Editorial Note: We earn a commission from affiliate links on Forbes Advisor. Commissions do not affect the opinions or ratings of our editors.

The 21st Century is unimpressive due to its limited availability (California only), narrow optional offers, and high level of complaints.

Table of Contents

Contents

21st Century Car Insurance

Like other insurance companies, 21st Century Insurance offers standard insurance options such as: To see also : How This All-Digital Provider Is Modernizing Auto Insurance.

Responsibilities. Suppose you are legally responsible for a collision that resulted in injury or damage to another person’s property. In this case, the liability insurance will cover the expenses resulting from the incident, such as medical or car repair costs, and attorney’s fees if they bring a lawsuit against you. Liability coverage is required to legally drive a vehicle in California and most other states.

Collision range. Suppose you are in an accident with another vehicle and your car is damaged or worn out. In this case, collision insurance will help you pay for the repair or replacement of your vehicle, regardless of who caused the accident.

Comprehensive coverage. If your vehicle is damaged in any way other than a collision with another vehicle, comprehensive protection may cover the cost of repair or replacement. For example, damage resulting from vandalism, fire, hail, flood, or a natural disaster such as a tornado is fully protected. Comprehensive insurance also covers collisions with animals and theft of the vehicle.

Both the collision and comprehensive insurance are optional and will pay up to the value of the car if it is added up or stolen, less the deduction.

Insurance of uninsured or underinsured drivers. This type of insurance covers medical expenses after an accident caused by an uninsured or insufficiently insured driver. Insurance for uninsured and underinsured drivers is optional in California.

Also available in California under “Uninsured Motorist Property Damage” or UMPD insurance. You pay for the repair of your vehicle if you are hit by the insured driver. The California UMPD insurance limit is $ 3,500, and state law says an uninsured driver must be identified in order for you to file a UMPD claim – which means hits and runs are not covered by California UMPD. Another option in these cases is to take advantage of collision insurance.

More Car Insurance Options from 21st Century

Roadside assistance. As a 21st century policyholder, you get free roadside assistance. To see also : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have. The 21st Century Roadside Assistance program offers 24/7 services such as towing and locking assistance.

Ancient car insurance. In addition to personal car insurance offers, 21st Century sells antique or classic car insurance. However, a vehicle must meet certain requirements to qualify for insurance. Some requirements are: The car must be at least 19 years old, in good condition and in a completely closed, lockable garage.

Rental reimbursement. If your car is not suitable for driving due to an accident covered by your policy, this cover helps to cover the rental or other transportation costs. It can compensate you up to a certain amount in dollars per day and up to the overall maximum amount.

SR-22. If you require a filed SR-22 insurance form, the 21st Century can do so on your behalf. The SR-22 is a form that the insurance company stores in your state to certify that you meet the minimum requirements for liability insurance.

21st Century Auto Insurance Discounts

To help drivers lower their insurance costs, 21st Century offers several discounts including: On the same subject : Responsibility Vs. Comparison of car insurance with full coverage.

Refer a Good Friend Program

The 21st century “Refer a Good Friend” program helps you earn gift cards for referring friends and family. For example, if you are a 21st century customer and refer a friend or family member to get a free quote, you may be eligible for a $ 25 gift card for companies like Walmart, Starbucks, or Lowe’s.

Also, if your friend or family member takes out an insurance policy for the 21st century, you can get an American Express card worth $ 50 when the policy is active for 60 days.

