Does car insurance cover hurricane damage? These are the coverages you need

Does car insurance cover hurricane damage?

Contents

- 1 Does car insurance cover hurricane damage?

- 2 Driving in hurricanes

- 3 Who gets the insurance check when a car is totaled?

- 4 How do you prove insurance damage from lightning?

- 5 What’s the difference between collision and full coverage?

- 6 Is it better to have full coverage or liability?

According to Matt Christopher, vice president of claims and shared services at Clearcover Insurance, you need to speak to your insurance company or independent representative to make sure you have the right coverage for these events. On the same subject : Oklahoma’s Car Insurance Requirements – InsuranceNewsNet.

Do you know if your auto insurance would cover damage if a hurricane hits your area?

While every claim is different, the key is having the right coverage in your policy, according to Matt Christopher, vice president of claims and shared services at Clearcover Insurance.

“It’s important that you speak to your insurance company or your independent agent,” he said. “You want to make sure you have the right coverage to cover these events.”

Multiple coverages may apply to weather-related damage such as hurricanes; The rock star among them is the comprehensive coverage.

WHAT IS COVERED BY FLOOD INSURANCE AND WHO SHOULD GET IT?

“The things that come with hurricanes, like wind,” Christopher said. “Wind will knock over branches and damage your vehicle. Then your fully comprehensive insurance would come into play.”

Christopher adds that coverage also applies to damage from floods, hail and heavy rain.

You’re likely to pay a deductible – an amount you owe in connection with collision damage waiver.

“It’s basically sharing the risk with the insurance company,” Christopher said.

HERE’S WHAT TO DO AFTER YOUR CAR IS FLOODED

Cars stand abandoned on the flooded Major Deegan Expressway after a night of extremely heavy rain from the remnants of Hurricane Ida September 2, 2021 in the Bronx, New York.

The other cover that can really come into play in hurricanes is collision.

“Think about hurricanes, it rains a lot and the roads could be slick and you could lose control,” Christopher said. “You could hit another vehicle, a tree or a rock. And then a collision can come into play.”

And just like Collision Damage Waiver, there is a collision-related deductible and you would be responsible for paying for your coverage to materialize.

But not all water damage is covered, and each individual claim will be different, Christopher said. While most insurance policies do not cover intentional acts, it is best to speak to your insurance company or professional.

“Make sure you have the right coverage because preparation is absolutely crucial,” Christopher said. “You must have that cover from a storm.”

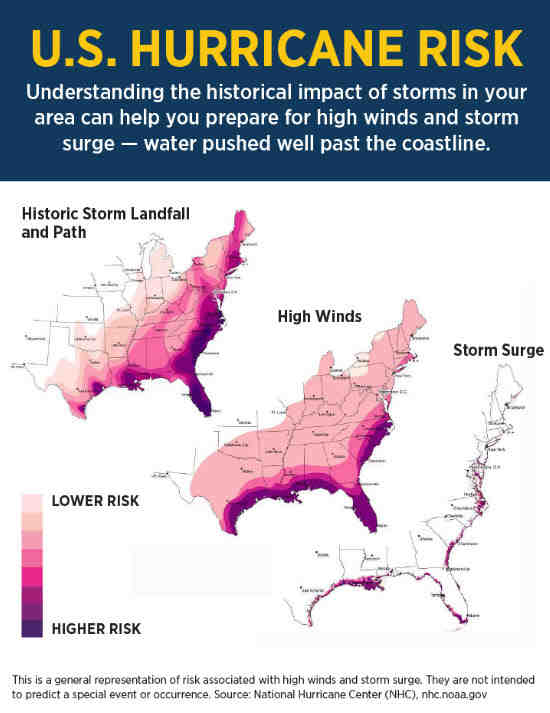

Christopher said insurance companies couldn’t provide retrospective coverage after a storm, so you need to be ready before hurricanes make landfall.

Cars drive on a wet road as rain falls from Hurricane Florence September 13, 2018 in Wilmington, North Carolina.

(Andrew Caballero-Reynolds/AFP/Getty Images)

Driving in hurricanes

It can be difficult and dangerous to drive in strong winds and storms accompanied by heavy rain and flooding. On the same subject : What do you do if someone scratches your car while parked?.

