How This All-Digital Provider Is Modernizing Auto Insurance

Disclosure: Our goal is to present products and services that we believe will be interesting and useful. If you buy them, the entrepreneur may get a small share of the sales revenue from our business partners.

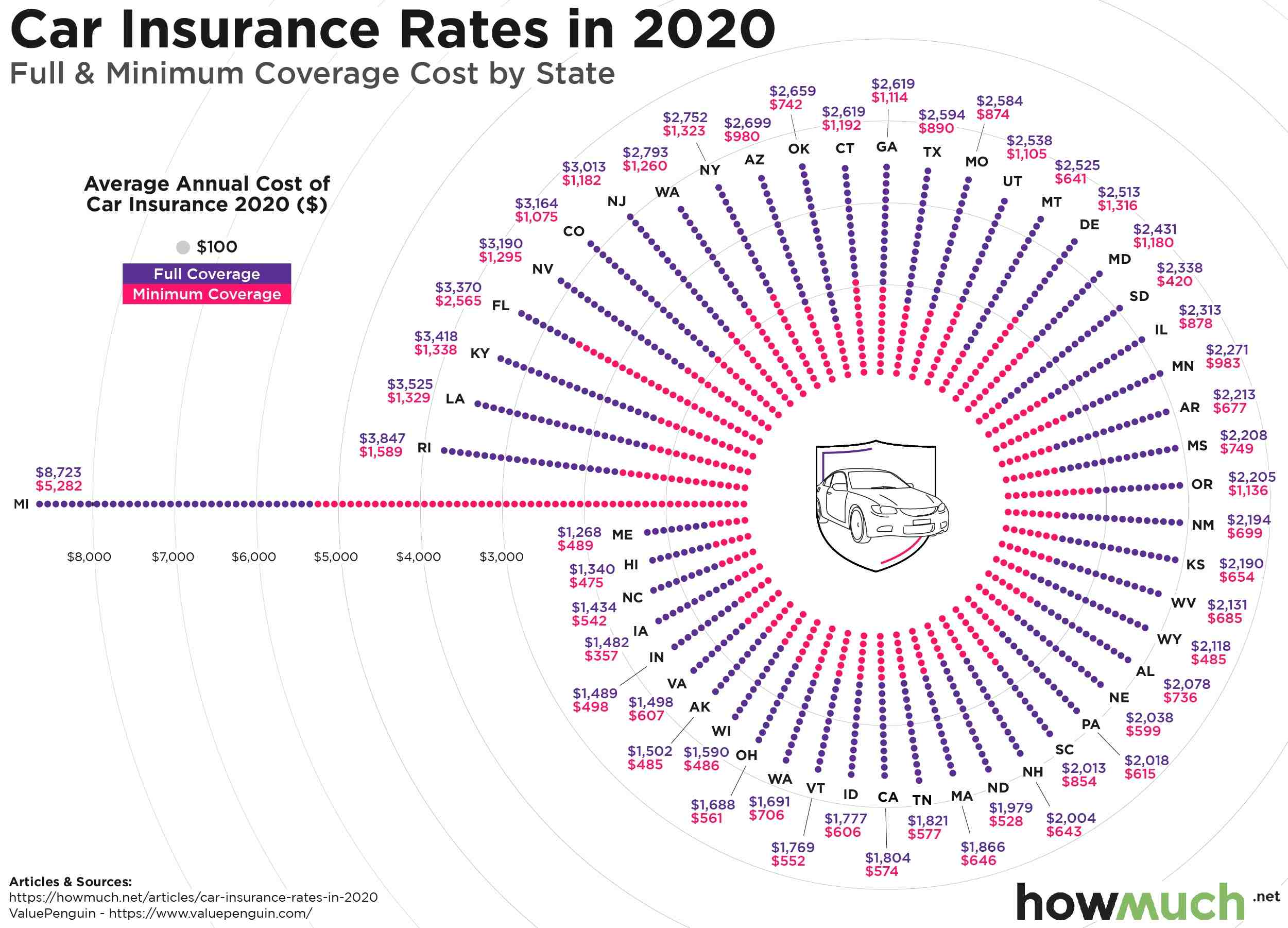

Entrepreneurs, freelancers and professionals of any kind who own a valuable car with a way to get out of the house and go to meetings. But auto insurance could mean more to you than just a monthly bill. Your premium rate, which averages just under $ 1,700 per year in the US, can have a direct impact on your business if you’re starting one. Additionally, the quality of care you receive in the event of an accident or any other unforeseen incident can also have significant consequences for the rest of your life.

