Illinois auto insurance rates increasing with inflation; how to find deals, discounts and quotes for cheap insurance

CHICAGO (WLS) — Your car insurance bill may be significantly higher lately, with some consumers paying up to 30% more.

“Each additional expense, especially when I’m not currently working, is very, very challenging,” said Christina Byrnes of Chicago.

Drivers like her are trying to stop rising auto insurance rates.

“There are still problems in the supply chain from the pandemic. So the cost to repair vehicles is more expensive, which increases the cost of insuring the car,” said consumer advocate Ben Moore of Nerd Wallet.

They and the Illinois Public Interest Research Group have been monitoring auto insurance price increases.

“It varies from eight to 10% at the lowest and almost 30% at the highest,” said PIRG’s Abe Scarr.

There are a few steps you can take to save. First, ask your insurer if you qualify for discounts.

“For example, maybe you’ve gone years without being involved in a car accident or traffic violation, you might qualify for a nice driver’s discount that you might be missing,” adds Moore.

You can also ask about programs that reduce the cost for people who don’t drive as often, known as “pay per mile” insurance.

“You get a plug-in device that plugs into your car’s diagnostic port that tracks the car’s mileage, or you download a smartphone app that automatically tracks the mileage you’re driving,” Moore said.

You can also try to save money by combining auto insurance with a home insurance policy and considering raising your deductible, which means you would pay more to fix your car after an accident.

“I will say only do this if you know you have enough money to cover a deductible in case you are involved in a car accident and need to file a claim,” Moore advised.

Illinois PIRG said cost challenges are even more difficult to navigate in our state.

“We think Illinois needs to do more to protect auto insurance customers,” Scarr said. “It’s just us and Wyoming that don’t do anything to regulate rates.”

While you’ll need to have liability insurance, experts say that if your car isn’t worth much, you might consider ditching your collision and comprehensive insurance to lower your bill. But be prepared to pay cash for damages.

Don’t forget to look for new quotes annually for the best deal.

Copyright © 2022 WLS-TV. All rights reserved.

New cars have a higher Declared Insured Value (IDV). Thus, the portion of the premium corresponding to the IDV is higher than that of used cars. As the VDI of used cars is lower, the premium corresponding to this component is lower.

Contents

- 1 How is motor vehicle insurance premium calculated?

- 2 Who benefits from rising interest rates?

- 3 Is life insurance inflation proof?

- 4 Are car insurance premiums increasing?

Auto insurance premiums are calculated on a risk basis. Insurance companies use a number of different statistics to determine your risk level as a driver and then use that to calculate your premium. This may interest you : The elderly and their cars: financial protection after an accident. Generally speaking, the riskier you look at insurance companies, the higher your insurance premium will be.

What are the 5 factors that determine the premium of a car insurance policy? What factors are most important for car insurance rates?

- Was. Age is a very significant ranking factor, especially for young drivers. …

- Driving history. This ranking factor is simple. …

- Credit score. …

- Years of driving experience. …

- Location. …

- Genre. …

- Insurance history. …

- Annual mileage.

Thus, the formula to calculate the OD premium amount is: Self Injury Premium = IDV X [Premium Rate (decided by the insurer)] [Add-Ons (eg, bonus coverage)] â [Discount and benefits (no bonus claim, theft discount, etc. Read also : Who is the number 1 insurance company?.)]

Your car insurance premium is the amount you pay your insurance company on a regular basis, usually every month or every six months, in exchange for insurance coverage. After you pay your premium, your insurer will pay for the coverages detailed in the insurance policy, such as liability and collision coverage.

The premium you have to pay for a life insurance policy depends on a number of factors such as age, full coverage (sum guaranteed), your medical history, gender, lifestyle and work. However, the premium for the same amount of life insurance coverage varies from insurer to insurer.

You pay insurance premiums for policies that cover your health – and your car, home, life and other valuables. On the same subject : Cheap car insurance for high risk drivers. The amount you pay is based on your age, the type of coverage you want, the amount of coverage you need, your personal information, your zip code, and other factors.

Premium is defined as a reward, or the amount of money a person pays for insurance. An example of an award is a year-end bonus. An example of a premium is a monthly car insurance payment.

The amount you pay for your health insurance each month. In addition to your premium, you typically have to pay other costs for your health care, including deductibles, co-payments, and coinsurance.

Definition: Premium is an amount paid periodically to the insurer by the insured to cover his risk. Description: In an insurance contract, risk is transferred from the insured to the insurer. To assume this risk, the insurer charges an amount called a premium.

