Here Are The Cars That Buy The Highest Insurance Rates For 2022

The luxury sports sedan Maserati Quattroporte is the most expensive car to insure for 2022, according to … [+] data from Insure.com

In a separate post, we’ve featured the 20 cheapest new cars to insure for 2022, according to website Insure.com’s annual report. At the top of the list is the Subaru Forester compact SUV in its 2.5I Wilderness trim, averaging $1,353 per year. Even the most expensive car on the list, the Jeep Wrangler Willys Sport at number 20, is only $1,415 per year.

But what about the models at the other end of the ledger? Aside from the unrivaled Rolls-Royce and Ferrari, the vehicle expected to offer the highest insurance rates among mainstream brands in 2022 is the Maserati Quattroporte luxury sports sedan, with an average annual price of $5,176. While probably no one would cross-shop for a reasonable Subaru and a six-figure Maserati, the site’s survey shows there’s a $3,823 spread in annual premiums between the most expensive and least expensive models in this regard.

Why such a clear difference? In general, repair-friendly models that are driven more gently and have the highest safety values are the cheapest to cover. On the other hand, the most expensive models to insure tend to be luxury vehicles that cost a fortune to repair, as well as high-performance models that can pump up to 600 horsepower (or more) to the pavement and then be driven fast and furious.

We count below the 20 most expensive cars to cover.

Insure.com bases the average annual cost of insurance on data from 3,000 separate models collected from the seven largest transportation companies in 10 zip codes per state, based on a hypothetical single 40-year-old man who commutes 12 miles to work each day, with a typical value policy limits, a clean balance sheet and good credit.

Of course, auto insurance rates can only go up from there, depending on personal factors. Those who have the most conspicuous and expensive rides, live in a major city and have traffic violations and/or culpable accidents on their ride records will be charged significantly more than the averages shown here. A recent report found that people with just a single ticket or accident typically pay 55 percent more per year than someone with a clean history. Some carriers may refuse cover if the car and/or driver pose an unacceptable risk.

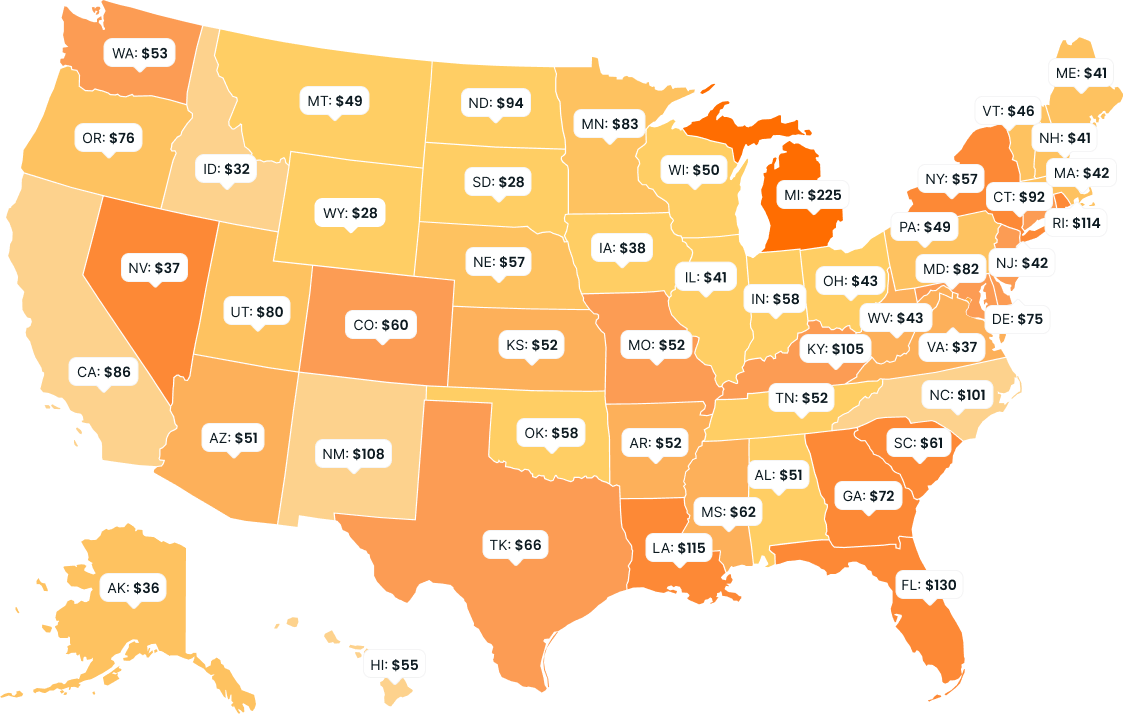

In addition, rates may vary from one state to another based on accident/damage/crime rates, the number of uninsured drivers, the frequency of inclement weather, population density, the number of insurance companies doing business in a particular state, and the Minimum coverage levels and insurance industry regulations required vary significantly.