Nobody wants to sign in with an overpriced and complicated provider. Thankfully, that’s not necessary. Clearcover, a technology-based auto insurance company, offers you fast, easy and great coverage at a great price.

If you’re curious about how much you can save with Clearcover, getting a quote is quick and easy and a great first look at how easy it is to work on it. To check your price, all you need to do is visit the Clearcover website, grab a short questionnaire, and you’ll be working with the actual numbers in minutes.

The Clearcover website is full of positive reviews from customers who have saved money by switching between versions. Jessica N., of Tempe, Arizona, saved over $ 2,000 a year after switching from Progressive and said, “When I switched, I actually got better coverage for less money. I have good, reliable insurance which is important. to have”.

Clearcover claims to offer the fastest loss experience in auto insurance. Their smart technology, award-winning app, and friendly customer service make the whole insurance experience quick, clear and convenient. You can easily manage your policy, change your billing, file a claim and more, all within the Clearcover app, making it perfect for the lifestyle of the modern professional.

Clearcover has appeared on Insider, Reuters, and VentureBeat, among other esteemed publications. Currently available in 20 states, with many more in the works, Clearcover is helping drivers nationwide to take control of their coverage and get quick, easy, hassle-free auto insurance at an affordable price. T.

Visit the Clearcover website to see what you can save.

Although the recipe is unfamiliar, the events of the 19th century gave lemonade its popularity. The temperance movement brought him to prominence in the United States. The Women’s Christian Temperance Movement pushed alcohol withdrawal and advocated lemonade as a substitute drink.

Does Lemonade deny claims?

Contents [hide]

- 1 Does Lemonade deny claims?

- 2 Does Lemonade offer fire insurance?

- 3 Why is it called underwriting?

- 4 Why is lemonade home insurance so cheap?

We will never conflict with our customers and we will never make money by denying their claims. To see also : Tips for lowering car insurance prices. Tweet this! That changes everything.

Does Lemonade pay the credits? About Lemonade Lemonade is incorporated as a utility company and its Giveback program allows customers to designate a charity where their excess premiums will go after the company takes a fixed percentage of premiums and uses the rest to pay credits.

Does Lemonade investigate claims?

To file a complaint, Lemonade customers record a video of themselves, which they send to Lemonade for processing. See the article : 2022 Car Insurance Overview – Forbes Advisor. On May 26, 2021, Lemonade tweeted that consumer records are scanned for fraud by artificial intelligence to “pick up non-verbal cues that traditional insurers can’t.”

How quickly does Lemonade pay claims?

Unlike traditional insurance companies which can take months to pay off a claim, Lemonade can pay in just three minutes.

How does Lemonade handle claims?

How the lemonade claims are different. Unlike any other insurance company, we take a flat rate from your premium, use the rest to pay for claims and return what’s left to the causes you care about. We earn nothing by delaying or denying complaints, so we handle them quickly and fairly.

How long does Lemonade insurance take to review a claim?

But where this process can take up to 30 days with some companies, Lemonade promises fast complaint processing, with most complaints refunded within minutes, the company says. Through Lemonade’s Giveback Program, you select a charity to benefit from your business when you sign up for a policy.

How long does Lemonade take to approve a claim?

But where this process can take up to 30 days with some companies, Lemonade promises fast complaint processing, with most complaints refunded within minutes, the company says. Read also : Responsibility Vs. Comparison of car insurance with full coverage. Through Lemonade’s Giveback Program, you select a charity to benefit from your business when you sign up for a policy.

