What is a non standard risk?

Contents

- 1 What is a non standard risk?

- 2 What are 4 main types of coverage and insurance?

- 3 What is standard coverage policy?

- 4 What is a non standard insurance?

Non-standard risk This applies to a request for coverage where the potential policyholder does not satisfy the preferred or standard risk profile of the insurance company. Read also : What are 4 main types of coverage and insurance?.

Is progressive standard or non-standard? Most insurance companies, including Geico and Progressive, offer non-standard car insurance. Other companies, such as The General and Safe Auto, specialize in offering non-standard insurance for high-risk drivers.

What’s the difference between standard and nonstandard insurance?

Standard car insurance is available for drivers at lower risk. It is easiest to find because all the major insurance companies and regional insurance companies usually offer it. This may interest you : What is the birthday rule?. Non-standard insurance is made for drivers who are considered high risk by insurance companies. It is usually more expensive and not as widely available as standard insurance.

What does non standard insurance mean?

Non-standard car insurance refers to high-risk coverage, the most expensive level. It is reserved for drivers who are too risky for insurance companies to cover their standard rates. Insurance companies usually divide the coverage into three risk levels: preferred, standard and non-standard.

What is standard car insurance?

Standard car insurance refers to the most basic car insurance offered to drivers who fall into an average risk profile. The standard coverage will usually be the cheapest type of car insurance available to the driver.

What does Standard mean in insurance?

Standard form or standard policy – an insurance form that is designed to be used by many different insurance companies and has exactly the same provisions, regardless of the insurance company that issues the policy.

What is non standard market?

A definition of this market can also be difficult to establish. To see also : Can my son drive my car if he is not insured?. Non-standard car insurance has traditionally been defined as a market for drivers who have certain risk factors that make it difficult or impossible for them to obtain insurance in a standard or preferred market.

What does non standard insurance mean?

Non-standard car insurance refers to high-risk coverage, the most expensive level. It is reserved for drivers who are too risky for insurance companies to cover their standard rates. Insurance companies usually divide the coverage into three risk levels: preferred, standard and non-standard.

What does non standard insurance mean?

Non-standard car insurance refers to high-risk coverage, the most expensive level. It is reserved for drivers who are too risky for insurance companies to cover their standard rates. This may interest you : What are the 3 types of car insurance?. Insurance companies usually divide the coverage into three risk levels: preferred, standard and non-standard.

What does Standard mean in insurance?

Standard form or standard policy – an insurance form that is designed to be used by many different insurance companies and has exactly the same provisions, regardless of the insurance company that issues the policy.

Which is classified as non standard by insurance companies?

Solution (by Examveda Team) Ration cards are classified as non-standard by insurance companies.

What are 4 main types of coverage and insurance?

The bottom line. Most experts agree that life, health, long-term disability and car insurance are the four types of insurance you must have. Always check with your employer first for available coverage.

