National Public Auto Insurance Review 2022 – Forbes Advisor

Editor’s note: We earn a commission from affiliate links on Forbes Advisor. Commissions do not influence the opinions or ratings of our editors.

About National General Car Insurance

Contents

- 1 About National General Car Insurance

- 2 National General Car Insurance Cost Comparison

- 3 Auto Insurance Complaints Against National General

- 4 National General’s Grade from Collision Repair Professionals: C-

- 5 Does National General offer Accident Forgiveness?

- 6 Does National General Offer New Car Replacement?

- 7 Does National General Offer Gap Insurance?

- 8 Does National General Offer a Diminishing Deductible?

- 9 Does National General Offer SR-22s?

- 10 Does National General Offer Usage-Based Insurance?

- 11 Does National General Offer Pay-Per-Mile Insurance?

- 12 National General’s Auto Insurance Discounts

- 13 More Insurance from National General

- 14 What are the disadvantages of general insurance?

- 15 Which insurance company has the highest customer satisfaction?

- 16 What time of year is cheapest to insure a car?

- 17 Which car company has least problems?

National General specializes in non-standard auto insurance for high-risk drivers. If you’re having trouble buying car insurance because of your driving record or other factors, companies like National General may be an option.

Drivers who insure their cars with National General may enjoy some of the benefits of their policy. For example, collision repairs at National General’s Gold Medal Repair have a lifetime warranty. Read also : Car Insurance: Average Cost in 2022. The company also offers emergency reimbursement of up to $500 for food, lodging and travel expenses if you are stranded due to an issue covered by your policy.

National General was founded in 1920 and sells multiple lines of insurance, such as auto, home, motorcycle and umbrella insurance. The company is headquartered in New York and sells insurance through an independent agent network of more than 55,000 agents nationwide. Allstate acquired National General in 2021.

National General Car Insurance Cost Comparison

Drivers who are considered high risk by car insurance companies should always expect to pay more for insurance than others. However, there are companies that can offer better prices. On the same subject : What the US auto insurance industry really thinks about electric vehicles and how to get the best policy. We reviewed National General car insurance rates for high risk drivers in California and found them to be very competitive with the top insurance companies.

Auto Insurance Complaints Against National General

The level of auto insurance complaints against National General is more than five times the industry average, based on complaints filed with state insurance departments nationwide. To see also : What is raising the prices of car insurance?.

Most of the complaints about National General auto insurance are related to delays in claim payments and unsatisfactory claims settlements.

National General’s Grade from Collision Repair Professionals: C-

In a survey of collision repair professionals by the CRASH Network, National General received a C grade.

The survey was based on the opinions of auto body experts who see how insurance companies compare in using lower-quality repair parts, whether an insurer’s claims process leads to fast and satisfactory claims for customers, and whether insurers encourage the use of repair procedures by recommended automakers.

Does National General offer Accident Forgiveness?

No, National General does not offer accident forgiveness as an optional coverage. Accident insurance “forgives” the accident and your premium will not increase if you are at fault for the accident.

Does National General Offer New Car Replacement?

Yes, National General offers new car trade-in insurance. This optional coverage will replace your car with a current model year or a new car if it is totaled due to an accident covered by your policy.

For cars up to three years old, National General car trade-in insurance will replace your car with a new car. If your car is four to 15 years old, car trade-in insurance will replace your car with a newer model with 20,000 kilometers less.

Does National General Offer Gap Insurance?

No, National General does not sell gap insurance. This is optional coverage that covers the “gap” between what you owe on a loan or lease and the depreciated value of your car if it’s totaled due to a problem covered by your policy (such as a car accident).

Does National General Offer a Diminishing Deductible?

Yes, National General offers a reduced deductible. You will receive a $100 credit toward your deductible for each 12-month policy period in which you have no claims, up to $500.

For example, if you have a $500 deductible and don’t file a car insurance claim during the 12-month policy period, you’ll get a $100 credit and your deductible will now be $400 if you need to file a claim.

Does National General Offer SR-22s?

Yes, National General offers SR-22 insurance. This is a document that proves to the state that you have car insurance. Reasons for needing an SR-22 may vary by state. Common reasons include a DUI conviction, a large number of traffic violations, or causing an accident while driving without insurance.

Does National General Offer Usage-Based Insurance?

Yes, National General offers usage-based car insurance. Drivers can sign up for National General’s DynamicDrive program, which uses the Routely app to track your driving habits, such as speeding, sudden and extreme braking, distracted driving due to phone use and the time of day you drive. You will immediately qualify for a discount of up to 10% for participating in DynamicDrive.

Does National General Offer Pay-Per-Mile Insurance?

No, National General does not sell pay-per-mile car insurance. With pay-per-mile insurance, you’ll typically pay a monthly or daily base rate and a per-mile rate. It can be a good option for low mileage drivers.

National General’s Auto Insurance Discounts

Discounts you can find at National General include:

More Insurance from National General

In addition to selling auto insurance policies, National General sells:

What are the disadvantages of general insurance?

Disadvantages include:

- It does not ‘reduce’ risk: General insurance is only a risk transfer mechanism, but this does not mean that the chances of a loss occurring are reduced.

- Moral hazard: Once an individual insures an asset, he may disregard its safety.

What type of risk does general insurance cover? General insurance helps us protect ourselves and the things we value, such as our homes, our cars and our valuables, from the financial impact of risks, big and small – from fire, flood, storm and earthquake, to theft, car accidents, travel accidents â and even from the costs of legal proceedings against us.

What is the purpose of insurance in general?

