St. Petersburg Car Insurance: Best Cheap Rates (2022)

The Cheapest Car Insurance in St. Petersburg Costs $49 a Month on Average, and Geico, State Farm, Travelers and Farmers Offer the Lowest Rates in Town

We at the Home Media reviews team will break down how much car insurance costs in St. Petersburg based on different driving profiles and explain what factors can affect your car insurance rates. If you are looking for coverage, we recommend that you reach out to the best car insurance companies in the nation for free quotes.

Cheapest Car Insurance St. Petersburg

Contents

- 1 Cheapest Car Insurance St. Petersburg

- 2 Car Insurance Quotes in St Petersburg

- 3 Average Cost of Car Insurance in St. Petersburg

- 4 Cheap Car Insurance in St. Petersburg: Conclusion

- 5 What are the 3 types of car insurance?

- 6 What would cause an increase in insurance premiums?

- 7 What do you do after you pay off your car?

- 8 Why is new driver insurance so expensive?

The cheapest car insurance in St. Petersburg is typically offered by Geico, State Farm, Travelers, Farmers and Allstate. On the same subject : Do you want to make your car insurance profitable? here’s everything you need to know. How much you pay for car insurance in St Petersburg will vary depending on your driving history and the amount of car cover you choose.

Cheapest Liability Car Insurance in St. Petersburg

In St. Petersburg, we found that Geico and State Farm offer the cheapest state minimum coverage on average. Read also : What is the gender rule in insurance?. Geico costs an average of $49 per month and $585 per year for a minimum auto policy, while State Farm averages $72 per month or $866 per year.

Each state sets different requirements when it comes to car insurance coverage. It usually includes liability coverage (bodily injury liability and property damage liability) as a minimum.

Cheapest Full-coverage Car Insurance in St. Petersburg

The car insurance providers that offer the cheapest full coverage rates in St. On the same subject : Future Generali Car Insurance Review – Forbes Advisor INDIA. Petersburg are generally State Farm, with an average of $162 per month or $1,941 per year, and Geico, with an average of ‘ $178 per month or $2,141 per year.

The most expensive full coverage provider in St. Petersburg, Fla., is often National General Insurance, which charges an average of $342 per month or $4,108 per year.

Car Insurance Quotes in St Petersburg

Car insurance quotes depend on a variety of factors, such as age, gender and driving record. Below are car insurance quotes based on our average estimates for the cheapest car insurance rates in St. Petersburg for several of these factors.

