Can you be double insured?

Contents

- 1 Can you be double insured?

- 2 What are the three types of coverage?

- 3 What is the important of insurance?

- 4 What are the 5 main types of insurance?

Yes, you can have two health plans. This may interest you : What is basic car insurance called?. Having two health plans is perfectly legal and many people have multiple health insurance policies under certain circumstances.

How does it work when you have two insurances? If you have multiple health insurance policies, you will have to pay any applicable premiums and deductibles for both plans. Your secondary insurance will not pay your primary insurance deductible. You may also owe other cost-sharing costs or direct costs, such as co-payments or coinsurance.

How does primary and secondary insurance work?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one who pays the second (secondary payer) only pays if there are costs that the main insurer did not cover. On the same subject : What are the 3 types of car insurance?. The secondary payer (which may be Medicare) may not pay all remaining costs.

Comment obtenir une aide ménagère par la CPAM ?

You have the possibility to contact the social service of votre caisse primaire d’assurance maladie (CPAM) which will be in measurement d’étudier votre dossier de demande d’aide. Vous trouverez les informations utiles sur le site ameli.fr ” être accompagné(e) par le service social de l’Assurance”.

Quelles sont les aides habituellement mises en place par l’Assurance maladie? Les aides de la CPAM (refund des soins, indemnités journalières, etc.) Elles peuvent accompagner l’attribution de l’aide financière exceptionnelle.

The CPAM rattachement code is indicated in the attestation of the mutuelle de l’assuré, sous la case ‘Organisme de rattachement Sécurité sociale’. Pour l’obtenir, il vous suffit donc de vous munir de votre attestation de droits.

Which insurance is primary when you have two?

If you have two plans, your primary insurance is your primary insurance. On the same subject : What is the birthday rule?. Except for Medicare company retirees, the health insurance you receive through your employer is normally considered your primary health insurance plan.

When both spouses have insurance which is primary?

In general, when both spouses have insurance plans, your own plan would be your primary insurer and your spouse’s plan would be secondary. If you are in a situation where both health plans will be used, insurers must coordinate with each other on how bills will be paid.

Does secondary insurance become primary?

For example, people traveling to the US and seeking travel medical insurance due to the high cost of health care often purchase medical insurance policies designed to pay for secondary. As there is no primary insurance policy, the secondary policy will pay as the primary.

When two insurance which one is primary?

Primary insurance: The insurance that pays first is your “primary” insurance, and this plan will pay up to the limits of coverage. You may be owed cost-sharing. Secondary insurance: Once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan.

Will secondary insurance pay if primary denies?

If your primary insurance denies you coverage, your secondary insurance may or may not pay part of the cost, depending on the insurance. If you don’t have primary insurance, your secondary insurance may make little or no payment for your health care costs.

How does a secondary insurance work?

How does secondary insurance work? Secondary insurance plans work alongside your primary medical plan to help cover gaps in cost, services, or both. Supplemental health plans, such as vision, dental, and cancer insurance, may provide coverage for care and services not normally covered by your medical plan.

Does secondary insurance become primary?

For example, people traveling to the US and seeking travel medical insurance due to the high cost of health care often purchase medical insurance policies designed to pay for secondary. As there is no primary insurance policy, the secondary policy will pay as the primary.

Will Medicare cover if primary denies?

Medicare may mistakenly pay a claim as primary if it meets all billing requirements, including coverage guidelines and medical needs. However, if the patient’s CWF MSP record shows that another insurer must primarily pay Medicare, we deny the request.

What are the three types of coverage?

3 Types of Automatic Coverage Explained

- Liability coverage. Protects you if you cause harm to other people and/or their things. …

- Collision coverage. Cover your car if you hit another car, person, or immovable object (like those damn ornamental stones Cousin Todd has at the end of the garage). #…

- Comprehensive coverage.

Do the French have SSN? All people born in France are given a social security number so that they can access these services. The number is generated by INSEE, the National Institute of Statistics and Economic Studies. Most French citizens will not make contributions until they start working at age 16.

What is a “numéro de sécurité sociale”? The “numéro de sécurité sociale” is a unique, personal 15-digit code. Employers use it to identify each employee in the system and it serves as a customer account number in social benefits administration.

What is SSN number in France?

Individuals born in France are registered for membership at birth. The INSEE (Institut National de Statistical y Estudios Economiques de France) assigns them a social security number based on the birth registration information it receives from French town halls (“mairies†).

Finding your social security number If you have a social security number, you can find it on your social security card. Some other places you can find your SSN are on tax returns, W-2s, and bank statements. You can even find it on previously filed USCIS forms.

What is SSN number in France?

