especially in a very short time – and the insurance company may not renew your policy. If the claim is based on the damage you have caused, your rates will almost certainly increase.

How many times we can claim bumper to bumper insurance?

In general, in addition to the bumper cover to the motor insurance bumper, the insurer allows only two damages during the policy period. However, this varies from insurer to insurer. Therefore, it is always advisable to buy car insurance to always be protected.

How is the bumper-to-bumper warranty used? Also called a vehicle service contract, the bumper-to-bumper warranty covers repairs to almost any part between the front and rear bumpers of your vehicle. For example, if your gearbox shuts down or your air conditioner breaks down, you can repair it for free (unless you have a franchise).

Does bumper-to-bumper cover damage?

As the name suggests, powertrain warranties only cover the vehicle’s powertrain, which is usually the most important and expensive component of a car. Meanwhile, the bumper-to-bumper warranty covers everything – powertrain, electronics, suspension, vehicle systems and more.

Is bumper-to-bumper coverage worth it?

Extended warranties from bumper to bumper are worth it because they offer superior peace of mind. With comprehensive coverage, you won’t have to worry about covering expensive repairs as your vehicle ages. However, bumper-to-bumper protection plans are often the most expensive coverage options.

Does bumper-to-bumper cover body damage?

A bumper-to-bumper warranty is sometimes called a comprehensive warranty. It covers almost everything from the front to the rear bumper. But not the bumpers themselves, because the body panels are not covered.

Does bumper-to-bumper warranty cover dents?

Does the bumpers be covered by an extended bumper warranty? The bumper is unlikely to be covered by an extended warranty from bumper to bumper because new car and aftermarket warranties do not cover dents, dents or scratches on any part of the vehicle.

How many times a year can I claim insurance for my car in India?

In general, there is no limit to the number of damages you can take under a car insurance policy in one year. However, it should be borne in mind that the car insurance requirement affects the NCB (No Claims Bonus). Repeated claims over the course of a year can also increase the premium when you renew the policy.

Is a scratch on a car considered an accident?

When it comes to dents, scratches and dents on doors, most car insurance requirements fall under collision or comprehensive coverage. These covers can be added to your shelf if desired and should be considered if you are concerned about damage to your vehicle.

Are car scratches covered by insurance in India?

In short, small dents / scratches on the surface of your car do not require a car insurance requirement. In fact, it is best to refrain from filing a lawsuit in such a scenario, because otherwise you could lose a lot of money.

What does bumper-to-bumper warranty not cover?

Bumper to bumper warranty does not cover normal wear and does not cover tires. Any damage to the car caused by the driver or other vehicles is also not covered. Tire wear, scratches and cracks on the windshield are ruled out under a typical bumper-to-bumper warranty.

Is it worth getting bumper-to-bumper warranty?

If you want to avoid unexpectedly expensive repairs, a bumper-to-bumper warranty can protect you financially and give you the peace of mind that you will be taken care of. Vehicle servicing contracts also typically include additional benefits such as roadside assistance, towing, and car rental fees.

Does bumper-to-bumper warranty cover chipped paint?

No, the bumper-to-bumper warranty usually does not cover paint damage. Cosmetic damage, such as dents, dents, and chipped paint, is considered regular wear and tear and is not included in the terms of most vehicle service contracts or mechanical failure insurance policies (MBIs).

Does bumper-to-bumper warranty cover dents?

Does the bumpers be covered by an extended bumper warranty? The bumper is unlikely to be covered by an extended warranty from bumper to bumper because new car and aftermarket warranties do not cover dents, dents or scratches on any part of the vehicle.

How long does GEICO take to investigate claims?

In fact, your claim can be settled in just 48 hours. We are proud to offer you personal attention 24 hours a day. Our application representatives are available at any time to help you apply and answer any questions you may have about the application process.

What does this mean when your insurance claim is under investigation? When an insurance company says ‘investigation’, and you might think it’s a claim investigation, it’s actually a tactic of insurance companies to assess you and decide how to file a claim and how much they feel they can get away with not paying your claims.

How long does it take GEICO to send an adjuster?

Picture your damage from several angles and transfer them at your request (we will guide you). 3. The car repairman will review the photos, write an estimate and make the payment in just one business day.

Does GEICO pay claims well?

Geico’s claims process is also more in line with the industry average. The company received a score of 881 out of a possible 1,000 points in J.D. Power’s 2021 car satisfaction study (average was 882). This is 10 points more than Geico scored in the same 2020 study.