Cheapest Car Insurance St. Petersburg: Age and Marital Status

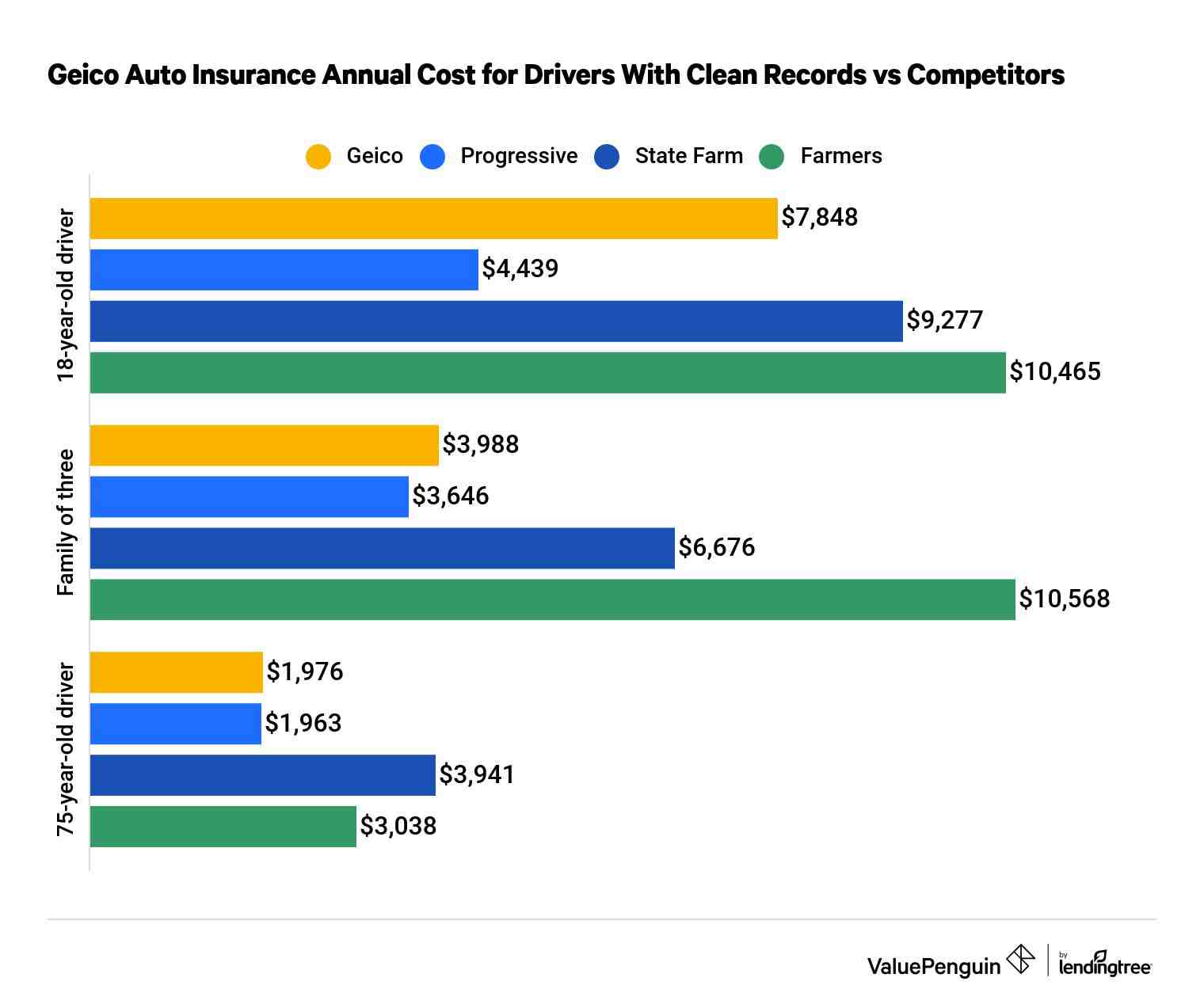

Age is one of the factors that significantly affects car insurance premiums. If you are young or a younger driver, you can expect to pay more for car insurance. This is because insurance agencies see you as a higher risk until you have more experience behind the wheel.

Marital status also affects car insurance rates, as married drivers usually pay less for coverage than single drivers.

The costs below reflect the average rates for 24-year-old drivers and 35-year-old married drivers in St. Petersburg. As shown below, 24-year-old single drivers pay hundreds of dollars more for full coverage car insurance than 35-year-old married drivers.

Cheapest Car Insurance St. Petersburg: Gender

On average, car insurance rates for men and women tend to be about the same. But sometimes, the costs can vary depending on the location and the type of vehicle you buy.

The table below shows the average cost of full cover car insurance by provider for male and female drivers aged 35. Geico tends to be the cheapest provider for both groups.

Cheapest Car Insurance St. Petersburg: High-risk Drivers

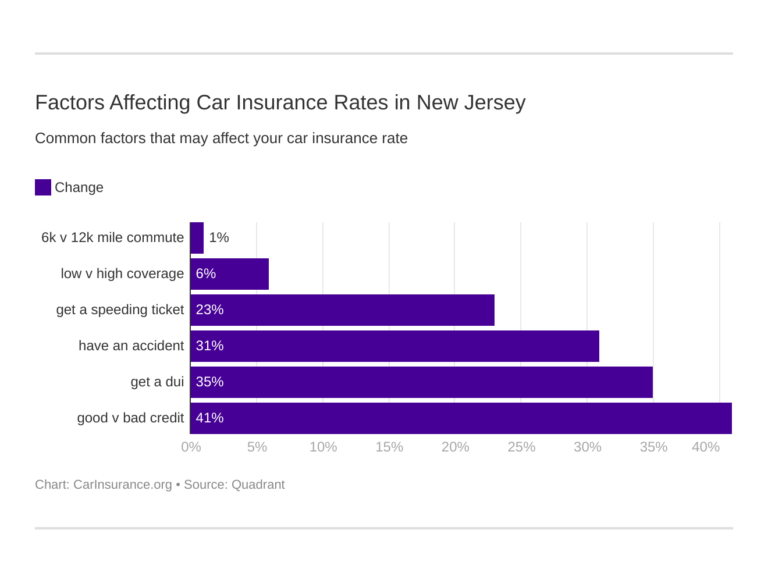

Another significant factor that can impact your car insurance rates is your driving record. If you have a speeding ticket, DUI or at-fault car accident on your record, you could pay hundreds of dollars more for car insurance coverage each year.

The sections below highlight the providers that offer the cheapest full coverage car insurance based on different driving violations.

Car Insurance Prices in St. Petersburg: Speeding Ticket

According to our rate estimates, State Farm and Travelers provide the best rates on average for drivers with a recent speeding ticket. State Farm costs $183 per month or $2,199 per year on average, while drivers pay an average of $210 per month or $2,518 per year for full coverage with Travelers.

