The best car insurance companies based on cost, coverage and service

Car insurance is a necessary expense for most Americans, as driving without it is illegal and public transportation options are limited outside of major US cities. Vehicle insurance can be expensive, especially if you’re a new driver or luxury car insurance, but it can save you tens of thousands of dollars in the event of damage or theft.

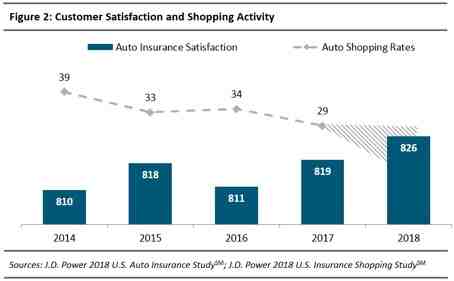

The ideal car insurance company combines good coverage with reasonable rates and excellent customer service. While price is important when shopping for auto insurance, it shouldn’t be the only factor. You will want to choose a company with a high customer satisfaction rating. This makes the process smooth and hassle-free when you need to file a claim. At the same time, a good car insurance company will offer many discounts to encourage good customers.

So which is the best car insurance company? This depends on various factors. Below, Select breaks down the best car insurance companies into five main categories. (See our methodology for more information on how we chose the best auto insurance companies.)

Best car insurance companies

Contents

- 1 Best car insurance companies

- 2 Best overall

- 3 Best for wide coverage

- 4 Best for customer satisfaction

- 5 Best for discounts

- 6 Best for military members and veterans

- 7 FAQs

- 8 How does car insurance work?

- 9 What are the different types of car insurance coverage?

- 10 How can I find the best price on car insurance?

- 11 Can you get a refund on car insurance?

- 12 Do car insurance companies check your credit?

- 13 How do car insurance companies pay out claims?

- 14 Bottom line

- 15 Our methodology

- 16 Who usually has the lowest car insurance?

- 17 Is Allstate good at paying claims?

- 18 Does life insurance give you money?

- 19 Is State Farm good about paying claims?

Subscribe to the Select Newsletter! On the same subject : How does insurance company make money?.

Our top picks in your inbox. Shopping recommendations to help improve your life, delivered every week. Apply here.

Best overall

Geico Auto Insurance

Cost

The best way to estimate your costs is to request a quote On the same subject : Who is the number 1 insurance company?.

App available

Policy highlights

Geico coverage and services are available in all 50 states and the District of Columbia, and 16 different types of discounts are available. In addition to the standard coverage options, Geico offers a variety of optional extras such as emergency roadside assistance, rental car reimbursement and mechanical breakdown insurance.

Pros

Cons

Geico is the best auto insurance company for affordable coverage, offering the lowest average premiums for minimum and full coverage. He also has a relatively high J.D. Power for customer satisfaction, an A++ rating from AM Best and an A+ rating from the Better Business Bureau (BBB). Finally, Geico has a wide variety of insurance products, including homeowners insurance and renters insurance, that make it easy to bundle and save on coverage.

Average annual premium for minimum coverage: $365

Average annual premium for maximum coverage: $1,297

Best for wide coverage

Nationwide Auto Insurance

Cost

The best way to estimate your costs is to request a quote Read also : Navy Insurance is fully connected to Texas Unconventional Car Insurance.

App available

Policy highlights

Nationwide offers nearly nationwide availability and customized services like the On Your Side® Review, a free annual insurance evaluation to ensure you’re properly protected and taking advantage of all the discounts available to you.

Pros

Cons

Nationwide offers one of the broadest networks of auto insurance, with coverage available in 47 states and the District of Columbia (all states except Alaska, Louisiana and Massachusetts). This is an important difference, as more companies competing for your business means lower premiums.

When it comes to coverage, Nationwide offers some of the lowest average car insurance rates for maximum coverage and some of the highest for minimum coverage. If you can combine your insurance products and save on overall coverage, Nationwide could be a good choice for you.

Average annual premium for minimum coverage: $549

Average annual premium for maximum coverage: $1,383

Best for customer satisfaction

State Farm Auto Insurance

Cost

The best way to estimate your costs is to request a quote

App available

Policy highlights

State Farm is one of the largest auto insurance companies by market share and has an excellent reputation for customer satisfaction. It offers 13 discounts, including for safe driving and young drivers.

Pros

Cons

According to the National Association of Insurance Commissioners (NAIC), State Farm is the largest auto insurer in the United States by market share. He has the highest grade point average of the J.D. Power among the companies on this list, making it best-in-class in terms of customer satisfaction.

