Is car insurance really necessary?

Contents

Owning a car insurance policy is required in most states. Read also : What is basic car insurance called?. If you are at fault for a car accident, the car liability insurance required by your car insurance policy will help you pay for covered losses, such as medical bills on the other side and damage to their car or other property resulting from the accident.

Do I really need my car insurance? Most states require you to have at least the minimum amount of insurance for any injury or property damage caused by an accident. Crash cover, which is optional, covers the damage to your car in the event of an accident. Complete coverage, as well as optional, protects against other hazards, such as theft or fire.

How can I avoid getting car insurance?

Below is a list of other things you can do to reduce your insurance costs. On the same subject : What are the 3 types of car insurance?.

- Shop around. …

- Before you buy a car, compare insurance costs. …

- Ask for more deductions …

- Reduce car insurance. …

- Buy from your homeowners and car insurance for the same insurance. …

- Maintain a good record …

- Take advantage of short distance discounts.

Can you pause car insurance?

You cannot technically â â œ kin kin â â € â œ ara ara ara aga aga iska iska iska iska iska iska waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa waa The only way you can stop your car insurance is to completely cancel your insurance, which you should only do when you change your policies or get rid of your car.

Can I get out of car insurance?

Most car insurance policies say you can cancel your policy at any time. You only need to send a written notice including the cancellation date. It is always a good idea (and in most cases conditional) to notify your old insurance when you move to a new insurance policy.

Is it OK not to have car insurance?

However, as we have mentioned, it is illegal in almost all states to drive without insurance. Even if you seldom drive your car, you may need it in the event of an emergency, and if you do not have car insurance then you risk fines and suspensions.

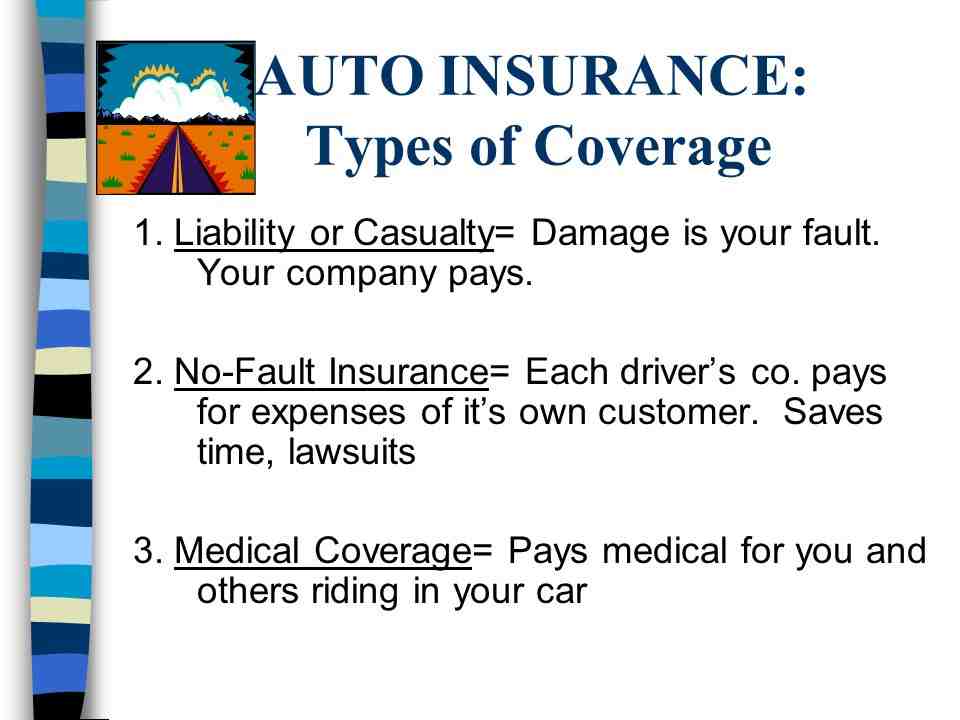

What are the different types of car insurance coverage?

The six standard car insurance options are: car liability insurance, uninsured and driver insurance, comprehensive coverage, accident insurance, health insurance coverage and personal injury protection. On the same subject : What is the birthday rule?. Depending on where you live, some of these insurances are mandatory and some are optional.

What are the five basic types of car insurance? The most popular types of car insurance include liability, conflict, personal injury protection, uninsured and uninsured driver, comprehensive, and medical payments.

What are the 7 different types of auto insurance you can purchase?

Here is a list of seven types and you need to know each one. This may interest you : What are 4 main types of coverage and insurance?.

- Liability insurance …

- Accident Insurance. …

- Comprehensive insurance. …

- Protecting Uninsured Traffickers. …

- Health / Personal Injury Protection. …

- Flawless Insurance. …

- Differential insurance.

What are 4 main types of coverage and insurance?

Bottom Line and Conclusion. Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have. Always check with your employer to get existing insurance.

How many types of auto insurance are there?

The five types of car insurance are liability, liability, accident, uninsured vehicle, and protection against personal injury / medical expenses.

What type of auto insurance must you purchase?

