What are at least two ways you can save on auto insurance Dave Ramsey?

Contents

Instead of paying a monthly premium, pay for your insurance six months or a year at a time. It’s almost always cheaper this way because it doesn’t cost the insurance company money to process your payments each month. This may interest you : Study: Florida is No. 2 in cost of car insurance in the nation. Pro Tip: Keep a little money in your savings account each month so you’re ready when the bills come due.

Which of the following is a way to save on car insurance premiums? Here are some ways to save on car insurance1

- Increase your deductible.

- Check the discount you qualify for.

- Compare car insurance quotes.

- Maintain a good driving record.

- Participate in a safe driving program.

- Take a defensive driving course.

- Explore payment options.

- Improve your credit score.

What are at least two ways you can save on car insurance quizzes? Three ways to lower your car insurance premiums are to get a high deductible, comprehensive insurance, and have a good driving record.

What are two ways to reduce the cost of car insurance? Some of the most impactful ways to lower your auto insurance include qualifying for multiple discounts, avoiding accidents, and changing your coverage. Comparing rates, trying usage-based insurance, and knowing how your vehicle can affect your speed can also help.

What is the malus bonus scheme in France? Bonus-malus is a system for modulating insurance premiums according to the behavior of the insured. This may interest you : Lemonade Car Insurance Review 2022 – Forbes Advisor. These adjustments must be made annually, based on claims involving the insured person’s liability.

How to cancel French car insurance? You can ask your insurer for cancellation with 10 calendar days notice. The cancellation request must be sent to your insurer in one of the following ways: Online if the contract has been signed online or if, at the time of termination, the insurer offers an online subscription. Paper Letter.

Raise Your Deductibles Raising what you pay a deductible if something happens can lower your upfront out-of-pocket costs. See the article : How to get cheap car insurance without a deposit. Look carefully at the numbers and determine if you can afford to pay a higher deductible if something happens.

Which can help reduce insurance costs? Ask for a higher deductible Typically, the higher the deductible, the lower the premium. Increasing your deductible from $200 to $500 can reduce the cost of collision and comprehensive coverage by 15% to 30%, according to the Insurance Information Institute, while a $1,000 increase can save you 40% or more.

Always avoid speeding, getting into accidents, and other driving incidents. Not only will you avoid expensive speeding tickets or other infraction charges, you’ll also help keep your insurance rates lower by proving you’re a less risky driver.

Which can reduce your insurance premium? Request higher deductibles By requesting higher deductibles, you can lower your costs substantially. For example, increasing your deductible from $200 to $500 can reduce collision and comprehensive coverage costs by 15 to 30 percent.

Request higher deductibles By requesting higher deductibles, you can lower your costs substantially. For example, increasing your deductible from $200 to $500 can reduce collision and comprehensive coverage costs by 15 to 30 percent. Switching to a $1,000 deductible can save you 40 percent or more.

What is malus system? In insurance, the bonusâmalus system (BMS) is a system that adjusts the premium paid by customers based on their respective claim history. The bonus is usually a discount on the premium given in the renewal of the policy if no claim was made in the previous year.

What is the bonus-malus score? The bonus malus ladder is a table used by insurers to determine the no-claims discount for your car insurance. The discount you receive is determined by the number of no-claim years you have. The higher you are on the ladder, the more no-claim discounts you will receive.

How does bonus-malus work?

In insurance, the term bonus-malus refers to a system that rewards policyholders for not making claims and punishes them for making claims. Policyholders who do not make claims are rewarded with a discount on premiums. Policyholders who make claims are penalized with a markup on the premium.

What is bonus-malus in the contract? The term “Malus/Bonus” in the contract bid refers to the incentive system used in the contract to guide the contractor’s performance. These systems are often used in industries such as construction, logistics, or in service contracts. The goal is to ensure high quality work and adherence to deadlines.

What is the bonus-malus approach?

In the bonus-malus system in car insurance, the bonus class of a customer is updated from one year to the next as a function of the current class and the number of claims in the year (considered Poisson).

What is the degree of bonus-malus? Understanding the motor statutory ‘bonus-malus’ If you are insuring a vehicle for the first time, you start in the middle of the ‘bonus-malus’ scale, that is at 11, the basic degree corresponding to the insurance premium rate of 100 %. Then, every year without an accident brings you down the notch on this scale.

What is bonus-malus in insurance? Bonus-Malus is a system according to which the insurance premium defined in the CMTPL contract is calculated based on the insurance history of the driver (authorized owner and / or Insured). Discounts are given to disciplined drivers and additional premiums to drivers who have accidents.

What is the bonus-malus system in France?

France has relied on a bonus-malus system that offers grants for the purchase of low-pollution vehicles and has placed a penalty on the purchase of high-pollution vehicles since 2008. The subsidy covers 27% of the purchase price or up to â¬6300 for BEVs, and 20% or up to â¬4000 for PHEV.

What is the difference between bonus and malus? The bonus is usually a discount on the premium given in the renewal of the policy if no claim was made in the previous year. Malus is an increase in premium if there is a claim in the previous year.

