Florida auto insurance rates are 59% higher than the national average. Here’s why we pay more. – Boca Raton’s most trusted news source | Boca Raton’s most trusted news source

Prices and tough economic times have made it difficult for families everywhere to make ends meet, and one of the causes is the rise in the cost of insurance. This is especially true in Florida, where auto insurance rates are 59% higher than the national average. There is no doubt that many car owners are wondering why they are paying so much – and, more importantly, what they can do about it.

How Much Do Floridians Pay for Car Insurance?

Contents [hide]

- 1 How Much Do Floridians Pay for Car Insurance?

- 2 Why is Car Insurance in Florida So Expensive?

- 3 How Can You Find Cheap Florida Car Insurance?

- 4 Don’t Take the Risk

- 5 How much insurance should I have on my car in Florida?

- 6 How can I save on car insurance in Florida?

- 7 Can I cancel GEICO after 1 month?

- 8 Is Florida a no-fault state?

Florida has some of the highest auto insurance rates in the country. According to Kristine Lee of The Zebra, motorists in Florida pay an average of $2,425 per year – 59% more than the national average. Even if you legally take out empty car insurance, you can still expect to pay more than $700 a month, which is still 51% above average.

Why is Car Insurance in Florida So Expensive?

So what makes car insurance in Florida so expensive? This may interest you : Michigan car insurance rates rise more than 7% in 2022 after no-fault reform aimed at lower rates.

First, insurance premiums are high everywhere, not just in Florida. Inflation, rising component prices, supply issues, extreme weather, and even a rise in car and converter theft have all contributed to higher premiums across the country. But there are several other reasons why Florida rates are so high:

High traffic levels. Heavy traffic means more opportunities for collisions or other incidents, and places like Miami, Tampa and Orlando have the heaviest traffic in the state. In fact, three Florida cities rank worst in the nation.

The weather. Extreme weather events have been on the rise for some time now, and major weather disasters mean huge payouts for insurance companies, often in the millions of dollars. hundreds or more. Florida in particular has a high speed of storms and hurricanes, which can lead to untold damage – and huge records.

Uninsured drivers. There are many uninsured drivers in the United States – more than 13% of all US motorists are uninsured. But that rate doubles in Florida, where more than 26% of drivers are uninsured. That’s more than one in four drivers. This, combined with Florida being a no-fault insurance state, means that insurance companies often have to pay larger premiums in the event of a collision…

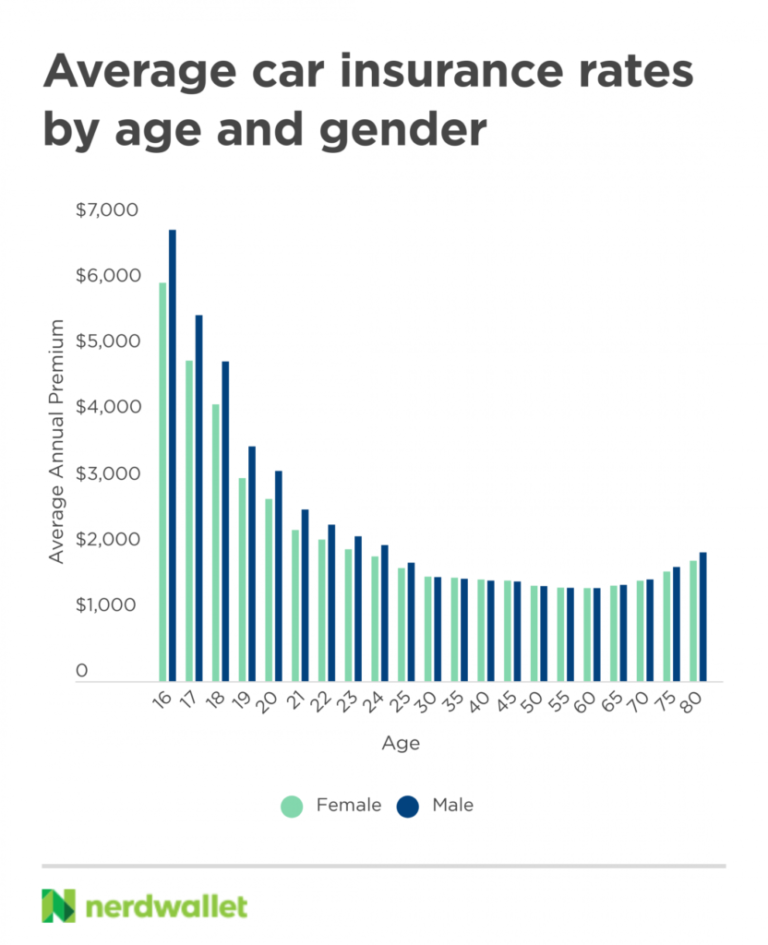

Population. Many retirees and students live in Florida, both of which represent a higher than average risk. Older drivers are more likely to experience accidents and injuries, while younger drivers tend to be careless and are more likely to drive drunk.

