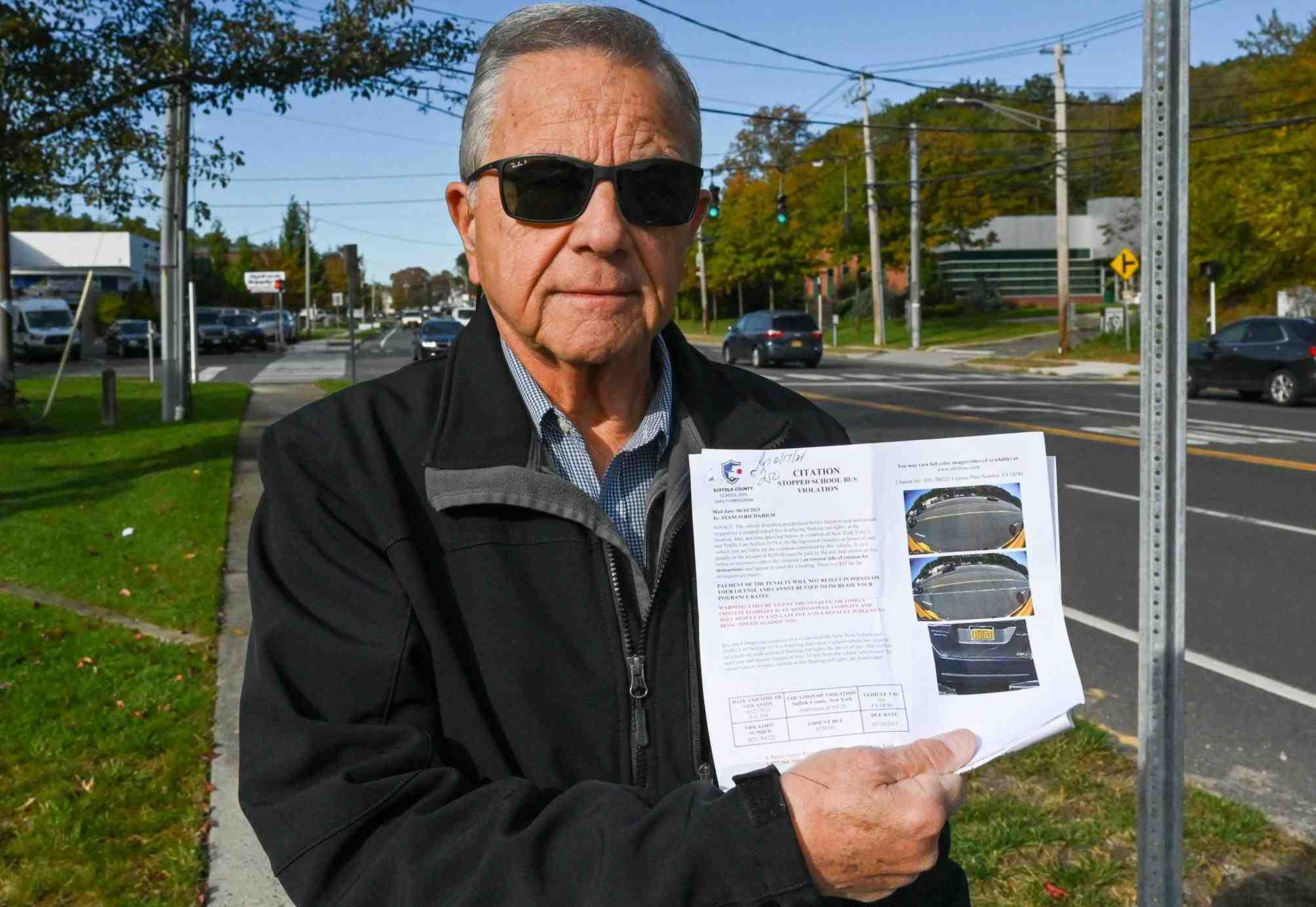

Insurance increases after ticket for failing to stop on a school bus

Editor’s note: We earn a commission from affiliate links on Forbes Advisor. Commissions do not influence the opinions or ratings of our editors.

