Car insurance rates in Illinois are rising rapidly; 2 bills introduced in the General Assembly are intended to reduce costs

Is it normal for car insurance to increase every year?

Contents

Why does car insurance increase every year? If you notice that your car insurance continues to increase every time you renew, it could be due to rising car insurance rates over time. These are often caused by factors beyond your control, such as increases in the cost of repairing and replacing vehicles or increases in claims and severity in your area.

Does Progressive increase interest rates after 6 months? Your progressive rates may increase after six months, depending on a number of factors. On the same subject : Money Minute: Tips for saving on car insurance.

What time of year is car insurance most expensive?

It is often thought that December can be the most expensive month to insure your car, but is that really true? Drivers who insure their cars in December can pay more than 15% more than those who insure in February, the cheapest time of the year, research by MoneySuperMarket found. See the article : Car Insurance for Teens.

Who normally has the cheapest car insurance? State Farm is the cheapest auto insurance company overall according to NerdWallet’s analysis, with an average rate of $39 a month for minimum coverage.

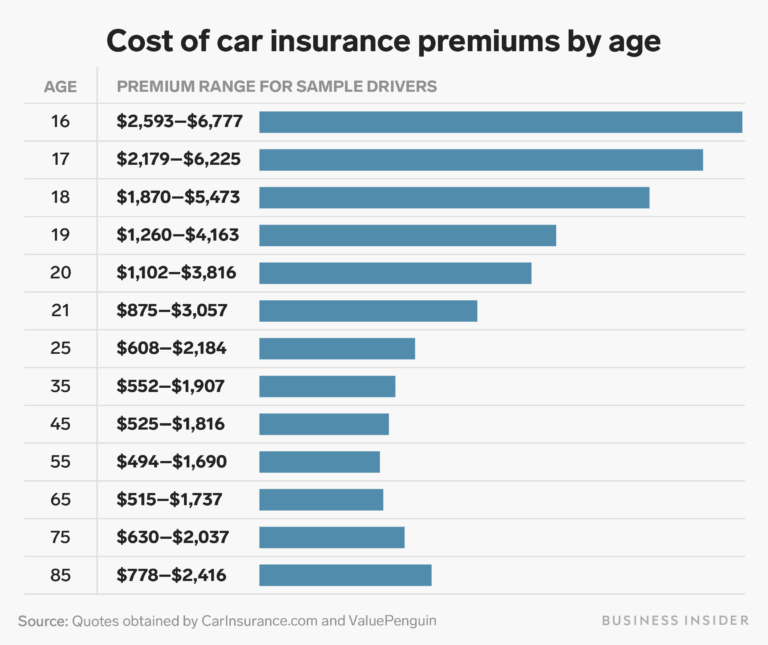

At what age is car insurance most expensive?

The Insurance Institute for Highway Safety reports that teenage drivers are four times more likely to be involved in a car accident than drivers over the age of 20. As a result, car insurance companies see young drivers as the riskiest to insure. Drivers aged 16 to 24 tend to face the highest premiums compared to other age groups.

At what age does car insurance drop in the UK? Once you’re 25, you may well find that the price of your car insurance starts to drop. All other things being equal, it should fall gradually between the 25 and 50s, with those between 50 and 60 generally taking advantage of the cheapest prices.

What is the cheapest month to buy car insurance?

August is the cheapest month of the year to take out new car insurance, according to new data.

Which day is cheapest for car insurance? Still, you should never just auto-renew, as it’s likely you’ll end up paying more than you need to. You should always compare prices, and we’ve found that the best time to buy car insurance is 20 to 26 days in advance, as this is usually the cheapest. For why, read this short guide…

What is the best time to insure your car?

You should always compare prices, and we’ve found that the best time to buy car insurance is 20 to 26 days in advance, as this is usually the cheapest.

What is the cheapest day to insure a car? When is the cheapest time to renew my car insurance? The best time to renew your car insurance is within 15 to 29 days of the renewal date. On average, motorists pay less for a new quote when they have more than a week left on their policy than if they renew on the last day.

Why did my car insurance go up 2024?

“Between 2020 and 2024, inflation increased the cost of vehicle parts and labor, car crash fatalities increased by over 10% and we saw a significant increase in extreme weather claims and vehicle theft. Read also : What is comprehensive auto insurance?. All of these factors contribute to the high rates we see today.”

What is a French carte grise? The term “carte grise” means the registration certificate in France. The French registration certificate (carte grise) is mandatory for French and foreign drivers resident in France who wish to travel on public roads in France or resell their vehicle.

Can I insure a French registered car in the UK?

Insure a foreign car if you plan to stay in the UK Once you’ve been driving in the UK for six months (or your current insurance expires), you’ll usually need to get UK insurance for your imported car.

How long can I drive a French registered car in the UK? A foreign registered vehicle can be used in the UK for six months if it is fully taxed in its home country. After this, the vehicle must be registered with the DVLA and will no longer have a foreign registration plate.

Can I insure a European car in the UK? Usually, yes. You can expect cars built for non-EU markets to be more difficult to insure and come with higher premiums. To begin with, many insurance companies will not give you a quote on an imported car, so you will need to look for a specialist.

