Do car insurance premiums change over time?

Nowadays, owning a car is more of a necessity than a luxury. And while it is mandatory in India by law, it is also a wise choice to insure your car immediately afterwards. When you buy a car insurance policy, it is usually the effective year of the policy. And at the time of renewal, the premium amount may change compared to what you paid in the previous year and it depends on various factors. The concept of insurance premium can be confusing as it is often marketed that the premium should be lower if you don’t make any claims or the car is old. However, the insurance premium can jump up every year even if you don’t make any claims. Why does this happen? In this article we will try to decipher this question.

Why do car insurance premiums increase every year?

Under the Motor Vehicles Act 1988, third party insurance is compulsory for all vehicles plying on public roads against any third party damage and loss due to an accident. Effective this year, the third-party premium is now prescribed and regulated by the Ministry of Road Transport and Highways in consultation with the Insurance Regulatory and Development Authority of India (IRDAI), the regulatory body for the insurance sector in India. Third party premium rates are revised every year based on several factors such as industry claims performance, inflation etc. Some of the key factors that are considered when changing renewal premiums are:

Below are some common reasons why car insurance premiums go up year after year:

If you forgot to renew your car insurance and there is a significant gap between last year’s policy & suggested policy duration, the service provider may inspect your car before offering a new policy. There is a good chance of a higher insurance premium even if the vehicle is undamaged and has no running problems. Your car has certainly aged and is now more prone to wear and tear; therefore, the insurance company can increase the price of the premium.

Another important factor that increases the price of your car insurance premium is the amount of coverage you opt for. For example, for the past few years you have only bought compulsory third-party insurance, but now you want to buy personal injury insurance as well. Thus, in such cases, because you have decided on wider protection, the price of the premium will also rise. In addition, if you opt for two separate covers (own damage and third party) instead of a comprehensive policy, the premium price may rise.

There are two main categories of car conversions. The first is a change to increase performance and the second is an aesthetic change. For example, adding eye-catching lines to your car’s hood / incorporating electrical or non-electrical accessories, etc. will be considered an aesthetic change. On the other hand, changes to the car’s engine will be associated with performance changes. Regardless of the changes, the value of your vehicle will increase as a result of such changes. Consequently, this will lead to an increase in your car insurance premium.

Car insurance providers heavily scrutinize the risk profile of the vehicle owner/driver. From an auto insurance perspective, a high-risk driver is a car owner who makes frequent claims or has a history of making multiple claims related to accidents.

How to lower your car insurance premium?

Although several factors can cause premium prices to rise, below are some of the most effective and simple ways to lower your auto insurance premiums during renewal:

Individuals who file more claims must pay higher premiums. Therefore, it is always recommended to pay for minor damage out of your own pocket. It will also help you get a No Claim Bonus or NCB which helps reduce your premium at the time of renewal.

As we have already seen, the premium can increase if there is a gap in the renewal of the insurance. Therefore, it is recommended that you renew your coverage at the given time and date. There may sometimes be a late renewal penalty, and you may lose your accrued no-claim bonus.

Now that you know how to lower your car insurance premiums, you can save a lot of money and stop worrying about high premium amounts. All of these points can really add up to your savings while keeping your vehicle insured. Also, remember to read the policy documents carefully before purchasing a policy.

Is it normal for my car insurance to increase every year?

Contents

- 1 Is it normal for my car insurance to increase every year?

- 2 What would cause an increase in insurance premiums?

- 3 Is it OK to switch auto insurance every 6 months?

- 4 Why is insurance higher for a person under 25?

Linkedin This may interest you : How to buy car insurance online – Forbes Advisor.

Email address

The views expressed above are those of the author. This may interest you : How are car insurance rates determined? | Chase.

Annual increases are typical across the industry, but the way each company views your risk factors may vary. Know your coverage and discounts to get the best price for the coverage you need.

- .

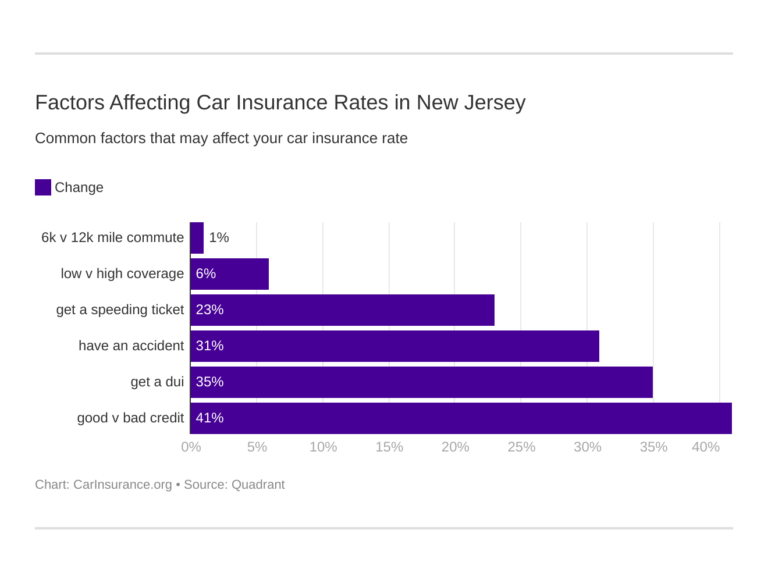

- Car accidents and traffic violations are common explanations for insurance rate increases, but there are other reasons why car insurance premiums go up, including a change of address, a new vehicle and claims in your zip code.

