Average Cost of Car Insurance 2022 – Forbes Advisor

Editorial Note: We earn commissions from partner links at Forbes Advisory. Commissions do not influence the opinions or evaluations of our editors.

Car insurance is required to legally drive in most states, so it’s helpful to know what you can expect to pay for coverage. Forbes advisors found the median cost of auto insurance was $1,601 for full coverage and $513 for state minimum coverage.

We analyze rates from the best auto insurance companies to get an average car insurance cost by:

All of these factors are taken into account by the car insurance company when setting the price and so affect what you pay.

How Much Is Car Insurance?

Contents

- 1 How Much Is Car Insurance?

- 2 Average Cost of Car Insurance by Company

- 3 What Is the Average Cost of Car Insurance in Your State?

- 4 Average Cost of Car Insurance for Teens

- 5 Average Cost of Car Insurance by Age

- 6 Average Cost of Car Insurance by Gender

- 7 Average Cost of Car Insurance by Car Type

- 8 Average Cost of Car Insurance by Driver

- 9 Factors That Affect Car Insurance Rates

- 10 What Does Car Insurance Cover?

- 11 How to Reduce Car Insurance Costs

- 12 Methodology

- 13 Best Car Insurance Companies 2022

- 14 Average Cost of Car Insurance FAQ

- 15 How much does insurance go down after 1 year no claims?

- 16 How much do average Americans pay for car insurance?

- 17 How can I lower my insurance premiums?

- 18 Is Geico actually good?

The national average cost for auto insurance is $1,601 per year, according to a Forbes Advisor analysis. To see also : Why car insurance is mandatory in Canada. These rates are for full coverage auto insurance, which includes optional coverage covering theft and damage to your own vehicle.

There is no standard definition of full coverage auto insurance, it generally includes:

Drivers with the minimum amount of auto insurance coverage required by their state pay an average of $513 per year, based on our analysis.

State minimum liability insurance is much cheaper than full coverage car insurance because it doesn’t cover your car. It only provides liability insurance for the amount required to drive legally.

Get Auto Deals As Low As $63/month, Compare Rates For Free, and Pay Less For Car Insurance

Average Cost of Car Insurance by Company

Each car insurance company rates risk differently which means prices can vary significantly between companies. See the article : NJM Auto Insurance Review 2022 – Forbes Advisor. That’s why comparing auto insurance quotes with several companies can help you find the best price for your specific situation.

Average car insurance rates by company for full coverage

Among the companies we analyzed, median rates for full coverage ranged from $1,141 per year with USAA to $2,277 from Farmers, a difference of $1,136 per year. On the same subject : What Are Car Insurance Premiums? – Forbes Advisor.

USAA may be the cheapest but is only available if you are a member of the military, a veteran, or a member of a military family. The next cheapest is Nationwide ($1,154 per year), about $1,100 cheaper than Farmers.

Average cost of car insurance by company for full coverage

A full coverage car insurance policy costs more than a liability only policy because it provides comprehensive collision and coverage coverage. If your car is rented or financed, your lender will usually ask you to carry full coverage car insurance.

Average car insurance rates by company for state minimum liability insurance

Average rates for minimum coverage among the companies we evaluated started at $322 per year with USAA and rose to $830 per year with Farmers, a difference of more than $500.

Auto-Owners ($356) is the cheapest after USAA ($322), which limits eligibility to active or veteran military members and their families.

Average cost of car insurance by company for minimum coverage

State minimum auto insurance is fairly inexpensive, but provides limited coverage. If your budget changes, you can increase your liability limit to get better coverage if you cause an accident. Also consider purchasing comprehensive and collision insurance if you want to add coverage for your car.

No matter what type of policy you buy, look for comparisons for the same coverage and limits to get an accurate picture of which auto insurance company is the most affordable.

What Is the Average Cost of Car Insurance in Your State?

Where you live is a factor in your car insurance rates. For example, auto insurance companies look at the number of claims in your area and how much they cost, and if your area is prone to bad weather, such as floods and hurricanes, among others.

Because the likelihood of an accident is usually higher in urban areas where there are more cars on the road, more populous states generally have higher average auto insurance rates than rural states with fewer drivers.

