4 simple ways you can lower your car insurance

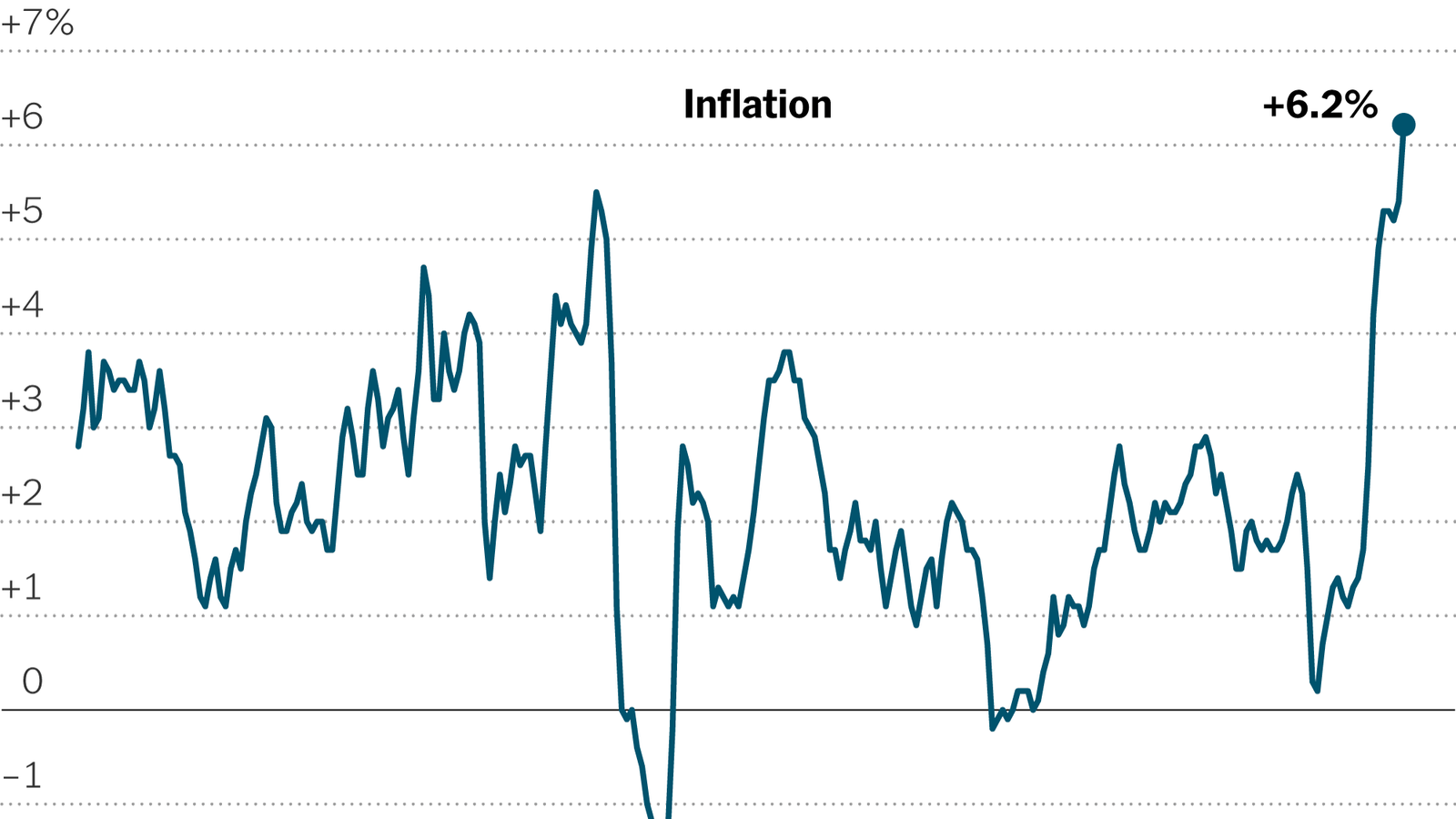

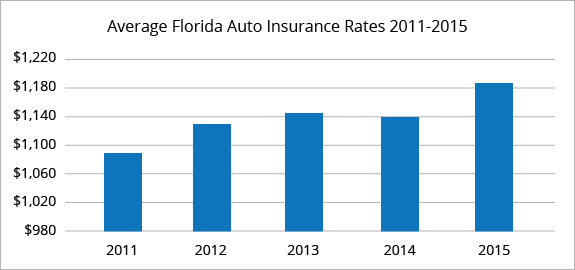

As gas prices for cars and cars continue to rise sharply, the cost of driving is rising. Your car insurance may be the only place you can save, especially if you are driving a little.