- What factors affect insurance premiums? Factors that affect health insurance premiums

- Age – This is one of the critical factors that affect the premium amount. …

- Past medical history â …

- Profession â …

- Policy duration â …

- Body mass index (BMI): …

Smoking habits â … On the same subject : Do you want to make your car insurance profitable? here’s everything you need to know.

Why do insurance companies keep raising rates?

Geographical location: …

The type of plan you choose:

The insurance company uses the total premiums paid by all its customers to compensate those who file claims. So even if you haven’t made a claim in a while and your situation hasn’t really changed in the last year, your premium could still go up.

Is it OK to switch auto insurance every 6 months?

The number of traffic accidents is increasing, resulting in more claims The number of traffic accidents has increased, resulting in more insurance claims. This higher claim volume, along with higher vehicle repair and replacement costs, is ultimately what drives up insurance rates across the industry.

In general, when you make a claim on your insurance policy over a certain amount due to an event that is primarily your fault, the insurance company will increase your premium by a certain percentage.

Is insurance cheaper if you pay every 6 months?

If your credit score drops due to increased debt, decreased income, late or late payments, too many credit inquiries, or any other reason, your insurance company may decide to raise your premiums to protect itself.

Is it better to pay 6 months upfront car insurance?

How often should you change your car insurance? It is recommended that you compare car insurance quotes at least once a year to ensure competitive rates. It’s not a bad idea to consider changing your car insurance before the end of each six-month policy, as car insurance companies often increase rates when a new term begins.

Does insurance go down after the first 6 months?

How many times can you change insurance? You can change your car insurance company at any time. This includes the day you start coverage and even when you have certain open claims. You also won’t be penalized for switching multiple times in a year. We recommend that you search for coverage at least once per policy term to ensure you get the best price.

Is it cheaper to pay insurance monthly or annually?

In most cases, a six-month policy will be cheaper than a 12-month policy because you’re paying for coverage over a shorter period of time. However, if you compare your car insurance price on a monthly basis, there may not be much difference between a six-month policy and a 12-month policy.

Is it bad to change car insurance companies often?

Advantages of paying for full car insurance If you pay your car insurance premium in advance for the entire period (usually six months or one year), some insurance companies will lower your premium. Progressive, Farmers, and Allstate are examples of companies that may offer a discount for paying in full.

Is it better to stay with the same car insurance?

After six months, the car insurance company will generally relax and accept the fact that you are making your payments on time and that your reliability rating will improve with them, lowering your overall costs.

What happens when you change insurance companies?

The Benefits of Paying Homeowners Insurance Annually You’ll typically get a lower interest rate than you would if you paid it monthly. Even if your mortgage lender allows you to make monthly payments once you are able to pay off the premium, the savings can be substantial.

Does changing insurance companies affect credit score?

No, it’s not a bad thing to switch car insurance companies often. Switching insurers can be a great way to save on your car insurance premium, but it’s important to know that you may be charged a cancellation fee every time you switch insurers mid-policy.

Why is insurance higher for a person under 25?

Staying with your current auto insurance company can be a positive decision. Many insurance companies offer discounts on car insurance to customers who have been loyal to them for many years. Arbella offers an additional 1% loyalty credit for each year you renew with them.

Changing the insurance company will not affect the open insurance claim you have. Your current insurance company will still pay out the claim as they normally would, even if you stop their coverage.

Why is insurance higher for 20 year olds?

Under normal circumstances, switching insurance companies will not affect your credit score. Insurance is a competitive market, one of the reasons why people and businesses switch insurance companies all the time in search of better coverage, better rates or better service.

Does insurance drop when you turn 20?

The reason insurance is higher for someone under the age of 25 is that younger drivers are statistically more likely to get into an accident than older drivers – so companies take more risk to insure them.

Why is insurance higher for younger people?

Is insurance cheaper when you turn 25? Usually yes. At Progressive, interest rates drop an average of 9% at age 25. However, there are other cost factors that affect your car insurance, such as your claims history. So if you’re in an accident right before you turn 25, your rate may not drop.

Why is insurance higher for a person under 25?

Car insurance for a 20-year-old costs an average of $5,517 per year, or $460 per month. Young drivers, especially those aged 25 and under, tend to have particularly high car insurance rates because they are involved in more accidents on average and are seen as more at risk by insurance companies.

Why is car insurance cheaper at 25?

Drivers see their auto insurance premiums start to drop around age 20, with a big drop around age 25. Rates usually level off over decades, starting around age 35. When you’re over 65, however, age usually affects your ability to drive.

Why is insurance higher for a person under 25?

Research shows that young drivers are involved in more accidents than the average adult due to their lack of experience behind the wheel, placing young drivers in a higher risk category. This is the main reason why young drivers pay a much higher premium for their insurance.

Why does your car insurance go down at 25?

The reason insurance is higher for a person under 25 is that younger drivers are statistically more likely to be involved in an accident than older drivers, so companies take more risks to insure them.