How Are Car Insurance Rates Determined? | Chase

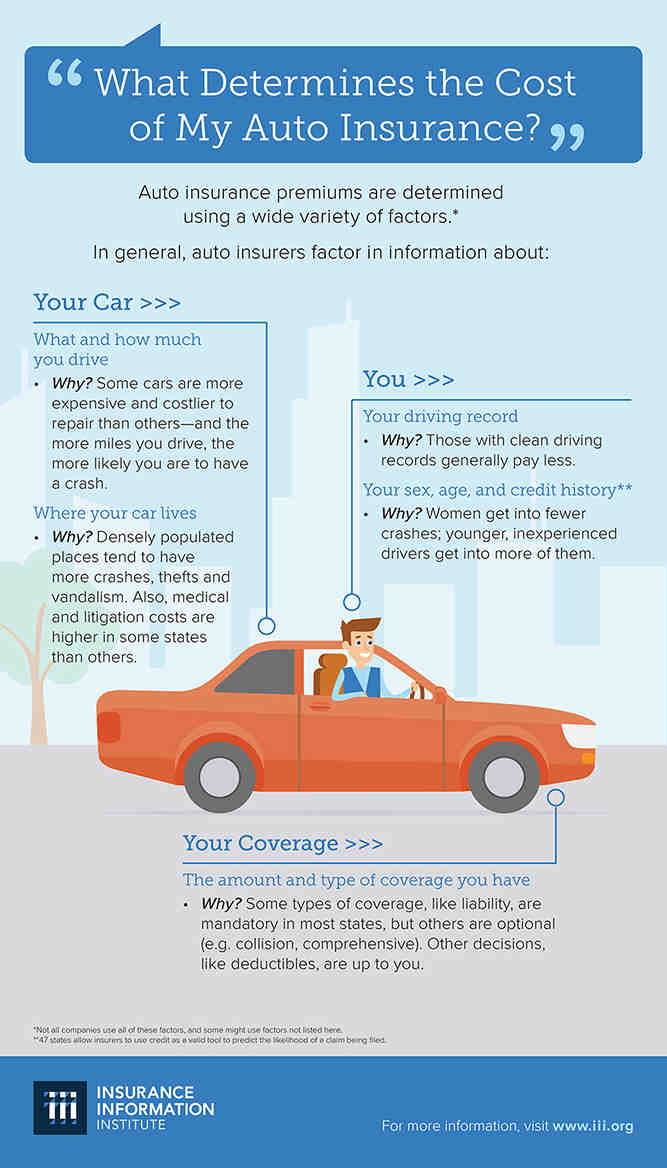

Every motorist on the road is required by law to have motor vehicle insurance. While this is required for all drivers, each person is different, as are their auto insurance rates and policies.

Insurance companies may consider several unique factors to determine how much risk you might be at – and therefore what you will be charged for the insurance. Understanding these factors and how insurers rate them can potentially help you improve your car insurance rates in the future. Let’s learn more about what factors determine your insurance premium.

Contents

- 1 Driving-related factors

- 2 Personal factors

- 3 Financial factors

- 4 Potential ways to lower your car insurance rates

- 5 In summary

- 6 What makes a car more expensive to insure?

- 7 What are 5 factors that are used to determine the cost of insurance premiums quizlet?

- 8 Which factors are taken into consideration when an insurance company determines the premium rate?

- 9 Does gender affect car insurance?

One of the first things insurers look for when evaluating your insurance application is your car and your driving history. To see also : Drivers Are More Open To The Use Of Credit, Education In Car Insurance Quotes. Here is a summary of some driving-related factors that can affect car insurance rates:

Your driving record

Your driving history can tell insurance companies about your driving habits and how likely you are to get into an accident, have traffic violations, or anything else that makes your insurance riskier. See the article : 9 Claims Not covered by auto insurance. If you’ve always been a safe driver in the past, this probably increases your chances of getting a cheaper fare.

Vehicle make and model

The vehicle itself can be an important factor in calculating your insurance premiums. For example, expensive new cars usually cost more to insure, but some older cars, including vintage or collectible ones, can also result in higher premiums due to expensive repairs or hard-to-find parts. See the article : Oklahoma’s Car Insurance Requirements – InsuranceNewsNet. On the other hand, cars with premium safety features can result in lower fares and help you qualify for certain discounts.

Intended use

How you use your car and how often can also play a role in your rate calculation. More kilometers driven usually means a higher risk of accidents, so people with long daily commutes are likely to pay a higher rate than someone who is a “weekend” driver who only occasionally makes trips around the neighborhood.

Personal factors

After evaluating your car and driving history, insurance companies will take a closer look at your personal information. There are several factors that can affect car insurance rates, including:

Age, sex and marital status

Your age can be used by insurance companies to assess your risk. Older drivers tend to have fewer accidents than younger drivers who are less experienced on the road. Younger drivers therefore often pay higher fees.