Least and most expensive states for full coverage car insurance

Our analysis of average auto insurance rates by state found that Vermont is the cheapest state for full coverage. The five cheapest states for full coverage auto insurance are:

The most expensive state for full coverage auto insurance is Florida. The five most expensive states for full coverage auto insurance are:

Least and most expensive states for minimum liability car insurance

Drivers in Iowa pay the least for minimum liability car insurance compared to other countries. The five cheapest states for state minimum auto insurance coverage are:

Michigan drivers pay the most for the state’s minimum liability auto insurance. The five most expensive states for state minimum auto insurance coverage are:

Average car insurance rates by state

Average Cost of Car Insurance for Teens

Teen drivers are inexperienced and have more accidents than older drivers, which means teenage drivers are very expensive to insure. That makes it important to shop for the best cheap auto insurance for teen drivers.

The median annual auto insurance rate for a 16-year-old driver with their own policy is $8,765. The median rate for a 17 year old is $6,829. That’s about 22% less than what a 16-year-old pays.

The cheapest way to insure a teen driver is usually to add him to your policy. However, it can double the cost of a parent’s car insurance. For example, enrolling a 16-year-old driver on a parental policy increased fares by an average of 82%, our analysis found. The annual fee for the parental policy jumped from $2,948 to $5,367. That’s a $2,419 increase.

Average car insurance rates for parents’ policy with teen added

Average Cost of Car Insurance by Age

The cost of car insurance begins to decrease as you go through your teenage years. You are no longer experienced. As long as you can keep your driving record clean of accidents or tickets, your fares will be cheaper and stay there until you hit your 70s.

Average car insurance rates by age

Car insurance rates generally decline over time from age 18 to 60. For example, a 30-year-old driver pays 64% less for car insurance than an 18-year-old driver on average. And at 60, you’re paying about 13% less for coverage than you would at 30. But rates start going up again when you hit your 70s and keep going up when you reach your 80s.

Senior drivers have experience on their side but reaction times can drop so auto insurance companies assume those in their 70s and older are more likely to have an accident.

Average Cost of Car Insurance by Gender

Gender is used as a scoring factor for auto insurance in all states except California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania.

Auto insurance companies found young men were more likely to engage in risky driving behavior, so they paid more than women initially. Rates tend to decrease for males after the age of 25 so most become on par with their female counterparts as they age.

Our analysis of auto insurance rates for men and women ages 18 to 80 found that men and women paid roughly the same amount for auto insurance in their middle years. Once men reach their senior years, auto insurance rates start to rise again. The same reasoning from their youth applies again. Actuarial data from auto insurance companies shows that older men exhibit riskier driving patterns than women, so they are charged more for car insurance.

