Study: Florida is No. 2 in cost of car insurance in the nation

Where is car insurance most expensive in the US?

Contents

These are the countries that cost the most for full-coverage car insurance:

- Michigan: $3,785 per year. To see also : Car insurance prices set to rise another 4% by the end of the year: study.

- Connecticut: $2,999 per year.

- Florida: $2,947 per year.

- New York: $2,783 per year.

- Louisiana: $2,783 per year.

Is State Farm leaving Florida?

Will State Farm leave Florida in 2023? Business | State Farm Florida is now the second largest home insurance company. It promises to live in Florida. See the article : Do you need insurance coverage for your car and home? Here are some of the best home and car insurance packages. PUBLISHED: July 24, 2023 at 7:00 a.m. | Updated: July 24, 2023 at 4:34 p.m.

Which insurance company is issuing from Florida? Farmers Insurance is the latest home insurance company to exit the Florida market, listing the move as a business decision that was “necessary to properly manage risk exposure,†according to a company statement given to Fortune.

What is the rate of State Farm in Florida? Yes, State Farm is the best insurance company in Florida. State Farm has a 4.1/5 rating from WalletHub editors, as well as an impressive A rating from the Better Business Bureau and a positive score of 0.67 from the National Association of Insurance Commissioners (NAIC).

What states is State Farm pulling out of?

Four property and casualty insurance companies – State Farm and Allstate – have confirmed they will stop issuing new home insurance policies in California, which may have come as a shock but should not have been a surprise. To see also : What are the common types of car insurance?. It’s a pattern Florida and other hurricane- and flood-prone areas know well.

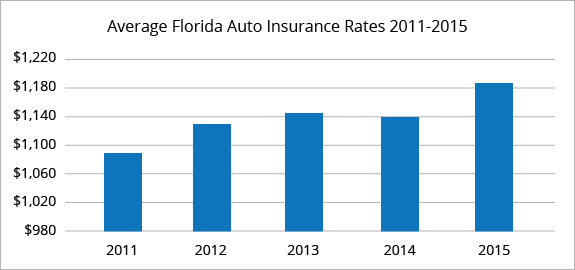

Where does Florida rank in car insurance rates?

Florida has the nation’s highest auto insurance rates. Not only do Sunshine State drivers pay the highest premiums in the country, but experts say these rates are only set to rise. On average, drivers in Florida shell out $2,560 each year, according to the motor vehicle application service FINN. The national average per year is $1,682.

Is Florida an expensive state for car insurance? In Florida, comprehensive auto insurance costs an average of $260 per month, while the minimum coverage is $94 per month. Comprehensive car insurance in Florida costs 37 percent more than the average cost of car insurance nationwide.

Are car insurance premiums high in Florida? Florida is among the most expensive states for auto insurance. According to estimates from Quadrant Information Services, Florida drivers pay $115 a month or $1,385 a year for an average minimum-coverage auto insurance policy.

Where does Florida rank in auto insurance? Car insurance costs by state: The most expensive and cheapest states for car insurance in 2024. Florida is the state with the most expensive car insurance, while Ohio is the cheapest. Read our complete guide to the cheapest and cheapest car insurance in the world.

Is car insurance cheaper in Florida or California?

You should expect to pay less for auto insurance when you move. The average annual auto insurance rate in California is $113 less than the average price in Florida. The exact price will depend on your coverage, driving history, and your auto insurance company.

Which city in Florida has the cheapest car insurance? On average, Gainesville and Tallahassee are the cheapest cities in Florida for full-coverage car insurance.

Is car insurance more expensive in Florida than California?

Florida vs. California auto insurance â premiums are equal. You should expect to pay less for auto insurance when you move. The average annual auto insurance rate in California is $113 less than the average price in Florida.

Is car insurance expensive in California?

The average cost of comprehensive auto insurance coverage in California is $2,089 per year or about $174 per month. This is almost 21% more expensive than the national average, according to our research. These estimates are based on the profile of a 35-year-old driver with a clean driving record and a good credit score.

Why is it so hard to get car insurance in California? Insurance companies still find it difficult to do business in the Golden State because regulations don’t allow them to raise rates when they want to. Drivers in California are still dealing with the consequences of tightening the insurance industry.

Is Florida more expensive for car insurance?

Florida drivers pay higher car insurance premiums than the national average. State claims are also down, which means drivers in the region may want to consider purchasing comprehensive policies that include collision and comprehensive coverage to ensure they are fully protected.