Millions of Americans now spend a few days in office. That means a little behind the wheel for Michelle Kostyn.

“I’m not going too far, not too far,” he told us as he filled his SUV with $ 75 in gas.

Cam Ray has reduced the miles he drives, too. He said, “I’m actually driving a little.” If it ‘s not necessary, I’m not driving. “

But are you still paying the same, or more, for car insurance now, even though you are driving less than you were two or three years ago?

In that case, it’s time to pick up the phone. According to John McCormick of CarInsurance.com, a quick phone upgrade to your travel site can save you money.

“People don’t think about car insurance but really should think about it,” he said. a lot. “

Another option is “pay-per-mile” car insurance, offered by companies such as Metromile.

“Instead of a flat rate of insurance,” Gina Minick of Metromile explains, “our customers pay less but also pay a few cents for every mile they spend. drive. “

Minick says the savings could increase dramatically for remote workers and slow-moving drivers.

“For us, that means driving about 10,000 miles a year or less,” he said.

However, there are things to consider before making any adjustments.

John McCormick says any hiking trip program will keep track of how many miles you drive. Metromile says that is not a bad thing at all, especially if you have an accident.

“If our insurance wasn’t a mistake, we have data to show that,” Minick said.

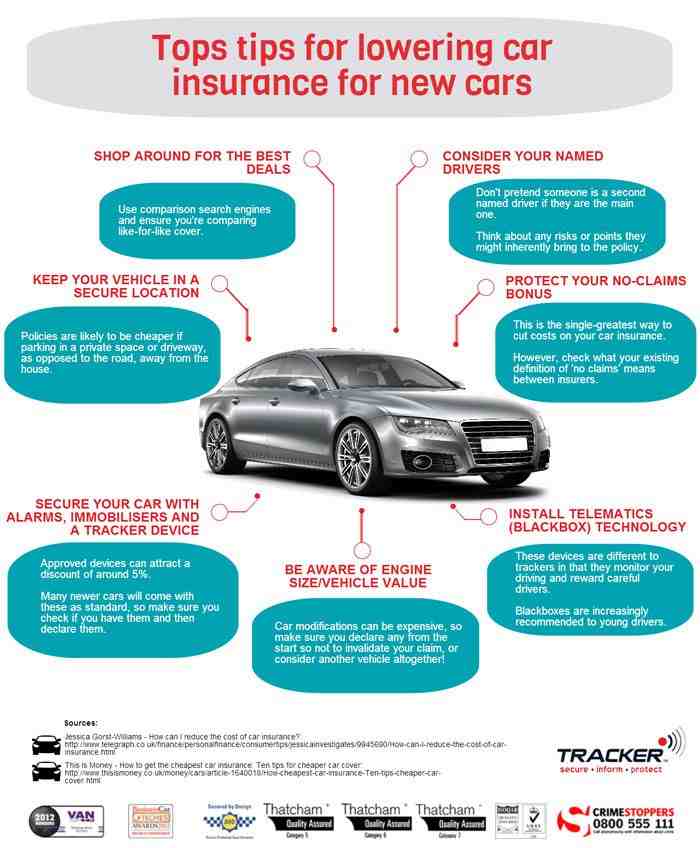

Methods of saving even if you do not drive below

If you do not drive below, however, there are other cost-saving options for you, too.

So make some calls, so as not to waste your money.

Don’t Waste Your Money “is a registered trademark of Scripps Media, Inc. (” Scripps “).

Like “John Matarese Money on Facebook

Follow John on Instagram @johnmataresemoney

Follow John on Twitter (@JohnMatarese)

For more customer news and savings tips, visit www.dontwasteyourmoney.com

Copyright 2022 Scripps Media, Inc. All rights reserved. This information may not be published, published, reposted or redistributed.

The Morning Headlines, sign up for a mix of what you need to know to start the day in Colorado, picked for you.

Contents

- 1 The Morning Headlines, sign up for a mix of what you need to know to start the day in Colorado, picked for you.

