How Much Does Car Insurance Cost?

Our goal is to give you the tools and confidence you need to improve your finances. While we receive compensation from our partner creditors, which we will always identify, all opinions are ours. When refinancing your mortgage, the total finance charges can be higher over the life of the loan. Credible Operations, Inc. NMLS #1681276, is referred to here as “Credible”.

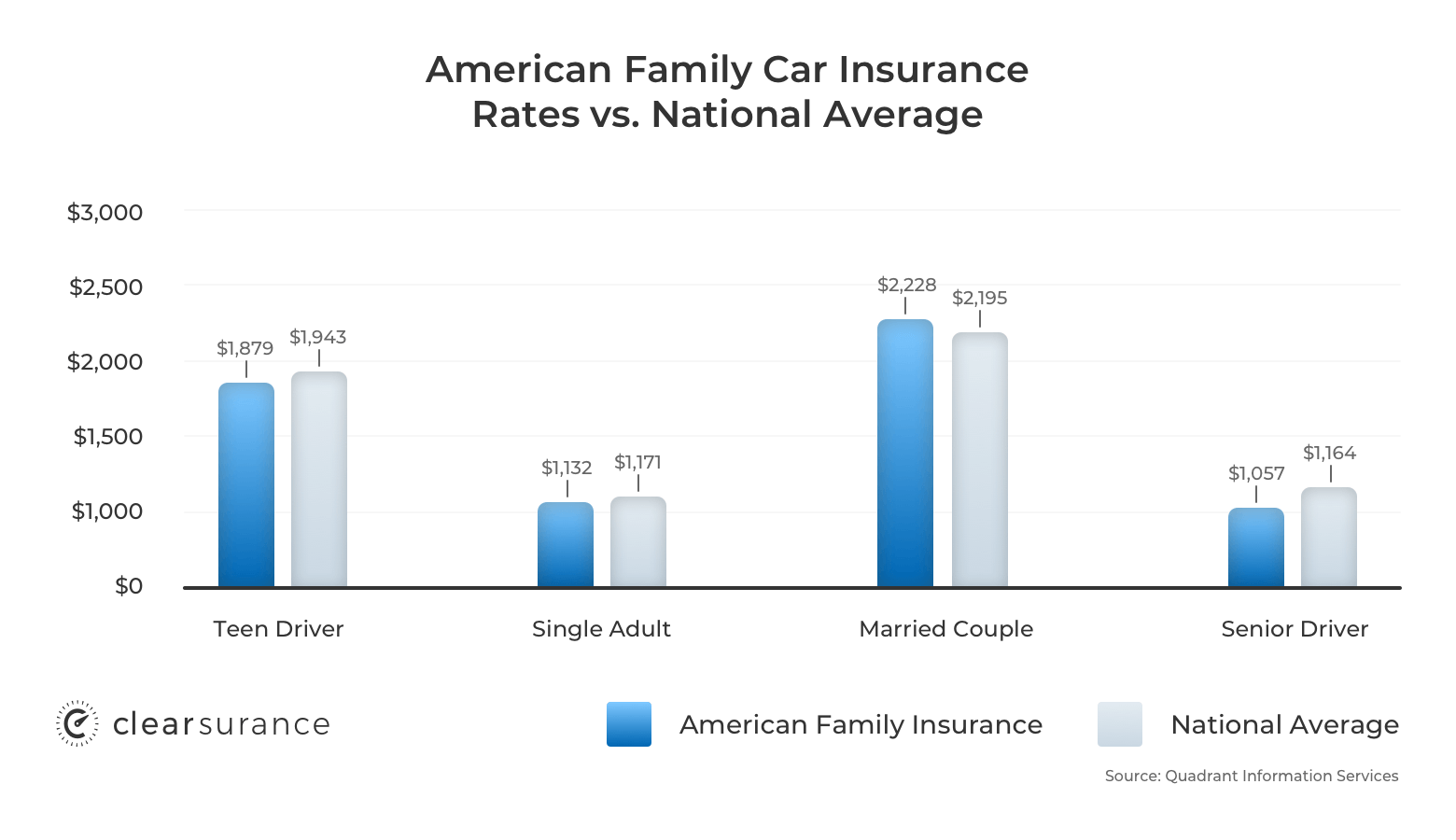

The amount you’ll pay for car insurance depends on your driving history, type of car, and location, among other factors. In 2019, the national average car insurance premium was $1,070 for the year, according to the National Association of Insurance Commissioners.

Let’s dive into the average auto insurance costs by state, as well as the factors that influence how much you pay.