Tourism. Being a popular vacation spot means that Florida receives many visitors year-round, which increases traffic on the road. Visitors also see Florida as a “party” state, which means a high incidence of driving under the influence of alcohol or drugs.

How Can You Find Cheap Florida Car Insurance?

So what can you do to lower those insurance premiums? Here are some tips: This may interest you : Is it better to stay with one insurance company?.

Don’t Take the Risk

With insurance premiums so high and finances so tight for many people, it can be tempting to go without car insurance and hope that things will work out. This is a bad idea for several reasons. On the same subject : What Factors Reduce Your Car Insurance?. It doesn’t matter how good a driver you are – it’s often the “other guy” who causes the accident. Drop your insurance, and you could end up on the hook for thousands in medical and legal bills.

How much insurance should I have on my car in Florida?

Overview of How Much Auto Insurance Do I Need in Florida If you live or work in Florida and drive a vehicle with four or more wheels, you are legally required to carry $10,000 of personal accident insurance (PIP ) and another $10,000 in property damage liability. (PDL).

How much car insurance do I need in Florida? Recommended Limits of Coverage: We recommend that you purchase Bodily Injury Liability in the amount of $100,000 per person/$300,000 per occurrence (accident), as a minimum. However, we suggest that you purchase higher limits if you have more assets that you want to protect.

What should my insurance coverage be in Florida?

According to Florida law, if you own a vehicle with four or more wheels you must carry $10,000 of personal protection insurance (PIP) and at least $10,000 of property damage liability insurance. You may be awarded up to $1,000 for PIP coverage and $500 for property damage liability.

What is the recommended level of coverage?

You should carry the most coverage you can afford, with 100/300/100 being the best level of coverage for most drivers. You may need additional coverage to protect your vehicle, including comprehensive, collision and collision coverage.

How much comprehensive insurance do I need in Florida?

Unlike other states, Florida car insurance requirements do not include bodily injury coverage. Instead, state drivers need at least $10,000 for personal injury protection (PIP) and $10,000 for property damage liability.

What type of auto insurance do I need in Florida?

627.736, Florida Statutes). It requires everyone who registers a vehicle in Florida to provide proof of personal injury coverage (PIP) and property damage liability (PD), with minimum limits of $10,000 each . PIP covers injuries that you and others may cause in a car accident, regardless of fault.

Do you need comprehensive and collision coverage in Florida?

Collision and full disclosure is not required in Florida. But if you don’t have them you could be facing huge out-of-pocket costs if your car is damaged. There are many uninsured drivers in Florida. If one of them damages your car, you will have to pay for the damage.

What type of auto insurance is required in most states?

Liability insurance: Almost all states require minimum liability insurance. This coverage helps pay for any injuries or damage you cause in a car accident, including that of the other driver and their passengers.

Do I need no fault insurance in Florida?

The basis of Florida’s no-fault system is that every licensed driver in Florida must carry at least $10,000 in Personal Injury Protection, or PIP, and $10,000 in Property Damage Liability, or PDL.

Do I need full coverage on my car in Florida?

In Florida, comprehensive auto insurance is considered the minimum insurance required by Florida law or a policy that protects drivers in most cases, depending on who you ask. There is no specific definition of full coverage car insurance in Florida, despite the popularity of the word.

Is full coverage required in Florida?

Absolute protection is a misnomer when it comes to debt protection. Comprehensive coverage does not fully cover the insured but provides the minimum coverage required by Florida law. We have extensive experience litigating insurance claims and obtaining compensation for injured individuals.

Which coverages are mandatory in Florida?

Any vehicle with a current Florida registration must:

- having PIP and PDL insurance at the time of vehicle registration.

- have a minimum of $10,000 in PIP AND a minimum of $10,000 in PDL. …

- providing continuous protection even if the vehicle is not driven or idle.

How can I save on car insurance in Florida?

How to get Florida car insurance?

- Maintain a Clean Driving Record. …

- Get a Driver Improvement Course. …

- Combine Different Discounts. …

- Combine different types of insurance. …

- Consider Usage-Based Insurance. …

- Park Your Car in a Safe Place. …

- Choose Your Car Model Wisely.

What is the average monthly cost of car insurance in Florida? The average cost of car insurance in Florida is $91 per month for limited coverage, or $238 per month for full coverage. Youngsters pay as little as $205 a month for low car insurance in Florida.

Can I cancel GEICO after 1 month?

You can cancel your Geico insurance policy at any time. Cancellations can be made immediately or scheduled for a future date. Geico does not charge a cancellation fee.

What happens if I cancel my Geico policy early? Geico doesn’t charge a cancellation fee if you cancel early, so you can cancel your policy at any time – right away or next day.

Can I cancel car insurance after a month?

Yes, you can cancel your car insurance at any time. Before you do, it’s a good idea to ask your insurer about their cancellation policy. Some companies require a notice period or apply cancellation fees.

How many days do you have to cancel an insurance policy?

