Consumer Alert: Survey Shows Female New Yorkers Pay More for Car Insurance

What age does insurance go down?

Contents

- 1 What age does insurance go down?

- 2 Is insurance cheaper for females?

- 3 Do girls pay more for car insurance?

- 4 Which married or single group pays more for car insurance?

Why does car insurance go down at 25? The cost of car insurance is usually cheaper at 25. As you gain driving experience and avoid accidents and claims, your insurance company will insure you as less risky and your rates will decrease.

At what age is car insurance most expensive?

18-year-old drivers on their own policy pay the highest car insurance premiums from the age groups Bankrate analyzed. This may interest you : Add car insurance to the rising cost of living in Florida.

Does car insurance go up at a certain age?

Younger drivers pay significantly more than older drivers for car insurance, but rates also rise after age 60. Age is one of the primary factors insurance companies consider when coming up with a car insurance quote. For a car insurance company, a driver’s age measures their driving experience and accident risk.

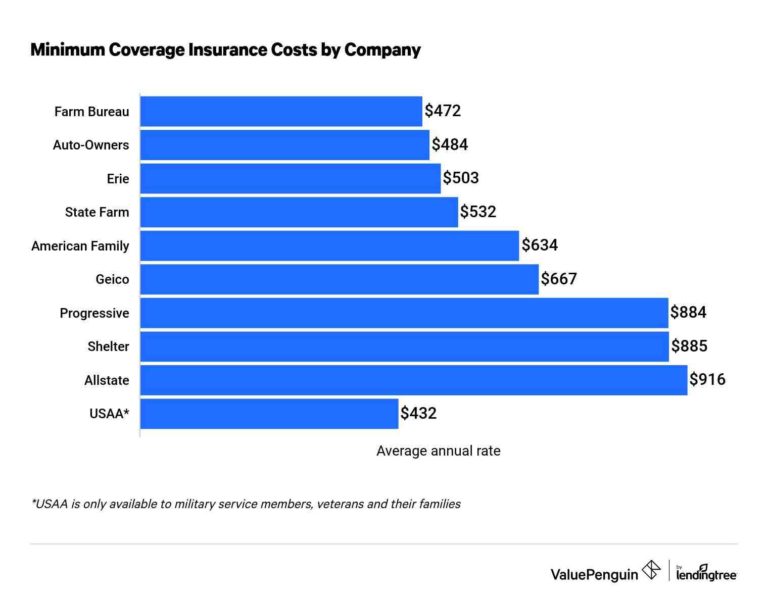

Is $300 a month a lot for car insurance?

Yes, $300 a month for car insurance is expensive. The average cost of car insurance ranges from about $60 per month for state minimum coverage to $166 per month for full coverage, although individual car insurance rates vary based on factors such as driving record, age and location.

Does car insurance really go down at 25?

Usually, yes. At Progressive, rates drop an average of 9% at age 25. But there are other cost factors that affect your car insurance, such as your claims history. So if you’re in an accident right before you turn 25, your rate won’t go down.

Will my insurance go down when I turn 30?

Car insurance rates start to drop around age 20, which means teenagers generally pay the most for car insurance. This may interest you : Safeco Car Insurance Review 2022 – Forbes Advisor. Prices continue to decrease as drivers get older, with significantly lower premiums when drivers reach around age 30.

At what age is car insurance cheapest?

Experienced drivers are less likely to have accidents, which means they cost less to insure. At Progressive, the average premium per driver tends to decrease significantly from 19-34 and then stabilize or decrease slightly from 34-75.

Does car insurance go down at 35?

Drivers see their car insurance premiums start to drop around age 20, with a big drop around age 25. Rates tend to increase over decades, starting around age 35. driving ability.

What makes auto insurance go down?

You may be able to lower your car insurance premiums by taking on more risk (which reduces the risk you pose to your insurer). This could mean: dropping optional coverage, such as collision or comprehensive if you own your vehicle outright. Reduce your coverage limits.

What age is car insurance cheapest?

Drivers see their car insurance premiums start to drop around age 20, with a big drop around age 25. Read also : Your Car’s Telematics Can Lower Your Car Insurance Costs. Rates tend to increase over decades, starting around age 35. driving ability.

Are 10 year olds cars cheaper to insure?

Yes, most older cars are cheaper to insure, especially when it comes to comprehensive and collision insurance. Cars lose value as they age, so the potential insurance payouts after an accident also drop.

Why is car insurance cheaper at 25?

Why car insurance can get cheaper at 25. Drivers under the age of 25 are statistically more likely to cause an accident and make an insurance claim, so insurance companies reduce this risk by paying higher premiums.

Is it cheaper to insure an old or new car?

In general, car insurance for older cars can be cheaper than insuring new vehicles of the same make and model if the used car is cheaper to repair or replace. A car depreciates in value over time, which reduces the maximum that an insurance company has to pay in the event of an accident.

Is insurance cheaper for females?

