Visit the RTO website where your car is registered, enter the registration number of your car in the given section and click “next” to find the details of the policy. 2. Visit the State Department of Transportation website and enter your car’s registration number to get details of your car insurance plan.

What are the 5 basic types of auto insurance?

Contents

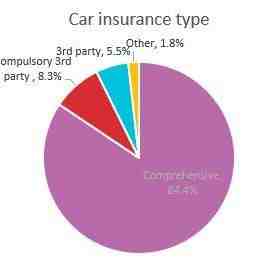

The most common types of car insurance include liability, collision, protection against personal injury, uninsured and underinsured drivers, casco and medical payments. This may interest you : What is the birthday rule?.

What are the 3 parts of car insurance? Responsibility. Most car insurances contain three main parts: personal injury liability insurance, property damage liability insurance and uninsured / underinsured drivers.

What are the 5 types of auto insurance?

Here is an overview of the most popular types of car insurance. Read also : Car Insurance.

- Motor liability insurance.

- Car insurance for physical damage.

- Rental insurance.

- Protection without defects or injuries.

- Coverage of uninsured / underinsured drivers.

What are the types of auto insurance?

The five types of car insurance are: liability, comprehensive insurance, collision, uninsured / uninsured driver and protection against injuries / medical payments. These are the most common types of car insurance, although many insurance companies also sell other types of coverage, such as gap insurance and reimbursement of rental costs.

What are 4 main types of coverage and insurance?

Bottom line. Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you should have. Always check with your employer for available coverage first.

What are 4 main types of coverage and insurance?

Bottom line. Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you should have. Read also : What is basic car insurance called?. Always check with your employer for available coverage first.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability covered for an individual or entity by insurance services. The most common types of insurance cover include car insurance, life insurance and homeowners insurance.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What is the most important insurance to have?

Health insurance is the most important type of insurance you will ever buy. This is because if you don’t have health insurance and something goes wrong, it’s not just your money that’s at stake – it’s your life. On the same subject : What are the 3 types of car insurance?. Health insurance is intended to pay for medical care.

Which 5 important insurances should you have? Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What is the most important type of insurance?

Health insurance is undoubtedly the most important type of insurance. A 2016 Kaiser Family Foundation / New York Times survey found that one in five people with health bills filed for bankruptcy. On the same subject : What’s the best car insurance coverage to have?. With such statistics, investing in health insurance can help you avoid significant financial problems.

What is the best type of insurance to have?

Here are eight types of insurance recommended by Dave Ramsey:

- Periodic life insurance.

- Car insurance.

- Homeowners ‘/ tenants’ insurance.

- Health Insurance.

- Long-term disability insurance.

- Long-term care insurance.

- Protection against identity theft.

- Umbrella policy.

What are the 4 important types of insurance?

Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you should have. Always check with your employer for available coverage first.

What is the most important insurance?

Health insurance Health insurance is the most important type of insurance you will ever buy. This is because if you don’t have health insurance and something goes wrong, it’s not just your money that’s at stake – it’s your life. Health insurance is intended to pay for medical care.

What are the 2 main insurance?

Primary insurance: The insurance that pays first is your “primary” insurance and this plan will pay up to the coverage limit. You may be required to share the cost. On the same subject : What are 4 main types of coverage and insurance?. Secondary insurance: when your primary insurance pays its share, the rest of the bill goes to your “secondary” insurance if you have more than one health plan.

How many types of main insurance are there?

However, there are four types of insurance that most financial professionals recommend to everyone: life, health, car, and long-term disability.

Can you have 2 types of insurance?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal and many people have multiple health insurance policies in certain circumstances.

What are the 2 major classification of insurance?

There are two broad types of insurance: life insurance. General insurance.

What insurance do you really need?

Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you should have. Always check with your employer for available coverage first. If your employer does not offer the type of insurance you want, get offers from several insurance providers.

What is the least important thing you should get insured?