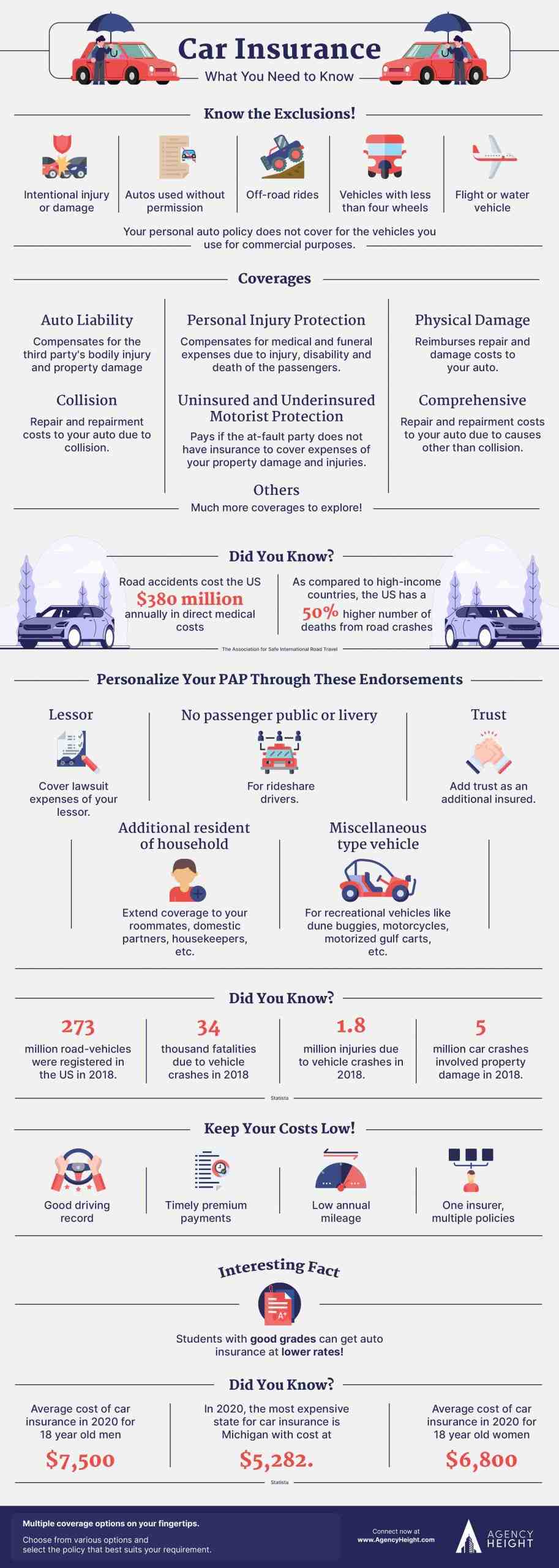

What type of coverage is there? 6 common types of car insurance coverage

- Liability coverage. Except in New Hampshire and Virginia, all states require licensed drivers to maintain liability coverage. …

- Collision coverage. …

- Personal injury coverage. …

- Uninsured and underinsured motorist protection. …

- Extensive coverage. …

- Medical payments.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

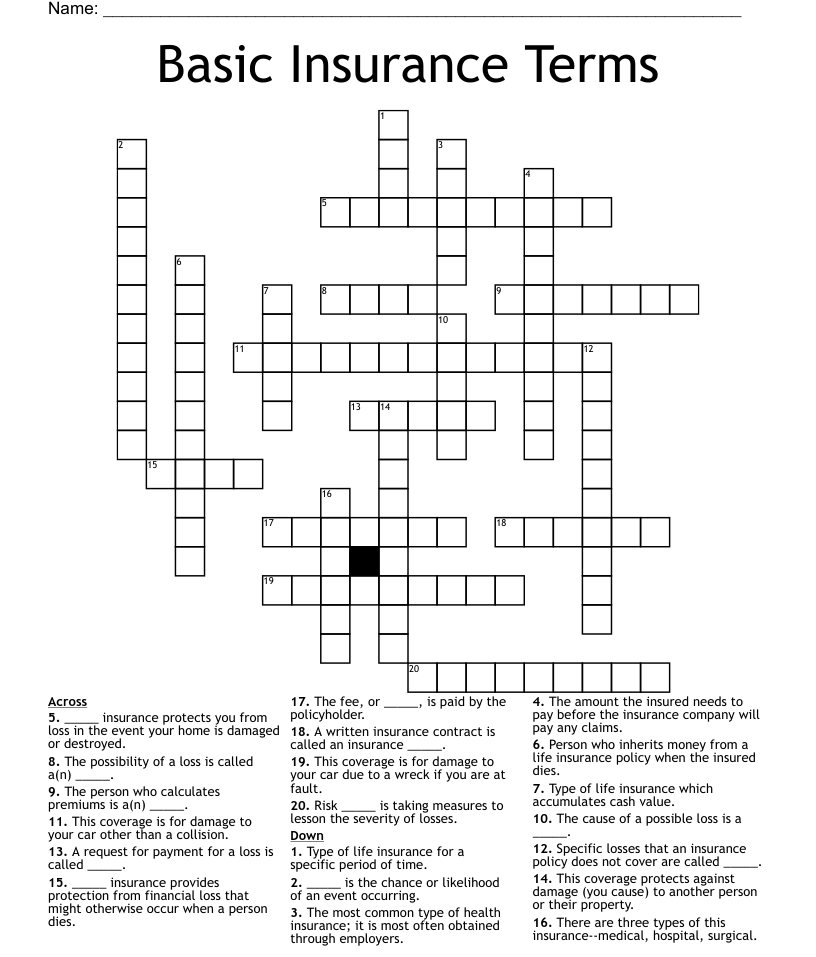

What are the 5 parts of an insurance policy?

Each insurance has five parts: declarations, insurance contracts, definitions, exceptions and conditions. Many guidelines contain a sixth part: endorsements. Use these sections as guide posts to review the guidelines. Examine each section to identify the most important provisions and requirements.

What are the 6 main types of insurance?

Six common options for car insurance are: car liability cover, uninsured and underinsured motorist cover, comprehensive cover, collision cover, medical payments and personal injury protection. Depending on where you live, some of these coverages are mandatory and some are optional.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability covered for a person or entity using insurance services. The most common types of insurance include car insurance, life insurance and homeowners insurance.

How many types of insurance coverages are there?

Six common options for car insurance are: car liability cover, uninsured and underinsured motorist cover, comprehensive cover, collision cover, medical payments and personal injury protection. Depending on where you live, some of these coverages are mandatory and some are optional.