Average car insurance rates by age and gender

Average Cost of Car Insurance by Car Type

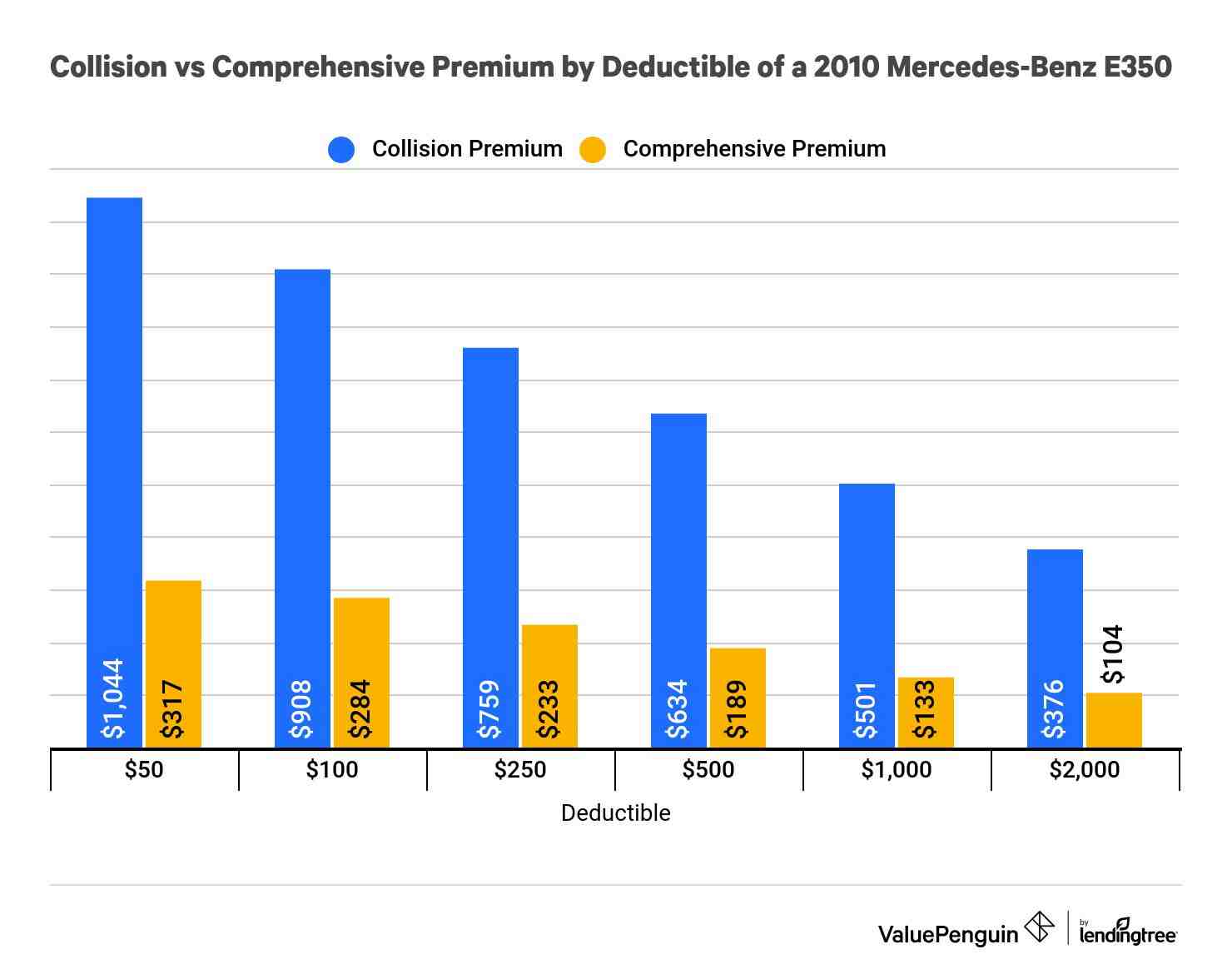

The type of car you drive affects auto insurance rates, especially collision costs and comprehensive coverage costs. Vehicles with a better safety record, cheaper repair bills, and cheaper replacements in the event of an accident, are cheaper to insure.

Minivans are the cheapest vehicle type to insure, with a median annual rate of $2,041, based on an analysis of fare data by vehicle type. While parents who are wary of young children are attracted to minivans, the most expensive types of cars are on the other end of the spectrum. The coupe—think two-door sports car—has the most expensive average fares at $3,894.

Car insurance rates for carriages may seem high, but the Porsche Panamera and Taycan, which come with hefty price tags and repair costs, both fall into this category.

Average car insurance rates by car type

Average car insurance rates by fuel type

Hybrid and electric car insurance is more expensive than gas powered car insurance because repairs can be more expensive. Mechanics may require specialized training and spare parts can be more expensive.

Average car insurance costs for top-selling vehicles

There is a tie for the cheapest vehicle to insure among the top 20 best selling vehicles. The Honda CR-V and Subaru Outback both have an average annual price of $1,723. That’s $1,405 less than the price of the most expensive vehicle on the list.

Tesla Model Y insurance is the most expensive at $3,128 per year, followed by Tesla Model 3 insurance at $3,053 per year. Tesla Model Y car insurance costs 82% more than Honda CR-V or Subaru Outback. The value of the vehicle and the cost of repairs are some of the reasons why Tesla models are so expensive to insure.

Average Cost of Car Insurance by Driver

Safe drivers usually pay lower fares than drivers with tickets or accidents on their driving record. Car insurance companies reward those with a clean driving record at lower rates because good drivers usually make fewer claims, so it’s generally cheaper to insure.

Average car insurance rates after a speeding ticket

Safe drivers (no tickets or accidents) pay an average of $1,601 per year for full coverage, based on our analysis. But if you’re caught speeding, expect to pay 24% more for auto insurance after the ticket, on average—an annual increase of $384. That brings the median rate after speeding tickets to $1,985.