Here’s what you need to know about average car insurance costs:

How much is car insurance?

Contents [hide]

- 1 How much is car insurance?

- 2 Factors that affect car insurance costs

- 3 Average car insurance cost by state

- 4 How to save on car insurance

- 5 How to purchase car insurance

- 6 How much is a 20k car payment?

- 7 How often is car insurance paid?

- 8 Does car insurance affect credit score?

- 9 What is considered a high car payment?

The amount you will pay for your car insurance premium varies depending on many factors. You can pay more or less than the national average of $1,070. On the same subject : Report: Florida is ranked 2nd highest for car insurance costs. Car insurance providers determine their rate based on the likelihood of paying for claims, as well as factors such as age, gender, and driving history.

Compare car insurance from leading carriers

Factors that affect car insurance costs

All car insurance carriers have their own unique way of setting prices. Read also : What is the gender rule in insurance?. However, some common factors that insurers use when determining your car insurance premium include:

Check out: Can you get car insurance with a learning permit?

Average car insurance cost by state

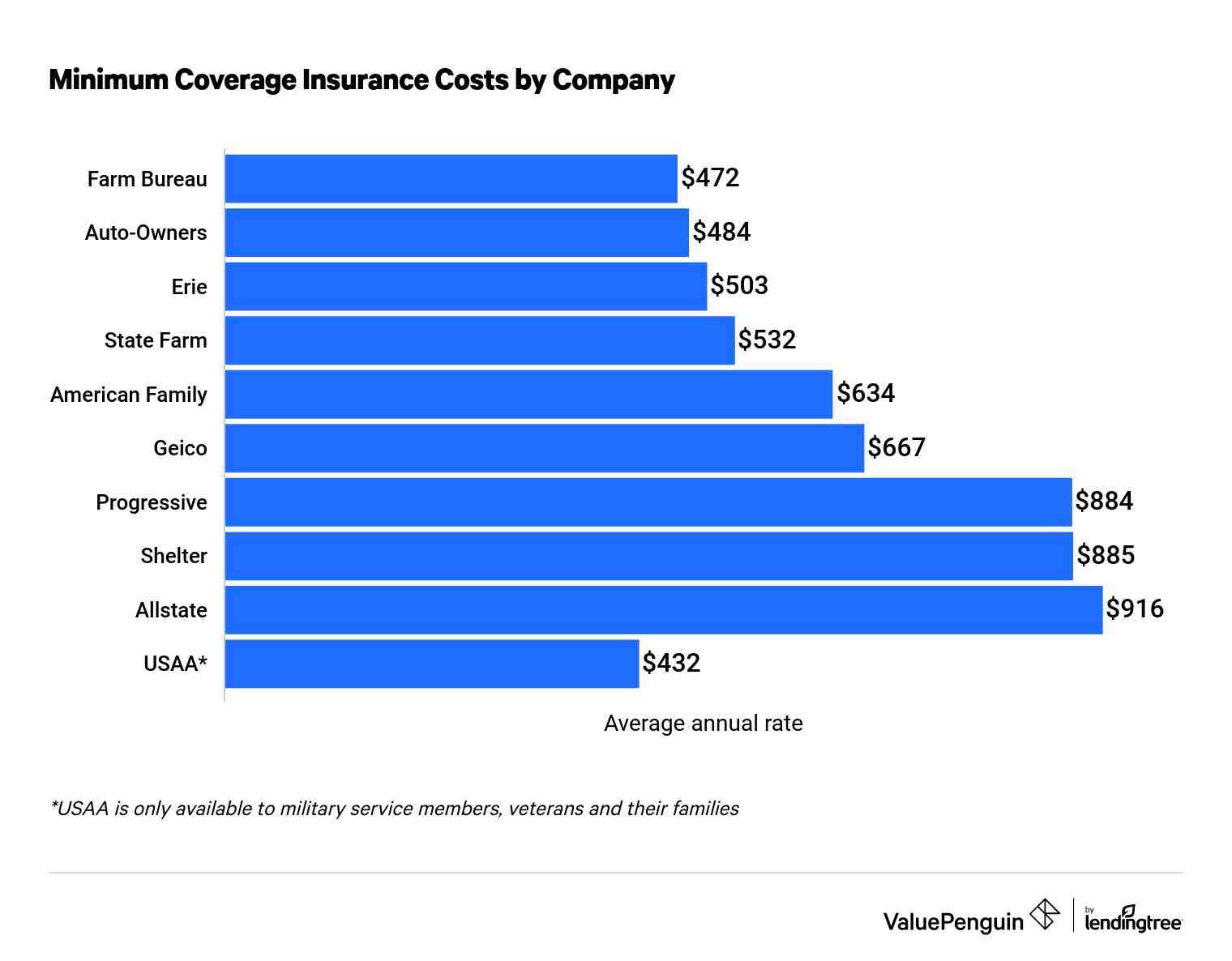

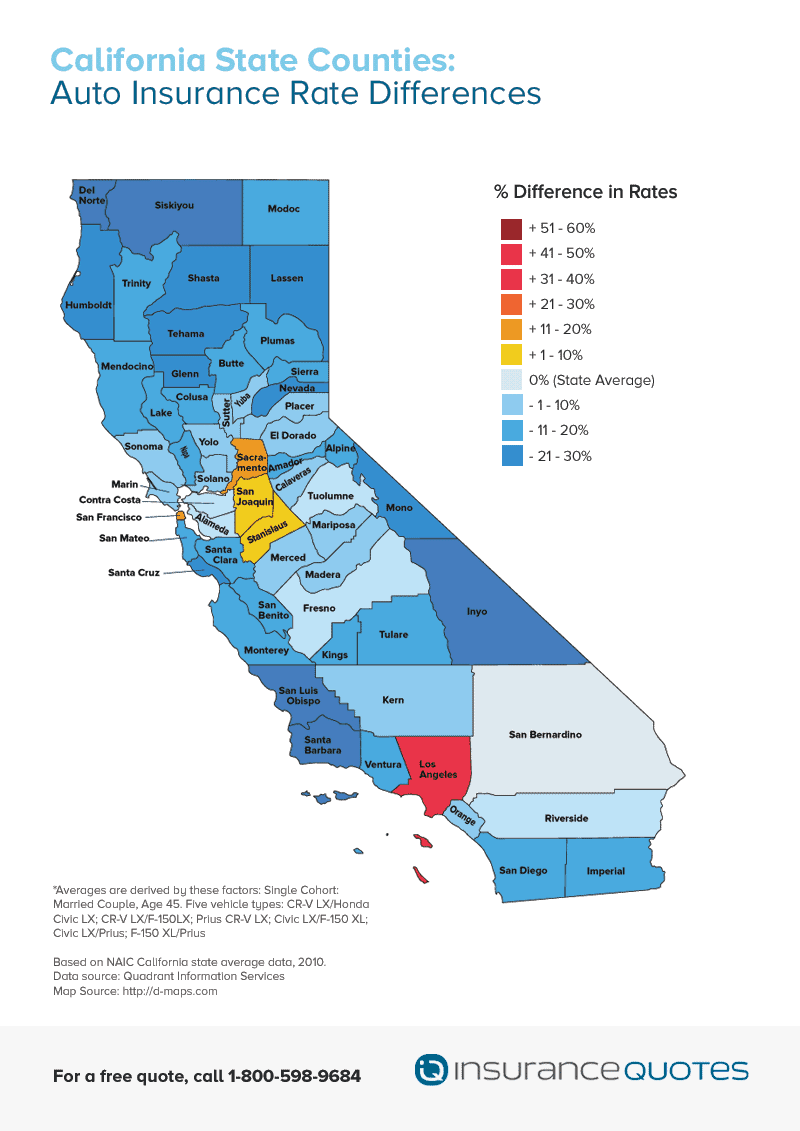