Auto insurance companies are required by state law to provide notice before canceling your policy. Depending on the country, you will usually have between 10 and 20 days.

What happens if you cancel your car insurance early?

If you have paid your premium in advance and cancel your policy before the term expires, the insurance company must return the remaining amount in most cases. Most auto insurers will extend your refund based on the number of days your current policy was in effect.

Can you cancel a policy at any time?

Yes, the policy can be canceled at any time, and you will receive a partial refund if you have paid your premium in advance and cancel before your policy expires. Some car insurance companies also charge a fee to cancel your policy before the policy expires.

Can I cancel my Geico Insurance and get refund?

Does Geico refund your money if you cancel? If you have paid your insurance premiums early and decide to cancel before your policy expires, Geico will refund any unused portion of your policy.

Can you cancel insurance at any time and get refund?

If you want to cancel your policy after the grace period you should check with your insurance. Most insurers will refund you if you haven’t made any claims in the policy year but you will usually have to pay administration fees.

How much does Geico charge to cancel policy?

If you want to cancel your policy, GEICO makes it easy with no cancellation fee*. Just follow the steps below: Call (800) 841-1587 to speak with a friendly, licensed agent. If you are prompted to speak with an Interactive Voice Response (IVR), say “cancel insurance policy” and then “auto.”

Do you get a refund if you cancel your car insurance?

If I cancel my car insurance, will I get a refund? If you have paid your premium in advance and cancel your policy before the term expires, the insurance company must return the remaining amount in most cases. Most auto insurers will extend your refund based on the number of days your current policy was in effect.

What is Geico’s cancellation policy?

If you want to cancel your policy, GEICO makes it easy with no cancellation fee*. Just follow the steps below: Call (800) 841-1587 to speak with a friendly, licensed agent. If you are prompted to speak with an Interactive Voice Response (IVR), say “cancel insurance policy” and then “auto.”

Does Geico have a grace period after cancellation?

Geico has a nine-day grace period if you can’t pay on time. After that, your policy can be cancelled. Geico does not have a late fee, but if you miss a payment, they will send a formal notice of cancellation within 14 days of the original due date.

Do I get a refund if I cancel my Geico policy?

Will I get a refund or owe money if I cancel? If you pay early, then yes, you will get a refund of the unused portion of your payments if you cancel your Geico policy. You can contact Geico to see how much you will get back and when you will get it.

Is Florida a no-fault state?

Florida is a no-fault car insurance state. This means that drivers must have personal injury protection (PIP) insurance to cover their medical expenses and other expenses related to the accident, regardless of who caused the collision.

Who pays for car damage in no-fault Florida? Because of Florida’s no-fault laws, your insurance will pay for the repairs to your car after an accident you did not cause in Florida. However, if the cost of the damage exceeds the limits of your policy, you may be able to get additional compensation elsewhere.

How is fault determined in Florida?

The determination of who is at fault after a Florida car accident is usually made by a judge using information gathered from the people involved in the accident, their legal representatives, their insurance claims adjusters, and the police who attended. responded to the accident.

Can I sue if im at fault Florida?

In Florida, you can make a claim or file a lawsuit even if you were responsible for an accident. Under the theory of comparative negligence, the injured party’s recovery may be limited by their percentage of fault. This can be a major point of contention in any negotiation.

How do insurance companies determine fault in Florida?

Types of State Liability Laws Many states, such as Florida, operate under a comparative fault system. Each driver gets a share of the fault based on the degree to which the insurance company’s investigators believe they contributed to the crash.

What happens when you are at fault in a car accident in Florida?

If you are at fault in a car accident, you may be sued for damages if the victim suffered permanent disability, serious injury or disfigurement, loss of body or property. he died. The definition of serious injury is found in the Florida Statutes.

Is Florida still a no-fault state in 2022?

Florida is a crime-free state. No-fault law means that, regardless of who is at fault, your accident insurance policy will step in to provide coverage up to the policy limits. Unlike many other states, Florida residents are not required to have personal injury liability.

Is FL still a no-fault state?

Home » Frequently Asked Questions » Car Accidents » Is Florida No Fault? Florida is a no-fault car insurance state. This means that drivers must have personal injury protection (PIP) insurance to cover their medical expenses and other expenses related to the accident, regardless of who caused the collision.

When did Fl become a no-fault state?

The Sunshine State began accepting no-fault auto insurance in the 1970s, technically dropped it in 2007 and then promptly did it again. As the theft continued – with the help of lawyers, doctors and auto contractorsâFlorida became one of the cheapest states for car insurance.

Is Florida a pure no-fault state?

WalletHub, Financial Company Yes, Florida is not liable. Florida being a no-fault state for auto insurance means that all drivers in Florida must purchase personal protection insurance (PIP) to cover their medical bills after an accident regardless of whether Who is to blame?

Do I need no-fault coverage in Florida?

The basis of Florida’s no-fault system is that every licensed driver in Florida must carry at least $10,000 in Personal Injury Protection, or PIP, and $10,000 in Property Damage Liability, or PDL.