A critical tip is to keep a safe distance from other vehicles, especially tall vehicles such as B. Trucks that can be pushed or overturned by strong winds. When exiting a freeway to wait for a thunderstorm, do not park near trees, power lines, or other objects that could fall on your car.

PROPERTY GOT HURRICANE DAMAGE? HERE YOU SHOULD DO

Rain can cause aquaplaning when your vehicle slides on the road, giving you less control. According to Aceable, an online education platform and resource for motorists, it only takes six inches of water on a road for your tires to lose traction and spiral out of control.

A foot of standing water floats most vehicles, leaving you unable to steer or brake. And two feet of water can tear away large cars like pickups and SUVs and even damage your engine, which is known as hydrolock.

Therefore, always avoid driving through standing water and get out of your vehicle immediately if you get into trouble.

Car insurance will help you pay for repairs, but it won’t save your life.

During a storm, it’s best to seek shelter indoors like a windowless bathroom, hallway, or even a closet, the National Weather Service explains. You should also try to get as deep as possible, preferably underground or in a basement area.

Who gets the insurance check when a car is totaled?

If you have a balance on your vehicle loan, the insurance company must send the settlement amount — or the portion needed to pay off your loan — to the finance company or bank. To see also : How auto insurance claims are deposited. If any settlement proceeds remain, the insurance company will write you a check for the balance.

How does the insurance determine the value of a totaled car? Key Takeaway: The total damage value is determined by adding the cost of repairs and associated costs, the depreciation of your car in the event of an accident, and the cost of rent refunds while your vehicle is idle for repairs. Then the value that the insurer sells for the sale of the damaged car for salvage is deducted.

Can I keep the money from an insurance claim?

As long as you fully own your car, you can do whatever you want with the damage money you get from your insurer. This means you can keep any money left over from your claim.

Qui doit envoyer le constat d’accident ?

Vous devez envoyer ce constat à votre insured, meme si la partie adverse a refusé de le compléter ou de le signer.

Où trouver un formulaire de constat ?

Pour obtenir an example de constat amiable, vous avez la possibilité d’en faire la demande :

- Via your Espace Personnel, (Heading Mon Espace Assurances/ Mes attestations). Il vous sera addressed by courrier.

- Auprès de l’Agence de votre choix où il vous sera directement draw.

Où trouver constat amiable en ligne ?

The application “eâconstat auto” is the official application of assurances français developed sous l’égide de France Assureurs. Elle permet de clarer facilement et rapidement un crash material à son assurance sur le model du constat amiable papier.

Do insurance companies give you a check?

If the car insurance claim payment came from your insurance company, you may receive a check made out to you and the authorized body shop. Auto insurers tend to write two-party checks to reduce the likelihood that the funds will be used for anything other than the intended repair.

Why am I getting checks from my insurance company?

“A deductible on your comprehensive or collision damage waiver is the amount that you are responsible for before an insurance company pays for any damage. If the insurance company sends your mother a check, it’s because you have yet to pay for repairs to the vehicle or have already paid for them.

Can the insurance company send me a check?

Auto insurance companies can send out a check as a tactic to avoid higher compensation for your injuries. When you cash a check from an insurance company, you often forfeit your right to any future claim or compensation.

How do insurance companies pay out claims?

Most insurers will pay the actual cash value of the item and then a second payment when you present the receipt proving you replaced the item. Then you will receive the final payment. You can often submit your expenses on the go as you replace items over time.

How do insurance companies pay out claims?

Most insurers will pay the actual cash value of the item and then a second payment when you present the receipt proving you replaced the item. Then you will receive the final payment. You can often submit your expenses on the go as you replace items over time.

What are the 4 steps in settlement of an insurance claim?

- Negotiating a settlement with an insurance company. …

- Step 1: Gather the information required for your claim. …

- Step 2: Submit your personal injury claim. …

- Step 3: Outline your damage and claim compensation. …

- Step 4: Check the insurance company’s first comparison offer. …

- Step 5: Make a counter offer.

How long does it take to get a payout from insurance?

Most Insurance Companies Pay Claims Within 30 Days Most insurance companies aim to pay accepted claims within 30 days of receiving the original claim. Within those 30 days, the company should assign a claims adjuster to the case, verify the facts, accept or deny the claim, and make an immediate payment.

How do insurance companies pay out?

