How to buy car insurance online – Forbes Advisor

Detailed Notice: We earn affiliate commissions from Forbes Advisor. Committees do not influence our editors’ opinions or ratings.

Back in the day, buying car insurance usually consisted of picking up the phone or visiting an insurance agent’s office. And your options may have been limited to the insurance companies your agent worked with.

Today, you can buy car insurance online, but that has its challenges. With such a wide selection of options, it can be difficult to zero in on the right policy for you.

But don’t worry. We’ll show you how to find a good policy at a fair price from the best car insurance companies, all from the comfort of your couch.

Compare Car Insurance Quotes

Contents

- 1 Compare Car Insurance Quotes

- 2 What Information Do I Need to Buy Car Insurance Online?

- 3 Determine How Much Car Insurance You Need

- 4 Where Do I Get Car Insurance Quotes Online?

- 5 What Other Ways Can I Buy Car Insurance?

- 6 Tips To Save Money When Buying Car Insurance Online

- 7 Pros and Cons of Buying Car Insurance Online

- 8 How Much Does Car Insurance Cost?

- 9 What Companies Have the Cheapest Car Insurance?

- 10 Best Car Insurance Companies 2022

- 11 How To Buy Car Insurance Online FAQ

- 12 What do u mean by insurance?

- 13 What is the most trusted insurance company?

- 14 Who owns the Jerry app?

- 15 What is GaBi LCA?

Get Car Quotes as Low as $63/month, Compare Rates for Free, and Pay Less on Car Insurance This may interest you : A woman calling NBC 6 responds after car insurance doesn’t pay off.

What Information Do I Need to Buy Car Insurance Online?

Before you start your online shopping journey, you will want to make sure that you have gathered all the necessary information. This may interest you : Car Insurance Specialist Includes Why Car Insurance Often Calls New Drivers. This will make the process go smoothly and produce an accurate car insurance quote.

Here’s the information you need:

To get your driving history, visit your state’s website. You can usually download and print your driver’s history after paying a small fee, for example $2 in California and $8 in Massachusetts and Florida.

Determine How Much Car Insurance You Need

The next step in buying car insurance online is to find out how much car insurance you need. You want to call the right amount. On the same subject : Is State Farm overpriced?. If you buy too much car insurance, you’ll be paying for coverage you don’t need. But if you buy less, insurance will be included, which can result in out-of-pocket bills if you get into a car accident.

Here are the most important types of car insurance to consider:

Liability insurance

If you cause a car accident, liability car insurance pays for other people’s injuries and property damage, such as their medical expenses and car repair bills. It also covers legal expenses if you are sued as a result of a car accident.

Every state (except New Hampshire and Virginia) requires you to have a minimum amount of car insurance. For example, if you buy auto insurance in California, you need to buy it at least 15/30/5. Here’s what those numbers mean:

It’s a good idea to buy more than your state’s minimum liability requirements. These funds are often insufficient. For example, if you cause a major car accident in California that causes serious injuries to the other driver and totals their car, $15,000 in medical expenses and $5,000 in car repair bills won’t go far. And you will be liable for any amount above your policy limit.

Uninsured motorist insurance

It is recommended that you purchase adequate insurance to cover what you may lose in a lawsuit.

Not everyone is a senior citizen who buys the required amount of auto insurance. One in eight drivers don’t have car insurance, according to the latest data from the Insurance Research Council. And then there are drivers who only buy the minimum in the state and have no insurance if they have an accident.

So what happens when someone with no or insufficient car insurance hits you? Uninsured motorist (UM) coverage and underinsured motorist coverage cover you and your passengers for medical bills and other expenses, such as lost wages, pain and suffering and funeral expenses.

Collision and comprehensive insurance

UM is required in some states and optional in others (you can decline coverage in writing). Even if UM is not required in your state, this is a good insurance to buy.

If you want to cover the auto repair bills of your car, you will need to add collision and comprehensive insurance to your policy. These types of coverage are often sold together, but they cover different types of problems:

Personal Injury Protection

If you rent a car or have a loan, your rental company or lender will likely require you to purchase these types of coverage. A policy that includes comprehensive and collision coverage, along with the liability insurance required to drive legally, is sometimes called comprehensive car insurance.