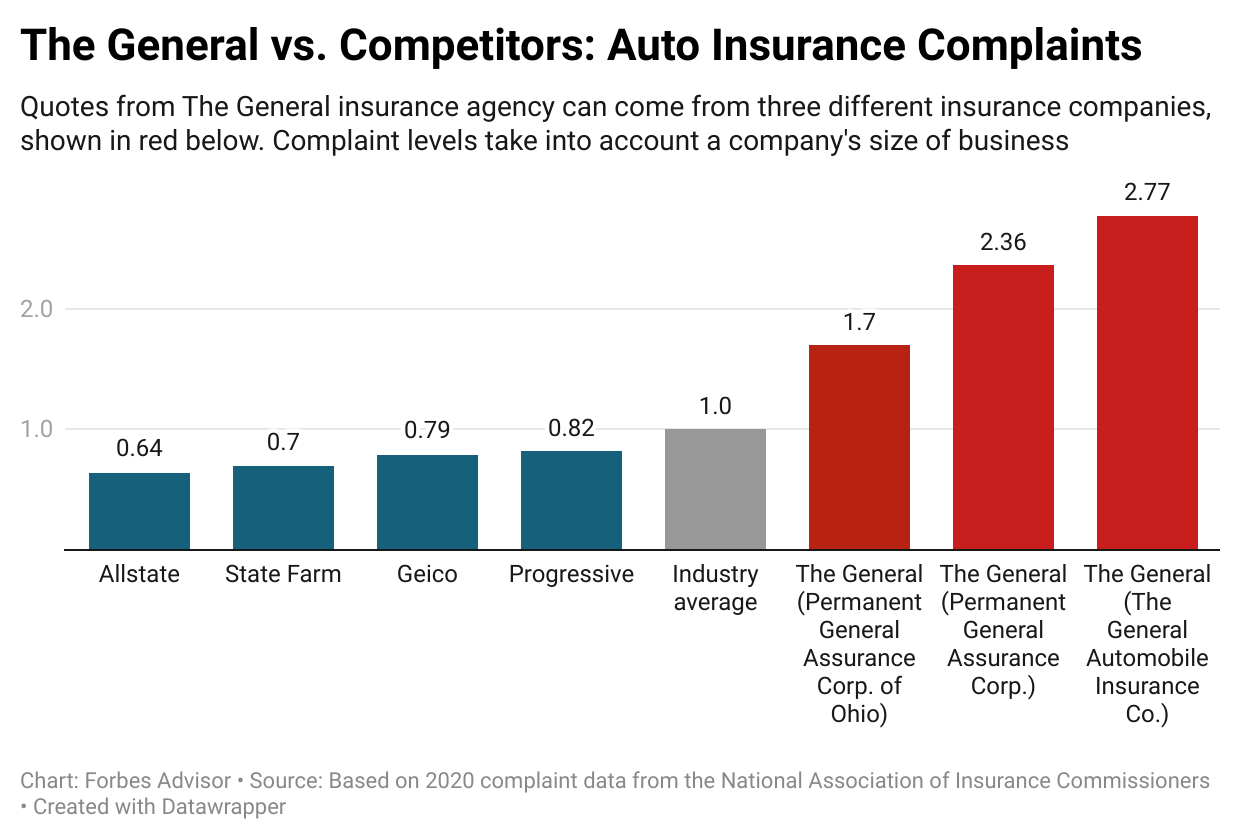

Car Insurance Complaint Comparison for 21st Century Insurance

According to complaints collected by the National Association of Insurance Commissioners (NAIC), the level of auto insurance complaints against the 21st century is much higher than for other auto insurers.

The industry average is 1.0, so less than this number means the business has fewer complaints than the average. At 2.22, the 21st century is almost double the industry average. Most of the complaints concerned delays in the payment of compensation and unsatisfactory settlements and offers.

For the past three years (and so much data is available), 21st century auto insurance complaints have been above the industry average. For this reason, you should consider other insurance companies.

Brief History of 21st Century Insurance

In 1958, Louis W. Foster founded 21st Century Insurance, initially known as 20th Century Insurance, to offer auto insurance throughout California. From a small start, Foster became a pioneer in insurance, using direct sales to his advantage. He believed that selling insurance directly to drivers (by phone or mail) with good driving performance would lower rates.

Farmers Insurance acquired 21st Century Insurance in 2009.

Best Car Insurance Companies 2022

With so many choices for insurance companies, it can be hard to know where to start to find the right car insurance. We’ve evaluated insurers to find the best insurance companies, so you don’t have to.

Help in making wise financial decisions

Download the Forbes Advisor newsletter for helpful tips, news, product reviews, and offers from a brand you can trust.

Thanks and Welcome to the Forbes Advisors Community!

I agree to receive the Forbes Advisor newsletter electronically. Please see our Privacy Policy for more information and details on how to opt-out.

The information provided on the Forbes Adviser is for educational purposes only. Your financial situation is unique and the products and services we evaluate may not match your circumstances. We do not offer financial advice, advisory services or brokerage services, nor do we recommend or advise individuals to buy or sell specific stocks or securities. Performance information may have changed since publication. Past performance is not indicative of future performance.

A Forbes Adviser adheres to strict standards of editorial integrity. To the best of our knowledge, all content is accurate at the time of posting, although the offers in this document may no longer be available. Opinions expressed are solely the authors and have not been provided, endorsed or otherwise endorsed by our partners.

Something went wrong. Please try again later.