Women’s car insurance is generally cheaper than men’s because insurers have found a statistical correlation between the gender of the driver and the cost and frequency of car insurance claims. On average, men simply drive more than women.

Why is life insurance cheaper for women? Life insurance is cheaper for women than men “The price of life insurance is based on actuarial data,” says Burgett. “Statistically, women live longer than men and are more likely to outlive the length of a [life insurance policy]. Therefore, coverage is generally more affordable for women.â

Is male or female insurance cheaper?

Considering that women are less likely to be in an accident than men and that men are more likely to drive without a seat belt, it may surprise drivers to learn that women pay more for car insurance on average than their male counterparts.

Are insurance rates based on gender?

Which states do not allow gender to be used to set car insurance rates? States that currently do not allow gender to be used to determine car insurance rates include: California.

Why is women’s insurance cheaper than men’s?

Male drivers are charged higher car insurance rates than female drivers for a variety of reasons. One simple reason for the difference is that men make more insurance claims than women. In addition, men drive more often than women. Men also prefer to drive more expensive cars, which are more expensive to repair.

Why is health insurance more expensive for females?

Women pay to live longer The average life expectancy is 79.9 for women in the United States and 74.2 for men, according to the Centers for Disease Control and Prevention (CDC). “Insurers paying more based on gender cite health risks as a major factor,” says Robin Townsend, ValuePenguin health and life insurance expert.

Why is insurance cheaper for females?

Generally, men pay more for car insurance than women. Women generally drive less than men and get into fewer accidents, which makes them less dangerous to insure and results in lower rates.

Does your gender affect health insurance?

1 But insurance companies traditionally tied gender to an applicant’s risk, so it was often a factor in setting premiums. However, insurers may not always consider gender as a factor – it depends on the particular type of insurance and where one lives.

Do girls pay more for car insurance?

Although females pay more for their car insurance premiums on average, less than 1 percent above what males pay, this reverses when you compare young drivers. According to The Zebra, a young man will pay about 14 percent more for their premium than their female counterparts.

Which married or single group pays more for car insurance?

Insurance companies tend to pay married drivers less for insurance because statistically they are more risky and financially stable. This means they are involved in fewer car accidents and make fewer claims than unmarried drivers, so they are cheaper to insure.

Is it cheaper for husband and wife to be on the same car insurance? Sharing a policy is generally cheaper because you split the cost of certain coverages. You benefit from your spouse’s clean driving record: If you have had violations or accidents, your spouse’s clean driving history can lead to a more competitive rate.

Why do singles pay more for car insurance?

Credit Score Statistical data shows that married drivers have better credit scores than single drivers. Thus, they usually pay less for car insurance.

Why do younger people pay more for car insurance?

Young drivers pay more because statistics show that teenagers are inexperienced, so they are more likely to get into car accidents compared to other age groups. According to the Insurance Institute for Highway Safety: Drivers between the ages of 16 and 19 are four times more likely to be involved in a car accident compared to older drivers.

Why does marital status matter for car insurance?

How does your relationship status affect auto insurance rates? Your personal relationship status has an impact on what you pay for car insurance. Because married drivers are considered more financially stable and safer drivers, they usually pay less for car insurance.

What gender pays more for car insurance?

Men tend to pay more for car insurance overall, although the difference is slight – about 1%. The difference is most pronounced for teenagers and young adults.

Is it better to put single or divorced for car insurance?

Is it better to put single or divorced on a car insurance application? If you are wondering if there is an advantage to listing yourself as single or divorced when applying for insurance, there usually isn’t. Both statuses are considered the same when your agent generates a quote.

Why does marital status matter on car insurance?

How does your relationship status affect auto insurance rates? Your personal relationship status has an impact on what you pay for car insurance. Because married drivers are considered more financially stable and safer drivers, they usually pay less for car insurance.

Why does being divorced affect your car insurance?

Auto insurance companies use historical data that shows married drivers are less likely to file a claim. So, married drivers are considered less risky customers. As a result, married drivers may pay slightly less for car insurance than divorced or single drivers.

Can I put single if I am divorced?

Single. As a single person, you are not legally bound to anyone – unless you have a dependent. You can be considered single if you have never been married, were married but then divorced or have lost your spouse. It is possible to be single at MANY times in your life.

Which group pays the most for car insurance?

Men tend to pay more for car insurance overall, although the difference is slight – about 1%. The difference is most pronounced for teenagers and young adults.

Is insurance group 14 high or low?

Cars in insurance group 14 offer a decent compromise between low insurance costs and average engine size. They also have good safety features and are relatively cheap to repair.

What groups of people pay the most of auto insurance?

In general, young drivers can expect to pay higher rates than older drivers, and around 70, car insurance rates start to rise again. Due to accident trends and data, men are more risky to insure than women and often pay higher rates.

If you have been in several accidents, your cost of car insurance is likely to be higher than someone with a clean driving record. If you’re a new driver and haven’t had insurance before, chances are you’ll pay more for car insurance.