Car insurance costs can vary greatly by state. Read also : Who owns the biggest insurance company?. To help you get a better idea of what different types of car insurance policies might cost in your state, the table below shows the average premium costs for full coverage insurance (liability, collision and comprehensive coverage) and for coverage of liability in all 50 states, as of 2019.

Annual premiums are based on the most recent data from the National Association of Insurance Commissioners. We also look at current minimum coverage levels by state so you can know how much coverage you should get. Minimum coverage levels by state are based on data from the Insurance Information Institute and Progressive.

How to save on car insurance

Car insurance is a major expense for drivers. Here are some steps you can take to save money on your policy:

When you’re ready to compare auto insurance quotes, we can help. Credible makes it easy to get quotes from multiple insurers.

Compare car insurance from leading providers

How to purchase car insurance

Gaining knowledge about the average cost of car insurance is a great first step in finding the right policy for your needs. When you’re ready to buy car insurance, you’ll usually follow these steps:

Disclaimer: All insurance-related services are offered through Young Alfred.

Jacqueline DeMarco has been a personal finance writer for over seven years and a contributor to Credible. She has contributed content to over a dozen financial brands, including LendingTree, Credit Karma, Fundera, Chime, MagnifyMoney, Student Loan Hero, ValuePenguin, SoFi, and Northwestern Mutual.

