Which is a type of insurance to avoid?

Contents

- 1 Which is a type of insurance to avoid?

- 2 Which of the following is not covered by a standard title insurance policy?

- 3 What is IDV?

- 4 What are 4 main types of coverage and insurance?

Avoid buying insurance you do not need. Chances are you need life, health, car, disability and perhaps long-term care insurance. Read also : What are the 3 types of car insurance?. But do not buy sales arguments that you need other more expensive insurance that gives you coverage only for a limited range of events.

Is insurance a monopolistic competition? In the third period, however, the results indicate that the insurance market was neither monopolistic nor perfectly competitive. Fixed income was earned as if it operated under monopolistic competition. Overall, the results show that market concentration is not significantly linked to competitive behavior.

Why is there no competition in health insurance?

Instead of being affected by competition, the prices of healthcare services are largely set by insurance companies and suppliers with monopoly power to maximize profits. Read also : What is the birthday rule?. … Commercial health plans have little bargaining power when negotiating prices with monopolistic providers.

Is there competition in the healthcare industry?

The health market has limited competition, and provides a platform for mediocre quality of care and unsustainable, rising health costs.

Why is healthcare not a competitive market?

7 The market structure in the health care system is not competitive. There are barriers to entry and exit. Some barriers come from professional licensing, long and expensive training and expensive investment requirements (eg hospitals are expensive to build).

Why is competition bad in health care?

Opponents of competition, on the other hand, typically fear that it will lead to undesirable outcomes such as a reduction in quality, access to health services based on ability to pay rather than medical needs and as a result inequality and inefficiency in the distribution of health services.

How does insurance competition affect medical consumption?

The competition in the insurance markets affects not only the monthly premium, but also the terms of cost sharing (such as copays and coinsurance rates) for the products offered. On the same subject : Can my son drive my car if he is not insured?. These terms determine the deductible for medical treatment, which can affect a patient’s medical decisions and health outcomes.

How has managed care affected price competition among hospitals?

Controlled competition transformed these institutional arrangements and incentives by increasing competition: (1) the ability of larger insurance sponsors to select and adjust plans (Enthoven, 1993); (2) Premium price based on control of medical expenses (Morrisey et al., 2003); and (3) increased market power for the insurance company, …

Is health insurance a competitive market?

Competition in Health Insurance, 2021 update Key findings from the 2021 update include: Seventy-three percent (280) of MSA-level markets were highly concentrated (HHI> 2500) in 2020, up from 71% in 2014. Average HHI across MSA The markets at the level were 3494 in 2020.

Is insurance a competitive market?

Because the insurance market is competitive, when companies become profitable, they start using milder insurance criteria and lower premiums to gain more market share. Read also : What are 4 main types of coverage and insurance?. Other insurance companies respond by applying the same guidelines, to prevent their shares from being taken away or to increase their market share.

What type of market is the insurance market?

The insurance market is cyclical.

What is an insurance market?

According to the Financial Times Lexicon, the insurance market is simply “buying and selling insurance.” Consumers or groups buy risk management insurance from insurance companies that offer coverage for specific risks.

Is health insurance a perfectly competitive market?

7 The market structure in the health care system is not competitive. There are barriers to entry and exit. Some barriers come from professional licensing, long and expensive training and expensive investment requirements (eg hospitals are expensive to build).

Which of the following is not covered by a standard title insurance policy?

Which of the following is NOT covered by a standard property insurance policy? UNREGISTERED RIGHTS TO PARTIES IN POSSESSION. Read also : What is the average payment for car insurance?.

What does a standard title insurance quizlet cover? a standard coverage title insurance insures against? losses as a result of any encumbrances that the title applicant overlooked and failed to include in the title report.

Which of the following is included by a standard title insurance policy?

A standard policy insures first and foremost against title deficiencies that can be discovered through an examination of a public journal. To see also : What does ot mean in auto insurance?. This includes deficiencies in property rights or registered liabilities or encumbrances, such as unpaid taxes or rates, and deficiencies due to lack of access to open streets.

What does a policy of title insurance do quizlet?

An owner’s title insurance policy will ensure the owner that they have salable ownership of the property; that the property is free and free of encumbrances, encumbrances or other defects unless shown by the police as an exception; and that the property has access to a public road or street.

Which of the following title insurance policies is the most common?

The most common type of property insurance is the lender’s property insurance, which the borrower buys to protect the lender. The second type is the owner’s property insurance, which is often paid for by the seller to protect the buyer’s equity in the property.

Which of the following is not a risk covered by title insurance quizlet?

A loan policy for real estate insurance insures against regulatory cases. An owner’s property insurance excludes from coverage defects, liabilities, encumbrances and adverse claims created by the insured creditor.

What does a policy of title insurance not do quizlet?

Title insurance protects against forged documents, but does not protect against claims from parties in possession because the grant holder should have visited the property; nor does it cover unregistered liens.

Which of the following is not covered by a title policy?

WRONG DELIVERED JOINT. The rights of persons in possession (before purchase) are not covered by the basic insurance, but they are covered by extended coverage. Changes in land use related to zoning are not covered by any form of property insurance.