If you or your passengers are injured in a car accident, personal injury protection (PIP) covers you and your passengers’ medical and other expenses regardless of who caused the accident.

Types of expenses covered by PIP include:

Medical Payments

PIP is required in some states and optional in others. Check with your state department of motor vehicles to determine if you are required to carry PIP coverage.

Other types of Car Insurance

Medical payment insurance, sometimes called “MedPay,” is usually sold in small amounts between $1,000 and $5,000. It covers medical bills for you and your passengers, regardless of who is at fault in the accident. MedPay is not available in every state.

Where Do I Get Car Insurance Quotes Online?

You can buy additional types of insurance if you need it. Here are some things to consider:

Now that you’ve gathered your information and determined how much car insurance you need, you’re ready to start collecting quotes. Don’t skip this step and get only one quote from one company. Insurers do not price their policies the same, and you can often find the same insurance for less from a different company.

The best way to get a good price is to compare car insurance rates from different insurance companies.

Buying car insurance online through an insurance company website

There are generally two places you can find car insurance quotes online: through insurance websites or comparison websites. Let’s look at both.

You can usually get free auto insurance quotes from the insurance company’s website. The insurance website will likely have a button to start your quote.

You will be asked to enter information such as:

You will also have the option to select your coverage types and policy limits and add additional drivers, if applicable.

After entering all the necessary information, you will receive a quote. You will also usually have the opportunity to review and change your insurance options. If you are satisfied with your coverage selection and pricing, you may have the option to purchase a policy.

Buying car insurance online through a comparison site

But before you buy, we recommend that you get insurance from multiple insurance companies. You may be able to beat your quoted price or find better insurance options.

If you want to get quotes from multiple insurance companies at once, you can use the comparison site. You will need to enter the same information that is requested by the insurance website. The comparison site will then offer car insurance quotes from multiple insurers.

A comparison site can be a useful tool to get an overview of multiple quotes. But some websites may offer a limited number of quotes. Or the website may not show you the quoted price and instead redirect you to the insurance company’s website, where you may enter additional information.

What Other Ways Can I Buy Car Insurance?

If you are not satisfied with your quotes, you may want to use both comparison sites and insurance websites.

If you don’t want to buy auto insurance online, you can talk to an insurance agent in person or over the phone. Generally there are two types of agents:

Tips To Save Money When Buying Car Insurance Online

It’s a good idea to talk to an independent insurance agent who can compile multiple quotes from different insurance companies.

Perhaps the biggest appeal of buying car insurance online is the convenience factor, but it’s also a great way to save money. Even if you already have car insurance, it’s worth getting a quote to see if you can get a better deal elsewhere. More than half (58%) of drivers believe they overpay for car insurance, but only 29% of companies have switched, according to a recent survey by Forbes.

Pros and Cons of Buying Car Insurance Online

Here are some tips to consider when buying car insurance online:

Pros for buying car insurance online

Cons for buying car insurance online

How Much Does Car Insurance Cost?

You can usually buy car insurance online in less than an hour. But it may not always be the best way to buy insurance. Here are some pros and cons to consider.