If you don’t stop for a school bus that’s stopped or in the process of slowing down, it might not seem like a big deal when you’re short on time. However, ignoring state laws regarding school bus stops can have dire consequences, including the possibility of harming an innocent child on their way to or from school.

Violations of state school bus laws can result in fines, fines and other penalties, such as points on your license or license suspension. It can also lead to higher car insurance rates.

According to an analysis by Forbes Advisor, drivers who receive a ticket for failing to stop for a school bus pay an average of 29% more for their car insurance, or about $500 more per year.

However, it’s worth noting that the amount that increases for your car insurance rate after not stopping for a school bus can vary depending on factors such as your insurance company, where you live, your age and driving history.

If you’ve recently been ticketed for failing to stop for a school bus in transit, read on to learn how it can affect your car insurance rates, as well as other penalties you should be aware of.

How Does Illegally Passing a School Bus Affect Auto Insurance?

Contents

- 1 How Does Illegally Passing a School Bus Affect Auto Insurance?

- 2 Car Insurance Rate Increases After Failing to Stop for a School Bus, by Company

- 3 Average Car Insurance Rate Increases by State After a Failing to Stop for a School Bus

- 4 Why You Should Never Pass a School Bus

- 5 Penalties for Passing a School Bus

- 6 Best Car Insurance Companies 2022

- 7 Why is USAA so good?

- 8 How long do tickets and accidents stay on your record in California?

- 9 How much does 6 points affect insurance?

- 10 How much is insurance on a race car?

Illegally passing a school bus that is currently stopped or about to stop will not affect your auto insurance rates. Read also : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have. You will only see your rates increase if you are caught and ticketed or fined for violating your state’s school bus safety laws.

After that, the consequences can vary depending on your state and how your insurance company treats the violation. Most states put a certain number of “points” on your driver’s license after you commit a traffic violation.

Car insurance companies have the right to increase your insurance rates at renewal time if they feel that the number of points on your record makes you a higher risk to insure. So there’s a good chance you’ll see your car rates go up because of a school bus traffic violation, just like you would after a speeding ticket or any other major or minor traffic violation.

Car Insurance Rate Increases After Failing to Stop for a School Bus, by Company

We analyzed the tariffs of 13 major auto insurance companies for drivers with school bus tickets and found that: On the same subject : 6 bad habits that increase your car insurance.

Average Car Insurance Rate Increases by State After a Failing to Stop for a School Bus

Why You Should Never Pass a School Bus

If you are caught in the act of passing a school bus, you will almost certainly be ticketed for failing to stop for the school bus. On the same subject : Auto Insurance Market Still Has Room to Grow: AISUS, Allianz Partners, Progressive: Market Size, Sharing, Future Growth and Opportunity Assessment of Auto Insurance 2021-2027. Unfortunately, the consequences can be far more damaging — and perhaps even fatal — for some.

The fact is that state school bus laws exist to protect children and teenagers as they get on and off the bus on their way to and from school. Passing a stopped (or stopping) bus with your lights on and your stop arm extended can lead to accidents and injuries that can be avoided by slowing down and obeying the law.

Penalties for Passing a School Bus

School bus tickets serve as punishment for endangering children’s lives and as a warning to never do it again. Some states have stricter penalties for drivers who commit this offense.

Here are examples of fines for passing a school bus.

Penalties in California

Under California Vehicle Code 22454, drivers in the state cannot pass stopped school buses displaying flashing red signals and a stop hand. They can only continue when the lights stop flashing and the brake stops working.

Drivers caught in the act of passing a stopped school bus can be fined up to $695. They will also receive one point on their driving record in the state of California.

Penalties in Florida

The Florida Department of Highway Safety and Motor Vehicles notes that the minimum fine for driving past a school bus on the child exit side when the bus is running a stop sign is $400. Furthermore, a driver who commits this offense twice within five years can have his driver’s license revoked for up to two years.

Other penalties may include a requirement to complete a basic driver improvement course upon conviction and four points on the offender’s driver’s record.

Penalties in New York

Drivers in New York can also face stiff penalties for passing a stopped school bus — with its red flashing lights on — while dropping off or picking up passengers.

According to the New York State Department of Motor Vehicles (DMV), a first offense can result in a fine of $250 to $400 and up to 30 days in jail. A second conviction within three years can result in another $600 to $750 fine and up to 180 days in jail.