What are the 3 types of insurance?

Then we take a closer look at the three most important types of insurance: property, liability and life.

What is standard coverage policy?

Standard coverage refers to the insurance that hedges against basic risks, including defects that can be determined from public registers, and the risk of falsification, competence and capacity.

What is the difference between standard and improved? For example, a “standard” policy covers the homeowner for matters affecting property rights up to and including the date of registration of the title deed, while its “enhanced” policy provides coverage for 28 additional risks, many of which relate to future coverage and automatic increases in coverage. to cover increases in …

What are the 4 basic coverages of the standard auto policy?

A car insurance will include a combination of different types of coverage. The five basic types are liability cover, collision cover, comprehensive cover, uninsured / underinsured motorist and medical payment cover.

What are the 4 types of coverage associated with auto insurance?

Six common options for car insurance are: car liability cover, uninsured and underinsured motorist cover, comprehensive cover, collision cover, medical payments and personal injury protection. Depending on where you live, some of these coverages are mandatory and some are optional.

What is basic insurance coverage?

Basic car insurance is an insurance that only covers liability coverage. It helps cover the damage you can inflict on other people and their property. This may include medical bills, repair or replacement of property and legal fallout. Almost every state has minimum limits for basic car insurance for its drivers.

What is a standard auto insurance policy?

Standard car insurance refers to the most basic car insurance offered to drivers who fall into an average risk profile. The standard coverage will usually be the cheapest type of car insurance available to the driver.

What is not covered by a standard homeowners policy?

Standard homeowners insurance policies usually do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or flood.

What is a specific policy?

A problem-specific policy [is] intended to meet the specific needs of an organization, such as a password policy. addresses issues of current relevance and concern to the Agency. Problem-specific policy statements are likely to be limited, specific and rapidly changing.

Do off grid homes have a specific type of insurance policy?

It is not an independent off-grid home insurance. Instead, most homeowners can use a traditional home insurance policy. Home insurance coverage may vary slightly based on your usage. While some live off the net permanently, others may purchase another property as a seasonal getaway.

What are the 3 basic levels of coverage that exist for homeowners insurance?

Homeowners’ insurance usually covers damage to and damage to the home’s interior and exterior, loss of or theft of property and personal liability for damage to others. There are three basic coverage levels: actual cash value, replacement cost and extended replacement cost / value.

What are the 3 parts of insurance?

There are three components of any type of insurance (premium, policy limit and deductible) that are crucial.

What is basic form homeowners insurance?

An HO-1, or “basic form,” is a policy that typically helps cover 10 hazards (compared to the 16 hazards covered by an HO-3). For example, falling objects or the weight of ice are dangers that are not covered by an HO-1 form, says III.

What are the different coverages on a homeowners policy?

A standard policy includes four main types of coverage: housing, other structures, personal property and liability. If your home is damaged by a covered event, such as strong winds, home coverage can help pay to repair it.

What is a non standard insurance?

Non-standard car insurance refers to high-risk coverage, the most expensive level. It is reserved for drivers who are too risky for insurance companies to cover their standard rates. Insurance companies usually divide the coverage into three risk levels: preferred, standard and non-standard.

Which is classified as non-standard by insurance companies? Solution (by Examveda Team) Ration cards are classified as non-standard by insurance companies.

What is standard vs nonstandard insurance?

Standard car insurance is available for drivers at lower risk. It is easiest to find because all the major insurance companies and regional insurance companies usually offer it. Non-standard insurance is made for drivers who are considered high risk by insurance companies. It is usually more expensive and not as widely available as standard insurance.

What does Standard mean in insurance?

Standard form or standard policy – an insurance form that is designed to be used by many different insurance companies and has exactly the same provisions, regardless of the insurance company that issues the policy.

What is standard car insurance?

Standard car insurance refers to the most basic car insurance offered to drivers who fall into an average risk profile. The standard coverage will usually be the cheapest type of car insurance available to the driver.

What standard insurance means?

A standard insurance provides conventional coverage for drivers who are considered low risk by insurance companies.

What is standard for car insurance?

You need at least $ 50,000 in personal injury liability insurance in most states, along with at least $ 25,000 in property damage liability insurance. Some states also require drivers to have uninsured motorist coverage and either PIP or MedPay.

What is a standard insurance?

Standard car insurance is the basic or lowest level of coverage available from an insurance provider. The regulations in most states require that a driver have liability insurance and will determine the exact dollar value of the coverage needed.

What is the difference between basic and standard insurance?

There are some services that are not covered under Basic, but are covered under Standard, and Standard allows you to leave the network, while Basic has zero coverage with domestic non-PPO providers except emergency care.