State Farm is the largest insurer on our list, ranking number 1 in 24 states. Progressive is most often the largest insurer after State Farm, gaining the largest market share in 15 states. Geico is the largest auto insurer in nine states, with Allstate and MAPFRE each having one state.

Why are Geico rates so low?

Most consumers qualify for more than one rebate, which helps lower the total cost of their premiums. The fact that it sells insurance directly to consumers is another big reason GEICO is so cheap. This eliminates the cost of intermediaries.

Are people happy with Geico? Geico is a reliable car insurance company known for its affordable rates and decent customer service. The company received fewer than the average number of complaints about its size in 2020 according to NAIC and scored 881 points out of 1000 in the 2021 Claims Satisfaction Survey. J.D. Power Auto.

Is Geico the most expensive?

| company | Average annual rate |

|---|---|

| Geico | $ 1,719 |

| State Agricultural Farm | $ 2,803 |

| the National average | $ 2227 |

Who is cheaper then GEICO?

Out of the nine companies in our USAA survey, Geico, State Farm, Nationwide, Travelers, and American Family have average rates that are cheaper than the overall national average. Progressive, Farmers, and Allstate all have average rates that are more expensive than the overall national average.

Is GEICO really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the statewide average. The average cost of California minimum coverage car insurance is $ 604 per year or $ 50 per month.

Why are GEICO rates so high?

Geico is so expensive because car insurance is generally expensive due to rising costs for insurers. But at $ 506 per year, the average Geico insurance policy is actually cheaper than most domestic competitors. In fact, Geico ranks first in WalletHub’s analysis of the 10 cheapest car insurance companies.

Can you haggle with Geico?

Please note that GEICO’s claims adjusters are qualified to negotiate. Their job is to keep money in GEICO’s pockets. On the other hand, GEICO’s claims that should be settled are likely to be settled. Each side may take a while to come to an agreement, but that is the nature of negotiation.

Can you negotiate with your insurance company?

While you cannot negotiate a car insurance rate, you are not contractually required to stay with the insurance company. If you find a cheaper rate elsewhere, you can change your insurer. Depending on when you cancel and fine print your car insurance policy, you may incur charges.

Does Geico lower rates after 6 months?

Your Geico insurance policy may go up after six months. If you made it through the policy without making a claim, you may be eligible for a car insurance discount. If you keep Geico car insurance for three years or more, you may receive a loyalty discount.

Does Geico ever lower rates?

GEICO agrees to cut California auto insurance rates by $ 91 million annually. Santa Monica, California – Beginning next month, GEICO will begin implementing a 10.7% aggregate rate cut for California policyholders.

Will Geico go up?

Geico’s coverage will increase by approximately 45% after the first accident resulting in a claim of $ 750 or more. If this is your second accident in less than three years, your insurance coverage will at least double depending on the total cost of the claim.

“The total cost of doing business is rising for virtually all US businesses, including insurance companies. And since “cost of doing business” is part of the premium calculation, consumers can expect higher premiums overall in 2022. “

Did GEICO raise their rates 2021?

According to an analysis by S&P Global Market Intelligence, GEICO Corp. can see the largest overall premium increase from the private car rate increases approved in December 2021.

Why does my GEICO bill keep going up?

Geico’s rates rise as drivers increase coverage, are involved in an accident, receive a speeding fine, or file a claim. Certain life events, such as adding a teenage driver to your policy, can also increase your rates.

What is the cheapest type of car insurance?

The state of minimum civil liability coverage is the cheapest type of car insurance. Liability coverage is on average $ 1,333 cheaper than a policy with full coverage.

How much cheaper is liability compared to full insurance? How much cheaper is liability than full insurance? Third party liability insurance is on average 64% cheaper than full insurance. Liability car insurance costs an average of $ 720 per year, while full insurance car insurance averages $ 1,997 per year, according to WalletHub’s 2021 data.

What are the 3 types of car insurance?

The three types of motor insurance that are commonly offered are third-party liability, comprehensive and collision insurance. Drivers may still purchase other types of car insurance, such as personal injury protection and the uninsured / underinsured driver, but these are not available in every state.

What are the 5 types of auto insurance?

Here is an overview of the most popular types of motor insurance.

- Car liability insurance.

- Car insurance against physical damage.

- Rental insurance.

- Protection without fault or personal injury.

- Insurance of uninsured / underinsured drivers.

What are the different types of car insurance coverage?

The six common car insurance options are: third party liability insurance, uninsured and underinsured driver insurance, full insurance, collision insurance, medical payment insurance, and personal injury protection. Depending on where you live, some of these insurances are compulsory and others are optional.

