BOGGAN

Approved auto insurance rate increases

Contents

Jump

States with the highest auto rate percentage increases

States with the lowest auto rate percentage increases

What will happen with auto insurance rates throughout 2022?

Open the guide page

Life-threatening inflation also affects car insurance companies. Across the country, car insurance meets the rate of change, many of which are price increases. According to S&P Global Intelligence Marketing data, the average filing rate is about 4.9 percent. This means that, with the average cost of car insurance being $ 1,771 per year fully covered, customers can soon pay up to $ 1,858 per year for the same insurance. To help you prepare for the next increase, Bankrate has dug in-depth data to identify the states with the most and the least affected by the rate hike.

Throughout the year, car insurance companies submit their state-of-the-art insurance rating algorithms to each state for approval. These algorithms may include rising prices, lowering or lowering variables, or may include mixed variables. To see also : Can I use my boyfriends insurance for pregnant?. To help customers understand how their budget may be affected by the increase in car insurance rates, we used S&P Global Market Intelligence to identify price changes and analyze the average price data of Quadrant Data Services to estimate the premium impact.

All price change data means filing the approved rate between January 1, 2022, and May 18, 2022. It is important to note that, although these rates are moderate, not all customers will be affected equally ah. Some companies may file a discount, for example, while other companies may file a significant increase. Rate increases are also not usually one-sided, which means they do not apply to the whole policy or driver. Typically, price filings are defined by specific types of coverage and specific price points, including the claim date of the driver and the type of vehicle being driven.

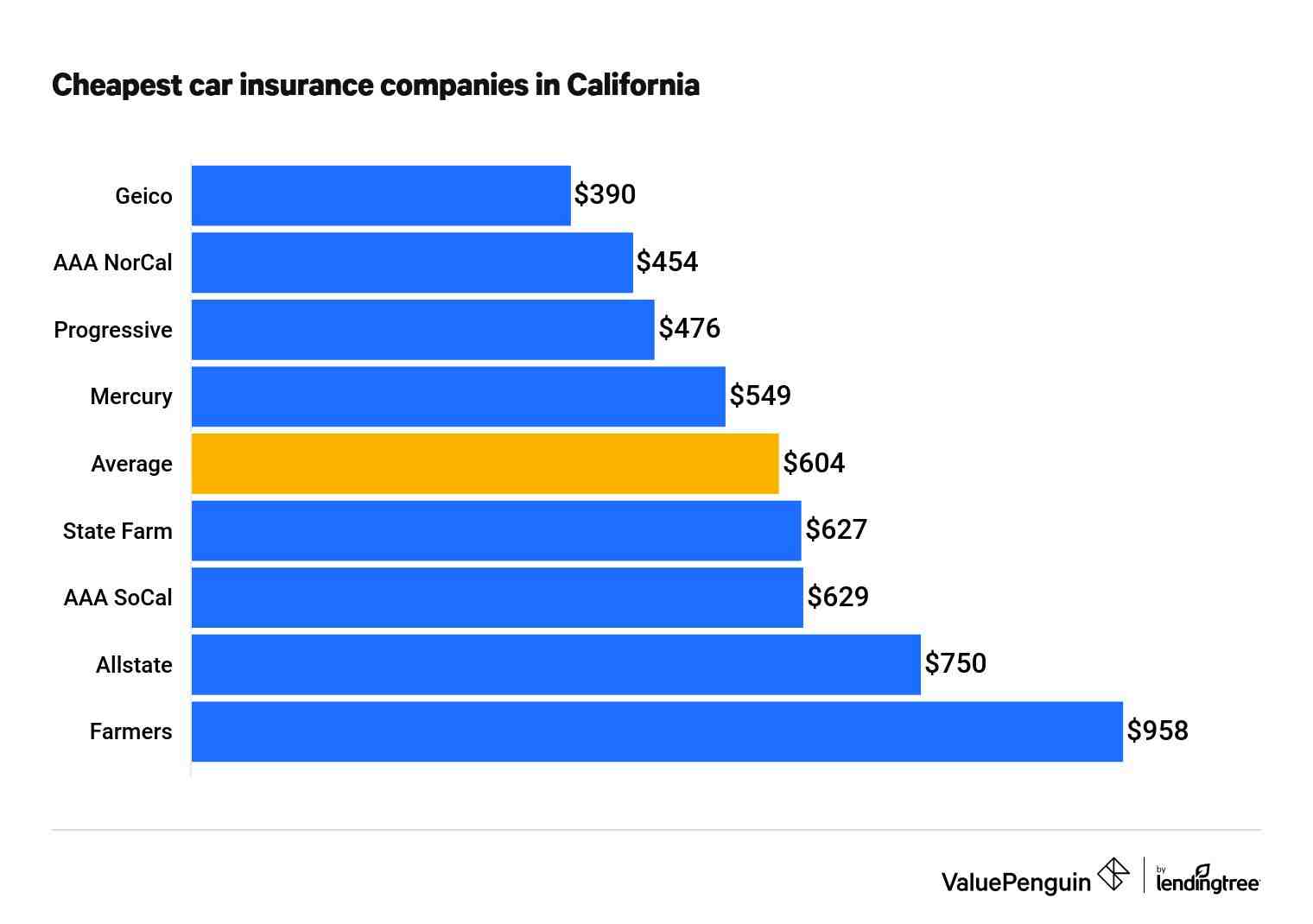

It should be noted that Florida reports filing at a different system level; therefore, the approved data was not available. Finally, California does not currently allow inflation. Requests for the rate increase were made in California, but none were granted.

The bottom line

Minnesota is, by far, the state with the highest car price increase. Based on the current state filing, nearly 2 million politicians will face an average 14 percent increase. This may interest you : Is State Farm overpriced?. Arizona and Louisiana are also the worst affected states, with an average increase of more than 7 percent.

Methodology

Only Massachusetts has the average car insurance rate lower. This may interest you : Can I lie about my job on car insurance?. Rates in Vermont and Colorado are below 1 percent on average, but all other states have an average increase of 1 percent or more.

While knowing the average growth rate in your state can help you prepare for a possible increase, there is a lot to talk about. Governments with high interest rates may experience a significant jump in fees, even with the average percentage rate low. Bankrate has reviewed the average cost of car insurance in all 50 states and Washington, D.C. and analyzed what the average fee would be after the state level was increased. The following five states are ready to have the highest rates after the current price increase comes into effect:

Submission of the current rate shows, on average, the cost of car insurance increased in the first half of 2022. But what will happen in the next year? Between January 1 and May 18, there was an average of 9.1 approved increases in the country per day. This means that, for the remainder of 2022, there is a high probability that the rate increase will continue to be filed.

According to Greg McBride, Chief Financial Officer of Bankrate, “As inflation continues to rise for 40 years, car insurance premiums will also be pushed, in part reflecting the high cost of car repairs and replacements.”