There really is no good news about consumer inflation. Now, when they get their owner renewal contracts and car insurance this year, they are more likely to realize that their prices have gone up significantly.

It is difficult to accurately predict how much it will increase in value because they vary across the site. But analysts generally estimate that the average increase is between one-hole high and two-hole low.

That may not seem like much, but analysts say this is just the beginning. Some expect this kind of increase every year for the next few years.

“As U.S. consumers already suffer from rising inflation, rising car and home insurance policies will be unwelcome,” said Joshua Shanker, a analyst at Bank of America.

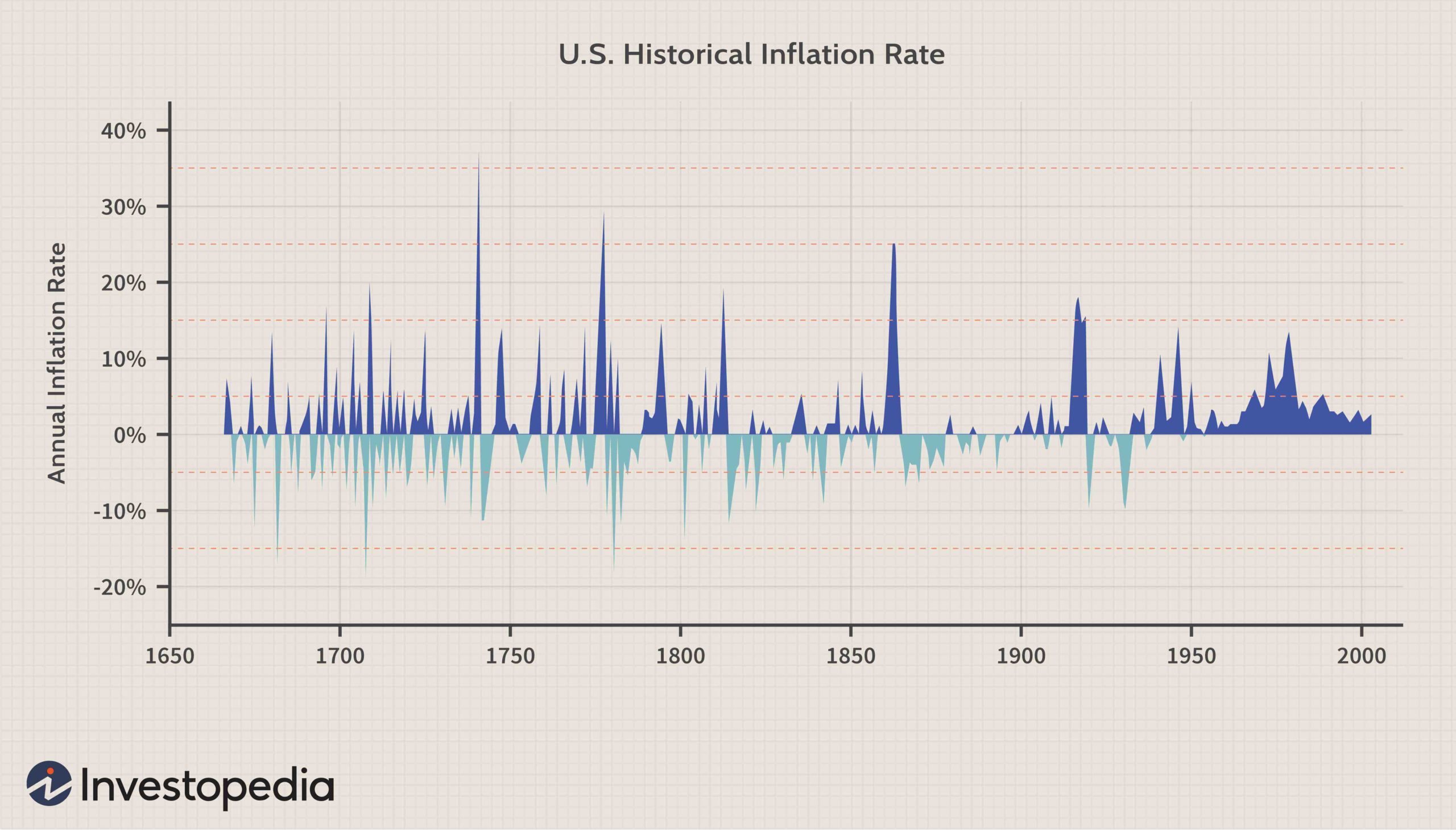

In the 12 months leading up to May, consumer inflation rose 8.6%, the fastest pace since December 1981.