Who benefits from rising interest rates?

One sector that tends to benefit the most is the financial sector. The profits of banks, brokers, mortgage companies and insurance companies generally increase — as interest rates rise — because they can charge more for loans.

Who do high interest rates affect? Higher interest rates affect people in different ways. The effect of higher interest rates does not affect every consumer equally. Consumers with large mortgages (often first-time buyers in the 20s and 30s) will be disproportionately affected by rising interest rates.

What sectors benefit from rising rates?

Historically, six of the 11 market sectors outperformed the broader market in the year after an initial rate increase: Communication Services, Energy, Finance, Healthcare, Information Technology and Utilities.

Where should I invest when Fed raises rates?

Investigate bank loan funds: Some funds invest in bank loans, whose payments adjust or “float” upwards as interest rates rise. As a result, funds investing in bank loan funds were popular this year.

Who benefits the most from rising interest rates?

One sector that tends to benefit the most is the financial sector. The profits of banks, brokers, mortgage companies and insurance companies generally increase – as interest rates rise – because they can charge more for loans.

Is life insurance inflation proof?

Indexing. Some life insurance policies link their premiums to any number of numbers intrinsically linked to inflation, such as the Retail Price Index and Average Earnings Index. Indexing means that your policy will adjust as inflation naturally occurs.

Is life insurance on the decline? Ownership of life insurance has declined sharply over the past 30 years, continuing a trend that began in the 1960s. In 1989, 77% of households had life insurance (see figure 1). In 2013, this share dropped to 60%.

What are the main assets of life insurance companies?

The assets held by life insurers back up the companies’ life, annuity and health liabilities. Accumulating these assets – through the collection of policyholder premiums and investment earnings – provides the US economy with an important source of investment capital.

Which life insurance company has the most assets?

As of 2020, Prudential Financial was the largest life insurer in the US, with assets worth approximately US$680 billion.

What do life insurers invest in?

Life insurers invest premiums they receive from customers. They generally opt for assets with characteristics in line with the characteristics of the insurance products they sell. For example, proceeds from a long-term insurance product would be invested in a long-term asset.

How does a life insurance company make money?

Life insurance companies make money from life insurance policies in four main ways: charging premiums, investing those premiums, cash value investments, and policy expiry.

Why do we need insurance?

Insurance plans are beneficial for anyone looking to protect their family, property/property and themselves from financial risk/loss: Insurance plans will help you pay for medical emergencies, hospitalization, contracting any illness and necessary medical treatment and care in future.

Is life insurance a source of income?

What are the benefits of life insurance? Payments are tax free. Death benefits are paid in a lump sum and are not subject to federal income tax because they are not considered income for the beneficiaries.

What is the source of income for a life insurance company?

Life insurance companies make money by selling a product for more than it costs to provide and investing the money they need to keep. It’s a robust business model that helps explain the size and longevity of many life insurers.

Is there money made in life insurance?

How do life insurers profit? Life insurers profit from the premiums they charge for policies and invest part of those premium payments to earn additional earnings.

What is an income for life policy?

What is a Life Income Plan? The lifetime income plan is a financial product for high net worth professionals that guarantees a guaranteed lifetime income to retired participants. Similar to a charitable remnant fund, life annuity plans are funded by a pool of investments.

The car insurance premium for small cars (up to 1,000 cc) will now increase to Rs 2,055 from Rs 1,468, an increase of 39.9%. The increase for mid-segment cars (1,000-1,500 cc) is also around 40%. In the case of larger cars and SUVs (above 1,500 cc) the increase is 25%.

Why do auto insurance premiums keep going up? Claims in your area If your city has a high rate of claims related to theft, accidents and weather, it becomes riskier for an insurance company to cover drivers in your area. This risk can lead to an increase in the price of car insurance, even if you have a perfect driving record.

