Types of Insurance Discrimination Not Allowed On the other hand, insurance companies should not discriminate on the basis of socially unacceptable factors such as race, gender and religion. Some other examples of socially unacceptable factors include: National origin.

At what age does car insurance go up?

Contents

Costs continue to decrease overall with each birthday. When drivers reach the age of 50, they see their best prices. About 60 years ago, however, car insurance costs started to climb and compare to what drivers see in their 40s.

Why is car insurance cheaper for females?

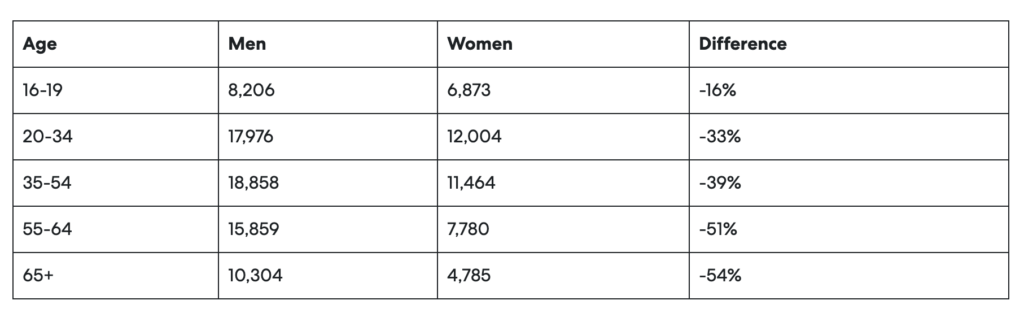

In general, men pay more for car insurance than women. Read also : Lemonade Car Insurance Review 2022 – Forbes Advisor. Women generally drive less than men and get into fewer accidents, which makes them less dangerous to insure and results in lower rates.

Are men better drivers?

Compared to women, male drivers of cars and vans were involved in twice as many fatal accidents. This may interest you : Is Geico owned by Allstate?.

Are men more likely to drive? Overview. Many more men than women die every year from car accidents. Men typically drive longer distances than women and are more likely to engage in dangerous driving practices, including the use of seat belts, driving while under the influence of alcohol, and speeding.

Does car insurance cost more for males?

Men tend to pay more for car insurance in general, although the difference is slight – about 1%. The difference is most pronounced for teenagers and young adults. Read also : 6 bad habits that increase your car insurance.

Can a UK resident drive a French car in France? If you are moving to France from another European country, you are allowed to drive a foreign vehicle (registered in your home country) for a period of up to six months before it has to be officially registered in France.

Does French car insurance cover me in UK?

Cover for expats living in France Sterling can insure a UK-registered vehicle, whether you are retired in France or moved there to work. We can also arrange cover if you plan to travel to additional European countries, and even further afield.

Does my car insurance cover me in the UK?

Yes, you are covered to travel to the following countries: Republic of Ireland, Northern Ireland, United Kingdom, Isle of Man, and Channel Islands. Your policy will also be automatically extended for you to travel to the EU Member States for up to 90 days in any insurance period.

Does my car insurance cover me in another country?

The short answer is, â € œno.â € In general, the car insurance you carry on your car in the US will not work abroad because you are not driving the same car. Unless you plan to send your car abroad, you will not have your car with you when you land in another country. You will be driving a rental car.

Can I drive in the UK with French insurance?

Do I need car insurance to drive in the UK as a foreign driver? Yes, valid car insurance is a legal requirement in the UK, even if you are just visiting.

Can I drive in the UK with a foreign insurance?

If you have a driving license from a “designated country”, you can use it in the UK for up to 12 months, but then you will need to exchange it for a UK license. If you become a UK resident within five years of becoming a UK resident, you do not have to take the UK Driver Test.

Will my French car insurance cover me in the UK?

Finally, your car insurance in France does not cover you to drive another car in the UK! However, your car is insured throughout Europe and beyond.

Can I use foreign car insurance in the UK?

Yes, you can make a car insurance policy as a non-resident. If you are visiting the UK for up to a few months and want to drive another car while you are here, a short term car insurance policy may prove the best bet.

What insurance do I need to drive in the UK?

You must have motor insurance to drive your vehicle on UK roads. Third party insurance is the legal minimum. This means that you are covered if you have an accident that causes damage or injury to another person, vehicle, animal or property. It does not cover any costs other than repairing your own vehicle.