Is 100 a month for car insurance good?

The national average cost of car insurance is $1,630 per year, according to NerdWallet’s 2022 rate analysis. This results in an average car insurance rate of around $136 per month.

Should I pay monthly or full?

Contents [hide]

- 1 Should I pay monthly or full?

- 2 What makes car insurance go down?

- 3 Can I buy a UK car sticker in France?

- 4 What is a reasonable amount to pay for insurance?

Whether it makes sense to pay in full depends on your budget. Read also : Is Progressive or Geico cheaper?. If a large payment leaves you short of cash, paying monthly may be the best option.

Is it better to make monthly payments or pay upfront? It’s best to pay off your credit card balance in full each month. Leaving a balance won’t help your credit score – it will just cost you money in the form of interest. Carrying a high balance on your credit cards has a negative impact on your scores because it increases your credit utilization rate.

Why is it better to pay monthly?

An increase in your monthly payment will reduce the amount of interest you will pay during the payment period and may even shorten the number of months it will take you to repay the loan. See the article : Does State Farm use credit scores?.

Is it better to pay upfront or monthly?

The lump sum makes sense if you can afford it comfortably and want to save in the long run. On the other hand, you should pay in installments if you don’t have enough cash upfront and feel more comfortable with a consistent monthly payment.

Is monthly payment Better?

Monthly payments simplify budgeting, but it’s not always the best choice when it comes to paying off your mortgage faster. Compared to biweekly payments, you will pay more interest over the life of your home loan. This is true regardless of whether your mortgage rate is low, fixed, or adjustable.

What makes car insurance go down?

Main Messages. Your age, driving history, credit score, address, occupation and car use can all affect the cost of insuring your car. On the same subject : Why are Geico rates so low?. You may see your car insurance decrease with age – particularly between the ages of 18 and 25 – if your insurance company offers age discounts.

Can I buy a UK car sticker in France?

While they are legal in France, they are not in Spain, Malta or Cyprus. They insist on a full size even if you have a UK number plate sticker. These rules apply to any country outside the UK that you are driving, so this doesn’t just mean France or mainland Europe.

Are UK license plate stickers legal in Europe? “GB plates will still be valid in the EU as long as drivers display a UK sticker on the back of the vehicle.” “Stakeholders were informed of the intention to change the signifier prior to notifying the UN. €

Do you have to have a UK sticker on your car in France?

From 28 September 2021, you must identify your vehicle as from the UK when driving abroad. If your license plate includes the UK identifier with the Union flag (also known as the Union Jack), you do not need a UK sticker to drive in France.

Do I need a UK sticker to drive in Europe?

From 28 September 2021 you will need a UK sticker instead of a GB sticker on your vehicle to drive abroad. You do not need a green card to drive in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia or Switzerland.

Do I have to register my UK car in France?

From 1 January 2021, all UK registered non-commercial vehicles imported into France will require an 846A certificate (Certificat de dédouanement). This is issued by the local customs office (in France), which you can consult here.

What documents do you need to keep in your car in France?

Documents for driving in France

- A valid full (non-provisional) driving license.

- A vehicle registration document (V5c) – the original is not a copy, called “carte grise” (grey card) in France.

- A certificate of auto insurance.

- Passport(s)

Where do you put a UK car sticker in France?

Do I need a GB sticker to drive in France? You will need to display a GB sticker on the back of your car unless you have EU number plates with the country code in a circle of stars on a blue background.

Do I need a UK or GB sticker in France?

Motorsport Checklist for France (1) UK stickers are mandatory in the EU unless your UK registration plates display the Euro GB symbol (Europlates), which has become a legal option as of 21 March 2001. The Euro plate must conform to the new British Standard (BS) AU 145d).

Can I keep a UK registered car in France?

The rules have changed and now when you bring your car into France from the UK you can only keep your British plates for the first six months. During this period, you are not legally required to register it unless you are becoming a French resident. After six months, you need to re-register your car in France.

Do I need a UK or GB sticker in France?

Motorsport Checklist for France (1) UK stickers are mandatory in the EU unless your UK registration plates display the Euro GB symbol (Europlates), which has become a legal option as of 21 March 2001. The Euro plate must conform to the new British Standard (BS) AU 145d).

Do I need a GB or UK sticker to drive in Europe?

From 28 September 2021 you will need a UK sticker instead of a GB sticker on your vehicle to drive abroad. You do not need a green card to drive in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia or Switzerland.

Do I need to display a GB sticker in France?

Frequently asked questions about driving in France. Do I need a GB sticker to drive in France? You will need to display a GB sticker on the back of your car unless you have EU number plates with the country code in a circle of stars on a blue background.

Do I need a sticker to drive in France?

Do I need a license to drive in Paris? Yes, you will need a Crit’Air sticker to drive in Paris. Central Paris is covered by a permanent low emissions zone (ZCR), which means that all vehicles must display a Crit’Air vignette to be able to enter at certain times.

What is a reasonable amount to pay for insurance?