WalletHub, Financial Company Auto insurance companies pay claims by sending a check or wire transfer to the person who submitted the claim, or by paying the mechanic directly. Once your claim is approved, you will be paid the amount set by your insurer.

How do you prove insurance damage from lightning?

To prove that lightning damaged your home and belongings, you need to provide evidence. A hole, scratch or other damage to the outside of your home is good evidence and should be photographed as soon as it is safe to go outside.

Does insurance pay for lightning damage? Lightning strikes can cause fires inside or outside your home, ruin expensive appliances and electronics, damage wiring in walls, and potentially shake and injure you or someone in your household. The good news is that lightning strikes are covered by almost all home insurance policies.

What happens if lightning strikes your car while driving?

Although every lightning strike is different, antenna, electrical, rear window, and tire damage are common. The heat from a lightning strike is enough to partially melt a vehicle’s antenna and can cause a small spark explosion as tiny metal fragments melt and burn.

What happens if a lightning strikes a moving car?

Unfortunately, the vehicle does not always perform so well. A typical cloud-to-ground, actually cloud-to-vehicle, lightning strike strikes either the vehicle’s antenna or along the roofline. The flash then goes through the vehicle’s outer metal shell and then through the tires to the ground.

Will you be OK if your car is struck by lightning?

As long as you get out of the car after the lightning strike, nothing should happen. The body of the car is made of metal and will have conducted the lightning’s electrical charge into the ground. For your safety, it doesn’t matter whether the engine is running or not.

What happens if lightning hits my house?

When the current from a lightning strike is conducted by a home’s gutters, windows, concrete floors, and other conductive materials, it can jump into the home’s electrical system. A direct hit or a nearby hit can cause an explosive surge that destroys the wires.

How do you know if lightning struck your house?

Even a lightning rod on the house may not provide complete protection… Here are three signs to look out for that indicate lightning may have struck your home.

- Visible fire damage on the roof. …

- Shock wave damage to your home. …

- Surge or electrical damage in your home.

Can you get struck by lightning if your in a house?

Even if your home is a safe haven during a thunderstorm, you could still be at risk. About a third of lightning strike injuries occur indoors. Here are some tips to stay safe and reduce the risk of being struck by lightning indoors. Avoid water.

Can a house explode from lightning?

Surge Damage: When lightning chooses one of the home’s electrical wiring as its primary or secondary path, the explosive surge can damage even connected non-electronic equipment.

Does insurance cover lightning surge?

Most standard home insurance policies cover damage to your home caused by lightning strikes. In addition, a homeowners policy usually covers fire damage if lightning starts a fire that damages your home.

What storm damage is covered by insurance?

Home insurance typically covers the following types of storm damage: water damage and ice damage. lightning strikes and surges. Wind, hail and fallen trees.

Can you claim for lightning damage?

The good news is that lightning strikes and fires caused by lightning are covered by almost all home insurance policies with no exclusions.

Is lightning a covered peril?

Check out our data methodology and learn more about how we make money. Damage caused by lightning strikes is covered by standard home insurance – but there can be gray areas and exceptions, although lightning is one of the main perils covered by home insurance.

What’s the difference between collision and full coverage?

Collision insurance pays for damage to your vehicle if you hit an object or another vehicle. Collision Damage Waiver pays for non-crash damage such as weather and fire damage. It also reimburses you for auto theft and damage caused by collisions with animals.

Is it worth giving a car comprehensive insurance? If you have a new model car, you probably want to keep full coverage even if you bought it without credit. Adequate insurance protects your investment in your vehicle and prevents high expenses in the event of an accident. Some older cars still have a reasonable value.

Is collision coverage a good idea?

Much like your car, collision insurance depreciates over time as it never pays out more than the vehicle’s value. If you don’t have a loan or lease that requires it, collision insurance will eventually lose its value and cost you more than you would pay after an accident.

Is collision better than comprehensive?

Collision Damage Waiver is coverage that helps pay for the replacement or repair of your vehicle if it is stolen or damaged in a non-collision incident. Comprehensive, sometimes referred to as “other than collision” coverage, typically covers damage caused by fire, vandalism, or falling objects (such as a tree or hail).

At what point does collision insurance stop being beneficial?

You should cancel your collision insurance when your annual premium equals 10% of the value of your car. For example, if your collision insurance costs a total of $100 per year, drop coverage if your car is worth $1,000 because at that point your insurance payments will be too close to your car’s value to be worthwhile.