How much is a 20k car payment?

For example, using our loan calculator, if you buy a vehicle for $20,000 at 5% APR for 60 months, your monthly payment would be $377.42 and you would pay $2,645.48 in interest.

What is the monthly payment of $20,000? The monthly payment for a $20,000 loan ranges from $273 to $2,009, depending on the APR and length of the loan. For example, if you borrow $20,000 for one year with an APR of 36%, your monthly payment will be $2,009.

How much a month is a 25k car?

Rates and conditions are subject to change without notice. Example: A six-year fixed-rate loan for a $25,000 new car, with a 20% down payment, requires a loan of $20,000. Based on a simple interest rate of 3.4% and a loan rate of $200, this loan would have 72 monthly payments of $310.54 each and an annual percentage rate (APR) of 3.74%.

How much is a 30k car payment?

With a loan of $30,000, an interest rate of 8% and a repayment period of 60 months, your monthly payment is about $700. car, gasoline and car insurance.

How much should I save for a 25000 car?

In general, a good rule of thumb is to aim for a 10% reduction for used cars and 20% for new vehicles. For example, if the new car you bought costs $25,000 and you want to make a 20% down payment, you will need to save $5,000.

How often is car insurance paid?

Paying car insurance annually is the standard payment option offered by most providers, but some may offer the option to split this annual cost into monthly payments.

Does car insurance bill a month in advance? Every time you settle your monthly premium, your insurance policy will be up to date until the next bill is due. This means that your insurance policy is legal and binding until the next bill is due. If you miss your next payment or are late, your insurer may decide to cancel your policy.

Is insurance paid monthly?

Most insurance companies allow premiums to be paid annually, monthly or quarterly. A discount can be applied for choosing the annual payment option. If a payment is missed, there is usually a short grace period during which the policy remains in effect, assuming payment is made within that period.

Is insurance a monthly payment?

Insurance can be paid monthly or annually, depending on your policy. Auto and home insurance typically comes with various payment options based on the length of the policy, which can be one month, six or 12 months.

According to insurance regulator IRDAI, insurers can charge premiums monthly, quarterly, semiannually, as well as annually as before. And the installment cannot change the value of the basic premium approved by IRDAI for the individual product.

A life insurance premium is a payment you make on a regular basis to keep your coverage active. These are typically monthly payments, but some insurers offer different payment schedules, such as annual or even semi-annual.

How often is car insurance paid in UK?

Most insurers allow you to pay for car insurance in two ways: with a single payment that covers the next 12 months or in 12 (or sometimes 11) monthly installments. If you choose to pay car insurance monthly, you are essentially taking out a 12-month loan from the insurance company.

Is vehicle insurance paid monthly or yearly?

While paying your provider annually or monthly are the most common options, some insurers allow you to pay your premium quarterly (four payments every three months). Splitting premium payments into four quarterly installments may be more pleasant for some.

How often does car insurance come?

As a driver, it is up to you to ensure that your car has a valid auto insurance policy. In most cases, when you take out car insurance, it lasts for a year… and when that year ends, it’s time to renew your policy or take out a new one.

Is insurance paid monthly or weekly?

Most people pay in full or opt for monthly installments, but your insurer may also offer quarterly payment plans, meaning you would pay every three months (four times a year). However, you may want to think twice before choosing one of the more frequent payment options.

Do you pay car insurance twice a month?

Most people pay in full or opt for monthly installments, but your insurer may also offer quarterly payment plans, meaning you would pay every three months (four times a year). However, you may want to think twice before choosing one of the more frequent payment options.

Why is my car insurance charging me twice a month?

Answer provided by. “Each car insurer has different terms and conditions. Since the accident did not cause the additional damage, your insurance company may charge your comprehensive coverage or collision coverage deductible twice.

Is it better to pay car insurance monthly or every 6 months?

Answer provided by. “Paying your car insurance premium in full every six months will save you money. Depending on the insurer, this can substantially reduce your premium compared to monthly payments.

Is car insurance yearly or monthly?

Most insurance companies allow you to choose whether to pay your car insurance premium monthly, every six months, or annually. You may receive a discount if you choose to pay the full amount of a six-month or annual policy upfront.

Does car insurance affect credit score?

The short answer is no. There is no direct effect between car insurance and your credit, paying your insurance bill late or not at all can lead to debt collection reports. Debt collection reports appear on your credit report (usually for 7 to 10 years) and can be read by future creditors.