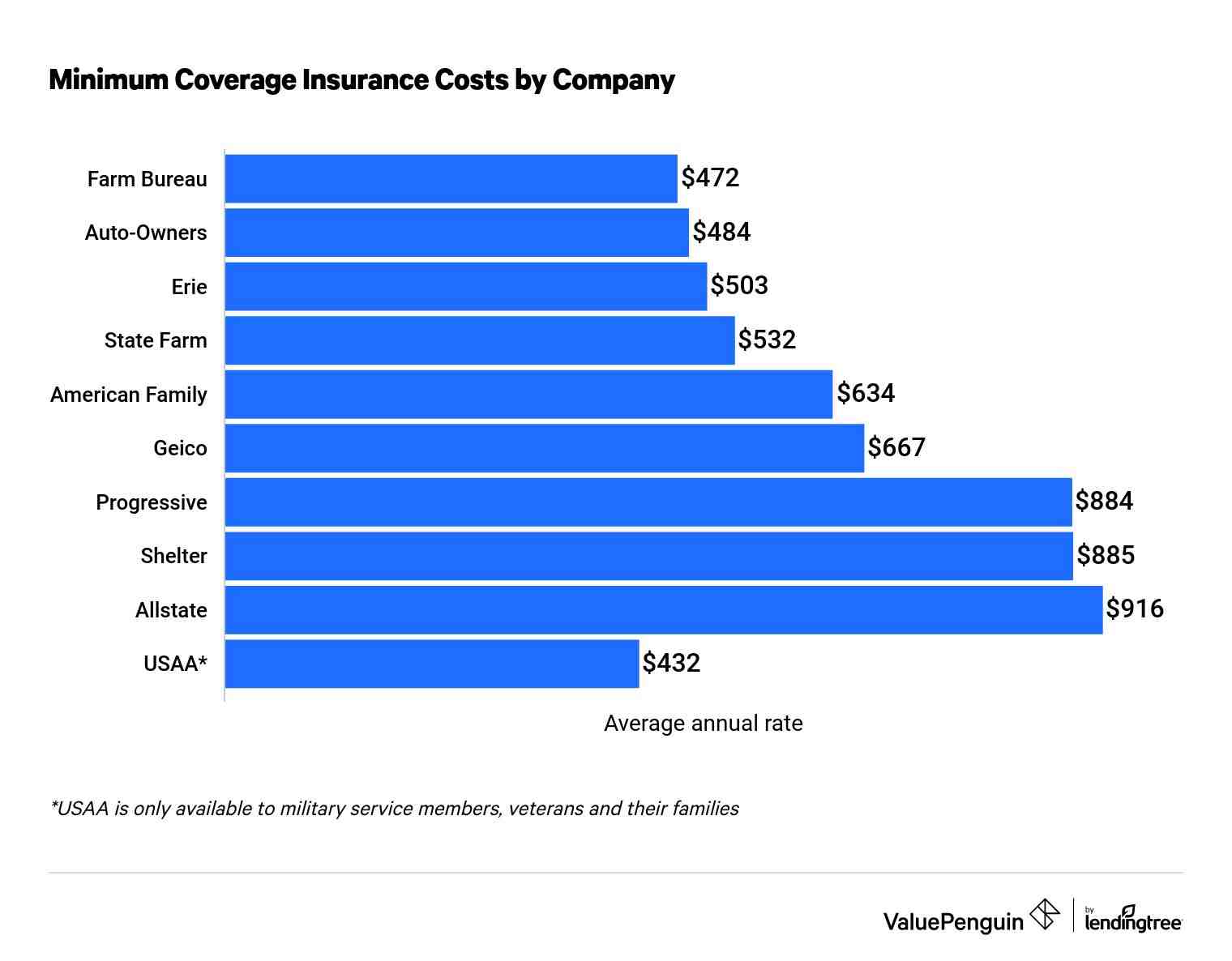

Drivers in the US pay an average of $1,771 a year for full-coverage car insurance, or about $148 a month, according to Bankrate’s 2022 analysis of average quoted premiums from Quadrant Information Services. Minimum coverage averages $545 per year.