Does Lemonade approve claims?

Once the reason for the complaint is explained, Lemonade’s AI robot examines it, asks you questions, and asks you to record a video explaining what happened. If everything looks fine, Lemonade says they approve the request immediately and transfer the payment immediately.

Does Lemonade insurance pay claims?

How the lemonade claims are different. Unlike any other insurance company, we take a flat rate from your premium, use the rest to pay for claims and return what’s left to the causes you care about. We earn nothing by delaying or denying complaints, so we handle them quickly and fairly.

How does Lemonade verify claims?

According to Lemonade, the videos of the affirmations that customers need to send are simply to allow them to explain their claims in their own words, and “non-verbal cues” are a facial recognition technology used to make sure a person is not making claims under multiple identities. .

How does Lemonade verify claims?

According to Lemonade, the videos of the affirmations that customers need to send are simply to allow them to explain their claims in their own words, and “non-verbal cues” are a facial recognition technology used to make sure a person is not making claims under multiple identities. .

Who underwrites lemonade insurance?

By subscribing to Lemonade Powered by tech, Lemonade is able to collect approximately 100 times more data points per customer than traditional insurers (both online and via the app).

Is lemonade a legitimate insurance company?

Lemonade is a legitimate renter insurance provider and we can confirm that its app makes it easy to purchase and manage your policy. Most claims tend to be paid quickly, although those involving larger losses may be subject to closer scrutiny.

Why is lemonade insurance so cheap?

Why is Lemonade home insurance so cheap? Lemonade Insurance offers potentially low prices due to the structure of its platform. Customer groups collect their premiums in a single collective pot which is taken from when a claim needs to be paid.

Does Lemonade offer fire insurance?

Lemonade renters insurance covers property damage caused by accidental fires. You can also purchase a separate fire insurance policy. This would provide you with extra coverage beyond the standard coverage limit and would also include fires caused by an event that is not covered by a standard policy, such as a flood.

Is lemonade a legitimate insurance company? Lemonade is a legitimate renter insurance provider and we can confirm that its app makes it easy to purchase and manage your policy. Most claims tend to be paid quickly, although those involving larger losses may be subject to closer scrutiny.

What type of insurance does lemonade offer?

Lemonade offers a variety of policy types, including home insurance, renters insurance, term life insurance policies, as well as pet insurance and auto coverage. Founded in 2015, Lemonade is the only company in our rating to be entirely online from checking quotes to filing complaints.

What is lemonade insurance?

What does a Lemonade Renters insurance policy cover? A Lemonade Renters policy covers your belongings against damage caused by things like fire, vandalism, theft, and other named dangers. It also protects you from liability claims for damage accidentally caused to others.

Does Lemonade offer health insurance?

Lemonade offers health insurance for homeowners, life, renters, and pets in the United States and Europe. The company uses a non-traditional insurance model: Lemonade takes a flat rate from the monthly premiums, uses the rest to pay for insurance claims, and donates the remaining money to a nonprofit the customer’s choice.

Why is lemonade insurance so cheap?

Why is Lemonade home insurance so cheap? Lemonade Insurance offers potentially low prices due to the structure of its platform. Customer groups collect their premiums in a single collective pot which is taken from when a claim needs to be paid.

What is a fire insurance policy?

Fire insurance is property insurance that provides additional coverage for loss or damage to a structure that is damaged or destroyed in a fire. Fire insurance can be limited to a rate below the cost of accumulated losses, requiring a separate fire insurance policy.

What is fire insurance called?

Some homeowner insurance policies, called hazard policies, only protect against specific risks. Fire is almost always a definite danger. All-risk policies are an alternative. They protect against risks unless they are excluded. All-risk policies also cover fire damage.

Is homeowners insurance the same as fire insurance?

More to the point, homeowners insurance is typically the type of insurance that can help pay for repairing your home in the event of a fire. Fire insurance is not a separate policy from the standard homeowner policy. Your home insurance is built to protect you from fire damage in several ways.