How long does it take to get a carte grise?

Carte grise You will receive your safe fold, generally within 7 working days.

How do I get an 846A certificate in France? The 846A certificate is the proof that you have paid the customs duties and taxes related to the importation of a vehicle, when required. It is delivered by customs offices with a copy of the customs declaration and receipt. Once secured, all you need to do is add it to submit your foreign car registration application.

What is a WW number plate in France?

‘WW’ plates apply to a temporary registration in France, which is valid for four months and cannot be renewed. This registration can be granted in several scenarios, one of which is where a person resident in France buys a car abroad and brings it back to the country with foreign plates.

What are WW plates in France? In order to benefit from your vehicle as soon as it is purchased, we can provide you with a temporary WW valid for 4 months, non-renewable, which allows you to use the vehicle legally and facilitate obtaining insurance in France, waiting to receive your final registration.

Is car insurance cheaper in Texas or Illinois?

You should expect to pay more for auto insurance in Texas than you did in Illinois. The typical annual auto insurance rate in Texas is $855 more expensive than the average cost in the state of Illinois. Remember that this cost depends on your level of coverage, driving and insurance history and your car insurance company.

Who has the lowest rates on auto insurance in Texas? The cheapest auto insurance company in Texas is Texas Farm Bureau at $1,268 per year on average, or $106 per month, according to the latest NerdWallet analysis of comprehensive auto insurance rates in Texas.

Is car insurance more expensive in Texas? Auto insurance in Texas is expensive because the state has three of the 10 largest cities in the country and large, growing populations across the state. In Texas, you can expect to pay approximately $5,335 per year for full coverage insurance or $1,689 per year for minimum coverage.

Is car insurance more expensive in IL?

Average Illinois Car Insurance Cost This is based on the profile of a 35-year-old driver with a clean driving record and good credit. Compared to the national average of $2008 per year, Illinois drivers pay about 30% less.

Who usually has the cheapest car insurance? State Farm is the cheapest major auto insurer in the country for good drivers, according to NerdWallet’s 2024 analysis of minimum coverage rates. State Farm’s average annual rate was $471 or about $39 per month.

Who has the cheapest car insurance in Illinois?

The cheapest car insurance companies in Illinois

- Cheapest company for minimum coverage: Secura.

- Cheapest company for full coverage: Geico.

- Cheapest company for drivers with previous incidents: Secura and Geico.

- Cheapest companies for young drivers: First Chicago, Secura and Auto Club.

What is the minimum car insurance in Illinois? You are in compliance with the law if you have liability insurance in the following minimum amounts: $25,000 for injury or death of a person in a crash. $50,000 for injury or death of more than one person in a crash. $20,000 for damage to property of another person.

Did Illinois raise car insurance rates?

“Since 2022, the top auto insurance companies have raised rates in Illinois by nearly $2.4 billion.†State Farm and Allstate, including subsidiaries, raised rates the most by $364 million and $210 million in 2023. The companies increased rates by $753 million and $439 million dollars since 2022, the release states.

Why did my car insurance go up in Illinois? “In some cases, we’re hearing from people who are paying $800 more for car insurance. Brasler said a big reason for the increase is that it’s more expensive for insurance companies to settle claims than in years past. “Parts costs are more expensive,” Brasler said.

Is car insurance high in Illinois? Because insurance coverage prices are cheaper in Illinois than the national average, you have a great chance of finding good car insurance in Illinois at excellent prices.

What state has the worst insurance rates?

Michigan Michigan has the most expensive auto insurance in the country. Drivers pay an average monthly rate of $275 compared to the national average of $156. Auto insurance premiums increased 31% in Michigan in the first half of 2023 – a significantly higher jump than the 17% increase nationwide.

Your particular driver profile, which includes factors such as where you live, your age and your driving record, affects what you pay for car insurance. But rising car repair costs and an increase in disaster-related claims are important reasons why car insurance prices are rising for many drivers.

Why did the insurance increase in 2024? “Auto insurance is reactionary, meaning the premium increases we see in 2024 are a result of insurers trying to recoup the losses they’ve experienced in recent years and accurately assess the risk of future loss,” said Bankrate analyst Shannon Martin with Kiplinger.

Why are insurance premiums increasing? Simons said several factors add to the rising premiums, such as rising costs of labor and parts to repair damaged vehicles, and the general increase in vehicle prices in recent years, which raises the underlying safety that is insured.

Why has my homeowners insurance doubled? As inflation increases, insurance companies respond by raising interest rates. That’s because the cost of items in your home will cost more than they did last year. As the price of appliances and equipment escalates, the prices will also adjust.

Is car insurance going up because of inflation?

Auto insurance rates are affected by inflation in several areas of the auto industry, including vehicle values, labor costs, the price of replacement parts, and health care costs.

Is inflation good for insurance companies? Periods of high inflation can lead to insurance companies experiencing higher claim payouts and operating costs, leading to more expensive premiums for the consumer. As a result, some customers may have to drop coverage or switch policies to save costs.

Why has car insurance gone up 2023 UK?