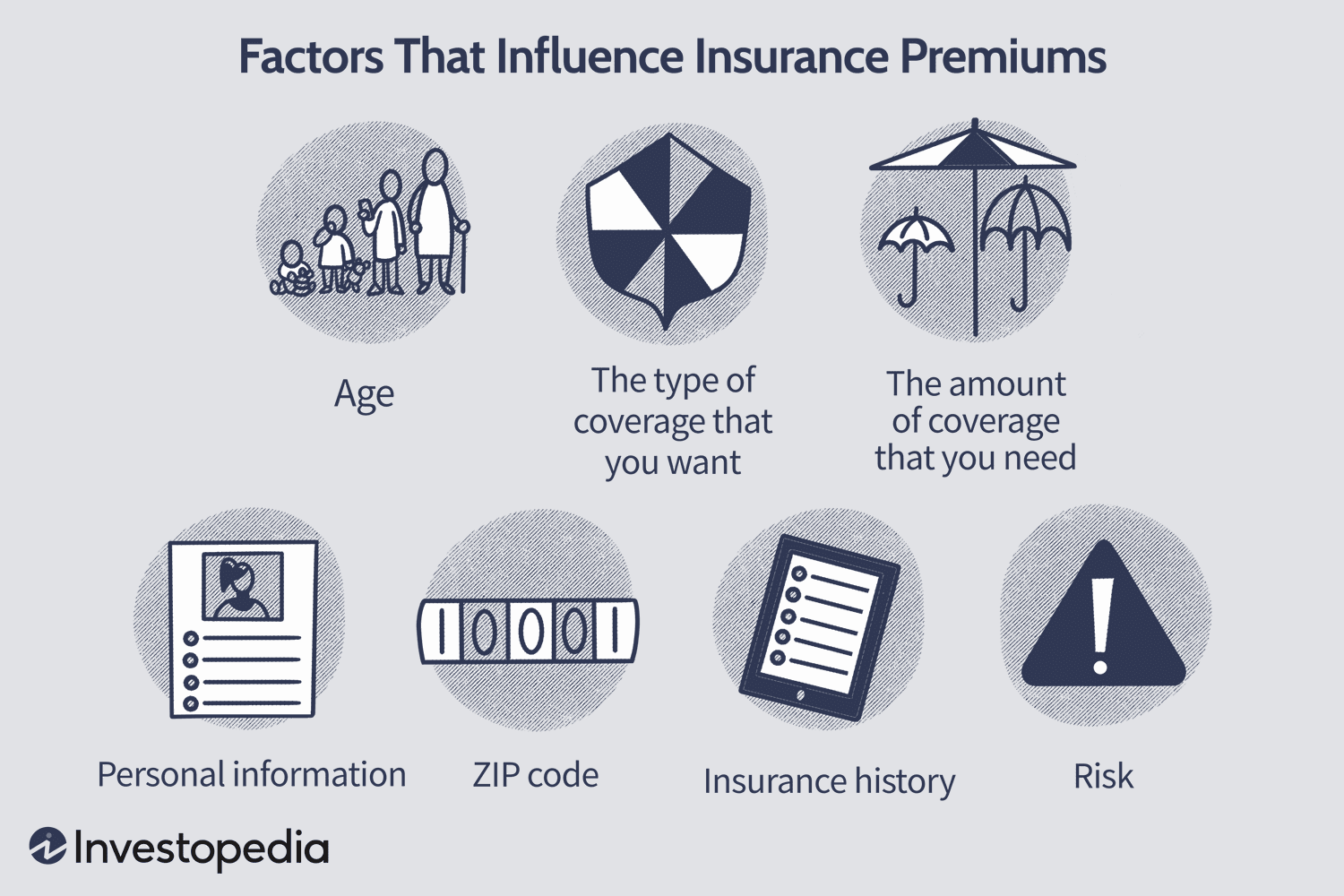

- 2 What causes insurance rates to go down?

- 3 Do you save money by paying car insurance annually?

- 4 What is 100% coinsurance mean?

- 5 Why do you need to have comprehensive coverage on your vehicle in addition to collision?

Coinsurance Percentage Breakdown Coinsurance is the amount you will pay for services covered by assuming you are not deductible. Read also : Gig Workers: Your Personal Car Insurance May Not Cover Your Accident During Delivery. When you sign up for a medical procedure, you pay 20 percent of the total cost of the loan, and health insurance pays 80 percent of the total cost of the loan.

What causes insurance rates to go down?