Gender and marital status are other factors that may be considered. Research by the U.S. Department of Transportation has found that men are more likely to have serious accidents and engage in potentially risky behavior than women. In addition, a national consumer organization found that married people are considered safer drivers and, on average, tend to pay less for insurance than people from other marital statuses.

Location

What do car insurance and real estate have in common? Location, location, location. Drivers in areas with higher crime rates are more likely to pay higher rates than those living in a community with lower crime rates. Even your choice of parking (on the street or in a private garage) can potentially affect your rate.

Discount eligibility

Some people are eligible for discounts based on certain criteria. For example, active and veteran military personnel and their families are often eligible for military discounts. There may also be discounts or special prices for students, educators, and more. You may also find certain incentives to insure multiple cars or to bundle your insurance packages. These offers often vary from one insurance company to the next, so it can be helpful to ask if there are any discounts you can take advantage of.

Financial factors

Your financial health and history is also factored into the calculation of your car insurance rates. Here are some of the details that insurers pay attention to:

Credit score

Depending on the state you live in, insurance companies may use your credit information as a factor in calculating your rates. This credit-based insurance score is not the same as credit scores used by lenders to assess creditworthiness, although both scores assess much of the same information.

Previous claims history

If your insurance company has to pay out a claim because of an accident you were at fault, you’ll likely see your rates go up the next time you renew your policy. Although some insurers now offer accident forgiveness plans, a history of frequent claims can result in higher rates.

The amount of coverage purchased

One of the factors that affect auto insurance rates is the actual amount of coverage you purchase. Minimum coverage policies, which cost less, may only cover injury or damage to others. Fully comprehensive policies tend to cost more, but will also typically cover your own injury or damage costs along with injury or damage to others.

Potential ways to lower your car insurance rates

Your prices are based on factors unique to you, and there are a few potential strategies you could consider to save money. These include:

Shopping around

Each insurance company has their own way of weighting your information in their calculations. If you’re not happy with your current auto insurance rates, it can be helpful to shop around and compare different insurers to see if you could get a better rate elsewhere.

Driving safely

As you’ve learned, your driving history can play a big part in determining your fares. Keeping your records free of accidents, fines, or other traffic violations could help lower your rate over time.

Paying bills on time

Paying your bills (insurance and otherwise) on time can help improve your overall credit score. This in turn could help increase your insurance value and get you better rates.

In summary

Your auto insurance rates aren’t just some random number created by someone behind a desk. As you can now see, companies use their own information to determine their rates. This means you may have some control over your prices. By doing things like driving safely, choosing a safer car that has cheaper insurance, and paying bills on time, you may be able to lower or improve your rates over time.

What makes a car more expensive to insure?

The Car You Drive – The cost of your car is a major factor in the cost of insurance. Other variables include the likelihood of theft, repair costs, engine size, and the car’s overall safety record. Cars with quality safety equipment may be eligible for premium discounts.

Why is a cheaper car more expensive to insure? If insurers find that there are more claims – or more expensive claims – they will raise premiums for drivers with that vehicle. Drivers could end up paying more to insure a certain inexpensive car model if: It is involved in more accidents than most vehicles. More is stolen than most vehicles.

Does car insurance depend on car value?

The type and value of your vehicle can affect your car insurance rates. If your vehicle model has high theft or accident rates (like many sports cars), your insurance premium may be higher. The value of your vehicle also determines the cost of comprehensive and comprehensive insurance.

What factors does car insurance depend on?

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

Is car insurance more expensive for more expensive cars?

And more expensive cars tend to cost more to insure because of the increased cost of repairing, replacing parts – particularly with foreign brands – or replacing the vehicle in the event of a total write-off.

What makes a car more expensive to insure?

The Car You Drive – The cost of your car is a major factor in insurance costs. Other variables include the likelihood of theft, repair costs, engine size, and the car’s overall safety record. Cars with quality safety equipment may be eligible for premium discounts.

Does the size of your car affect insurance?

Vehicle size In addition to age and security features, the size of the vehicle also affects your annual premium. While it’s easy to assume that a smaller car is cheaper to insure because fewer repairs are required after a collision, that doesn’t necessarily have to be the case.

What makes a car more expensive to insure?

The Car You Drive – The cost of your car is a major factor in insurance costs. Other variables include the likelihood of theft, repair costs, engine size, and the car’s overall safety record. Cars with quality safety equipment may be eligible for premium discounts.

Does insurance depend on car model?

Insurance companies use several factors to determine your premium, including your age, driving history, location, and the make and model of your vehicle. Expensive makes and models cost more to repair or replace, so insurers often charge higher premiums for coverage.

Do smaller cars cost more to insure?

As Bankrate noted, these cars tend to have higher insurance premiums because they are more likely to be involved in accidents. However, nearly half of American drivers incorrectly believe that driving a red car drives up insurance premiums.