The cost of parts and labor has increased due to inflation, this means it costs insurance companies more to pay to repair or replace vehicles. It is also more complicated to repair cars now, as many of them use expensive technology and equipment.

What is the average UK car insurance increase in 2023? This means that motor cover was on average 25% more expensive throughout 2023 than in 2022. This comes from ABI’s Motor Insurance Premium Tracker, which covers the fourth quarter of 2023. The tracker is the most comprehensive in the UK, analyzing almost 28 million policies sold a year.

Why did my car insurance go up when nothing changed?

Why did my car insurance go up when nothing changed? Your car insurance may increase if the cost of repairs, work or healthcare increases. This is because car insurance companies raise their prices to account for higher costs in these areas.

Is it normal for car insurance to increase every year? Unfortunately, it is normal for car insurance prices to increase most years. However, companies cut insurance rates from time to time. Some companies offer loyalty discounts, so you may see prices drop after several years with the same supplier.

Why is my Geico insurance suddenly so much higher? Geico may have raised your rates due to changes in your policy or circumstances. Examples include adding a new type of coverage, becoming eligible for an additional type of discount, being involved in an accident or buying a new car.

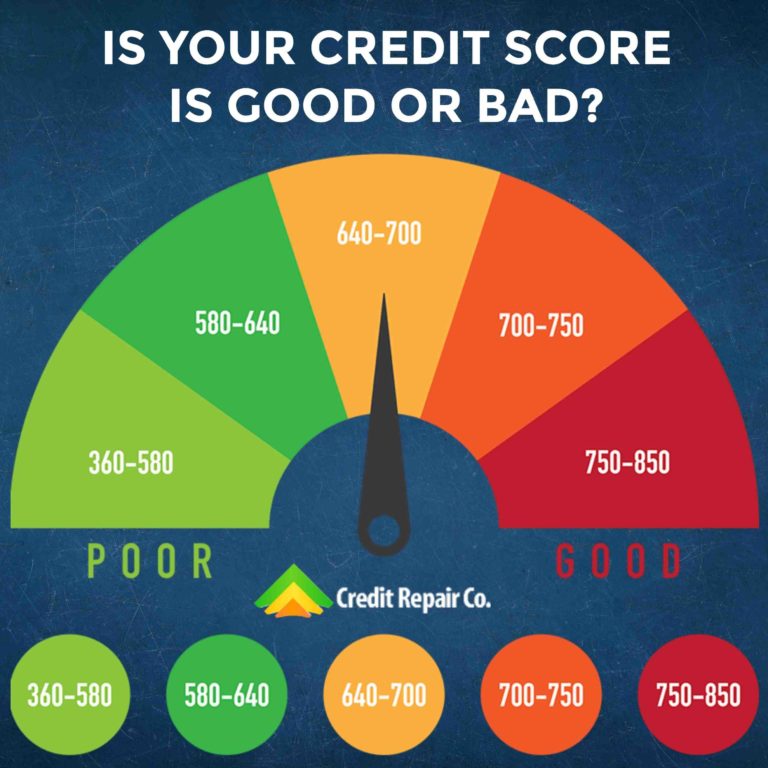

Does credit score affect car insurance?

In addition to your driving history and type of vehicle, your credit score can affect what you pay for car insurance.

Why does my car insurance keep going up for no reason?

Although it may seem arbitrary, there are actual reasons why you may see your price go up and down. Car insurance rates can change based on factors such as claims, driving history, adding new drivers to your policy and even your credit score.

What is the minimum coverage for car insurance in France? Third party liability (tiers collision or responsabilite civile) This is the minimum amount of insurance you need under French law. It insures against damage and injury to all third parties in incidents where you are at fault. This includes passengers in your car.

Why is car insurance so high in the UK? The increases come as insurers pass on the rising cost of parts and materials, while repairs have become more expensive as cars become more sophisticated. Observer readers have spoken about the impact of the huge increases and what they have done in response.

What is third-party insurance in France?

Liability coverage, often called third party insurance, is the minimum coverage you must purchase to insure your vehicle. This warranty covers damage that the vehicle may cause: damage to a pedestrian or passenger, damage to another vehicle or to, for example, a building.

What is covered by third party insurance? Third Party This is the legal minimum and covers you for damage to someone else’s vehicle or property or damage to someone else in an accident. This includes accidents caused by your passenger. It does not cover repairs to your own vehicle.

Do I need additional insurance when driving in France? You must have third party insurance (a legal requirement) at least when driving in France, but it does not cover any costs you incur as a result of an accident. Make sure your insurance is fully comprehensive and you have your motor insurance certificate before you go.

Can I cancel my car insurance in France?

Since ‘Loi Hamon’ 2014, there exists a right for consumers to cancel their car and house insurance policies at will, after the end of one year of the contract. The right of termination is free of charge and with a full refund of any unexpired premium.

Is car insurance a legal requirement in France? As a user of French roads, you are required by law to take out compulsory road insurance for your car. Motor insurance for a French car according to French law is mandatory, therefore it applies to anyone who wants to drive legally on public roads regardless of the length of their stay.