A third conviction (or more) within three years can result in additional fines of $750 to $1,000 per offense and an additional 180 days in jail.

Furthermore, five points are added to your driving record for each conviction, which can have a serious impact on your auto insurance rates.

Penalties in Pennsylvania

There are several guidelines that Pennsylvania drivers must follow when it comes to school bus safety. For example, drivers in the state must stop when:

Drivers must remain in place until the red lights stop flashing and the stop arm is pulled. Violators of Pennsylvania school bus laws can receive a $250 fine and five points on their driving record. They can also have their driver’s license suspended for 60 days.

Penalties in Texas

In Texas, drivers must stop if they approach a school bus that has alternating flashing red signals in front or rear. They can only proceed when the lights stop flashing or when they receive a signal from the driver that it is OK to pass.

Drivers who violate Texas public school bus laws face fines of up to $1,250 for a first offense. Repeated violations can result in a driver’s license being suspended for up to six months.

Criminal charges may be considered if the violation results in serious bodily injury, and a ticket for passing a school bus will not be dismissed if the driver engages in defensive driving.

Best Car Insurance Companies 2022

With so many choices for car insurance companies, it can be difficult to know where to start to find the right car insurance. We’ve evaluated insurers to find the best car insurance companies, so you don’t have to.

Why is USAA so good?

Full-Service Banking USAA has been an innovative bank for years. They offer many premium services as standard on all accounts. These include free checking and savings accounts with no minimum balance fees, free checking, a free rewards debit card, free overdraft protection, free online bill pay and more.

Why is USAA better than other banks? With no-fee monthly checking and savings accounts, generous ATM fee policies, a standard APY that comes with every checking account, and many tools and programs designed to help customers avoid overdrafts and meet their financial goals, USAA offers a complete package of good banking practices.

Does USAA have a good reputation?

USAA earns the best reputation among financial services companies. SAN ANTONIO – USAA has earned the highest ranking among financial services companies on the list of America’s Most Reputable Companies, according to the Reputation Institute. Overall, USAA ranked 36th among the companies listed in the top 100.

Is USAA a reputable company?

Overall, most policyholders are satisfied with their experience with the company. USAA has a 1.2 star customer review rating on BBB and a 1.3 star rating from Trustpilot.

Is USAA good at paying claims?

USAA is good at paying claims compared to the average insurance company, according to the latest research from J.D. Powera about the pleasure of harm. USAA scored 909 out of 1,000 for their claims process, compared to an industry average of 880 out of 1,000.

Is USAA better than normal insurance?

USAA ranked first among insurance providers in our analysis of average rates, while Geico auto insurance ranked second among nine insurers. Geico’s satisfaction ratings were not as strong as some others for customer service, claims handling and customer loyalty compared to USAA.

Why is USAA so successful?

Serving only military families gives USAA one big advantage: a huge brand focus. Serving a narrowly defined niche allows financial marketers and brand builders to target their products, services and solutions to the specific circumstances, needs and preferences of that group.

What is USAA’s business strategy?

USAA has a niche business model, with a specialized customer segment. The company targets its offering to active and former members of the US military and their immediate families.

What is USAA competitive advantage?

“USAA’s low cost structure, high customer retention, efficient use of technology and exceptional customer support capabilities have enabled it to build a sustainable competitive advantage in the personal lines sector.

What makes USAA successful?

Customers are loyal and more likely to stay with the company and get additional financial products than customers at other companies. USAA’s dedication to customer experience and individual service keep customers coming back and singing their praises. Companies in any industry can learn from the best.

Why is USAA customer service so good?

Rather than viewing its customers as anonymous outsiders, USAA has a strong culture of welcoming customers into the family. Part of that comes from the company only offering service to members of the military and their families, but another part comes from building a strong camaraderie and supporting every customer.

How long do tickets and accidents stay on your record in California?

California: Three years from date of accident1. New York: Three years from the end of the year in which the accident occurred2. New Hampshire: Five years from date of accident3. Oregon: At least five years4.

How do I remove an accident from my California driving record? To correct information about a traffic accident, use form DL-208 “Request for Correction of Traffic Accident Record”. The Department of Motor Vehicles (DMV) will only use this form to correct traffic violation or conviction information on your driving record.