Individuals born in France are registered for membership at birth. The INSEE (Institut National de Statistical y Estudios Economiques de France) assigns them a social security number based on the birth registration information it receives from French town halls (“mairies†).

Every Frenchman is given a national identification number at birth, the “numéro d’inscription au répertoire” (NIR or register of the national repertoire), also called “numéro de sécurité sociale” (or social security number). This INSEE number consists of 13 digits and a two-digit key.

The “numéro de sécurité sociale” is a unique, personal 15-digit code. Employers use it to identify each employee in the system and it serves as a customer account number in social benefits administration. … The next two digits are the month of birth, from 01 to 12.

How can I find out what my social security number is? If you have previously worked in France, your social security number will appear on your employment history statement (“relevé de carrière†), which you can apply for at the latest old-age insurance box (CNAV, MSA, etc.) which you paid contributions in France.

Finding your social security number If you have a social security number, you can find it on your social security card. Some other places you can find your SSN are on tax returns, W-2s, and bank statements. You can even find it on previously filed USCIS forms.

If you received an SSN at some point in your life but don’t know it now, you need to apply for a replacement card. This is the only way to get your number because the Social Security Administration (SSA) does not provide Social Security numbers in any other way.

Log on to GovSSNRecords.org. You can search for SSN and other detailed biographical data by typing your name or phone number in the text box. Click “Submit” and you will be taken to a new screen where you can access the information for a fee.

What is the important of insurance?

Buying insurance is important as it ensures that you are financially secure to face any kind of problems in life, which is why insurance is a very important part of financial planning. A general insurance company offers insurance policies to cover health, travel, motor vehicle and home.

What is the most important insurance? Health insurance is the most important type of insurance you will buy. That’s because if you don’t have health insurance and something goes wrong, it’s not just your money at risk – it’s your life.

What is the importance of life insurance?

Life insurance provides cash, or what is known as a death benefit, to the chosen beneficiary after death. It can help give your loved ones access to money when they need it. Understanding life insurance can help you plan for your family’s long-term financial needs.

What is insurance and why is it important?

Insurance is a financial safety net, helping you and your loved ones recover after something bad happens – like a fire, theft, lawsuit or car accident. When you purchase insurance, you will receive an insurance policy, which is a legal contract between you and your insurer.

Which is one of the most important benefits of life insurance?

The most obvious benefit of life insurance is the tax-free cash payment to your loved ones if you die. Financial protection is the most important asset that life insurance provides for you and your family.

What’s the importance of insurance?

Insurance plans are beneficial for anyone looking to protect their family, property/property and themselves from financial risk/loss: Insurance plans will help you pay for medical emergencies, hospitalization, contracting any illness and necessary medical treatment and care in future.

Why is insurance important for most?

No one plans to get sick or injured, but most people need medical care at some point. Health insurance covers these costs and offers many other important benefits. Health insurance protects you from unexpected high medical costs. You pay less for in-network covered health care even before you meet your deductible.

What are benefits of insurance?

The obvious and most important benefit of insurance is loss payment. An insurance policy is a contract used to indemnify individuals and organizations for covered losses. The second benefit of insurance is managing cash flow uncertainty. Insurance offers payment for covered losses when they occur.

What is insurance and why is it important?

Insurance is a financial safety net, helping you and your loved ones recover after something bad happens – like a fire, theft, lawsuit or car accident. When you purchase insurance, you will receive an insurance policy, which is a legal contract between you and your insurer.

Which insurance is most important and why?

Health insurance is arguably the most important type of insurance. A 2016 Kaiser Family Foundation/New York Times survey found that one in five people with medical bills filed for bankruptcy. With a statistic like that, investing in health insurance can help you avoid significant financial hardship.

What is insurance Why is it important?

Insurance is a financial safety net, helping you and your loved ones recover after something bad happens – like a fire, theft, lawsuit or car accident. When you purchase insurance, you will receive an insurance policy, which is a legal contract between you and your insurer.

Which insurance is the most important to have?

Health Insurance Health insurance is the most important type of insurance you will buy. That’s because if you don’t have health insurance and something goes wrong, it’s not just your money at risk – it’s your life. Health insurance is intended to pay the costs of medical care.

What are 5 important insurances you should have?

Home or property insurance, life insurance, disability insurance, health insurance and auto insurance are five types that everyone should have.