Car Insurance Prices in St. Petersburg: At-fault Accident

In St. Petersburg, having an at-fault accident on your driving record can have a significant impact on your car insurance rates. We found that State Farm generally provides the lowest car insurance prices for drivers with a recent accident on their record, costing $196 per month or $2,354 per year on average for full coverage.

Car Insurance Prices in St. Petersburg: DUI

Car insurance in St. Petersburg skyrockets if you have a recent DUI on your record. Based on our cost estimates, State Farm typically provides the cheapest car insurance for drivers with a DUI, costing $183 per month or $2,199 per year on average for full coverage.

Average Cost of Car Insurance in St. Petersburg

Based on our research, the average cost of car insurance in St. Petersburg is $244 per month or $2,926 per year for a full coverage insurance policy. This is about 69% more expensive than the national average, which is $1,730 per year. These averages are based on a 35-year-old driver with a clean driving record and good credit score.

Car Insurance Prices in St. Petersburg: What Affects Them?

Car insurance costs are based on several factors, some of which are within your control and some of which are not. Understanding the factors that are within your control can help ensure that you get the best car insurance quotes possible.

Here are the factors that affect car insurance rates:

Cheap Car Insurance in St. Petersburg: Conclusion

The average cost of car insurance in St. Petersburg is much higher than the national average even if you have a perfect driving record. City drivers can generally find affordable car insurance through Geico, State Farm, Travelers, Farmers and Progressive.

Cheapest Auto Insurance in St. Petersburg: FAQ

Below are frequently asked questions about car insurance in St. Petersburg:

What are the 3 types of car insurance?

3 Types of Auto Coverage Explained

- Liability coverage. Protects you if you cause harm to others and/or their stuff. …

- Collision coverage. It covers your car if you hit another car, person or immovable object (like those darn ornamental rocks that cousin Todd has at the end of his driveway). # …

- Comprehensive coverage.

What type of car insurance is best? Which is better Car Insurance? Taking comprehensive car insurance cover is always advisable as it provides full protection not only of someone else’s car such as Third Party car insurance, but also the Own damages to your car, as also any injury to the owner driver.

What are the 2 main types of car insurance?

The two main types of car insurance policies are liability only and full coverage. While liability-only policies have liability insurance for bodily injury and property damage, full coverage includes comprehensive and collision insurance along with state minimum coverage.

What is basic car insurance called?

Basic car insurance is often known as liability insurance. Requirements vary by state, but basic auto insurance can be divided into two main types of liability insurance: personal injury and property damage.

What are the two types of car insurance?

Six common car insurance coverage options are: auto liability coverage, uninsured and underinsured motorist coverage, comprehensive coverage, collision coverage, medical payments coverage and personal injury protection.

What is the most common type of car insurance?

Bodily injury (BI) liability coverage is the most common type of auto insurance because it is required in almost every state.

What is the most common type of car insurance?

Bodily injury (BI) liability coverage is the most common type of auto insurance because it is required in almost every state.

What type of coverage is best for car insurance?

You should carry the highest amount of liability cover you can afford, with 100/300/100 being the best level of cover for most drivers. You may need to carry additional coverage to protect your vehicle, including comprehensive, collision and void coverage.

What are the 5 basic types of auto insurance?

Six common car insurance coverage options are: auto liability coverage, uninsured and underinsured motorist coverage, comprehensive coverage, collision coverage, medical payments coverage and personal injury protection.

What are 4 main types of coverage and insurance?

Four types of insurance that most financial experts recommend include life, health, auto and long-term disability.

There are some things that are out of your control but can still affect your premium, including: rising repair costs, an increase in distracted drivers on the road, more drivers on the road, higher speed limits in your geographic area, and an increase in uninsured drivers.

What causes health insurance premiums to increase? Americans spend a large amount on health care each year, and the cost continues to rise. In part, this increase is due to government policy and the start of national programs such as Medicare and Medicaid. There are also short-term factors, such as the financial crisis of 2020, that will raise the cost of health insurance.

What do you do after you pay off your car?

Once you have paid off your loan, your lien must be satisfied and the lien holder must send you the title or release document within a reasonable period of time. Once you receive any of these documents, follow your state’s protocol for transferring title to your name.

Is Colorado a title state? There are only nine states that hold the title: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin.

What happens when you pay off a car loan early?

Prepayment penalty Lenders make money from the interest you pay on your loan each month. Paying off a loan early usually means you pay no more interest, but there may be an early prepayment charge. The cost of those fees may be more than the interest you pay on the rest of the loan.