Common reasons for lowering car insurance premiums Car insurance costs usually go down for the following reasons: You are getting old. You are driving safely for three years after an accident or other crime. To see also : Budget Insurance Launches High-Risk Driver Insurance Plan – PR Newswire APAC. You change insurance companies.

Do you save money by paying car insurance annually?

It costs a lot of money first, but paying for car insurance with annual fees will save you a lot more money than you have to pay each month. This may interest you : What is a good monthly car insurance payment?.

Does paying for car insurance in full save money? Benefits of Paying Full Car Insurance By 2021, drivers who paid the full premium saved about 4.7% on average, according to Zebra, an insurance comparison website. And saving money is not the only opportunity to pay in advance.

How much can you save if you pay car insurance annually?

Almost every donor will offer a discount for full payment, but the cost may vary. On average, expect to save about 20%. A good way to find out how much you can save by paying in full is to apply for car insurance premiums.

Is it cheaper to pay car insurance every 6 months?

In most cases, a six-month plan will be cheaper than a 12-month plan because you pay for protection in the short term. However, if you compare car insurance prices each month, it may not be much different between a six-month plan and a 12-month plan.

Is it better to pay car insurance monthly or yearly?

Paying your insurance premiums annually is almost a very cheap option. Most companies offer you a full discount because it costs a lot of money for the insurance company if the policyholder pays their monthly premiums as that requires work manually monthly to keep the policy active.

Is insurance cheaper if you pay annually?

Typically, plans offer lower premiums for payers once a year or on time, so this is a cheaper option. If companies have to deal with your payment once or twice a year, that saves them money and staff, so they encourage lenders to choose this option.

Is it smart to pay your insurance in full?

Paying your car insurance premium in full can save you money – but paying a lot of money may not be possible if it causes you financial stress. Paying credit accounts on time and keeping your debts low can strengthen your debt and help you qualify for better insurance premiums in the future.

Can you pay for insurance annually?

Benefits of Paying Home Owners’ Annual Insurance But you should know that there are benefits to paying the total annual mortgage in one year. Generally, you will receive a lower rate than you would have paid if you had paid it each month.

Is it cheaper to pay car insurance annually?

Paying your insurance premiums annually is almost a very cheap option. Most companies offer you a full discount because it costs a lot of money for the insurance company if the policyholder pays their monthly premiums as that requires work manually monthly to keep the policy active.

Is it better to pay auto insurance monthly or yearly?

Monthly fees may seem like a cheap option at first, but they are almost always the most expensive way to pay for car insurance in the long run! Although it is a lot of money first, you will save money on your expenses if you can pay for a year or half a year when you buy car insurance.

Is French car insurance valid in UK?

Does foreign car insurance work in the UK? If you bring your car on a trip to the UK, your existing insurance will usually provide third party protection while you are here – though it is a good idea to check this out before driving in the UK.

What is extra insurance called in France?

Apart from public health insurance in France, many people pay to take out French health insurance. This is known in France as â € œmutuelleâ € and is designed to cover some of the health and medical costs. One of the additional medical expenses comes from visiting a doctor.

What insurance do I need to drive in France?

You must have at least third party insurance (legal requirement), but it does not cover any costs incurred by you as a result of the accident. Make sure your policy is complete and that you have your Vehicle Insurance Certificate before you leave.

What is 100% coinsurance mean?

So the total cost-sharing value for a portion of your insurance policy may be different from the coinsurance percentage. In fact, it is possible to have a plan with 0% coinsurance, which means you pay 0% for health care costs, or even 100% coinsurance, which means you have to pay 100% of the cost .

Is 100 coinsurance good or bad? Yes, you should insure 100% of the insurance value, but never use 100% coin insurance. What if you made a mistake during the loss, which is when the value is calculated? Do not put an insured person under such difficult circumstances. Insure 100% of the insurance value and use 90% coinsurance.

What is a good coinsurance percentage?

Most people tend to have a standard 80/20 coinsurance policy, which means you are responsible for 20% of your medical expenses, and health insurance will cover the remaining 80%.

Does 20% coinsurance mean I pay 20%?

Coinsurance is the percentage of medical bills you pay, and the rest is covered by a health insurance policy, which usually applies after your deductible has been met. For example, if you have 20% coinsurance, you pay 20% of every medical debt, and health insurance will cover 80%.

What does 30% coinsurance mean?

How it works: You have paid $ 1,500 in health care costs and have incurred the amount you pay. When you go to the doctor, instead of paying all the costs, you and your plan share the cost. For example, your plan pays 70 percent. The 30 percent you pay is your coinsurance.