Average car insurance rates after a DUI

Our rate evaluation found that car insurance rates after a DUI were on average 74% higher than rates for drivers without a DUI. That raised the average auto insurance rate for good drivers from $1,601 to $2,786 per year, an increase of almost $1,200.

Average car insurance rates after an at-fault accident

Car insurance rates after an accident increased by an average of 45% for drivers who caused property damage. That increases the average rate by $720 per year, from $1,601 to $2,321. Note that minor accidents don’t necessarily mean your rates have gone up.

Some state laws prohibit one minor accident from triggering an interest rate hike. For example, in New York, auto insurance companies are not allowed to increase rates if the total accident damage is less than $2,000 and there are no injuries.

And, even when state laws don’t apply, some insurance companies will let minor accidents pass without lowering your rates. For example, in most states, Progressive will not increase rates if your total accident claim is $500 or less.

Also, many auto insurance companies offer accident forgiveness benefits—as part of being a loyal customer or for a fee—that saves you from rising rates after your first car accident. But if you’ve had two crashes, don’t expect to pass on the second.

Average cost of car insurance based on credit

Auto insurance companies say drivers with lower credit scores are more likely to file claims. That’s why auto insurance rates for drivers with bad credit are often very high.

Our fare analysis found that, on average, drivers with bad credit paid 76% more than drivers with good credit. That is a price increase of more than $1,200 a year, from $1,601 to $2,818.

Not all states allow your credit score to be used in pricing auto insurance. Using your credit-based insurance score is prohibited from calculating auto insurance rates in California, Hawaii, Massachusetts, and Michigan.

Factors That Affect Car Insurance Rates

The main factors for a car insurance quote are:

What Does Car Insurance Cover?

Here are the main types of auto insurance:

Related: What does auto insurance cover?

How to Reduce Car Insurance Costs

Whether you buy a minimum liability auto insurance policy or a robust full coverage auto insurance policy, there are ways to save.

Methodology

We use data from Quadrant Information Services, an insurance data and analytics provider. Fares are based on a driver with a clean record who insures the Toyota RAV4. The full coverage rate includes $100,000 in bodily injury liability coverage per person, $300,000 per accident and $100,000 in property damage liability, uninsured motorist coverage and other coverage required in the state. The rate also includes collision and is comprehensive with a $500 deduction. Minimum auto insurance rates cover the minimum amount of auto insurance required in each state. Rates are effective from May 2022.

Best Car Insurance Companies 2022

With so many options for auto insurance companies, it can be difficult to know where to start to find the right auto insurance. We’ve evaluated insurance companies to find the best auto insurance company, so you don’t have to.

Average Cost of Car Insurance FAQ

What is the average cost of car insurance?

The average cost of auto insurance is $1,601 per year, according to a Forbes Advisor analysis of full-coverage auto insurance policies. The average annual cost of a basic liability auto insurance policy is $513.

Full coverage car insurance includes collision coverage and comprehensive coverage, which covers your car and is a great benefit but comes with additional costs.

Exactly what you will pay for car insurance depends on your driver profile and car insurance company. The best way to determine the cost of your car insurance is to compare auto insurance quotes.

What is the average cost of car insurance per month?

The average monthly cost of auto insurance is $133 for a full coverage policy, according to a rate analysis by Forbes Advisor. The average price of auto insurance per month is about $43 per month for state minimum liability auto insurance.

Your fare will vary based on your personal information, such as the car you drive, your driving record, and where you live. To get the best auto insurance rates, do a shop comparison with at least three different auto insurance companies.

How can I get the best car insurance rates?

The easiest way to get the best auto insurance rates is to shop around.

Evaluating the average auto insurance rate can help you see how much you can pay for an auto insurance policy. However, the cost of your car insurance will differ due to various factors that affect your car insurance rates. This includes personal information, such as where you live, the car you drive, and your driving record.

To get cheap auto insurance rates, compare auto insurance quotes with at least three auto insurance companies. Be sure to compare the same coverage types and limits.

While there are many types of insurance (from auto insurance to health insurance), the most lucrative careers in insurance are those who sell life insurance.

How much does insurance go down after 1 year no claims?

This can save you money. Even after just one year of driving without a claim, you can get up to 30 percent off the cost of next year’s auto insurance. After five years, this could reach 60 percent. It builds up over time.

