How a recession could affect your car insurance

The increase in the price of goods has squeezed the budget across the country. In fact, Americans are spending about $433 more per month in October 2022 compared to October 2021. If you are trying to lower your monthly expenses, you can look to your car insurance rates as a place to cut back. While saving on car insurance can be beneficial to your bottom line, you should be aware that some strategies can put you at greater financial risk in the long run. Bankrate can help you understand how the recession is affecting your car insurance and show you what steps to consider – and which ones you may want to skip – as you try to save on your car insurance at in the recession.

The current state of the economy

Contents

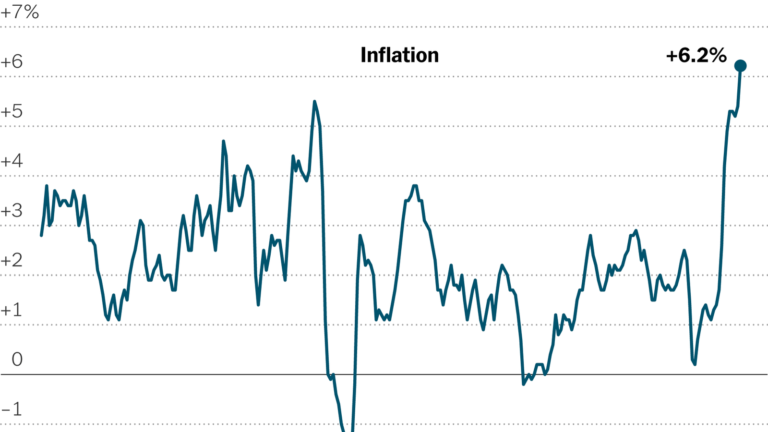

2022 was a wild ride for American households. Inflation rose rapidly, prompting the Fed to implement a series of aggressive measures in an effort to control the situation. While inflation has moderated recently – it peaked in July at 9. See the article : Can Theft Be Covered With Car Insurance?.1 percent year over year and currently sits at 7.7 percent over the year – higher prices have weighed heavily on Americans’ budgets.

In a Bankrate survey, 55 percent of working Americans said their wages have not kept up. The high cost of living already makes things tough, but when wage increases can’t keep up, American households may end up treading water, or worse, losing money every month. The situation is dire: nearly 7 in 10 Americans are worried about a recession. Economists are less optimistic, with Bankrate’s Third Quarter Economic Index showing a 65 percent chance of a recession by mid-2024.

But what is recession? Bankrate’s chief economic reporter Sarah Foster explained that traditionally, a recession is when the economy shrinks for six consecutive months, although the best scores are more complicated. The economy contracted for six consecutive months in 2022, but the labor market remained strong and unemployment figures were at record lows, something that has been linked to the recession. “There’s only one group of economists that can make an official announcement, and that’s the National Bureau of Research’s Business Intelligence Committee,” Foster said. “Until then, we’ll never really know. But it may be less of a question for Americans’ personal finances. “

That’s because the recession and inflation “have taken away the ability of Americans to buy and do what they want and need,” according to Foster. Whether the current state of the economy is officially called a recession is just a matter of words. What is important is that due to inflation, spending power has already been reduced.

How a recession affects your car insurance

Every recession is different, which means that with every recession, you may face different challenges with your car insurance. For example, Stephen Crewdson, Executive Director at J.D. Power, told Bankrate that the current economy is very different from the Great Recession where car insurance premiums were very low. See the article : Is Geico owned by Allstate?. Purchases and replacements slowed during the Great Recession. People have been starving, they have been following what they know. “Today’s economy, with inflation, creates different struggles.

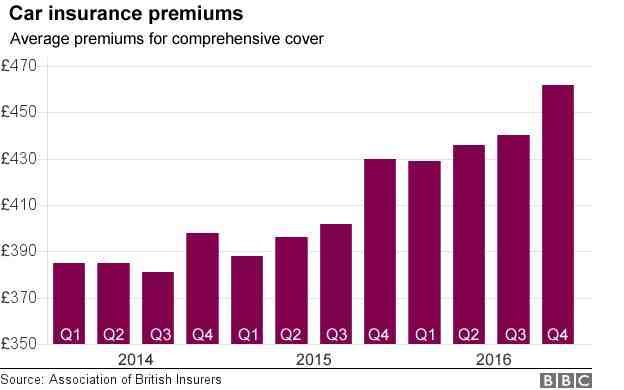

Recessions can mean higher car insurance rates

The increase in the price of goods leads to an increase in the cost of car insurance. This is because claims are becoming more numerous and expensive as the cost of repairing and replacing vehicles, as well as the cost of post-accident health care, increases. This may interest you : Does car insurance need to be in name of registered owner?. When claims are more expensive, insurance companies compensate by charging higher to ensure that they can continue to cover losses at higher rates.

“We pay more for everything we consume, and [insurance] is an added bonus,” said Tim Grant, Senior Director of Underwriting at LexisNexis. While auto insurance rates will vary based on your credit score, most consumers will likely begin or continue to see their premiums increase.