What risk does a fire insurance policy normally cover?

Fire insurance is a type of property coverage that compensates for damage and other losses you may suffer as a result of a fire. It covers the costs of repairing or replacing damaged property in your home, as well as the costs of living if you have to move while your home is unusable.

What type of insurance covers fires?

Homeowners insurance typically helps protect personal belongings from specific risks (described in most policies as “dangers”), such as fire and lightning. If your belongings are damaged or destroyed in a fire, homeowners insurance can help you pay to repair or replace them.

Does home fire insurance cover wildfires?

A homeowners insurance policy will cover fire damage, including forest fires. If your home is damaged in a fire, your policy provides several types of coverage to help repair or rebuild your home, replace your belongings and, if necessary, pay for temporary housing if you can’t live in the house.

Is fire insurance the same as home insurance?

More to the point, homeowners insurance is typically the type of insurance that can help pay for repairing your home in the event of a fire. Fire insurance is not a separate policy from the standard homeowner policy. Your home insurance is built to protect you from fire damage in several ways.

Are covered by fire insurance policy?

The policy offers coverage against any type of damage caused by an accident caused by a fire; it does not cover the damage or destruction caused to the property insured by its natural heating, fermentation, self-combustion.

Why is it called underwriting?

The term underwriter originated from the practice of having each risk taker write their name under the total amount of risk they were willing to accept for a specific premium.

What does it mean to subscribe? The underwriting simply means that your lender verifies the details of your income, assets, debt and property in order to issue final approval for your loan. An insurer is a financial expert who examines your finances and assesses how much risk a lender will take if they decide to take out a loan.

Where the term underwriting comes from?

The term underwriting is believed to have been coined by the famous insurer Lloyd’s of London who, at first, would have accepted some of the risk of an event in exchange for a premium (for example, a sea voyage involving the possibility of a shipwreck and the subsequent loss of cargo and / or also of crew members).

Why do they call it underwriting?

The term underwriter originated from the practice of having each risk taker write their name under the total amount of risk they were willing to accept for a specific premium. Although the mechanisms have changed over time, underwriting continues today as a key function in the financial world.

Who called underwriters?

An insurer is any party that values and assumes the risk of another party for payment. Underwriters work in many areas of finance, from insurance to mortgage lending. Underwriters determine the level of risk for lenders.

When did underwriting begin?

Depending on these factors, taking out a mortgage can take a day or two or weeks. Under normal circumstances, initial subscription approval occurs within 72 hours of submitting the complete loan file. In extreme scenarios, this process could take up to a month.

Why is lemonade home insurance so cheap?

Why is Lemonade home insurance so cheap? Lemonade Insurance offers potentially low prices due to the structure of its platform. Customer groups collect their premiums in a single collective pot which is taken from when a claim needs to be paid.

How good is lemonade to pay off the credits? Lemonade is # 1 on our best homeowner insurance companies list of 2022. Lemonade home insurance focuses your interactions around its website and mobile app, so you can sign up online without talking to an agent human and file complaints via the app, with some even paid instantly.

Why is lemonade insurance different?

Lemonade was built differently. Instead of profiting from unclaimed rewards, we take a flat fee from your prize as profit and donate any money that may be left over, after paying for claims and expenses, to charities (this is called Lemonade Giveback).

Why is Lemonade insurance so successful?

Lemonade is able to get by without physical or human branches because it offers very standardized rates for all of its customers. Simplifying this process cuts down on overheads, allowing Lemonade to continue making money even if its AI models are still not up to par with traditional insurance underwriters.

Is Lemonade a trusted insurance?

Is Lemonade Renter Insurance Reliable? Lemonade is a legitimate renter insurance provider and we can confirm that its app makes it easy to purchase and manage your policy.

Is Lemonade insurance really cheaper?

That said, Lemonade insurance policies start at just five dollars a month, much lower than traditional insurance companies. You can adjust the amount of coverage you want on the Lemonade app or site and instantly see the correct quote. Higher payouts require higher premiums.