How long does GEICO take to respond to demand?

| Ins. Comp. | GEICO |

|---|---|

| Not. Cases | 29 |

| Avg. (Days) | 52 |

| Shortest (days) | 5 |

| Longest (days) | 200 |

How long does it take to receive a settlement check from GEICO?

The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.)

How long does a GEICO investigation take?

Inspection and Repair Process The inspection usually takes about 30 minutes. If your car is not safe to drive, we will send a GEICO controller to inspect your car.

What does a GEICO investigator do?

What does SIU do? SIU fights fraud in a variety of ways, including: investigating potential fraudulent activities – SIU scrutinizes suspicious allegations in search of evidence of fraud.

How long do Liability investigations take?

Completion of the investigation In general, the insurer must complete the investigation within 30 days of receiving your request. If they cannot complete the investigation within 30 days, they will have to explain in writing why they need more time.

How long does it take GEICO to pay a claim?

The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.) Like most things in life, it works best when everyone is playing and collaborating nicely.

Can GEICO refuses to pay claim?

Sometimes GEICO car insurance claims are rejected for a good reason. In many cases, however, the insured receives a letter of refusal that seems irrelevant to the specific claim you have made. It is possible that you are dealing with a denial of a request in bad faith.

Is GEICO good about paying claims?

Geico’s claims process is also more in line with the industry average. The company received a score of 881 out of a possible 1,000 points in J.D. Power’s 2021 car satisfaction study (average was 882). This is 10 points more than Geico scored in the same 2020 study.

How long do GEICO payments take?

Provide your current account information. Your bank will process your payment within five business days. (The transaction will appear on your bank statement as “GEICO PYMT.”) For added convenience, store your bank information so that you do not have to re-enter it the next time you make a payment.

Can I claim twice for an accident?

It depends on the terms of your insurance policy, but it is unlikely that you will be able to claim the same injury twice. The policy could simply cover your legal costs for taking action – in which case you obviously need to file a lawsuit.

Can you apply to 2 insurance companies? When applying for multiple health insurance policies, you must notify all different companies at the time of hospitalization. You can then select the company you want to apply to first. Here is a list of original documents that must be attached to the application form.

Can I file same claim twice?

Once a new lawsuit has been filed and provided there is no impediment to filing an additional or re-application (such as disqualification), there is no limit to the number of times that an application can be opened and closed.

What happens if you file too many claims?

Also, if the cost of repairing the damage is only slightly higher than your deductible, consider paying it yourself. “Submitting more claims can mark you as high risk, and this can result in higher premiums or, potentially, canceled coverage,” Wegmann said.

How many claims can you have before your insurance gets canceled?

There is no set number of claims that an insurer allows before deciding to revoke your policy. It will also depend on the severity of the request and is usually based on the activities of the request over a period of time, such as 36 months.

Will my insurance Drop me after 2 accidents?

Both standard and non-standard insurers can dismiss you if you have too many accidents within a certain time frame. Every accident you claim can affect your insurance rates and whether you can renew your policy or get a new policy.

How many insurance claims are too many?

Generally, there is no set amount of home insurance claims you can make. However, two claims over a five-year period could cause an increase in home insurance premiums. More than two requests in the same period can affect your ability to find coverage and even lead to policy cancellations.

At what point will insurance drop you?

According to the Insurance Information Institute, insurers cannot cancel policies older than 60 days – but there are exceptions. Insurers can dismiss you if you do not pay the premium, if you misrepresent yourself in the application or if your driver’s license is suspended or revoked.

Will Geico Drop me after 2 accidents?

Geico insurance will increase by about 45% after your first accident resulting in compensation of $ 750 or more. If this is your second accident in less than three years, your insurance will increase at least twice, depending on the total cost of the damage.

How many claims can you file?

Generally, there is no set amount of home insurance claims you can make. However, two claims over a five-year period could cause an increase in home insurance premiums. More than two requests in the same period can affect your ability to find coverage and even lead to policy cancellations.

Can an insurance company cancel you for too many claims?

Unlike non-renewal, which occurs only at the end of the shelf life, cancellations can occur at any time. Non-renewals can occur for many reasons, which can include too many policy violations, credit changes, and too many claims.

Can I have 2 claims at the same time?

It really doesn’t matter if you have two car insurance claims within the same week or a year apart. All claims submitted within a three-year period are considered “multiple claims” in your claim history. You will usually have to pay two deductibles if your policy is set up with the deductible on comprehensive coverage.

Can an insurance company drop you for filing a claim?

Insurance companies can dismiss you as a customer if you apply after an accident – but the good news is that you will face non-renewal rather than cancellation.