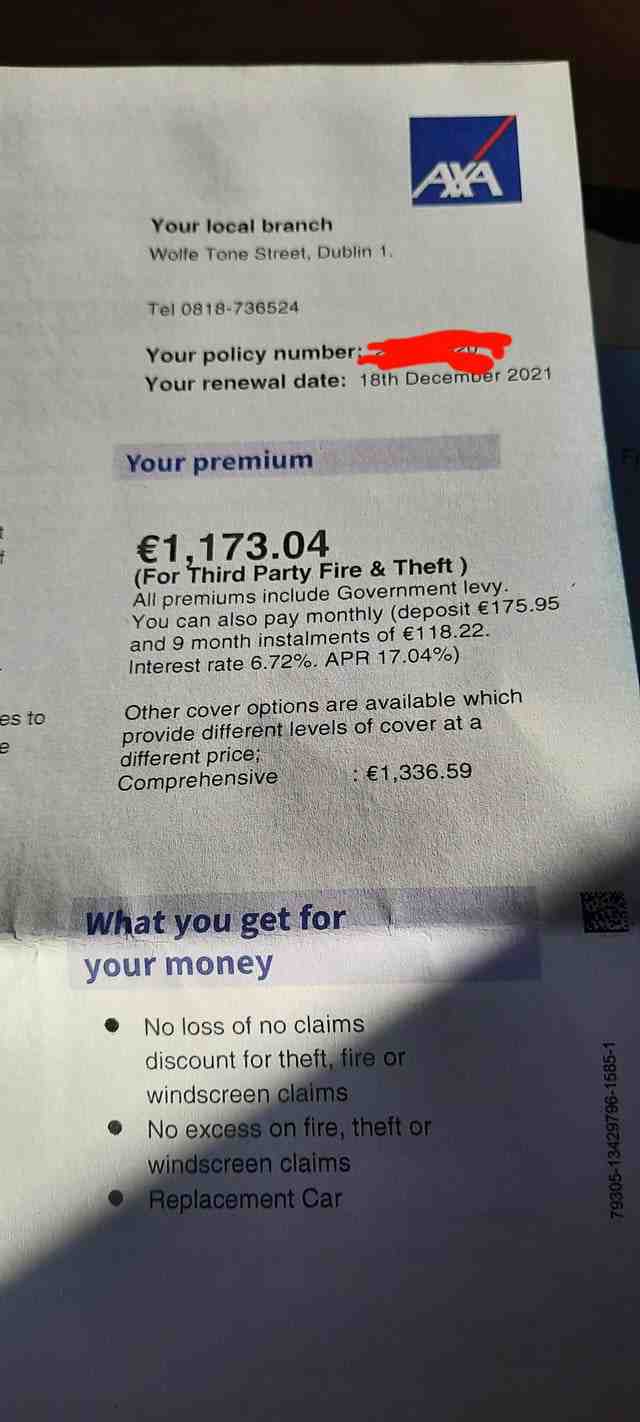

Nationally, the average cost of car insurance is $1,569 a year, according to a Forbes consultant analysis of car insurance rates from major insurance companies. But your rates will vary depending on a number of factors.

What Companies Have the Cheapest Car Insurance?

Factors in car insurance premiums include:

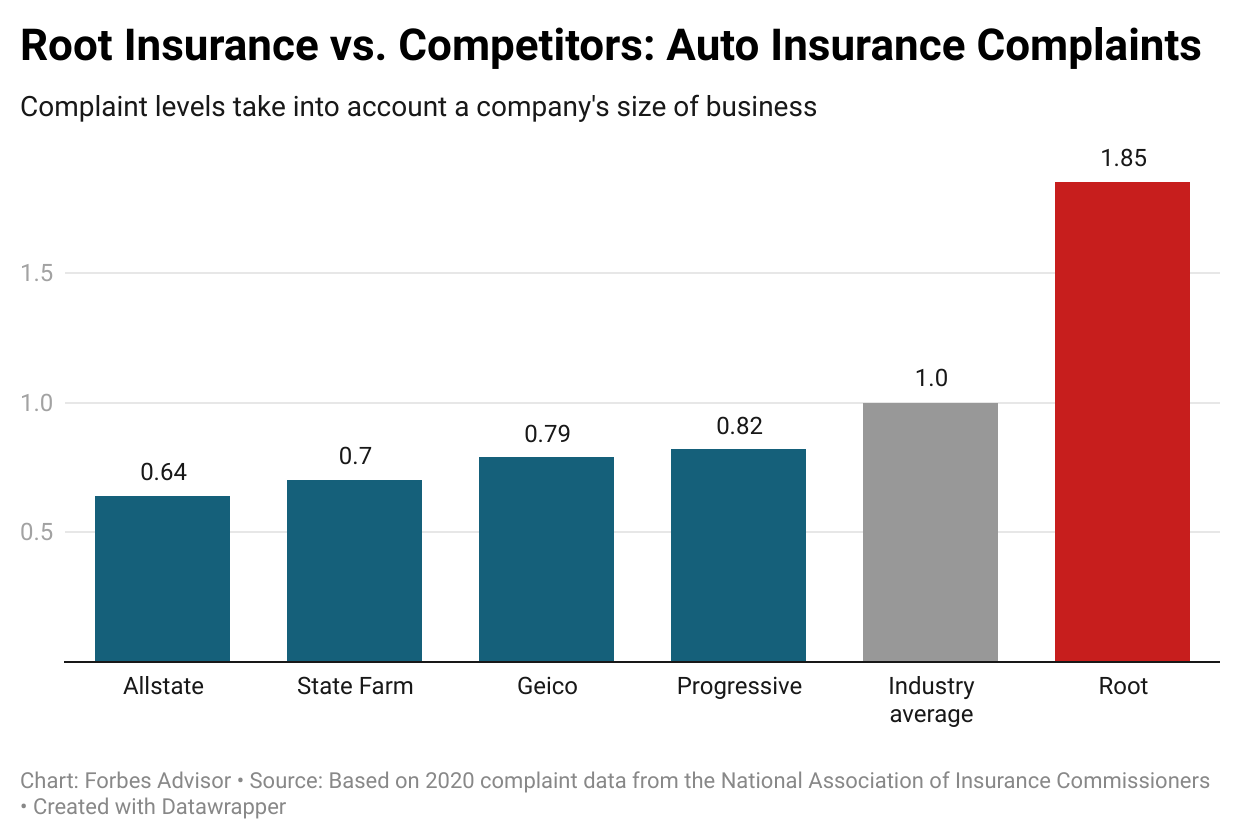

USAA has the cheapest car insurance, but it’s only available to military members, veterans and their family members. If you can’t get USAA car insurance, it’s worth getting a quote from Geico.

But it doesn’t stop there. It is wise to take advantage of the large number of quotes at your fingertips. As you will see below, car insurance rates can vary greatly depending on the company.

Best Car Insurance Companies 2022

Here’s a look at the best cheap car insurance companies, according to the Forbes consultant’s analysis of car insurance prices.

How To Buy Car Insurance Online FAQ

Is it cheaper to buy car insurance online?

With so many options for car insurance companies, it can be difficult to know where to start to find the right car insurance. We’ve evaluated insurers to find the best car insurance companies, so you don’t have to.

It is not necessary to buy car insurance online, but it is an effective way to compare car insurance prices from different insurance companies. Comparing rates is the best way to save on car insurance because not all companies price their policies the same. You can get free quotes from insurance websites or by using a comparison site.

How fast can you get car insurance online?

Some car insurance companies offer small discounts if you get your quote online.

You can usually get car insurance online in less than an hour. If you are in a hurry, make sure you have all the necessary information in advance, such as the driver’s license numbers of all the drivers in your policy, and your vehicle’s information and VIN. You should also know how much car insurance you need before getting quotes.

Can I buy car insurance for a new car online?

Compare quotes from several different insurance companies to find the best policy that fits your needs and budget. Once you find a policy you like, you can set your policy dates, make payments and start coverage.

Yes, you can usually buy car insurance for a new car online. It’s a good idea to start the process of shopping for car insurance before going to the dealership to get an idea of how much the policy is worth. Buying business car insurance can be very expensive and your options will be limited, so make sure you don’t skip this step.

If you have your new vehicle identification number (VIN), you can purchase your policy before going to the dealership. If you don’t have a VIN, you can compile auto insurance quotes based on the year, make and model of the car you plan to buy.

When you buy your new car, you can get the VIN and buy a policy online (usually in less than an hour). You will need proof of insurance before you can take your new car out of the dealer’s lot.

What do u mean by insurance?

Is the insurance legal? Yes, Insurance is a completely legal company. An insurer is not an insurance company, though; is an online marketplace that you can use to compare companies and quotes. Your policy will not be written by the insurer, but by the company you choose based on the quotes you receive.

Insurance is a way of managing your risk. When you buy insurance, you are buying protection against unexpected financial losses. The insurance company pays you or someone you choose if something bad happens to you. If you do not have insurance and an accident occurs, you may be responsible for all associated costs.

What are the 4 most common forms of insurance?

What is insurance and example? In insurance, the insured is the person or business covered by the insurance policy. A single policy can (and often does) cover multiple insurances. For example. Stanley is a home owner who lives with his two children, his wife, and her father.

What is the most common form of insurance?

However, there are four types of insurance that most financial experts recommend that everyone have: life, health, auto, and long-term disability.

What are common forms of insurance?

Health insurance is the single most important type of insurance you will ever buy. That’s because if you don’t have health insurance and something goes wrong, it’s not just your money at risk – it’s your life. Health insurance is designed to cover the cost of health care.