Most states require liability insurance for bodily injury and property damage. Some states also require drivers to purchase additional types of insurance, such as personal injury protection (PIP) or uninsured / uninsured driver (UM / UIM).

What are the 3 types of car insurance?

The three types of international car insurance offered are liability, comprehensive insurance, and accident insurance. To see also : What’s the best car insurance coverage to have?. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured driver / insurance, but are not available in every state.

What type of car insurance is the most important?

Now, there are a lot of different types of car insurance. The most important are responsibility, full coverage and conflict.

What are 4 main types of coverage and insurance?

Bottom Line and Conclusion. Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have. Read also : Car Insurance. Always check with your employer to get existing insurance.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance, and car insurance are all five types of insurance.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability incurred by an individual or entity in the form of insurance services. The most popular types of insurance include car insurance, life insurance and landlord insurance.

What are the 7 main types of insurance?

7 Types of Insurance are; Life Insurance or Personal Insurance, Property Insurance, Sea Insurance, Fire Insurance, Liability Insurance, Guaranteed Insurance.

What is insurance and its types? Insurance policies can cover medical expenses, car damage, business losses or accidents while traveling, etc. Life Insurance and General Insurance are the two main types of insurance. General Insurance can be further subdivided into clubs of different types of policies.

What are the 5 most common types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance, and car insurance are all five types of insurance.

What are 3 common types of insurance?

Some common types of insurance include:

- Health insurance.

- Car insurance.

- Life insurance.

- Home insurance.

What are the basic 4 types of insurance?

Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have. Always check with your employer to get existing insurance.

What are the major types of insurance?

Donâ & # x20AC; & # x2122; t be afraidâ & # x20AC ;?

- Long-term Life Insurance. …

- Car insurance. …

- Home / Tenant Insurance. …

- Health Insurance. …

- Long-Term Disability Insurance. …

- Long-Term Care Insurance. …

- Identity Theft Protection. …

- Umbrella Policy.

What are the major types of life insurance?

There are two major types of life insuranceâ € ”lifetime and lifetime. Life as it is sometimes called permanent life insurance, and consists of several components, including normal life, international life, altered life and altered global life.

What are the 3 types of insurance?

We then examine in detail the three most important types of insurance: property, liability, and life.

Which is a type of insurance to avoid?

Avoid buying insurance you do not need. Chances are you will need life, health, a car, a disability, and, perhaps, long-term care insurance. But do not buy the sales argument that you need another expensive insurance which gives you insurance only for limited events.

Why is health insurance not competitive? Rather than affecting competition, the cost of health care is largely set by insurers and providers with individual capacity to maximize profits. … Business health plans have less bargaining power when negotiating with monopolistic providers.

Is insurance a monopolistic competition?

In the third term, however, the results indicate that the insurance market is not dictatorial or completely competitive. Tough earnings are earned as if by working alone. Overall, the results show that market observation is not significantly related to competitive culture.

Is insurance a competitive market?

Because the insurance market is competitive, when companies become profitable, they start taking flexible writing terms and lower their fees to get more market share. Other insurance companies react by following similar policies, to prevent their shares from being taken away or to increase their market share.

Is health insurance a monopoly?

Although the insurance companyâ sa TMs forecasts are different, the industry merger has resulted in the acquisition and exercise of the single health insurance â € awooddaâ awoodda awoodda awoodda awoodda awoodda awoodda awoodda awoodda awoodda halkii halkii halkii halkii halkii halkii halkii halkii halkii halkii halkii halkii halkii halkii to convey the beneficial benefits that are said to be providing to the customers.

Is insurance an oligopoly?

The US health insurance market is oligopolistic in nature; however, it is not the oligopoly market structure alone that accounts for the complexity and major benefits of the healthcare sector.

How does insurance competition affect medical consumption?

Competitive market competition affects not only the monthly fees but also the cost-sharing requirements (such as payments and coins) for the goods to be paid. These requirements determine out-of-pocket payments for health care, which can affect patient health decisions and health outcomes.

Is health insurance a competitive market?

Health Insurance Competition, Renewal 2021 Significant results from Renewal 2021 include: Seventy-three percent (280) of MSA level markets were highly concentrated (HHI> 2,500) by 2020, up 71% by 2014. Average HHI overall MSA-Market markets were 3494 by 2020.

How has managed care affected price competition among hospitals?

Managed competition has changed this institutional and motivational structure by increasing competition: (1) major insurance sponsors who are able to select and improve plans, (Enthoven, 1993); (2) The value of premium based on the control of medical expenses (Morrisey et al., 2003); and (3) Enhanced market capability through insurance, …

Is insurance a competitive market?

Because the insurance market is competitive, when companies become profitable, they start taking flexible writing terms and lower their fees to get more market share. Other insurance companies react by following similar policies, to prevent their shares from being taken away or to increase their market share.

Is insurance in a hard market?

Insurance companies are pushing harder and lower rules and insurance costs are rising, making it harder for customers to get insurance.

What type of market is the insurance market?

The insurance market is cyclical.

What is an insurance market?

According to the Financial Times Lexicon, the insurance market is simply “buying and selling insurance.” Clients or groups purchase risk management insurance with insured insurers.