Who is lemonade insurance underwritten by?

By subscribing to Lemonade Powered by tech, Lemonade is able to collect approximately 100 times more data points per customer than traditional insurers (both online and via the app).

Does lemonade underwrite their own insurance?

Lemonade is a regulated and licensed insurance company, which means we underwrite, price and sell policies, as well as manage and pay claims. We are also a charitable company and a certified B-Corp, which means we care about the community and the environment, not just business results.

Who is behind lemonade insurance?

| Guy | Public company |

|---|---|

| Founded | April 2015 |

| Founders | Daniel Schreiber Shai Wininger Ty Sagalow |

| Headquarter | New York City, United States |

How does lemonade underwrite?

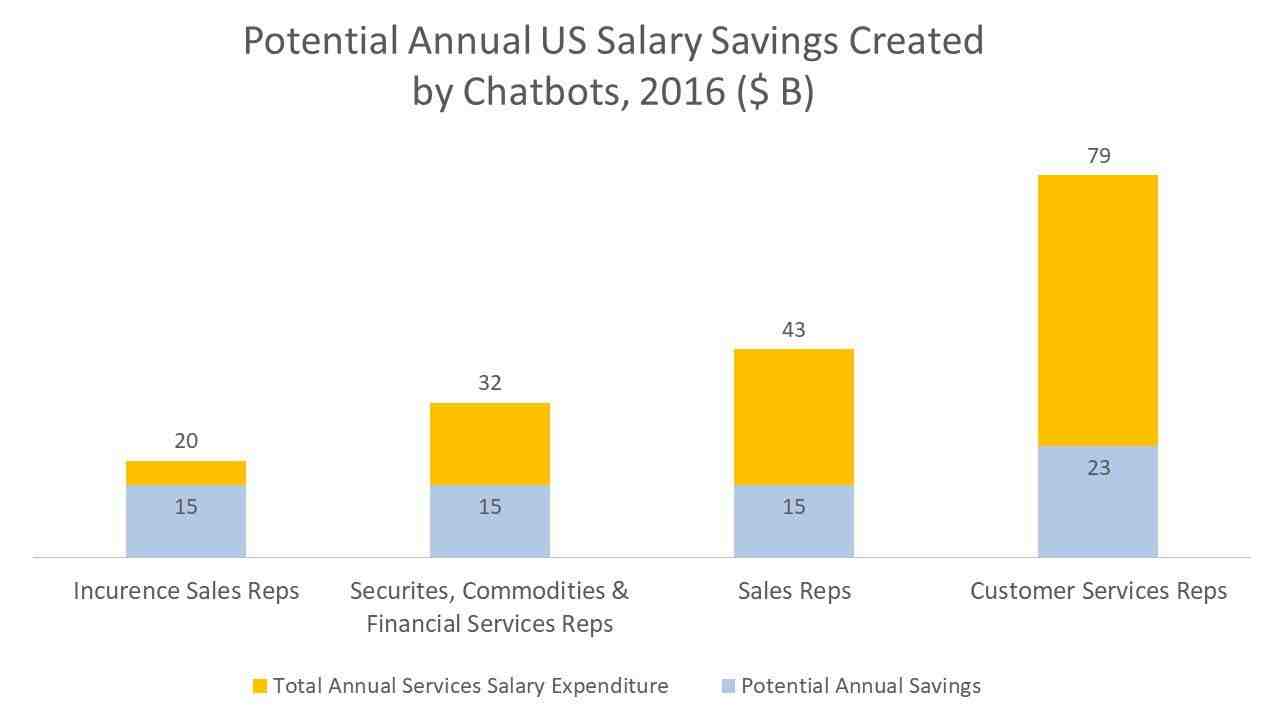

The competitive advantage of Lemonade E on the front-end, the company uses artificial intelligence chatbots to interact with customers, underwrite policies and pay requests. This allows Lemonade to provide a high quality user experience at a lower cost than traditional insurers.