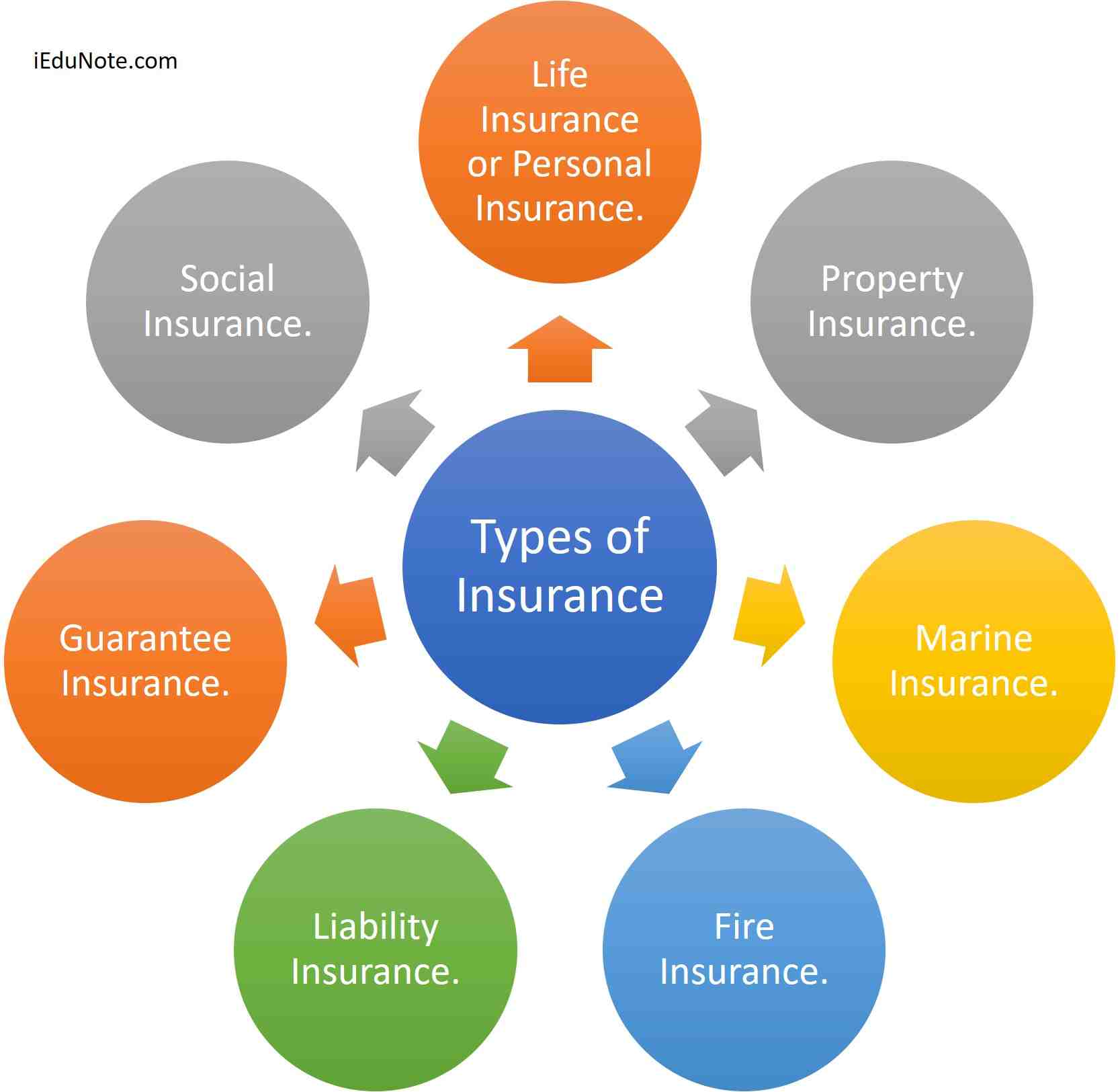

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and auto insurance are five types that everyone should have.

What are the 4 main types of coverage and insurance? The bottom line. Most experts agree that life, health, long-term disability and auto insurance are the four types of insurance you should have. Always check with your employer first for available coverage.

What are the 5 parts of an insurance policy?

Every insurance policy has five parts: statements, insurance contracts, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guides in reviewing policies. Examine each part to identify its key provisions and requirements.

What are the 4 key elements of an insurance policy?

Most experts agree that life, health, long-term disability and auto insurance are the four types of insurance you should have.

What are the 6 elements of an insurance policy?

These elements are a definable risk, a fortuitous event, an insurable interest, risk shift, and risk distribution. Also, there is a very important legal difference between a reserve and an insurance company.

What are the 6 main types of insurance?

Six common car insurance coverage options are: automotive liability coverage, uninsured and uninsured motorist coverage, comprehensive coverage, collision coverage, medical payments coverage, and personal injury protection. Depending on where you live, some of these coverages are mandatory and some are optional.