What type of car insurance is the most important?

Today, there are many different types of car insurance. The most important of them are civil, comprehensive and collision liability.

Which insurance company has best claim settlement ratio?

Max Life Insurance has the highest claims settlement rate in terms of number of claims at 99.22%. They are followed by HDFC Life Insurance and Tata AIA Life Insurance with 99.07% and 99.06% respectively. Out of the top 10 life insurers, nine have a loss adjustment rate above 98%.

Which health insurance has the highest claims settlement rate in 2021? Oriental Insurance is at the top with 92.71% and New India Insurance with 91.99% claims ratio.

Which car insurance company has highest claim settlement?

| Car insurance companies | A network of cashless garages | Claims adjustment ratio 2018-2019 |

|---|---|---|

| Bajaj Allianz car insurance | 4000 | 62% |

| Bharti axa Car insurance | 5200 | 75% |

| Cholamandalam Car Insurance | 6900 | 84% |

| Digital car insurance | 1400 | 76% |

Which general insurance has best claim settlement ratio?

The best insurance companies with the best claims ratio

- Reliance General Insurance Co. …

- SBI General Insurance Company Ltd. …

- Shriram General Insurance Co. …

- Tata AIG General Towarzystwo Ubezpieczeniowe Sp. z o. o. …

- United India Insurance Company Ltd. …

- Uniwersalne Towarzystwo Ubezpieczeń Ogólnych Sompo Sp.

Which car insurance company has the lowest complaint?

By controlling size, Nationwide has the fewest complaints among the top auto insurance insurers, and Chubb has the fewest complaints about home insurance. Nationwide has a Car Insurance Complaints Index of 0.43.

Which health insurance company is best in claim settlement?

The leader among private general insurers is HDFC Ergo General Insurance with 99.8% of claims settled within the first 3 months of filing a claim. Edelweiss General and Go Digit follow with 99.72% and 99.65% respectively in the first three months.

Which insurance company is best for claims?

The best insurance companies with the best claims ratio

- Reliance General Insurance Co. …

- SBI General Insurance Company Ltd. …

- Shriram General Insurance Co. …

- Tata AIG General Towarzystwo Ubezpieczeniowe Sp. z o. o. …

- United India Insurance Company Ltd. …

- Uniwersalne Towarzystwo Ubezpieczeń Ogólnych Sompo Sp.

Which health insurance company has the highest customer satisfaction?

Kaiser Permanente is consistently recognized as having the highest customer satisfaction and in particular excels with its Medicare Advantage plans. However, Kaiser Permanente is only available in eight states and Washington.

Which insurance company has the highest claim settlement ratio?

The highest loss adjustment ratio is PUB LIC at 98.31%. The IRDAI report also revealed that the total amount of the benefit for 2016-17 is Rs. 13,850.62 crore.

Is Progressive and Liberty Mutual the same company?

Liberty Mutual and Progressive are domestic auto insurance providers that offer standard coverage with optional extras. Insurance companies are almost equal when it comes to costs and discounts as well as valuation and claim processing.

Which companies belong to Progressive? Companies from the Progressive Home program

- All Risks CO., LTD. Phone: 888-309-9176.

- American modern. Phone: 800-784-0251.

- American Strategic Insurance Corp. Phone: 866-487-2643.

- Guarantor. …

- The first American non-life insurance group. …

- First of all, the Insurance Group. …

- Homesite Insurance Group. …

- IDS Accident Insurance.

Who is Liberty Mutual owned by?

Liberty Mutual is owned by Liberty Mutual policyholders because it is a mutual and its shares are not available to investors in the public market. Four of the top 10 car insurance companies in the US are mutual insurance companies.

Who bought Liberty Mutual Insurance?

On May 1, 2018, Liberty Mutual completed the sale of the Boston-based Liberty Life Assurance Company to the Lincoln Financial Group. The transaction included the reinsurance of Liberty’s Individual Life and Annuity Company into Protective Life Insurance Company.

Who is the parent company of Liberty Mutual?

Is Liberty Mutual owned by Prudential?

Liberty Mutual is not affiliated with the Prudential Insurance Agency, LLC and its affiliates. Liberty Mutual is an equal housing insurance company.

Are Liberty Mutual and Geico the same company?

Liberty Mutual’s insurance options look identical to those offered by Geico as Geico does not have their own insurance policies – instead, Geico uses an insurance company to insure its clients, and Liberty Mutual is one of the home insurers for Geico.