- Some common types of insurance include: Health insurance …. Here are eight types of insurance, and eight reasons why you might need it.

- Health insurance. …

- Car insurance. …

- Life insurance. …

- Homeowners insurance. …

- Umbrella insurance. …

- Renter’s insurance. …

- Travel insurance. …

What are the 5 most common types of insurance?

Pet insurance.

What is life insurance an example of?

Home or property insurance, life insurance, disability insurance, health insurance, and auto insurance are five types that everyone has.

What is life insurance give an example?

Whole life insurance and universal life insurance are both examples of cash value insurance.

What life insurance means?

Life insurance can be defined as an agreement between a policy holder and an insurance company, where the insurer promises to pay a sum of money in exchange for the sum assured, upon the death of the insured person or after a certain period of time.

What type of insurance is life insurance?

| Life insurance is a contract between you and an insurance company. Basically, in lieu of your insurance payments, the insurance company will pay a lump sum called a death benefit to your beneficiaries after your death. Your beneficiaries can use the money for whatever purpose they choose. | Type of life insurance | The length of the policy |

|---|---|---|

| Cash value | Universal | Constant |

| Yes | Can be changed | Constant |

| Yes | Grave | Constant |

| Yes, as usual | Safe | Regular, as usual |

What is an example of insurance in business?

Yes, as usual

What are the 5 kinds of insurance useful to business?

Business property insurance Examples of specific risk policies include fire, flood, crime and business interruption insurance. General risk policies cover the risks faced by the average small business, while special risk policies are often purchased when there is a high risk in a particular area.

- 5 Types of Business Insurance

- General Liability Insurance. General liability protects your business from a variety of unexpected situations. …

- Product Liability Insurance. …

- Professional Liability Insurance. …

- Commercial Property Insurance. …

What is the most trusted insurance company?

| Home Based Business Insurance. | Car Insurance Company | General Assessment |

|---|---|---|

| Our reward | #1 USA | 9.5 |

| Low military standards | #2 Geico | 9.2 |

| Editor’s Choice | #3 State Park | 9.2 |

| The most popular provider | #4 Progressive | 9.2 |

Lower Rates for High Risk Drivers

What is the most reputable life insurance company?

Which insurance company has the best customer satisfaction? USA. USAA is the best insurance company in our rating. According to our 2022 survey, USAA customers report the highest levels of customer satisfaction and are more likely to renew their policies and recommend USAA to other drivers.

- Rating the Best Life Insurance Companies

- #1 Life Haven.

- #2 Grant.

- #3 Life in New York.

- #3 Northwestern Mutual.

- #5 Lincoln Financial.

- #5 John Hancock.

- #7 AIG.

How do I choose a good life insurance company?

#7 State Park.

Who is the top five insurance company?

Searching for existing insurance providers, referrals or your state’s insurance website. Ensuring financial stability and evaluating customer satisfaction. Reviews of company life insurance products. Shop around with multiple insurers to get the best policy at the best possible price.

Who owns the Jerry app?

The five largest insurance companies in the United States are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.

Jerry was co-founded by Art Agrawal, Musawir Shah, and Lina Zhang in 2017. The company’s mobile app was launched in January 2019. Agrawal, who previously co-founded YourMechanic, is Jerry’s current chief executive officer (CEO).

How does Jerry insurance make money?

What is Jerry’s app? Jerry (formerly Jerry.ai) is the fastest way to compare and buy auto insurance. In less than 45 seconds, Jerry compares auto insurance quotes from over 45 carriers. If you receive a deposit and decide to change it, we will handle all the paperwork. We will even cancel your old policy.

Does Jerry save money?

How does Jerry make money? Jerry Services Inc. is a licensed insurance agency. As your agent, Jerry makes money by earning commissions from the insurance companies we work with.

Is Jerry legit for insurance?

Jerry tracks your renewal, analyzes coverage, shops for insurance before the renewal date, compares prices, and does all the paperwork to get you replaced and save you money.

How does auto insurance company make money?

Yes, Jerry’s app is a legitimate and licensed insurance broker that is backed by technology and an experienced team of licensed insurance agents. Jerry is the #1-rated insurance comparison app with a 4.7/5 rating in the App Store and over 2 million users across the US.

Is the Jerry app legitimate?