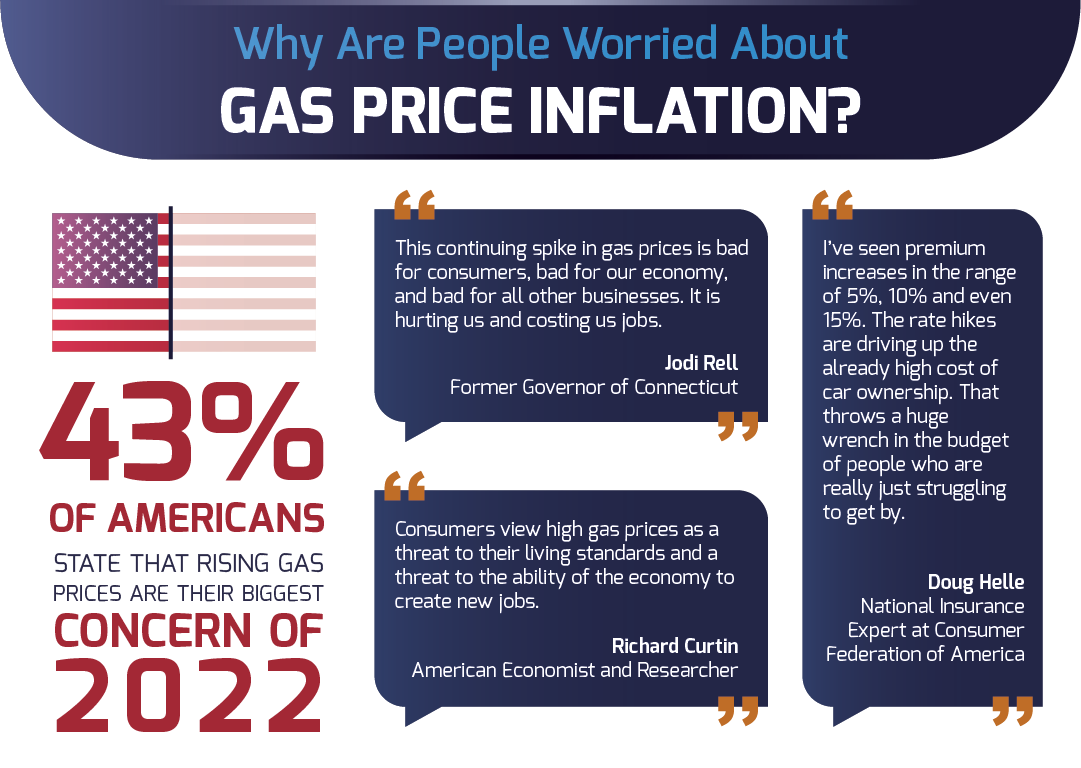

Is car insurance going up due to inflation?

According to US Bureau of Labor Statistics (BLS) tracking, the average cost of car insurance has increased more than twice the general rate of inflation over the past 40 years.

Does insurance increase with inflation?

From May 2021 to May 2022, the price of goods and services increased by 8.6% in the US. 50% higher than the current inflation rate.

Does inflation affect car insurance?

When determining insurance premiums, insurers look at a number of factors, including industry trends such as the number of claims and costs to repair vehicles and homes. If these costs rise, the price of insurance premiums is likely to rise as well. Unfortunately, due to inflation, these costs are increasing.

Why is the cost of insurance increasing?

Accidents are on the rise, leading to more claims The number of car accidents has increased, leading to more claims. This higher claims volume, along with higher vehicle repair and replacement costs, is what is driving insurance rates across the industry.

Like almost every purchase consumers make now, the average cost of car insurance is likely to rise for many drivers throughout 2022. Nationally, car insurance rates are rising by an average of 4.9%, according to data from S&P Global Market Intelligence approved fee record.

Why does my homeowners insurance keep going up?

Insurers increase the cost of coverage to keep up with the rising cost of repairing or replacing your home – due to inflation. The age of your home will also affect the price of your coverage. Older homes have a greater need for repair and maintenance.

Car accidents and traffic violations are common explanations for the insurance rate increase, but there are other reasons car insurance premiums increase, including a change of address, a new vehicle, and claims to your zip code.

Vehicle insurance premiums are expected to increase from June 1, after the government’s proposal has been accepted by stakeholders.

Why is insurance going up so much?

Why are insurance rates going up? A number of pandemic-related trends are driving up car insurance rates across the industry. Inflation has possibly had the biggest impact – as the cost of goods and services rises, so does the cost of protecting our customers on the road.

How do insurance companies compete with one another?

As the insurance market is competitive, when companies become profitable, they start to adopt lenient underwriting criteria and reduce their premiums to gain more market share. Other insurers react by adopting the same policies, to avoid withdrawing their shares or to increase their market share.

There are some things that are out of your control but can still affect your premium, including: rising repair costs, an increase in distracted drivers on the road, more drivers on the road, higher speed limits in your geographic area, and an increase in drivers. without insurance.