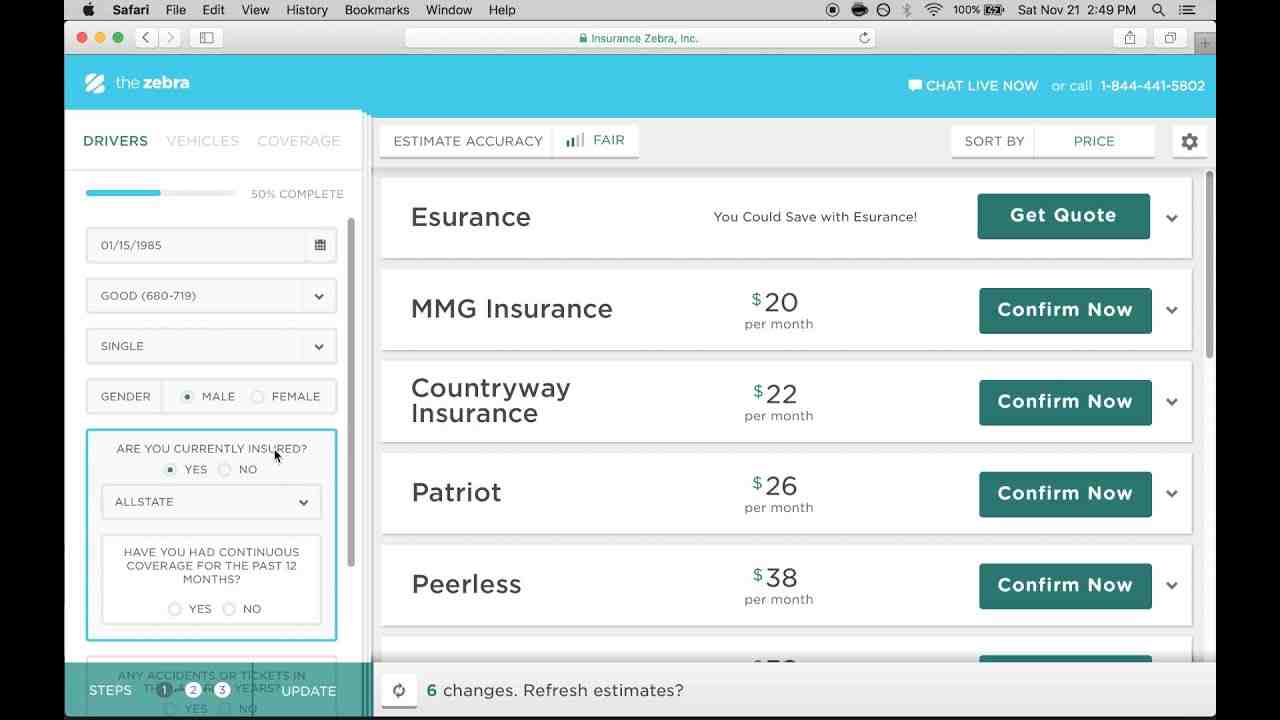

How can you reduce your costs to be insured? Listed below are other things you can do to reduce your insurance costs.

- Shop around. …

- Before buying a car, compare insurance costs. …

- Ask for higher deductibles. …

- Reduce coverage on older cars. …

- Buy your real estate and auto coverage from the same insurer. …

- Maintain a good credit history. …

- Take advantage of low mileage discounts.

How much insurance is the right amount?

Financial experts generally recommend purchasing 10 to 15 times your annual income on coverage, although your personal number may be higher or lower.

What is a good amount for insurance?

The best liability coverage for most drivers is 100/300/100, which is $100,000 per person, $300,000 per accident in personal injury liability, and $100,000 per accident in property damage liability. You want full protection if you cause a significant amount of damage in a fault accident.

What percentage of your income should go to insurance?

What percentage of your income should you spend on life insurance? A common rule of thumb is at least 6% of your gross income plus 1% for each dependent.

How do I decide how much insurance I need?

One of the simplest ways to calculate your replacement income value is: insurance coverage = current annual income x years remaining until retirement. For example, if you are 40 years old, your annual salary is €15 lakh and you plan to retire at age 60, the coverage required is €3 crore (€15 lakh x 20).

What is the average cost of an insurance policy?

The national average cost of insurance is $65 per month for minimum coverage, or $785 per year. Your rate varies depending on where you live, what type of coverage you have, and your driving history.

How much does home insurance cost in Paris?

Annual premiums usually start at around €100-150, but can cost €500 or more for expensive properties. Average costs in France in 2020 were €248, but ranged between €200 and €300 in different regions.

How much is a typical insurance policy?

In 2020, the national average cost of health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary across the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the health insurance that’s right for you.

How much is insurance in Paris?

How much is car insurance in Paris? Car insurance in Paris Kentucky costs single car drivers an average of $2,718 a year, or about $226 a month. Compared to the state’s annual average of $2,644, car insurance in Paris is $74 higher.

How much is insurance in Paris?

How much is car insurance in Paris? Car insurance in Paris Kentucky costs single car drivers an average of $2,718 a year, or about $226 a month. Compared to the state’s annual average of $2,644, car insurance in Paris is $74 higher.

How much does the French healthcare system cost?

The French healthcare system is one of the most expensive in the world and cost containment is an imperative for both the government and insurers. However, French costs remain far outstripped by the US. France spends $2,047 per capita on health compared to the US’s $4,095.

How much is home insurance in Paris?

Costs of multi-risk home insurance in France Annual premiums generally start at around €100–150, but can cost €500 or more for expensive properties. Average costs in France in 2020 were €248, but ranged between €200 and €300 in different regions.

How much is the average car insurance in France?

The average annual car insurance premium in France in 2016 was around €400, making it the fifth highest in the EU and above the overall EU average. Tous risk premiums are higher, usually in the region of €600-900 annually.