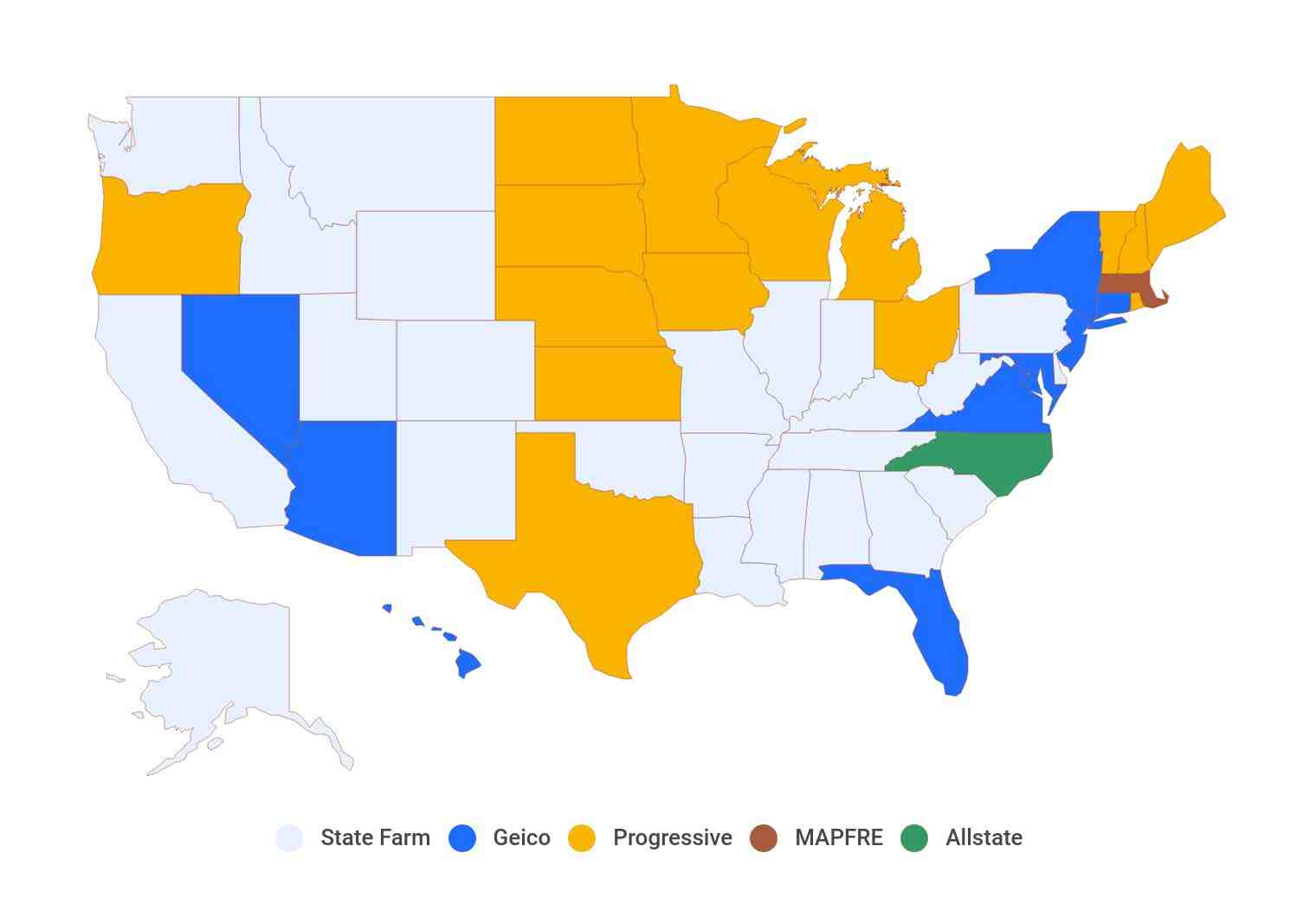

It can be helpful to shop around with multiple providers each year (or more frequently if personal factors change) to make sure one is getting the lowest rates available. While some drivers can save some money by minimizing liability insurance and/or increasing the deductible on comprehensive and collision insurance (or dropping it altogether), it’s not always a wise move for those who do some of the most expensive trips on the road own street.