5 types of insurance you don’t need

- Mortgage life insurance. There are some insurance agents who will try to convince you that you need mortgage life insurance. …

- Identity theft insurance. …

- Cancer insurance. …

- Protect your credit card payments. …

- Collision coverage on older cars.

What insurance should you avoid?

Avoid buying insurance that you don’t need. You probably need life, health, car, disability and maybe long-term insurance. However, don’t buy sales arguments that you need other more expensive insurance that provides you with coverage only for a limited range of events.

Which insurance are most important to have?

Health insurance is undoubtedly the most important type of insurance.

What are the 2 types of insurance?

There are two broad types of insurance:

- Life insurance.

- General insurance.

What are the 2 basic types of life insurance? There are two main types of life insurance – fixed and full life insurance. Full life insurance is sometimes called permanent life insurance and comprises several subcategories, including traditional lifelong, universal life, variable life and variable universal life.

Is own damage insurance mandatory?

It is mandatory and without it you can get a high fine. Plus, you don’t have to worry about costs in the event of an accident. It covers many costs of own damage, including natural disasters, vandalism, accidents, total damage and theft.

Is self-insurance compulsory for a car in India? In India, the purchase of third party liability insurance (TP) for motor vehicles is mandatory. The purchase of car insurance for own damage (OD) is not mandatory.

Do I need my own insurance policy?

California Law You must demonstrate financial responsibility for every vehicle you own in the event of injury to other people or damage to their property. … If you do not have car liability insurance, you can be fined, your license revoked and your vehicle confiscated.

What insurance is usually required?

Bottom line. Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you should have. Always check with your employer for available coverage first.

What are the 3 types of car insurance?

The three types of car insurance that are universally offered are liability insurance, comprehensive insurance and collision insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured / underinsured drivers, but they are not available in all countries.

When should you consider getting umbrella insurance?

You should take out circular insurance when your net worth exceeds the limits of homeowners or car liability insurance. Umbrella insurance extends your liability limits to $ 1 million or more, which can better protect you from costly claims or lawsuits if you have a particularly high net worth.

Is own damage insurance mandatory for bike in India?

One that covers both third party damage and your own bike. By law, it is mandatory to have at least bicycle insurance that covers obligations to third parties. Bicycle insurance for own damage is not mandatory by law, but in the end it is more useful for cyclists as it covers their own damage and losses.

Is own damage insurance mandatory in India?

It is mandatory under the Motor Vehicles Act 1988. This type of insurance provides coverage for damage to the insured’s vehicle. It is not mandatory, but it provides more protection than just third party insurance.

Is it compulsory to have own damage insurance for bike?

It is not mandatory, but it provides more protection than just third party insurance. This type of coverage provides coverage of both liabilities to third parties and the cost of own damage under the single premium. It is mandatory and without it you can get a high fine.

Which insurance is mandatory for bike in India?

Therefore, there are two main types of bicycle insurance available in the Indian market: third party liability insurance and general bicycle insurance. Of these, a liability plan is mandatory. The comprehensive plan offers broad coverage and includes mandatory coverage.

Is OD insurance compulsory in India?

In addition, you can also opt for comprehensive insurance to cover both liabilities to third parties and your own damage, both under one policy. No, OD insurance for your car or bike is not mandatory, but it is recommended to protect your own vehicle.

Which insurance is mandatory OD or TP?

The regulator does not currently allow long-term stand-alone OD policies. However, keep in mind that TP liability insurance is mandatory for the purchase of OD coverage or the extension of an existing policy.

Can I drive without OD insurance?

No. Self-insurance or own damage is not mandatory. While it is important to protect your car and you from financial losses, third party insurance coverage is mandatory coverage and helps you avoid legal fines.

Which insurance is mandatory in India?

In India, under the Motor Vehicles Act, it is mandatory that all vehicles operating in any public space must have an insured motor vehicle. Insured persons must have at least car liability insurance for ‘third party liability’, even if they opt for basic insurance plans.