What is the bonus-malus rating?

Bonus-malus system A type of rating mechanism in which the insured’s premium is adjusted based on their respective loss experience history, which is used interchangeably as âno-fault discountâ, âmerit valueâ, âexperience ratingâ or âno claim discountâ in different countries, based on penalizing insureds are responsible…

Who typically has the cheapest car insurance?

The cheapest auto insurance companies are Nationwide, Geico, State Farm, Travelers and Progressive. **Although USAA has the lowest fares overall, its service is limited to active duty military members, veterans, and their families.

Why is car insurance expensive in France? By 2022, vehicle owners in France will pay more than 500 euros for comprehensive motor insurance. Meanwhile, the average premium for third-party liability insurance, which is mandatory for all drivers in France, is only 153 euros.

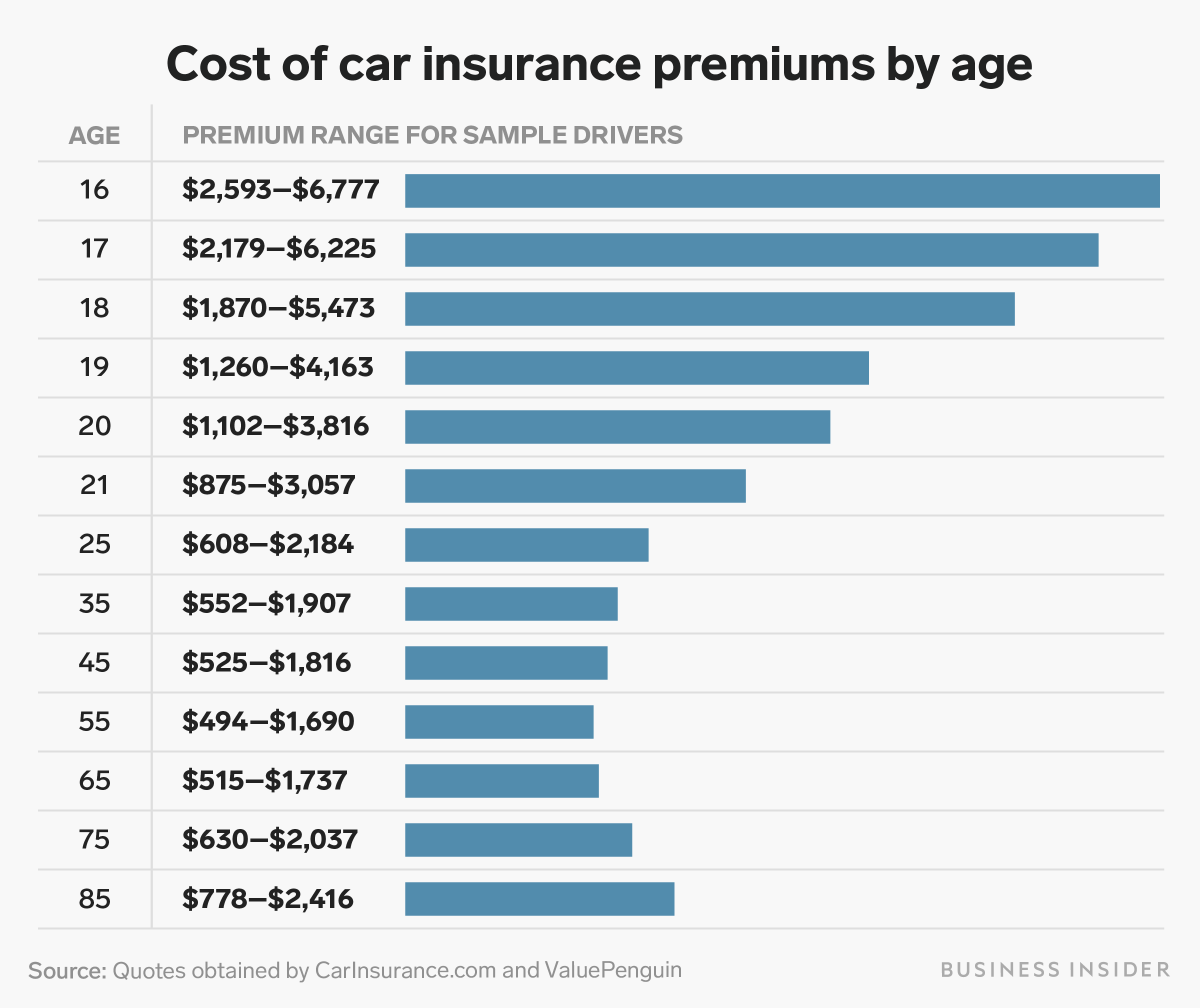

What age group has the cheapest car insurance? Experienced drivers are less likely to have an accident claim, which means they cost less to insure. At Progressive, the average premium per driver is decreasing significantly from 19-34 and then stabilizing or slightly decreasing from 34-75.