Mastering the Art of Compare Car Insurance

In the intricate world of car insurance, understanding how to compare policies effectively is crucial. This comparison not only ensures that you secure a policy that best meets your unique needs but also that you do so at the most competitive price available. The process involves examining various factors such as coverage options, premiums, customer service quality, and the financial stability of insurance providers. This guide aims to demystify the process, offering you the knowledge needed to make an informed decision when comparing car insurance.

The Importance of Comparing Car Insurance

Contents

- 1 The Importance of Comparing Car Insurance

- 2 Key Factors to Consider When Comparing Car Insurance

- 3 Practical Tips for Compare Car Insurance

- 4 FAQs About Comparing Car Insurance

- 5 Utilizing Technology in Your Comparison

- 6 The Role of Customer Reviews and Ratings

- 7 The Final Step: Making an Informed Decision

- 8 Conclusion

Comparing car insurance is more than just a means to find the cheapest option; it’s a strategy to discover the best value for your investment. To see also : Michigan lawmakers vote on auto insurance bills. With the right approach, you can uncover policies that offer comprehensive coverage at a price that aligns with your budget, thereby ensuring that your vehicle is adequately protected without overspending.

Key Factors to Consider When Comparing Car Insurance

- Coverage Options: Understand the types of coverage available and decide which ones are essential for your situation.

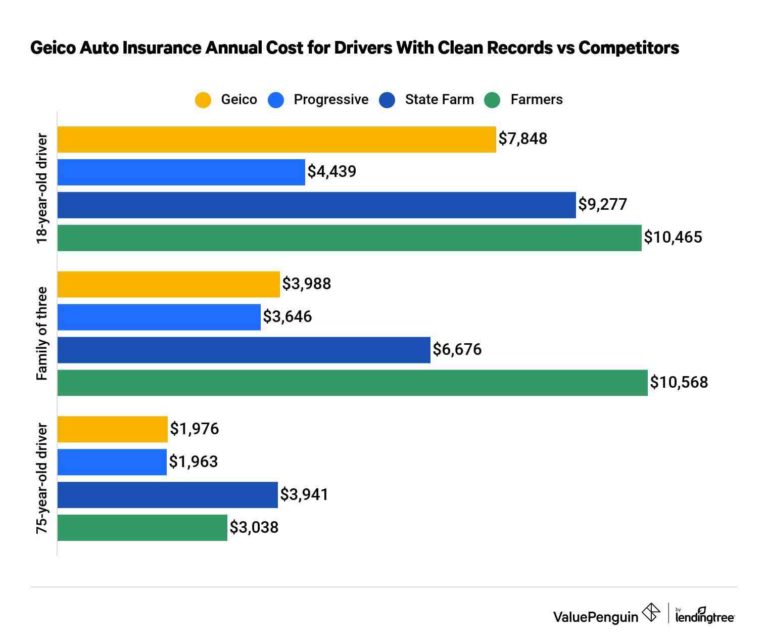

- Premiums: Consider not only the cost but also the payment options and discounts that may apply.

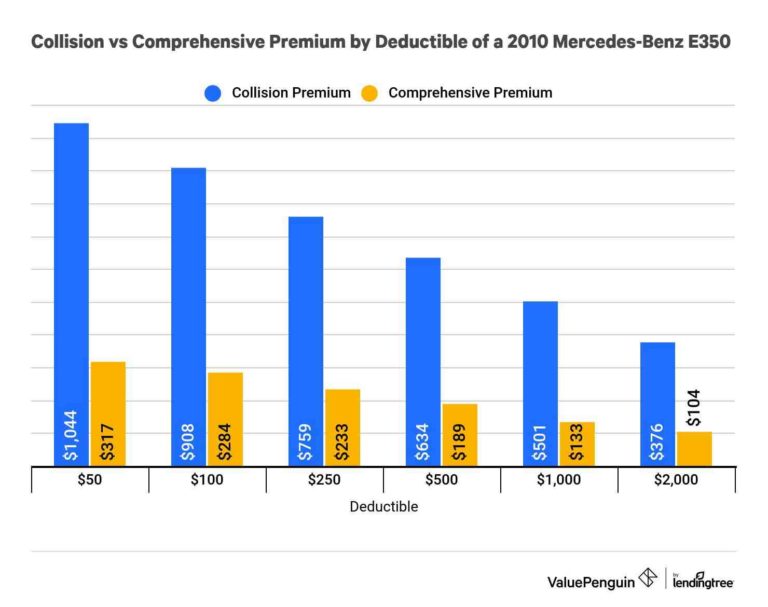

- Deductibles: Higher deductibles can lower your premiums, but ensure you can afford them in case of a claim.

- Company Reputation: Research insurers’ reputations for customer service and claims satisfaction.

- Policy Limits: Ensure the policy limits are sufficient to protect your assets in the event of a major accident.

Practical Tips for Compare Car Insurance

- Gather Accurate Information: Prepare all necessary personal information and details about your vehicle to get the most accurate quotes.

- Use Comparison Tools: Online comparison tools can simplify the process, allowing you to see quotes from multiple insurers side by side.

- Read the Fine Print: Pay close attention to exclusions, limitations, and conditions in the policy documents.

- Consider the Insurer’s Network: Ensure the insurer has a robust network of repair shops and claims service centers.

FAQs About Comparing Car Insurance

How often should I compare car insurance policies?

It’s advisable to compare policies annually or after significant life changes, such as moving or buying a new car, to ensure you always have the best deal. See the article : Which is a type of insurance to avoid?.

Can I switch insurers if I find a better deal?

Yes, you can switch insurers if you find a policy that offers better value, but be mindful of any cancellation fees or penalties. See the article : How to make a car insurance claim – Forbes Advisor UK.

Will comparing car insurance affect my credit score?

No, car insurance quotes typically involve a soft inquiry, which does not affect your credit score.

Utilizing Technology in Your Comparison

Highlight how technological advancements, such as mobile apps and online comparison platforms, have made comparing car insurance quotes more accessible and efficient than ever before. Encourage readers to take advantage of these tools to streamline their comparison process.

The Role of Customer Reviews and Ratings

Discuss the importance of considering customer reviews and independent ratings in your comparison. These can provide valuable insights into an insurer’s customer service quality and claims handling efficiency.

The Final Step: Making an Informed Decision

Emphasize the importance of weighing all factors before making a decision. Remind readers that the cheapest option is not always the best and that finding the right balance between cost and coverage is key.

Conclusion

Comparing car insurance is a critical step in securing the right protection for your vehicle at the best possible price. By focusing on the essential factors, utilizing available tools, and conducting thorough research, you can navigate the comparison process with confidence. Remember, the goal is not just to save money but to ensure that you and your vehicle are adequately covered. Take the time to compare options, ask questions, and choose a policy that aligns with your needs and budget. In doing so, you’ll not only protect your vehicle but also gain peace of mind knowing you’ve made an informed, financially savvy decision.