Do I pay less interest if I pay off my car loan early?

Pre-calculated interest is fully calculated in advance, and the total amount of interest you have to pay your lender does not change even if you start paying off your loan faster. Whether you are paying simple or pre-calculated interest will make a difference in your early payment options.

Is it good to pay off a car loan early?

Paying off a car loan early can save you money – as long as the lender doesn’t assess too large a prepayment penalty and you don’t have other high-interest debt. Even a few extra charges can go a long way in reducing your costs.

Is it better to pay off car loan early or save?

Save Money Paying off your loan early means you will eventually free up your monthly money for other expenses when the loan is paid off. It also lowers your car insurance payments, so you can use the savings to stock up for a rainy day, pay off other debt or invest.

Is Oklahoma a title holding state?

As of July 1, 2022 Oklahoma is a title holder state. Once the Oklahoma title is released, the title is sent or held electronically to the lien holder.

Who holds title in Oklahoma?

Effective July 1, 2022, Oklahoma became a state that has a title for all vehicles, boats and motorcycles that are issued a title. We are here to help you stay informed and understand the changes on this new title retention requirement in sunny Oklahoma!

Is Oklahoma going to electronic title state?

OKLAHOMA CITY â Oklahoma is now the 25th state in the nation to enact legislation allowing the use of electronic titles and liens for vehicles, boats, trailers and farm equipment. Senate Bill 998, authored by Sen. Rob Standridge, R-Norman, and Rep. Mike Osburn, R-Edmond, was approved by Gov.

Does lienholder hold title in Oklahoma?

We wanted to offer the following updates to our vehicle records processes in Oklahoma. Effective July 1, 2022, Oklahoma will become a state that has a title for all vehicles, boats and motorcycles that are issued a title. All securities processed on or after July 1st with an active lien will be held by the lien holder.

Why is new driver insurance so expensive?

Young drivers cost more to insure because they are statistically more likely to have an accident — around 25% of all claims are made by drivers under the age of 25. Insurers also look at many other things when working out how old you are. pay for a policy, including your: Vehicle. Job title.

Why is car insurance so expensive under 25? The reason why insurance is higher for a person under 25 is because younger drivers are statistically more likely to get into an accident than older drivers – therefore they are more risky for insurance companies.

Why are new cars insurance so expensive?

Because of their value, cost of repair, risk of theft and other factors, it can cost more to insure a new car versus an older one. If your new vehicle is financed, your lender will likely require you to carry more insurance than the legal minimum, which typically results in higher premiums.

Do newer cars have more expensive insurance?

How much does new car insurance cost? New cars are generally more expensive to insure than old ones, particularly if you carry comprehensive and collision insurance, as they cost more and are therefore more expensive to replace.

Why is insurance more expensive for teens?

Research shows that due to a lack of experience behind the wheel, young drivers get into more accidents than the average adult, which puts young drivers in a higher risk category. This is the main reason why young drivers pay a much higher premium for their insurance.

Why do younger people pay more insurance?

It is a matter of statistics. Younger drivers generally have more car accidents because they have less experience. As a result, they are more expensive to insure. Younger drivers also tend to buy more for car insurance.

Why do teens pay more for insurance coverage?

Many do not have an established credit history, and even responsible teenagers, do not have an established driving record. Therefore, insurers consider them “riskier” drivers behind the wheel. This will automatically lead to insurers raising rates when adding a teenager to a car insurance policy.

Why is 18 year old insurance so expensive?

Car insurance is so expensive for 18-year-olds because teenagers are more likely to make a claim than older, more experienced drivers. Car insurance companies consider 18-year-olds to be high-risk drivers and charge them higher premiums as a result.

Why is car insurance so expensive for new drivers UK?

Why is car insurance more expensive for young drivers? In other words, young drivers are higher claim risks, so they can often pay more than double the average car insurance premium. The average comprehensive policy costs 17-24 year olds £1,835** a year.

Why is car insurance so expensive in Britain?

Higher repair costs factor into higher claims values in London, meaning insurers raise premiums for capital drivers. Many Londoners also pay higher premiums because they are driving expensive vehicles, which cost more to repair and replace and are also more likely to be targeted by thieves.

Why is new driver insurance so expensive?

Young drivers cost more to insure because they are statistically more likely to have an accident – approximately 25% of all claims are made by drivers under 25. Insurers also look at many other things when working out how much. you have to pay for a policy, including your: Vehicle. Job title.

Will my car insurance go down after a year UK?

This depends entirely on you and your driving. If you have had a claim-free bank account for a year, it is likely that your insurance premium will be lower after twelve months, unless other circumstances have changed.