How long do traffic tickets affect insurance in California?

Insurance companies generally view speeding tickets as an indication of risky driving behavior. Because of this, your premium will usually increase after you receive a speeding ticket and will remain elevated for three to five years, although each company has its own insurance criteria.

How long do tickets stay on insurance in California?

| Country | How long does a speeding ticket stay on your driving record |

|---|---|

| California | 3 years |

| Colorado | Permanently |

| Connecticut | 3 years |

| Delaware | 2 years |

How do you keep your insurance low after a ticket?

How to help keep insurance rates lower after a speeding ticket

- Take a defensive driving course or traffic school. Many insurers offer discounts – and this can help with your ticket.

- Try shopping around for a new insurer – you may be able to find some great savings.

- Most insurance companies offer various discounts.

How much does 2 points affect insurance in California?

We analyzed quotes from several insurers and found that having two points on your driver’s license can increase your auto insurance rate by 180%.

Do all accidents show up on your driving record California?

In California, any traffic accident that is reported by the police to the State Department of Motor Vehicles (DMV) will appear on your record for an extended period of time. However, if the reporting police clearly indicated that the other party was at fault, the accident may not appear on your driving record.

Do insurance companies report accidents to DMV California?

The short answer is “no”. Insurance companies do not report accidents to the DMV.

How long do accidents stay on your record in California?

In California, for example, most accidents and minor violations stay on your driving record for three years. Accidents involving more serious offenses stay on your record longer – 10 years for a DUI conviction.

Does a no fault accident go on your record in California?

Yes, a no-fault vehicle accident will indeed go on your driving record. For example, if another driver stops you at a stop sign and your vehicle sustains significant damage, you will need to contact your insurance company and file a claim for reimbursement of these costs.

How long do tickets stay on insurance in California?

| Country | How long does a speeding ticket stay on your driving record |

|---|---|

| California | 3 years |

| Colorado | Permanently |

| Connecticut | 3 years |

| Delaware | 2 years |

Do traffic tickets go away California?

A traffic ticket will remain on your record for up to three years. Many times people want the ticket to just go away, but once you’ve signed the ticket and paid for it, there’s not much you can do. It will remain on your record for three years, and this will have a negative impact on your insurance rates.

How much does 2 points affect insurance in California?

We analyzed quotes from several insurers and found that having two points on your driver’s license can increase your auto insurance rate by 180%.

How do you keep your insurance low after a ticket?

How to help keep insurance rates lower after a speeding ticket

- Take a defensive driving course or traffic school. Many insurers offer discounts – and this can help with your ticket.

- Try shopping around for a new insurer – you may be able to find some great savings.

- Most insurance companies offer various discounts.

How much does 6 points affect insurance?

If you receive 6 points on your license, your car insurance premiums will likely increase and your license may be restricted, suspended or revoked, depending on your state. Driving license points are used to track offences, so accumulating 6 points is a sign of increased risk for insurers.

What is the point of your insurance? A single point is unlikely to affect a driver’s insurance costs if it is the only point on the driver’s record. One point is awarded for a minor violation, such as driving with broken tail lights or an expired license, that the insurance company may not even hear about.

What does 6 points on your license mean in NY?

If you get 6 or more points on your New York State driving record in 18 months, you must pay a driver responsibility evaluation fee.

How do I get points off my license in NY?

You can remove points from your NYS license by taking a DMV approved Points and Insurance Reduction (PIRP) course. Attending a New York defensive driving school will not only prevent you from getting your license suspended, but it will also help you save 10% on your auto insurance premium in the future.

What do you do if you get 6 points on your licence?

If you have received six points on your driver’s license within two years of passing the test, your driver’s license will be automatically revoked. This means you will need to reapply for your provisional license and then retake the theory and practical driving tests.

Can you drive with 6 points on your license?

According to the Road Traffic (New Drivers) Act, any driver who receives six or more demerit points within two years of taking the test will have their driver’s license revoked. This includes any penalty points given before they passed the test. Penalty points are valid for three years.

What happens if u get six points?