Are nicer cars more expensive to insure?

Yes, in general. Sports cars, luxury cars, and high-performance cars can be more expensive to insure because they also cost more to repair, are more likely to be stolen, and be involved in more accidents.

What type of cars make insurance higher?

For example, an expensive luxury car model will cost more to repair compared to a standard model, resulting in higher premiums. RRP of the vehicle. More expensive cars usually cost more to repair due to custom, foreign, or premium parts, which generally translates into higher insurance premiums.

Are luxury cars higher on insurance?

If you insure a luxury car, you have to expect to pay more for the insurance than for a standard car. Because luxury cars tend to be more expensive than standard vehicles, insurance costs are also higher.

Does the type of car you have affect your insurance?

The make, model, trim level, year, and body type of your car all play a role in how much auto insurance costs. An expensive car model with additional features and a large engine costs more in insurance than a standard car model with a high safety rating.

The top 5 factors that affect car insurance premiums are:

- your deductible.

- Your vehicle.

- your mileage.

- your driving history.

- Personal Information.

What Determines Your Insurance Premium Quizlet? Factors that can affect a car insurance premium are: – Value of the insured vehicle: the higher the value of the car, the higher the premium. -Proof of repair of the car: The better the car damage can be repaired, the lower the premium. – Your age: Younger drivers have less experience and pay higher premiums.

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

In general, the premium calculated for private health insurance is the sum of two components: the average amount an insurer expects to pay for the services covered under the plan; and a stress factor reflecting the insurer’s cost of operating the plan (including administrative costs and a rate of return…

The age of residence has the greatest impact on insurance premiums. Donna, who is single and 30, recently received multiple speeding tickets and was shocked at the impact on her car insurance.

Insurance companies use credit scores and history to determine your insurance premium.

What is an insurer’s consideration in a life insurance consideration clause? The consideration clause regulates exactly how high the contribution payments are and when they are due. The legal consideration for life insurance consists of applying for and paying the initial premium. It may also include the effective date.

-The greater the risk, the higher the premium. – Actuaries base life insurance premiums on three factors: mortality, interest and expense.

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

These elements are a definable risk, a random event, an insurable interest, risk shifting and risk sharing.

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

What are the 4 most common forms of insurance?

Four types of insurance that most financial experts recommend include life, health, auto, and long-term disability.

There are three important elements in calculating the premium. They are (1) mortality, (2) management costs, (3) expected return on his investment.

What factors are considered when an insurance company determines the premium rate for a life insurance policy for an applicant? To determine the premium rate for a whole life policy, an insurance company considers the applicant’s risk classification.

Age is the most important factor in determining costs, the younger you are the lower your payments tend to be. Gender is also a crucial factor, with women statistically living five years longer than men; As a result, insurance carriers typically offer slightly lower premiums to women.

The three main factors used as the basis for determining the cost of premiums in life insurance are (1) mortality (the average number of deaths), (2) interest, and (3) cost. Other main factors used to determine premium rates are age, gender, health status, occupation and habits.

Medical history Next to your age, your health is the most important factor that determines your premiums. Healthier people have a lower risk of dying while the policy is active, so they are generally eligible for lower life insurance rates.

Does gender affect car insurance?

Insurance companies are prohibited from calculating insurance prices based on gender in the following states: California. Hawaii.

Does gender change car insurance? Some states are changing the way insurers factor gender into premiums. Oregon requires auto insurance companies to offer rates specifically for their customers who select the X gender marker identity. California has outright banned gender-based auto insurance ratings.

Does gender play a role in car insurance?

Men tend to pay more for car insurance overall, although the difference is small – around 1%. The difference is clearest in adolescents and young adults.

Does gender influence car insurance?

Some people feel that using gender as a factor in setting premiums is unfair, and several policymakers have enacted legislation making the use of gender to determine rates illegal. Insurance companies are prohibited from calculating insurance prices based on gender in the following states: California. Hawaii.

Does gender play a role in insurance?

1 However, insurance companies have traditionally tied gender to an applicant’s risk, so it has often been a factor in setting premiums. However, insurers cannot always consider gender as a factor – this depends on the type of insurance and where you live.

Is car insurance cheaper if you’re a girl?

Car insurance for women is generally cheaper than for men because insurers have found a statistical correlation between a driver’s gender and the cost and frequency of car insurance claims. On average, men simply drive more cars than women.

Do girls pay less for insurance?

On average, women pay more for car insurance than men, even though they have fewer accidents, a study shows. Women can pay up to 7.6% more for car insurance than men, depending on their age and where they live, according to research from The Zebra.

Is it cheaper to insure a girl or a boy?

Men and women usually pay about the same for car insurance. For typical adult drivers, we found only a small difference in insurance costs between males and females. We found a price difference of less than 1% between men and women in their 30s.