What is not included in basic title insurance quizlet?

Items that are not included in a standard CLTA policy include: Defects known to the insured but not disclosed to the title insurance company. Easements, encumbrances and encumbrances not shown in public records. Rights or claims of persons in physical possession of the property. Mining requirements, water rights and regulation statutes.

What does title insurance protect against quizlet?

A standard title insurance protects against errors discovered in the title AFTER closing, not before closing. If a title problem is found before closing, it must be removed or the buyer will have the right to terminate the contract (or accept a vague title).

Which of the following is not a risk covered by title insurance quizlet?

A loan policy for real estate insurance insures against regulatory cases. An owner’s property insurance excludes from coverage defects, liabilities, encumbrances and adverse claims created by the insured creditor.

Which of the following is not covered by a title policy?

WRONG DELIVERED JOINT. The rights of persons in possession (before purchase) are not covered by the basic insurance, but they are covered by extended coverage. Changes in land use related to zoning are not covered by any form of property insurance.

What is title insurance quizlet?

title insurance is used to insure against title deficiencies in public registers. -Insured pays a one-time premium; continues as long as the buyer maintains an interest in the property (does not run with the plot)

What is IDV?

IDV refers to the insured declared value and is the maximum sum insured determined by the insurance company offered in the event of theft or total loss of a vehicle. In short, IDV is the current market value of your vehicle.

How much is IDV reduced each year? What is the IDV or depreciation percentage for car insurance each year? IRDAI determines the depreciation rate based on the age of the vehicle. While it is 5% for vehicles under 6 months old, vehicles less than 1 year old, the rate is 15% and then 20%, 30%, 40% and 50% each year.

What IDV should I buy?

At best, IDV is the maximum insurance amount that the insurance company undertakes to compensate your loss. Getting an IDV that is close to the market value of your car is always the best option. Reducing the IDV value will result in lower premiums, but it also gives you lower coverage than necessary.

How much IDV should I choose?

Normally the depreciation on a new car is 5 percent, therefore the maximum IDV should by default be 95% of the price from the showroom of the car. “The moment you take the car outside the showroom, IDV starts to come” The value of a car falls by 5 percent within six months after purchase.

How do I choose IDV?

Basically, IDV is the current market value of the vehicle. If the vehicle suffers a total loss, IDV is the compensation that the insurer will give to the policyholder. IDV is calculated as the manufacturer’s listed sales price minus depreciation.

Does IDV decrease every year?

The depreciation factor reduces the IDV requirement each year, and so does the premium. Within the first six months of the new vehicle, the value of the car falls by 5%. If a vehicle is more than five years old, the price is determined by mutual discussion between both parties (car owner and insurance company).

What does IDV mean?

What is insured declared value (IDV)? The term ‘IDV’ refers to the maximum claim your insurance company will pay if your vehicle is damaged without repair or stolen. Assume that the market value of your car is Rs. 8 lakh when you buy the policy. This means that the insurance company will pay a maximum amount of Rs.

What is the meaning of UAI?

| Acronym | Definition |

|---|---|

| UAI | Unprotected anal intercourse |

| UAI | University Admissions Index (NSW / ACT, index required by HS graduates to enter the university) |

| UAI | International Academic Union |

| UAI | Union des Associations Internationales (French: Union of International Associations) |

What is the full form of Ikr in chat?

IKR: I know, right?

What is IDV in business?

Identity Verification (IDV)