Is a 10% coinsurance good?

If your policy has coinsurance, it means you will still have to pay even after meeting your deductible. A 10 percent coin insurance may sound like a small expense, but if you need care for serious medical problems like cancer, it can still be thousands of dollars.

What does 100% no deductible mean?

What is the plan for unplanned health insurance? A policy with no deductible insurance means you get the full benefits of sharing the cost of your plan right away. You will not need to pay a certain amount in your pocket before the insurance company starts paying for covered medical services.

Is it better to have a deductible or not?

In most cases, as the policy goes downhill, the charge goes down. When you are willing to pay more than ever when you need care, you save the money you pay each month. As the policy reduces, the cost goes up.

What does it mean 100% No deductible?

Yes, a zero-deductible policy means you do not have to reach a minimum before the health insurance company will contribute to the cost of health care. Lower-cut projects often come with higher costs, whereas more discounted plans come with lower monthly fees.

What does having no deductible mean?

Having unavoidable car insurance means you have opted for security measures that do not require you to pay any pre-claim coverage. For example, suppose you chose to provide a collision protection without deductible. If you have a covered $ 1,500 repair claim, your insurance employer will reimburse you in full $ 1,500.

Is it better to have a copay or coinsurance?

Co-Pays will be a fixed dollar of less than the percentage you would pay. A project with Co-Pays is better than a plan with Co-Insurances.

Should I choose a plan with coinsurance?

Since copies often do not calculate the cost of health insurance or out of pocket, you should consider these costs when comparing plans. If you regularly buy prescription drugs and expect to see a doctor more often each year, then consider plans for low-cost copays.

What are the benefits of coinsurance?

Generally defined as a percentage and defined in the coinsurance clause policy, coinsurance allows the policyholder to share the cost of the insurance service with the insurance company – the insurance company pays a portion of the insurance the cost of the insured service, and you pay the rest.

Is it better to have a copay or deductible?

Copays are a fixed fee that you pay when you receive covered care such as visiting an office or fetching prescription medication. The deductible is money that you have to pay out of pocket for benefits covered before the health insurance company starts paying. In most cases, your copay will not go to your deductible.

Why do you need to have comprehensive coverage on your vehicle in addition to collision?