The forecast for 2022 continues to increase, and the forecast for 2023 continues to increase.

– Stephen Crewdson Executive Director at J.D. Power

Inflation has slowed a bit in recent months, but don’t expect auto insurance rates to drop anytime soon. Insurers are feeling the effects of inflation, but they cannot increase premiums immediately. First, they must submit an application to increase premiums with each state’s Department of Insurance, and there is no guarantee of approval. For example, California did not approve rate hike requests for more than two years starting in 2020 and ending with the recent approval for Allstate. If a rate change is approved, it generally takes effect on a new policy date and a renewal date. This means that it can take a full year for each company’s business book to be affected by the exchange rate.

If your policy renews for a year on January 1, for example, but the renewal rate increase goes into effect on February 1, you won’t see your rate increase a month after your renewal. Instead, your policy will be rolled over into the new rate plan on your renewal after the rate change, so January 1 of the following year (if you have a 12-month policy). This means that, even if inflation continues to be low, we could see rates increase in 2023.

Recessions may leave you underinsured

If you are experiencing the reduced spending power that is common in a recession, you may want to look at your insurance premiums as a way to save money. If you are tempted to cut your coverage in order to recover a lower premium, you should know that this is a risky move. Lower limits can result in a cheaper plan, but you also expose yourself to higher out-of-pocket costs if you create a claim. If you cut your limits back too far and find yourself having to pay out of pocket, you could end up damaging your finances more than if you had paid a higher limit in the first place.

The current crisis is due to inflation. The cost of car insurance increases due to the increase in the cost of claims, but unless you make a manual change to your policy, the coverage limit remains the same. This means that taking your car insurance may not be as far as it seems, considering how much more expensive it is after an accident. Basically, inflation can leave you uninsured. While this mostly affects drivers who purchase the minimum coverage, it doesn’t hurt to check your auto insurance limits with your agent or company representative. If you feel that you may be uninsured due to inflation, you can increase your coverage to provide more financial protection while looking for ways to adjust your increase, by discounting or buying your policy.

Recessions may prompt you to shop

Car insurance rates are rising across the industry, but that doesn’t mean that every company charges the same price. Additionally, rates vary by state, so learning about the average rate in your area can help you decide if your rate is competitive. Shopping for your car insurance with multiple carriers can be an effective way to find lower rates, and consumers seem to know this. In a study conducted by LexisNexis, the cost of buying personal insurance began to increase significantly from July 2022. The number of purchases increased by 5.3 percent over the year of August 2022. While the most recent increase in The purchase took place around April 2021, this increase may indicate. that policy makers are willing to make the switch to find lower car insurance rates.

Beth Riczko, CEO of Property & amp; International Lines Market confirms this, telling Bankrate that “A National Insurance Commission survey shows that nearly half of consumers expect their insurance premiums to increase (48 percent), and that may be the reason why more than half have already looked into whether they will seek the means. to save money for their existing policy (56 percent).” Because car insurance companies charge different rates, shopping around and changing car insurance companies can help you get a lower rate.

How to save on car insurance during a recession

If you’ve seen your car insurance premiums increase due to inflation, or if you just need to find some room in your budget due to the effects of inflation, you can take steps to lower your premiums.

In personal finances, the most important step Americans can take is to focus on what they can and cannot control.

– Sarah FosterBankrate Senior Financial Reporter

Car insurance rates are at least partially within your control. Here are some tips to help you save on your car insurance:

Make sure your finances are still protected

Saving during a recession means more than just thinking about the bottom line. It means knowing that insurance is, at its core, a form of financial protection. When it comes down to it, cutting back on your car insurance might not be the best place to find room in your budget. Grant explains: “The risk is, if you look to drop coverage when repairs and replacements are at their highest, you could be putting your family in dire financial straits by downsizing.”

… while cutting coverage may seem like a reasonable idea in the short term, it could be more expensive for consumers in the long run.

– Beth RiczkoPresident of Property & Individual Market Lines, nationwide

Car insurance is designed to provide a means of financial security in the event of an accident. If you cut your coverage too far, you may face out-of-pocket compensation. In such an environment of inflation, it can affect the money more than usual.

In general, reducing your car insurance coverage is not the best strategy to save on your premiums. Bankrate’s analysis of average car insurance rates shows that, for a comprehensive coverage policy, there is little difference between most liability limits. Switching from a 100/300/50 plan, for example, down to the lowest limit will save you an average of $13 per month, based on our rates.

The bottom line

The U.S. economy may or may not be officially in recession, but it may or may not matter to the average household. Since inflation has reduced spending power, it has led to an increase in car insurance prices and has led to an increase in insurance sales. While shopping around to find the cheapest auto insurance rates is a great savings strategy, dropping coverage won’t usually save you much and may expose you to higher financial risk. Pricing has many Americans in its vice grip, but maintaining the right auto insurance can help ensure that you come out of this patch unscathed.