Does cancellation of insurance affect credit? Answer provided by. “Cancelling your car insurance policy shouldn’t affect your credit score. While auto insurance companies look at your credit score to determine your rate, they don’t use your credit beyond that. Canceling insurance would be different from canceling a credit card or closing a loan.

What happens if you miss a payment on car insurance?

What happens when your car insurance is canceled because you missed a payment? If you miss a car insurance payment, you will receive a legally required cancellation notice from your insurer. This notice may come by mail or by phone or email.

Does car insurance payments have a grace period?

There is no default grace period. Insurers establish this period, which can vary from 24 hours to 30 days. In most cases, if you miss your payment due date, the company will send you a cancellation notice.

Can car insurance be cut off after missed payment?

Your car insurance policy will not be canceled immediately because you missed a payment. Auto insurance companies are required by state law to provide notice before canceling your policy. Depending on the state, you will usually have between 10 and 20 days.

What happens if I make a late payment on my car insurance?

Late payments can result in a lapse in coverage, which means you would lose protection for your vehicle and driving without coverage would be illegal. If you have an accident after your car insurance ends, you will have to pay out of pocket for any damage you cause to yourself, others and your car.

Does car insurance reflect on your credit?

While your car insurance policy will never affect your credit score, the opposite may be true. According to the National Association of Insurance Commissioners, 95% of auto insurance companies use what’s called a credit-based insurance score to calculate premiums in states where the practice is allowed.

Does car insurance count as a debt?

Lenders consider any mortgages you have or are applying for, rent payments, car loans, student loans, any other loans you may have, and credit card debt as debt. For the purposes of calculating the debt-to-income ratio, life insurance, health insurance and car insurance premiums are not included.

What happens if you owe money to an insurance company?

If an insurance company does not have sufficient funds to pay the insured’s claims, the guarantee association will use the assets that the company owns and guarantee funds to pay the claims.

Is car insurance reported to credit bureaus?

Auto insurance companies don’t report your premium payments to credit bureaus, so your policy doesn’t appear on your credit report. As with other types of bills, such as utility and medical bills, however, your insurer may send an unpaid balance to a collection agency if you stop paying your bill.

What is considered a high car payment?

According to experts, a car payment is too high if the car payment is more than 30% of your total income. Remember, car payment is not your only car expense! Be sure to factor in fuel and maintenance expenses. Make sure your car payment doesn’t exceed 15% to 20% of your total income.

What is a reasonable monthly car payment? NerdWallet recommends automatic loan payments of no more than 10% of your monthly payment. How much does this monthly payment amount allow you to borrow? Enter the amount you think you can spend each month. NerdWallet recommends a maximum of 36 months for used cars, 60 for new ones.

Is 800 a month a lot for car payment?

Experts say your total car expenses, including monthly payments, insurance, gas and maintenance, should be around 20% of your monthly salary. For non-mathematical wizards like me… Let’s say your monthly salary is $4,000. So a safe estimate for car expenses is $800 a month.

Is 600 a high car payment?

| credit score | Average monthly payment, new car | Average monthly payment, used car |

|---|---|---|

| No cousin: 601-660 | $696 | $532 |

| Subprime: 501-600 | $692 | $531 |

| Deep subprime: 300-500 | $660 | $515 |

| Source: Experian Information Solutions. |

Is $500 a lot for a car payment?

The average payment for a new car in the United States passed the $500 a month mark for the first time, reaching $503, according to a recent study by Experian. And if that wasn’t enough, the average duration of a car loan is now 68 months.

What’s considered an expensive car payment?

NerdWallet recommends not spending more than 10% of your take-home pay on your monthly auto loan payment. So, if your monthly after-tax payment is $3,000, you can afford a $300 car payment.

Is 500 a month too much for a car payment?

Auto loan payments are calculated using a number of factors, including your credit score, the APR you qualified for, the length of the loan term, and more. However, given today’s average rates and payments, anything over $600 can be considered too much to pay on your car loan.

How much is too much for monthly car payment?

How much car can I pay based on salary? According to our research, you shouldn’t spend more than 10% to 15% of your net monthly income on car payments. Total vehicle costs, including loan payments and insurance, must not exceed 20%.

How much is a normal car payment a month?

Average monthly car payment for new cars is $677. Average monthly car payment for used cars is $515. 38.22% of consumers financed new vehicles in Q2 2022. 61.78% of Consumers financed used vehicles in Q2 2022.

Is 500 a month a high car payment?

The average payment for a new car in the United States passed the $500 a month mark for the first time, reaching $503, according to a recent study by Experian. And if that wasn’t enough, the average duration of a car loan is now 68 months.