Insurance companies typically give discounts to people who own multiple cars, who “bundle” vehicle and home insurance with the same company, drive a minimum annual mileage, pay premiums annually, and/or set up automatic payments. Such savings can seem minimal on policies that otherwise cost thousands of dollars a year. Many companies rate tariffs based on actual driving habits, based on data collected from monitors plugged into a vehicle’s onboard diagnostic port, although we suspect they rarely work in favor of someone who owns a high-performance car that practically begging to be piloted aggressively.

For better or worse, here are the 20 vehicles that Insure.com says will trigger the highest possible average annual auto insurance rates, with applicable trim levels for each.

The most expensive cars to insure for 2022:

Read Insure.com’s full report here.

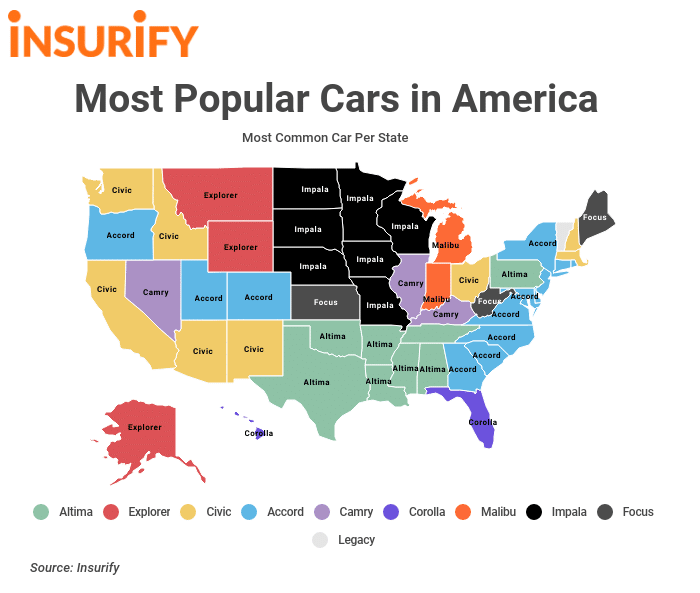

Statistics show that smaller, sportier cars are driven at higher speeds by younger, riskier drivers. Because they are involved in more accidents, they are more expensive to insure. For this reason, it stands to reason that larger vehicles such as SUVs would be less expensive to insure.

Are men better drivers?

Contents

- 1 Are men better drivers?

- 2 Why is car insurance so expensive in some states?

- 3 Does car insurance decrease as car gets older?

- 4 What age pays the most for car insurance?

Male car and van drivers were involved in twice as many fatal accidents as women. On the same subject : Another problem for American motorists: car insurance costs.

Are men or women worse drivers? Fatalities 2020Men and women Accidents involving male drivers are often more serious than those involving female drivers. However, women are more likely than men to be killed or injured in accidents of the same severity, although the gender gap in fatality risk decreases with age.

Are guys better at driving?

Researchers from Johns Hopkins University found that female drivers were involved in slightly more accidents than men, but the difference wasn’t huge – 5.1 accidents per million miles driven for men, compared to 5. Read also : Another pain point for US drivers: Car insurance costs.7 accidents for women.

Who drives worse males or females?

Studying 6.5 million auto accidents at the US University of Michigan, researchers found that women were involved in 68 percent of accidents. That surprised the researchers, who claim that men drove 60 percent more cars over the study period, compared to just 40 percent more women.

Why is car insurance so expensive in some states?

The combination of densely populated urban centers, high healthcare costs, expensive auto repairs, and the state’s severe weather and natural disaster risks all contribute to California’s higher than average insurance premiums. To see also : Will car insurance cover hail damage?. Luckily, shopping locally can help offset the high cost of coverage.

Why is insurance more expensive in some federal states? One of the reasons auto insurance rates vary from state to state is that each state has its own insurance laws. The average premium in Maine is $858, which is 40% less than the national average. This makes it the cheapest state for car insurance.

Why are car insurance prices so different from state to state?

Because auto insurance is regulated at the state level, states have different minimum coverage requirements that drivers must have in order to legally drive. There are typically five types of insurance that states may require drivers to have, including: Personal Injury Liability (BI)

What state has the highest car insurance rates?

The 10 most expensive states for car insurance

- New York. …

- Georgia. …

- Maryland. …

- Michigan. Average annual auto insurance premium: $2,497. …

- New Jersey. Average annual auto insurance premium: $2,350. …

- Florida. Average annual auto insurance premium: $2,343. …

- Rhode Island. Average annual auto insurance premium: $2,321. …

- South Carolina.

Is car insurance the same in every state?

Even in states where zip codes cannot be used as a factor in determining rates, you may find that the average cost of car insurance in your state can vary significantly when compared to a neighboring state. Auto insurance rates can vary widely by state, often by hundreds or even thousands of dollars.