Purpose of Insurance Its objective is to reduce financial uncertainty and make accidental loss manageable. It does this by substituting the payment of a small, known fee – the insurance premium – to a professional underwriter in exchange for assuming the risk of a large loss and promising to pay in the event of such a loss.

What is risk in general insurance?

Risk in terms of insurance In terms of insurance, risk is the possibility that something harmful or unexpected will happen. This may involve loss, theft or damage to valuable property and belongings or may involve injury to someone.

What are the 4 types of risk in insurance?

Types of risk – the many different ways in which risks are categorized. A few categories commonly used are market risk, credit risk, operational risk, strategic risk, liquidity risk, and event risk.

What is a risk in insurance?

In terms of insurance, risk is the possibility that something harmful or unexpected may happen. This may involve loss, theft or damage to valuable property and belongings or may involve injury to someone.

What is risk and risk type in insurance?

Risk insurance refers to the risk or possibility of something harmful or unexpected occurring which could include loss or damage to a person’s valuable property or injury or death to a person where insurers assess these risks and, based on them, work out the premium that the insured should pay.

Which insurance company has the highest customer satisfaction?

US News Rating USAA is the best insurance company in our ratings. According to our 2022 survey, USAA customers report the highest levels of customer satisfaction and are most likely to renew their policies and recommend USAA to other drivers.

Which insurance companies have the highest ratings? Top rated companies include Geico, State Farm, Mass Mutual and New York Life; all have the highest possible grade A .

Who is the number 1 insurance company in America?

State Farm is the number one auto insurer in the country in terms of market share and premiums written, followed by Geico, Progressive and Allstate.

What is the largest American insurance company?

| Society | Net premiums written |

|---|---|

| State Farm Group | 66.2 billion dollars |

| Berkshire Hathaway (BRK.A) | 46.4 billion dollars |

| Progressive Insurance Group (PGR) | 41.7 billion dollars |

| Allstate Insurance Group (ALL) | 39.2 billion dollars |

What time of year is cheapest to insure a car?

Drivers who renew their insurance policies in August pay an average of 10 percent less than those who renew their policies in January. According to new data, August is the cheapest month of the year to take out a new car insurance policy.

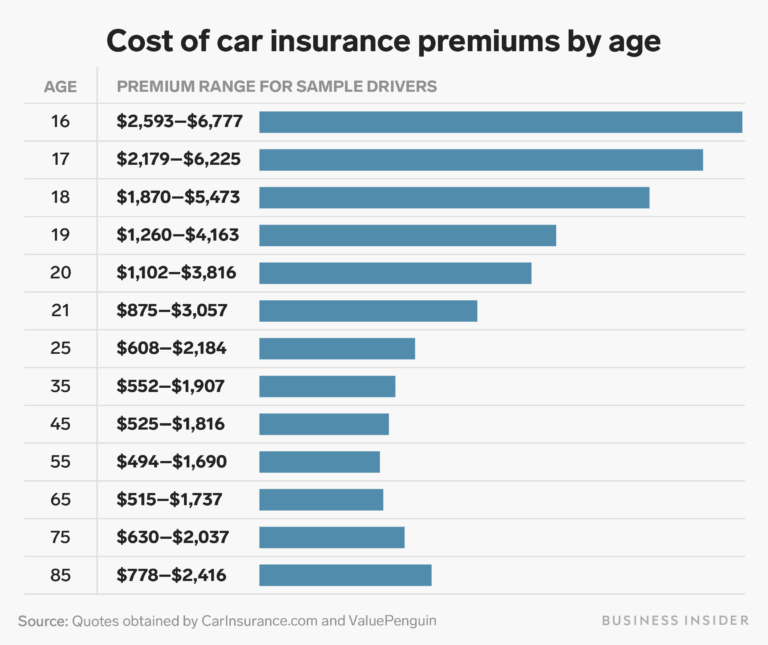

At what age is car insurance the cheapest? After young drivers gain more experience and turn 25, their car insurance costs drop by around 33%. Costs continue to generally drop with each birthday. When drivers turn 50, they will see their best rates. However, around age 60, auto insurance costs begin to rise and compare to what drivers see in their 40s.

What is the cheapest month to insure a car?

The only downside is that it is generally the most expensive time to buy a car insurance policy. “Our data shows that February and August are usually the cheapest months to buy car insurance.

State Farm and Geico are the cheapest major auto insurance companies in the country. State Farm offers an average rate of $41 per month for a minimum liability policy, which is 29% cheaper than the national average. Geico also offers cheap auto insurance deals from around $52 per month.

Is it better to pay car insurance monthly or every 6 months?

âPaying your full car insurance premium every six months will save you money. Depending on the insurance carrier, this could significantly lower your premium compared to monthly payments.

What time of year is car insurance most expensive?

Get a free insurance quote for your vehicle Drivers who insure their cars in December could pay more than 15% more than those who insure in February, the cheapest time of year, according to research by MoneySuperMarket.

Is 200 a month a lot for car insurance?

Yes, $200 a month is a lot for car insurance. Only four states have average rates for full coverage higher than $200 per month, and no states have average rates for minimum coverage that high.

Which car company has least problems?

RepairPal Most Trusted Car Brands 2022-2023: They also found that Asian car manufacturers dominate the car market with trusted brands. Toyota takes the top spot again with Honda, Kia, Lexus and Acura rounding out the rest of the top five.

Which car company has the fewest recalls? A new study by iSeeCars.com analyzed 31 years of recall history and found that Porsche boasts the lowest recall rate, Volkswagen the highest, GM has the best “recall timeliness” of the major automakers, Tesla earns the best recall proactivity, and Ford worst.