If you have received six points on your driver’s license within two years of passing the test, your driver’s license will be automatically revoked. This means you will need to reapply for your provisional license and then retake the theory and practical driving tests.

What happens if you get too many points?

Earning too many points can result in a suspended license Generally, you must be convicted of a moving violation for points to be added to your license. If you get too many points over a period of time, your state’s DMV may temporarily suspend your license.

How many points until license is suspended in NY?

If you get 11 points for traffic offenses in a period of 18 months, your driving license can be suspended. A “point reduction” means that the number of points on your driving record used to calculate the total number of points earned within 18 months will be reduced by 4 points and may help you avoid suspension.

How much is insurance on a race car?

The Real Cost of Insuring Your NASCAR Car According to our friends at National General, insuring your NASCAR car for a year is… $9,000! Nine thousand dollars to protect your car, yourself and others on the road – all with you behind the wheel of your very own NASCAR car.

Can you get race car insurance? Insuring race team owners can’t just call their local State Farm representative and ask for a race car policy. Instead, racing teams usually have to insure their cars with companies that specialize in motorsports. K&K Insurance Group, for example, has been providing motorsport insurance since 1952.

How much does race car insurance cost?

A: A typical race car and class or class trailer usually costs about $650 to $1,000 a year to insure. Since the rate is based on value, higher value operations (such as Pro Mods) may have higher premiums.

How much is insurance on a race car?

The Real Cost of Insuring Your NASCAR Car According to our friends at National General, insuring your NASCAR car for a year is… $9,000! Nine thousand dollars to protect your car, yourself and others on the road – all with you behind the wheel of your very own NASCAR car.

How much are f1 drivers insured for?

Top Formula 1 drivers are widely speculated to have up to $80 million in personal injury coverage – and usually pay for their own insurance. In this high-risk sport, payouts cover medical expenses in the event of an injury, as well as compensation for lost income. Death benefits are also taken into account.

Are supercars expensive to insure?

And while collision coverage and comprehensive coverage are optional, you really won’t skip it. Not on your supercar anyway. Make no mistake, exotic car insurance is certainly expensive. Expect to pay several thousand dollars a year to insure most production supercar models.

Are supercars expensive to insure?

And while collision coverage and comprehensive coverage are optional, you really won’t skip it. Not on your supercar anyway. Make no mistake, exotic car insurance is certainly expensive. Expect to pay several thousand dollars a year to insure most production supercar models.

How expensive is it to insure a supercar?

As Below Invoice wrote, on average supercar insurance can range from a fairly cheap $1,500 a year to $35,000 a year or more. More expensive hypercars are likely to command an even higher premium, but it varies a lot.

Are Lamborghinis expensive to insure?

Average Cost of Lamborghini Insurance Across all the Lamborghini models we examined, we found that auto insurance costs ranged from $5,424 to $7,949 per year. Insurance rates were closely related to the value of the vehicle, as more expensive models cost more than cheaper models.

What insurance companies cover supercars?

Some of the major insurers that offer supercar insurance are:

- Allstate.

- GEICO.

- State Farm.

- Progressive.

- Safeco.

How much is insurance usually on a sports car?

As you can see in the chart below, the cost of insuring a sports car is typically around $2,100 per year for full coverage, based on quoted annual premiums from Quadrant Information Services. By comparison, the national average cost of car insurance for a standard sedan is $1,674 for full coverage.

Are Sport models more expensive to insure?

Car Price The price of your car plays a big role in determining your car insurance premiums. The more expensive the car, the more it will cost to repair or replace. If it is a sports or luxury vehicle, it will cost even more. That’s why auto insurance premiums are so much higher for expensive cars.

How do you insure a sports car?

To insure an exotic or sports car, get an auto insurance quote as you would any other car. But keep in mind that high-performance vehicles can lead to higher auto insurance rates. More horsepower means more risk for your insurer. And not all insurers insure all high-end vehicles.

What sports car has the highest insurance?

| Rank | The most expensive | 1 Year Rate |

|---|---|---|

| 1 | BMW i8 | $3,892.71 |

| 2 | Maserati Quattroporte | $3,674.71 |

| 3 | Nissan GT-R | $3,496.03 |

| 4 | Maserati GranTurismo | $3,379.09 |