How much will my insurance increase after the UK 2022 accident? If you have already claimed your car insurance, you can expect to pay 20% to 50% more for coverage in the future. However, the amount varies depending on who is to blame for the claim, the severity and cost of the accident, and your overall driving record.

Does insurance go down after the first 6 months?

After six months have passed, auto insurance companies will generally calm down and accept the fact that you made your payments on time and your reliability rating improved with them, lowering your overall costs.

Does Geico go down after 6 months?

If you are a new driver or have recently signed up with a new insurance provider, you may be wondering when the cost of your auto insurance coverage will drop. Generally, car insurance rates remain the same on subsequent policy renewals, even if you are a safe driver with an accident-free record.

Why did my car insurance go up after 6 months?

While it may seem arbitrary, there is a real reason you may see your prices go up and down. Car insurance rates can change based on factors such as claims, driving history, adding a new driver to your policy, and even your credit score.

Does insurance get cheaper after 6 months?

In most cases, a six-month policy will be cheaper than a 12-month policy because you pay coverage over a shorter period of time. However, if you compare the price of your auto insurance on a monthly basis, there may not be much difference between a six-month policy and a 12-month policy.

Should car insurance decrease every year?

Does auto insurance diminish over time? Yes, auto insurance diminishes over time. You may find that your car insurance rates drop with age or have a teenage driver on board. And you may get a discount if you take out insurance with the same company for three to five years.

How often should your car insurance go down?

If you are a safe driver, you will start to see a decline every time you renew your policy, even before you turn 25. After 25 years, you should see a bigger drop in your rates.

Is it normal for car insurance to decrease?

Usually, yes. At Progressive, rates fall by an average of 9% by age 25. But there are other cost factors that affect your auto insurance, such as your claim history. So if you get into an accident just before you turn 25, your rates may not drop.

Should you change car insurance every year?

It is smart to at least consider changing your car insurance every year. That way, you’ll be able to compare offers to make sure you’re getting a reasonable rate for car coverage.

How many insurance claims before you drop?

There is no limit to how many claims you can file. However, most insurance companies will drop you as a client after three claims over a three-year period, regardless of the type of claim.

Can insurance drop you for too many claims?

The insurer may cancel the policy or choose not to renew at the end of the policy term. Non-renewal can occur after several accidents or making too many claims. At the same time, early cancellations can result from serious problems such as loss of driving rights or insurance fraud.

How many auto claims are too many?

While there’s no limit to how many auto insurance claims you can file per year, you’ll find that most auto insurance companies will tell you that your policy can be canceled immediately if you file two claims within two years. Once you make a third claim, there is a chance the insurance company will drop you.

How many insurance claims is too much?

In general, there is no set amount for a home insurance claim that you can file. However, two claims over a five-year period can cause your home insurance premium to rise. More than two claims in the same period can affect your ability to find coverage and even cause the policy to be cancelled.

How much do average Americans pay for car insurance?

The average cost of auto insurance is $1,771 per year for full coverage, or about $148 per month, according to Bankrate’s 2022 analysis of average premiums quoted from Quadrant Information Services. Minimum coverage costs an average of $545 per year.

How much does the average American pay for auto insurance? The national average cost of auto insurance is $1,630 per year, according to NerdWallet’s 2022 rate analysis. That works out for an average auto insurance rate of around $136 per month.

How much do most people pay for insurance a month?

The national average monthly health insurance cost for one person on an unsubsidized Affordable Care Act (ACA) plan in 2022 is $438.

How much do people pay monthly for insurance?

BY Anna Porretta Updated October 01, 2022 In 2020, the national average cost of health insurance is $456 for individuals and $1,152 for families per month. However, costs vary between different health plan options.

How much does the average person spend on life insurance per month?

The average cost of life insurance is $26 per month. This is based on data provided by Quotacy for a 40-year-old who purchased a $500,000 20-year term life insurance policy, which is the most common term and sales amount.

What do most people pay for insurance?

The average American family pays about $1,779 per month. What about employer coverage? The average American worker pays $5,969 in 2021 for employer-sponsored group health insurance. Total annual premium costs (employer and employee) in 2021 for employer-offered coverage rose 4% compared to 2020 to $22,221.

How much do Americans overpay on car insurance?

American drivers pay an average of $368 more each year for auto insurance. Within certain ZIP codes, fares vary by an average of 154%, allowing drivers to find savings of an average of 32%. Only 12% of drivers find shopping for car insurance easy, leaving 88% missing out on the opportunity to find cheaper insurance.