Inflation, weather events that raise the cost of homeowners insurance

Several factors combine to drive homeowners ’insurance premiums, including the rise in severe weather events over the past five years and inflation.

In 2021, the United States recorded 20 catastrophic events with losses of more than $ 1 billion each, according to the National Environmental Information Center. That compares with the inflation-adjusted 1980-2021 annual average of 7.7 and the annual average for the last five years (2017-2021) of 17.8 episodes. They are all losses that must be paid for.

Insurance often transmits some of these risks to insurers, but with catastrophic events, regulators “say enough is enough to raise rates,” said Matthew Carletti, an analyst at JMP Securities, Citizens’ Company.

“So insurers have to pay more for that protection and pass it on to customers,” Carletti said.

Also contributing to the high inflation rate is the rising inflation to the 40-year high.

During the disaster, not only did the housing market rise, but scarcity resulted in everything from wood to oil (used for items such as tarmac and roofing materials) and even workers building, repairing or renovating. housing. All of this has increased the cost of rebuilding a home in the event of a disaster, which is a major factor in homeowners’ insurance costs.

“The cost of home repairs and building materials is unlikely to change because the price of a new loan is going up by 6%,” Shanker said. “And, it would seem that the excessive excess, or lack thereof, of homeowners insurance is the worst in a decade, if not more.”

That is another reason why insurers raise prices.

High inflation, the need to drive faster at the cost of car insurance

Car insurance rates are also benefiting from higher costs. Not only does the price of used cars go up during a disaster for a variety of reasons, including a limited number of new cars for sale and a strict preference for road trips when flying, but the cost of labor and parts is limited. also jumped on the bandwagon.

A couple of accidents that happen while driving a mile are back to the early stages of the spring disaster, and you have catastrophic cooking.

“Suddenly, you have people with expensive cars driving, and then they drive like crazy, and there are a lot of accidents,” Shanker said. “It is clear that this has had a negative impact on (downsizing) the oversupply of the private car market.”

Unfortunately, price increases are also coming in packages, analysts say.

Typically, insurance companies can raise the price of one over the other to protect packages, which seem to be more profitable over time because of their high probability of being with insurance.

“Bundlers are likely to realize that the price of their cars and their housing policy are going up in the same way, and insurance has little power to offset the increase by controlling the price of another part of the policy package,” Shanker said.

He estimates the packages could see a 10% increase in the renewal rate this year.

That “possible shock shock for many customers, many of the best connected customers, will lead them to shop for a better deal,” he said. “In this high-value meeting, multi-policy packages rarely buy from large numbers.”

Contents

- 1 How does a 50/50 Claim affect insurance premiums?

- 2 Can insurance raise rates for no reason?

- 3 Do insurance rates go down at 25?

- 4 How much should insurance increase each year?

Claim 50 50, who pays what? If you and the other party both accept 50% of the responsibility for the accident, their insurance will pay for your loss and the insurance will pay for the other party’s injury. This may interest you : Do car insurance check your job?.

What does 50/50 mean for an insurance claim? Claiming 50/50 means that the repairer has allocated 50% of the negligence to both parties to the accident. This means that each party was liable to the other party for violating that obligation.

Even if you have been considered a safe driver in the past, your insurer may re-evaluate your driving record and decide to raise your money if new claims show you have become a dangerous driver. To see also : What is the difference between full coverage and liability?. However, filing a complaint does not mean that your insurance coverage will increase automatically.

Why does insurance cost go up after an accident? Insurance providers do not increase costs to penalize you. Instead, insurers adjust your values after an accidental crash to show new data based on accidental exposure.

Do insurance claims raise your rates?

Filing a complaint often results in an increase in value which can be between 20% and 40%. Increased rates can persist for years, although the size and lifespan of the flow can vary greatly between insurers.

Filing a complaint increases your risk with your insurance provider, and as your risk increases, so does your fees. You can expect to see an increase of 9% to 20% per case, although this number varies with the type of claim and the number of claims you have already filed.

Generally, when complaints against your insurance policy exceed a certain threshold due to the first occurrence of your error, the insurance will increase the amount of your insurance by a certain percentage. On the same subject : What Are Car Insurance Premiums? – Forbes Advisor.

Filing a complaint increases your risk with your insurance provider, and as your risk increases, so does your fees. You can expect to see an increase of 9% to 20% per case, although this number varies with the type of claim and the number of claims you have already filed.

Why does insurance cost go up after an accident? Insurance providers do not increase costs to penalize you. Instead, insurers adjust your values after an accidental crash to show new data based on accidental exposure.

Can insurance raise rates for no reason?