What is covered under the collision coverage?

Collision insurance helps pay for the repair or replacement of your vehicle if it is damaged or destroyed in an accident involving another car, regardless of who is at fault. This is different from liability insurance, which helps pay for damage to someone else’s car from an accident you cause.

Is full coverage the same as collision insurance?

Collision Damage Waiver includes Collision Damage Waiver and Collision Damage Waiver, in addition to any optional coverages you may need and that your insurer offers. In the event of an accident, it provides financial protection against damage to your vehicle and passengers, as well as damage to the other party’s vehicle and passengers.

Is it better to have collision or comprehensive?

Comprehensive insurance is better than comprehensive insurance if you have to choose between the two. Collision Damage Waiver is inexpensive, can be purchased individually, and pays for damage caused by events outside your control, such as an accident. B. vandalism, theft, natural disasters or collisions with animals.

Is collision and full coverage the same?

The main difference between collision damage waiver and collision insurance is the situations covered. Collision insurance pays for damage to your car if you hit an object or other vehicle, while comprehensive insurance pays for theft or damage from causes such as inclement weather, fire or fallen trees.

What is Full Coverage also called?

Fully comprehensive cover Fully comprehensive cover is insurance cover for damage to your vehicle. It protects your vehicle in the event of theft or vandalism.

Is it better to have collision or comprehensive?

Comprehensive insurance is better than comprehensive insurance if you have to choose between the two. Collision Damage Waiver is inexpensive, can be purchased individually, and pays for damage caused by events outside your control, such as an accident. B. vandalism, theft, natural disasters or collisions with animals.

Is full coverage better than comprehensive?

The difference between collision damage waiver is the difference between the damage caused when a tree fell on your car (risk damage waiver) and the damage caused when you hit a tree (collision). Because collision damage waiver protects you against a wider range of risks, it costs more.

Is it worth having fully comprehensive insurance?

For the vast majority of motorists, full comp offers the cheapest car insurance. This is because it offers a higher level of coverage than third party policies. It also means that you don’t end up paying for expensive repairs to your car if you’re involved in an accident that was your fault.

At what point is collision insurance not worth it?

You should cancel your collision insurance when your annual premium equals 10% of the value of your car. For example, if your collision insurance costs a total of $100 per year, drop coverage if your car is worth $1,000 because at that point your insurance payments will be too close to your car’s value to be worthwhile.

Is it better to have full coverage or liability?

Full coverage usually gives you more protection and is likely needed if you’re still making payments on your car. If you drive a vehicle that is more than 10 years old or has a high mileage, or if you have enough money to easily replace it, you should consider driving with liability only.

When is fully comprehensive insurance not worthwhile? The 10% rule states that you can cancel comprehensive insurance if the annual premium equals or exceeds 10% of the market value of your car. For example, if your car is worth $4,000, it might not be worth paying $400 or more for full coverage.

Is it smart to have full coverage?

As a rule, it is advisable to take out fully comprehensive vehicle insurance. Liability insurance does not pay for damage to your own vehicle after an accident that you are at fault for. It also does not cover damage caused by theft, vandalism or natural hazards.

How long should you keep full coverage on a car?

The rule of thumb used to be that car owners should cancel comprehensive insurance after the age of five or six years or after 100,000 mileage. (Many websites complain about this.)

How much more is full coverage vs liability?

How much cheaper is liability insurance than comprehensive insurance? Liability insurance is on average 64% cheaper than fully comprehensive insurance. According to WalletHub data for 2021, third-party auto insurance costs an average of $720 per year, while comprehensive auto insurance costs an average of $1,997 per year.

What is considered to be full coverage?

What does “comprehensive insurance” mean? When you finance or lease a vehicle, your lender may use the term “fully comprehensive,” but that simply means they require you to carry comprehensive and collision insurance, as well as anything else your state requires.

Are there different kinds of full coverage?

When people talk about “fully comprehensive” car insurance, they’re often referring to a combination of coverages that help protect a vehicle. But there really is no such thing as “comprehensive insurance” for your car. Some coverages (e.g. motor vehicle liability insurance) are required by law.

How much is insurance in Paris?

Single car drivers in Paris pay an average of $2,914 per year for car insurance. That’s about $243 a month to insure your car.