Most insurance companies generate revenue in two ways: Charging premiums to replace insurance, then reinvesting those premiums in other generating assets.

Is Jerry a real company?

Yes, Jerry’s app is a legitimate and licensed insurance broker that is backed by technology and an experienced team of licensed insurance agents. Jerry is the #1-rated insurance comparison app with a 4.7/5 rating in the App Store and over 2 million users across the US.

Does the Jerry app cost money?

Jerry, formerly known as Jerry.ai, is a service designed to act as a personal insurance agent. It partners with auto insurance companies like Progressive, Nationwide, and Geico, as well as more than 50 others to provide consumers with auto, home, and renters insurance.

Does Jerry run your credit?

Jerry does not charge its clients a commission to use its platform, instead, they earn commissions from their insurance partners. As a result, customers only pay for the insurance policies they find through Jerry’s app.

What kind of company is Jerry?

No. Regular purchases of car insurance rates will have no effect on your credit score or the cost of your insurance. In the state of California, a credit check is not required to obtain rates.

Does Jerry run your credit?

Jerry is an AI, ML, and bot powered car ownership that saves customers time and money on car expenses. In her first product, Jerry reformed and disrupted the century-old auto insurance process, turning pages and hours of calls into a handful of clicks.

Is Jerry a startup?

No. Regular purchases of car insurance rates will have no effect on your credit score or the cost of your insurance. In the state of California, a credit check is not required to obtain rates.

Is Jerry the company legit?

Jerry, which says it has turned its model into the first mobile car ownership “app,†aims to save its customers time and money on car expenses. The Palo Alto-based startup launched its car insurance comparison service using artificial intelligence and machine learning in January 2019.

What is GaBi LCA?

Yes, Jerry is a legit company! Founded in 2017, Jerry Services Inc. (that’s our fancy name) is based in Palo Alto, Californiaâ but you’ll find Jerry’s offices around the world, bringing together some of the best minds in technology and insurance.

GaBi combines modeling and reporting software with leading life cycle assessment (LCA), data collection and reporting tools. We enable LCA professionals to impact business results by helping to save money, reduce risk, deliver product benefits and increase revenue.

How much does GaBi LCA cost?

What is a GaBi database? The GaBi database is the largest LCI database on the market today and contains about 13,500 databases, including nearly 1,000 plan types. This is supplemented by about 3,500 ready-to-use puzzles.

Does GaBi include Ecoinvent?

GaBi Software offers training in written, in-person, and video formats. Q: How much does GaBi Software cost? Pricing for GaBi Software starts at $1,500 for a one-time payment.

How much GaBi cost?

The integrated ecoinvent data with all the data of the mixing process and the parameters of the Cutting System Model, is fully integrated into our GaBi software: the flow hierarchy of ecoinvent is completely identical to the flow hierarchy of GaBi so that Fully compatible with all GaBi Data.

Is GaBi LCA free?

Gabi is completely free to use. There is no obligation to move forward after your price comparison and we will never charge you any fees. How much can I save using Gabi? Everyone is different, but in general we are able to find savings for about two-thirds of our customers, with an average savings of $961 per year.

What is GaBi used for?

GaBi Education is a free version for students and teachers of classroom teaching. Use industry standard LCA software and LCI data in your curriculum!

How much does GaBi software cost?

In addition, gabi is also a component of traditional lawot-lawot (mixed vegetable with coconut milk) and types of âmodifiedâ pork/beef stew such as pochero, sinigang and nilaga. Laing.

Is GaBi software free?

Q: How much does GaBi Software cost? Pricing for GaBi Software starts at $1,500 for a one-time payment.

What is a product life cycle assessment?

GaBi Education is a free version for students and teachers of classroom teaching. Use industry standard LCA software and LCI data in your curriculum!

Is GaBi software free?

Product life cycle assessments (LCAs) assess the overall environmental impact of the manufacturing process, use and disposal process. (called the value chain or âproduct life cycleâ) necessary to provide a particular product.

How much does GaBi software cost?

GaBi Education is a free version for students and teachers of classroom teaching. Use industry standard LCA software and LCI data in your curriculum!

How do I create a GaBi database?

Q: How much does GaBi Software cost? Pricing for GaBi Software starts at $1,500 for a one-time payment.