Why are my auto insurance quotes so different?

Auto insurance rates vary from one insurance company to another as each uses their own unique formula to assess risk and determine how much you pay.

What state has the highest car insurance rates?

The central theses

- The most expensive state for comprehensive auto insurance is Michigan at around $4,003, more than triple the national average of $1,265.

- The cheapest state for comprehensive auto insurance is Maine at around $589, 53.4% below the national average.

Where is auto insurance the most expensive?

Most Expensive State for Auto Insurance: New York On average, New York drivers pay $5,936.28 per year for auto insurance. That means they pay a whopping 92% above the average for the rest of the country.

What state has the most expensive car insurance?

The most expensive state for comprehensive auto insurance is Michigan at around $4,003, more than triple the national average of $1,265. The cheapest state for comprehensive auto insurance is Maine at around $589, 53.4% below the national average.

Who has the highest insurance rates in the United States?

States with the highest full auto insurance coverage rates: New York: $2,498. Louisiana: $2,351. Michigan: $2,105. Rhode Island: $2,066.

Why is car insurance so expensive in the US?

A driver’s auto insurance premium could become expensive due to recent claims or driving violations. Speeding tickets, at-fault accidents, and DUIs have a big impact on insurance premiums. After an infringement or claim, an insurer will bill a driver for three to five years.

Is car insurance in America Cheap?

| Federal State | Cheapest company | Average annual rate |

|---|---|---|

| Arizona | geiko | $272 |

| Arkansas | Southern Farm Bureau Insurance | $261 |

| California | geiko | $374 |

| Colorado | American national | $192 |

What is the most expensive state to insure a car?

The most expensive state for comprehensive auto insurance is Michigan at around $4,003, more than triple the national average of $1,265. The cheapest state for comprehensive auto insurance is Maine at around $589, 53.4% below the national average.

Is car insurance in USA expensive?

Drivers in the US pay an average of $1,771 a year for comprehensive auto insurance, or about $148 a month, according to Bankrate’s 2022 analysis of average premiums offered by Quadrant Information Services. Minimum coverage costs an average of $545 per year.

Does car insurance decrease as car gets older?

Are older cars cheaper to insure? Yes, most older cars are cheaper to insure, especially as far as fully comprehensive and comprehensive insurance is concerned. Cars lose value as they get older, which means that the possible insurance benefits after an accident also decrease.

What age pays the most for car insurance?

Statistically, drivers under 25 and over 65 pay more for car insurance than middle-aged adults. The cause: Young people are three times more likely to have an accident than drivers over the age of 20 and thus earn the highest premiums of all age groups.

Does age affect your car insurance premium? Key Takeaways Your age plays a big part in the rate you pay for car insurance: drivers under the age of 24 often pay the highest insurance rates. Car premiums often start falling after you turn 25. Typically, drivers in their 40s and 50s pay the lowest rates.

Does insurance get lower at 25?

At 25, many insurers reduce premium costs. But there’s no set timeline for when your policy’s cost will go down. If you can keep a clean driving record, you should be able to find a good car insurance deal.

Can I drive in the UK with a foreign insurance?

If you have a ‘specific country’ driving licence, you can use it in the UK for up to 12 months, but will then have to exchange it for a UK driving licence. If you apply within five years of becoming a UK resident, you do not need to take the UK driving test.

Is EU car insurance valid in UK?

Yes – as long as you have at least third party motor insurance you can drive in Europe after Brexit – all UK insurers are required by law to include at least 30 days of European coverage per year. If you are planning a longer trip, you may need to purchase additional insurance.

Can a UK resident drive a French registered car in France?

maybe I think it was a British car with a French license, which was a no no. A UK resident cannot drive a foreign-registered car in the UK.

Does insurance go down at 21?

Yes, car insurance goes down when you turn 21. Car insurance falls by about 20% between the ages of 20 and 21, and car insurance premiums continue to fall each year into the 20’s and 30’s. The 21-year fall in interest rates is the second largest age-related price change on average.

Do insurance rates go down at 22?

The biggest reductions in car insurance rates typically occur as teenage drivers age, typically when they turn 18 or 19. Rates continue to decrease with age, especially when drivers are over 25 years of age.

At what age does insurance go down for males?

Car insurance for male drivers drops by 15% by the age of 25, and actually drops every year up to the age of 25. Once males reach their mid-twenties, rates begin to fall more gradually, reaching a plateau by middle age. The premiums will only increase again from the age of about 65 to 75 years.

Do insurance rates go down at 20?

Drivers see their car insurance premiums begin to decline around age 20, with a large drop around age 25. Tariffs tend to stabilize for decades after around age 35. However, once you are over 65, age tends to affect driving ability.