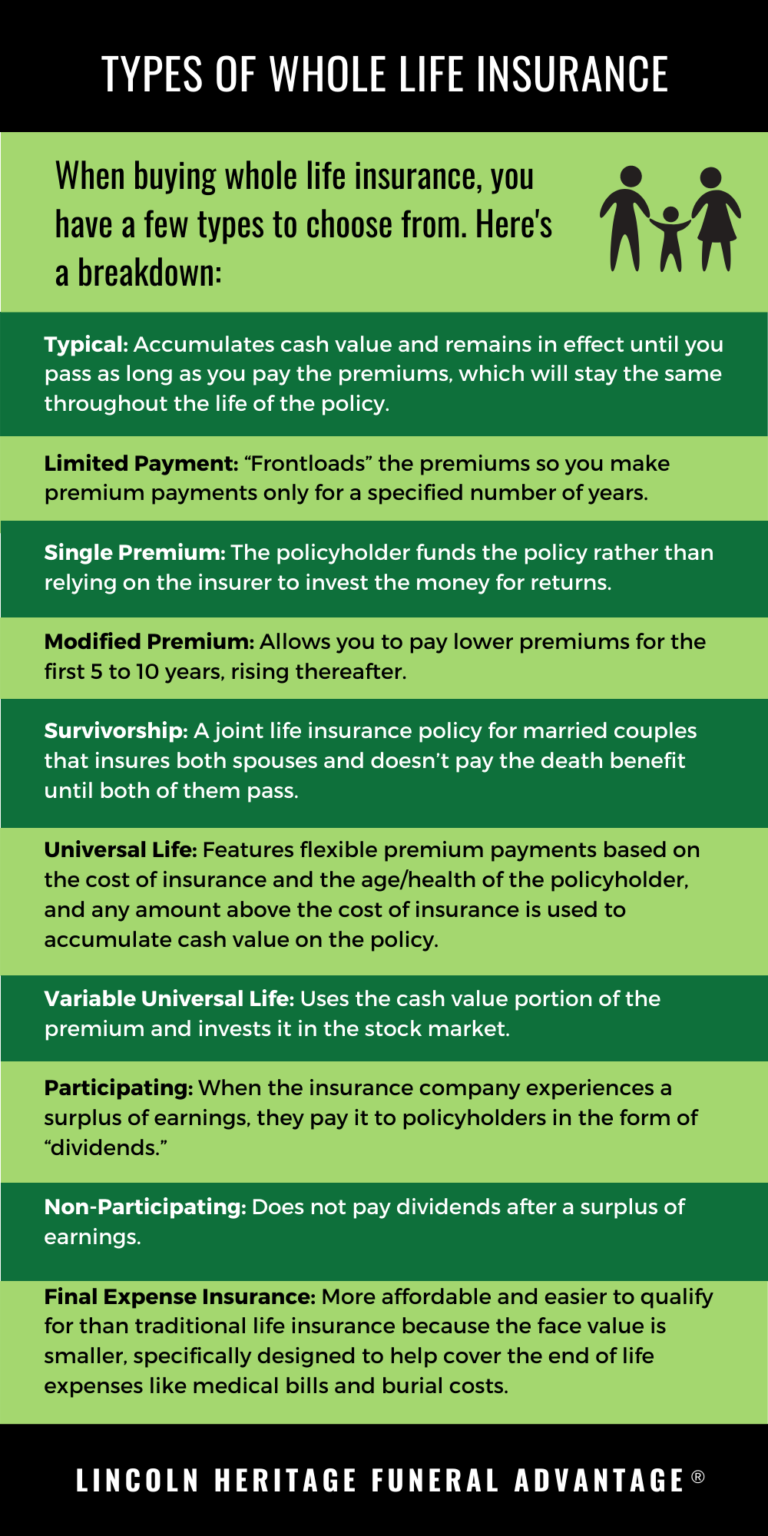

Comprehensive is a different type of collision protection that protects your vehicle against such things as falls, theft and damage to property. Complete and complete collision insurance is often combined to protect the vehicle against a wide range of damages, as part of fully covered car insurance.

How important is it to provide complete information and collision? A collision with complete security is an important addition to credit insurance: A collision protection compensates for the damage to your vehicle if you hit an object or another vehicle. Complete insurance covers non-perishable damage, such as weather and fire damage.

How important is comprehensive coverage?

Full details help pay for repairs or restores your car if it has been stolen or damaged by something other than a collision. Summary helps to cover theft and damage caused by damage and natural disasters, falling objects, fires, hail, floods or animals.

Should comprehensive and collision deductible be the same?

Complete reports are usually produced for less damage than collisions, so low cost often makes sense. Sometimes colluding deductibles can drop to $ 100 or $ 250, but most agents recommend you start with $ 500 and increase if you can.

Should I have a higher collision deductible?

According to the Insurance Bureau, increasing your cash flow from $ 200 to $ 500 can reduce the cost of multiple costs by 15-30%; Up to $ 1,000 deductible can save 40%.

Is it better to have a $500 deductible or $1000?

A $ 1,000 deductible fee is better than a $ 500 deductible if you can afford to pay extra out-of-pocket expenses in the event of an accident, because reducing the amount means you will have to pay lower premiums. . Choosing an insurance deductible depends on the size of your emergency fund and how much you can afford to pay each month’s premiums.

Does collision and comprehensive coverage include deductibles?

Complete safety and collision protection can be used to help repair the damage caused to your vehicle by accident. Both parts have a deductible that you are responsible for paying before the protection starts to cover the damage.

Whats better collision or comprehensive?

The main difference between complete insurance and collision is the conditions they claim. Collision insurance covers the damage to your vehicle if you hit an object or another vehicle, while full protection compensates for theft or damage caused by causes such as bad weather, fire or fallen trees.

When should you consider dropping collision and comprehensive coverage?

The general rule was that car owners should not be subject to full insurance when the car is five or six years old, or when the speed reaches the 100,000 mark. (Many websites talk about this.)

What is better to have comprehensive or collision?

It is better to have comprehensive insurance than collision insurance, if you need to choose between the two. Complete protection is not cheap, it can be purchased alone, and it compensates for damage caused by events beyond your control, such as property damage, theft, natural disasters or running and animals.

Is full coverage better than comprehensive?

The difference between total and collision is the difference between damage caused by a tree falling on your car (wide), and damage caused while driving in a tree (collision). Because complete protection protects you from many dangers, it will cost more.