How do I not overpay car insurance?

Shop around and get quotes from several auto insurance companies. This will give you a better sense of whether you are paying more. Choose a higher auto insurance deductible. Maximize auto insurance discounts by asking your auto insurance agent to review possible discounts.

Why car insurance is so expensive in US?

Driving Notes A driver’s car insurance premiums can be expensive due to a recent claim or driving violation. Speeding tickets, accidental accidents, and DUIs have big implications on insurance premiums.

How much money do Americans waste on car insurance?

Nationally, drivers spend an average of $1,771 per year on full-coverage auto insurance, which accounts for 2.57% of the average American’s annual income.

Listed below are other things you can do to lower your insurance costs.

- Have a look. …

- Before you buy a car, compare insurance costs. …

- Ask for a higher deduction. …

- Reduce coverage on older cars. …

- Purchase your homeowner and car coverage from the same insurance company. …

- Maintain a good credit record. …

- Take advantage of low mileage discounts.

Can you negotiate with insurance companies? While you can’t negotiate your auto insurance rates, you’re not contractually obligated to remain with your insurance company. If you find a cheaper rate elsewhere, you can change your insurance provider. Depending on when you cancel and the fine print of your auto insurance policy, you may be charged.

Is Geico actually good?

Geico is a leading auto insurance company known for its affordable rates and decent customer service. The company received fewer than the average number of complaints for its size in 2020, according to NAIC, and scored 853 out of 1,000 points in the J.D. Insurance Spending Study. Power 2022 USA.

Is GEICO good at paying claims? Geico is better at paying claims than the average insurer, according to JD Power’s latest claims satisfaction survey. Geico scored 881 out of 1,000 for their claims process, compared to the industry average of 880 out of 1,000.

Is GEICO really the cheapest?

Geico is the cheapest major auto insurance company in the country, according to NerdWallet’s latest analysis of minimum coverage levels. Geico’s average annual rate is $354, or about $29 per month.

Is Geico cheaper than Geico?

| Company | Annual Average Rate |

|---|---|

| Geico | $1,719 |

| National | $1,777 |

| National average | $2,227 |

Is Geico cheaper than other insurance?

According to our research, Geico’s full coverage car insurance rates are about 25% cheaper than the national average for good drivers.

Can switching to Geico really save you?

Car insurance. Of course, one of the fastest ways to save money is to switch your car insurance to GEICO. After all, it only took 15 minutes to get a quote, and new GEICO customers reported average savings of over $500 a year.

How is GEICO at paying claims?

Checks are mailed no later than 48 hours after the accident investigation is complete. If you have an accident, you can start your GEICO claim process by filing a claim online at geico.com or calling (800) 841-3000 at any time. A claims representative is available 24/7.

Is GEICO good at paying out claims?

Overall, respondents with Geico insurance policies were pleased with the company’s customer service throughout the claims process, giving the company a 4.2 star rating out of 5.0. In addition, participants gave the company a 4.1 star rating for satisfaction with the results or settlement of claims.

How fast does GEICO pay claims?

Payment recovery usually takes about six months, but sometimes happens faster, depending on the circumstances. (GEICO claims are like snowflakes—they’re all unique.) Like most things in life, this works best when everyone is playing well and working together.

How long does GEICO take to process a payment?

Provide your checking account information. Your bank will process the payment within five business days. (The transaction will appear on your bank statement as “GEICO PYMT.”) For added convenience, save your banking information so you don’t have to enter it again the next time you make a payment.

Do people actually use GEICO?

Geico is the second largest auto insurance company in the US. The company was founded in 1936 and has grown to insure more than 28 million vehicles on more than 17 million auto policies. Here are some other important things to know about Geico Insurance: 4.5/5 rating from WalletHub editors. 2.6/5 average rating among users.

How popular is Geico insurance?

Geico is the second largest auto insurance company in the country, known primarily for the low rates it offers consumers directly online and over the phone. It is available in all 50 states and Washington, D.C.

Do people like GEICO?

Yes, Geico is a good car insurance company. Geico is a good choice for drivers who want to pay less for their car insurance needs. Overall, Geico received an average score in each of the categories we reviewed, including customer service and claims handling.