But sometimes prices can rise without warning. The insurance company may raise your price for a number of reasons, and some have nothing to do with your driving record or claim date.

How often can an insurance company raise the price? No one likes to see their health insurance costs go up, but it’s a normal experience. In fact, most health insurance plans improve their value at least once a year. Upcoming notification of price changes is usually mailed to those with a deficit policy, with new rates taking effect in the new year.

Can insurance rates go up for no reason?

In some cases, yes, even accidents you do not cause can increase your level of admissions, as insurers have data showing that some drivers are prone to unintentional accidents. Even accidents that you do not cause can increase your level in some states.

If your credit score drops, increased debt, lower income, late or delayed payments, more credit inquiries, or other reasons, your insurance company may choose to increase your fees to protect themselves.

What do u mean by insurance?

Insurance is a way to manage your risk. When you buy insurance, you buy protection against unexpected financial losses. The insurance company will provide you or someone you choose if something bad happens to you. If you do not have accident insurance, you may be responsible for all related costs.

What are the four functions of insurance?

Insurance activities can be studied in two parts; Basic activities, and, secondary activities …. 7 insurance activities are;

- The insurance provides for sure,

- Insurance provides protection,

- Risk Sharing,

- Loss prevention,

- Provides Capital,

- Improves efficiency,

- Supports Economic Development.

According to The Balance, the following are some common factors that lead to an increase in car insurance premiums:

- Traffic Violations. …

- Accident Occurred. …

- Complete Claim. …

- old age …

- Car insurance expired. …

- Put Credit Points …

- High Risk Areas.

Car accidents and traffic violations are a common explanation for rising insurance rates, but there are other reasons why car insurance premiums go up including change of address, new car, and code breach claims.

Why did my auto insurance go up for no reason?

You may have moved to an area where the crime rate is high, including car theft. Or there may be a population density in your new area. This means more cars parked on the road and higher probability of accidents. Or there may be a limit beyond the neighborhood claim.

Why does my car insurance keep going up for no reason?

You may have moved to an area where the crime rate is high, including car theft. Or there may be a population density in your new area. This means more cars parked on the road and higher probability of accidents. Or there may be a limit beyond the neighborhood claim.

What causes your insurance rates to go up and why?

There are things that are beyond your control but can still affect your insurance premiums, including: an increase in maintenance costs, an increase in busy drivers, more drivers on the road, a higher speed limit in your geographic area, and an increase in uninsured drivers.

Why does my insurance keep going up every year?

These reasons may include filing a new lawsuit or adding a traffic violation to your driving history, adding or changing a vehicle, adding or changing a driver and increasing the amount of your insurance.

Is it normal for your car insurance to increase every year?

There are many factors that affect insurance rates. Lowering your credit rating, points against your driver registration, or changing locations can cause your costs to increase. So, it is normal for car insurance to go up every year.

Do insurance rates go down at 25?

In general, younger drivers tend to pay more for car insurance — but when you turn 25, the cost of your insurance may go down. According to CarInsurance.com, the average annual fee for a 24-year-old male with full insurance is $ 2,273. At age 25, that average is down to $ 1,989, down about 12.5%.

Is it true that your car insurance is down 25? Normally, yes. In development, prices fall by 9% on average at age 25. But there are other cost factors that affect your car insurance, such as your claim date. So if you have an accident before you reach 25, your level may not go down.

How much does insurance decrease when you turn 25?

As a result, their value can be thousands of dollars cheaper. Compared to 16-year-old drivers, Policygenius found that 25-year-old drivers pay an average of 72% less on car insurance per year.

Is insurance cheaper for females?

Women like to pay less for car insurance than men. And it should come as no surprise that young drivers pay the most. Age is related to driving experience and risk of having a car accident.

Does insurance go down when you turn 25?

In general, younger drivers tend to pay more for car insurance “but by the age of 25, the cost of your insurance will fall. According to CarInsurance.com, the average annual premium for men 24 age with full insurance is $ 2,273. At age 25, that average drops to $ 1,989, a decrease of about 12.5%.

Does insurance go down at 25 for females?

Your car insurance will go down after you turn 25, but not like it happens on other birthdays. However, as long as you live in a situation where insurance does not result in gender insurance coverage, one important change occurs at age 25: the difference between what male and female drivers pay for car insurance.

How much should insurance increase each year?

| Year | Average Annual Value | % Change YoY |

|---|---|---|

| 2016 | $ 1,368 | 6.90% |

| 2017 | $ 1,437 | 5.00% |

| 2018 | $ 1,521 | 5.8% |

| 2019 | $ 1,548 | 1.8% |