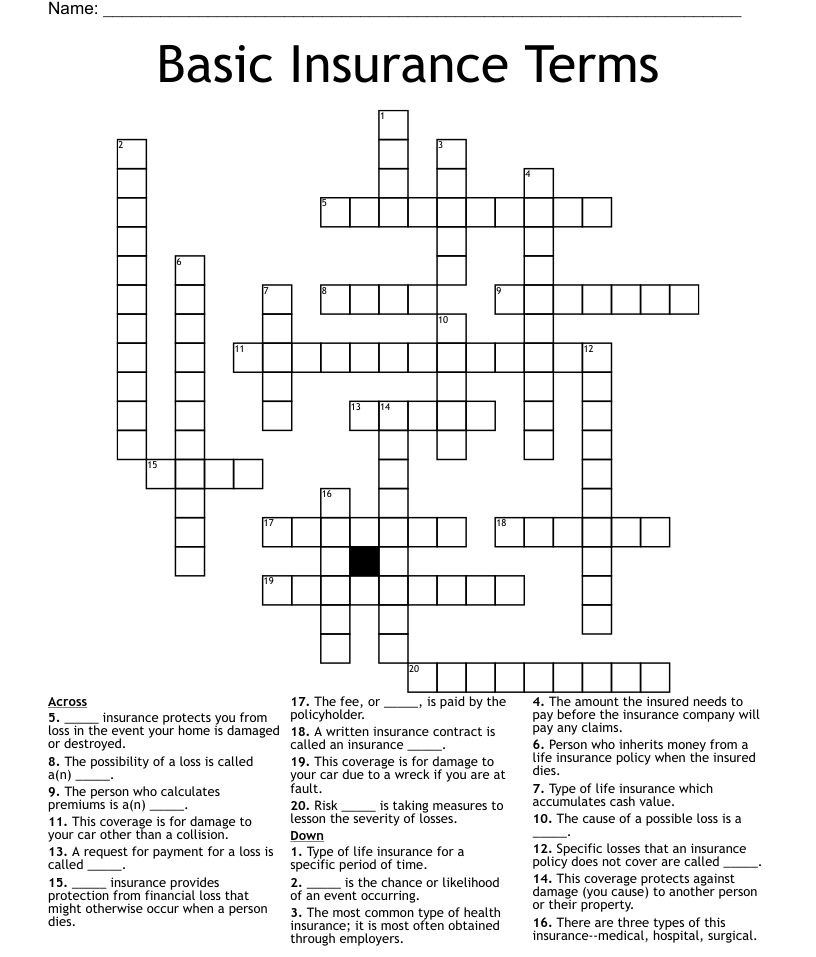

What are 4 main types of coverage and insurance?

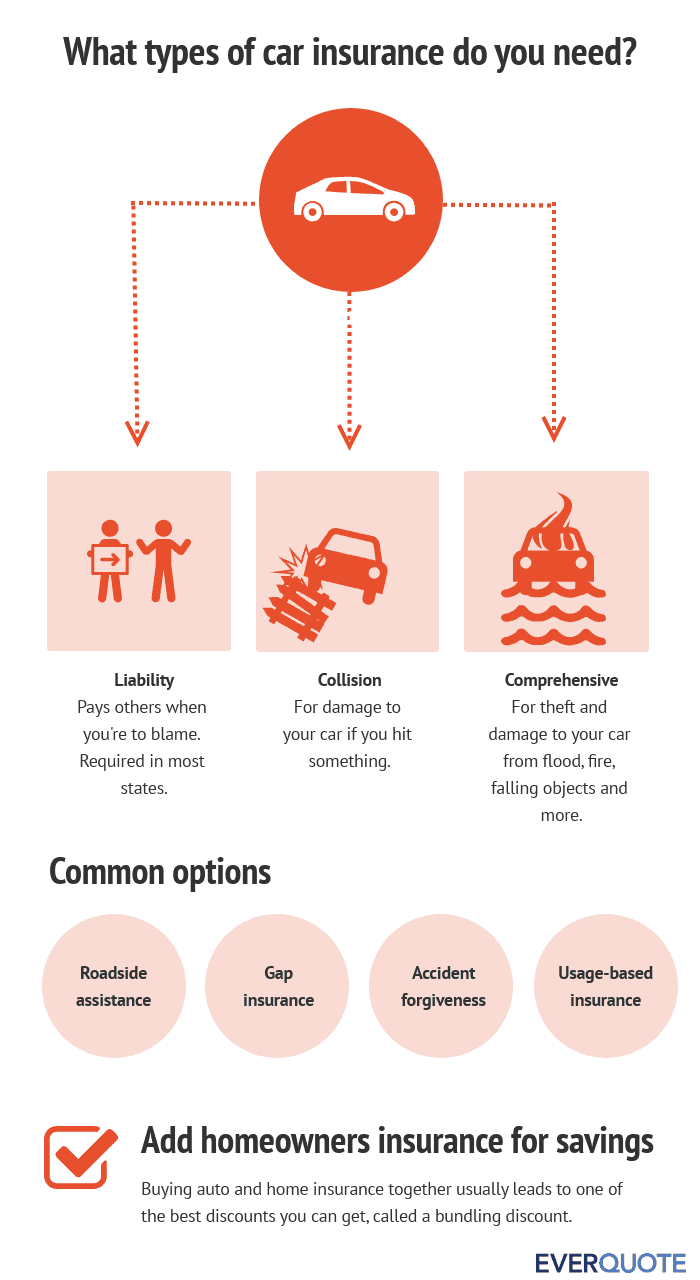

The bottom line. Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you must have. Always check with your employer first for available coverage.

What is a type of insurance coverage? Insurance coverage refers to the amount of risk or liability covered for a person or entity using insurance services. The most common types of insurance include car insurance, life insurance and homeowners insurance.

What are 3 common types of insurance?

Some common types of insurance include:

- Health insurance.

- Car insurance.

- Life insurance.

- Home insurance.

What are the 3 types of insurance?

Then we take a closer look at the three most important types of insurance: property, liability and life.

What are the 5 most common types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What are the 6 main types of insurance?

Six common options for car insurance are: car liability cover, uninsured and underinsured motorist cover, comprehensive cover, collision cover, medical payments and personal injury protection. Depending on where you live, some of these coverages are mandatory and some are optional.

What are the 5 parts of an insurance policy?

Each insurance has five parts: declarations, insurance contracts, definitions, exceptions and conditions. Many guidelines contain a sixth part: endorsements. Use these sections as guide posts to review the guidelines. Examine each section to identify the most important provisions and requirements.