State Farm’s full coverage premiums are among the lowest, while minimum coverage rates are right in the middle. State Farm enjoys an A++ rating from AM Best, indicating excellent financial health. In addition to auto insurance, State Farm offers a wide range of other insurance products, so include as many as you can in your offer. You may be able to save money on the total cost of your policy.

Average annual premium for minimum coverage: $456

Average annual premium for maximum coverage: $1,397

Best for discounts

Farmers Insurance

Cost

The best way to estimate your costs is to request a quote

App available

Policy highlights

Farmers sells auto insurance in every state except Alaska, Delaware, Hawaii, Maine, New Hampshire, Rhode Island, Vermont, Washington, D.C., and West Virginia and offers an incredible 22 discounts.

Pros

Cons

Each car insurance company offers different discounts to encourage safe drivers, good students and customers who insure multiple vehicles. The more discounts available, the greater your potential savings. Kmečka zavarovalnica offers 22 discounts on car insurance, which is the most among all insurance companies.

You can save by joining paperless billing, bundling other insurance products, paying premiums on time and other activities. Regardless of which company you insure your vehicle with, you should familiarize yourself with the various discounts available. With Farmers you will have more options than with other companies.

Average annual premium for minimum coverage: $550

Average annual premium for maximum coverage: $1,524

Best for military members and veterans

USAA Auto Insurance

Cost

The best way to estimate your costs is to request a quote

App available

Policy highlights

USAA auto insurance is available in all 50 states, Washington D.C. and some international locations. In addition to low rates and coverage options for unique circumstances, such as active members, customers have access to an intuitive mobile app.

Pros

Cons

USAA stands out because it enjoys high rankings based on several factors. For starters, it offers the lowest average premiums. Equally important is customer satisfaction, as no one wants to deal with a difficult customer service experience when they file a claim. Fortunately, USAA has J.D.’s highest customer satisfaction ratings. Power, so you know you are “in good hands”.

The only catch? Not available to everyone – only military members, veterans and their immediate family members are eligible for a USAA auto insurance policy.

Average annual premium for minimum coverage: $354

Average annual premium for maximum coverage: $1,209

FAQs

How does car insurance work?

Car insurance covers damage, theft and bodily injury in the event of an accident. You pay a monthly (or biannual) premium based on the coverage you need and the type of policy. In the event of an accident, you can file a claim and your insurance company will pay you the damages based on different criteria. Making claims can sometimes lead to higher premiums, so you’ll want to do so with caution. Car insurance companies offer lower premiums to drivers with clean records because they are less likely to make claims.

What are the different types of car insurance coverage?

Car insurance has five main types of car insurance that you can include in your policy. Each offers different levels of loss protection. At a minimum, you will need liability insurance that protects against damage and bodily injury. Depending on the level of protection you are looking for, you may want to add additional coverage to your policy. Here’s a look at some of those options:

How can I find the best price on car insurance?

You can find the best price for car insurance by requesting a quote directly on the website of each insurance company. Some aggregators will get auto insurance quotes from multiple companies when you submit one form.

By shopping around for auto insurance, you can find the plan that best fits your budget and coverage needs. You can save money by adding other products to your policy, such as homeowners insurance and renters insurance.

Can you get a refund on car insurance?

Car insurance is usually paid monthly or twice a year. If you have already paid your premium for the policy period and wish to cancel it, you will generally receive a partial refund for the unused portion.

Do car insurance companies check your credit?

How do car insurance companies pay out claims?

In the event of an accident, you can file a claim with your insurance company by calling the claims department. Major insurance companies have mobile applications that allow you to quickly submit claims and upload all the necessary documents in one place.

Automobile insurance companies pay claims after investigation and review of all related documents. Please check your policy for any restrictions on your coverage.

Bottom line

Auto insurance is an unavoidable and costly expense for most Americans, and many companies are competing for your business. By understanding how premiums are priced and requesting multiple quotes, you can save money while ensuring your vehicle is protected against damage and loss. Consider customer satisfaction ratings and you’ll increase your chances of being satisfied if you ever have to file a claim.

Our methodology

To determine the best auto insurance companies, Select analyzed dozens of U.S. insurance companies that have policies that fit a variety of needs.

In narrowing down and ranking the best auto insurance companies, we focused on average cost, coverage, availability, ease of use and customer satisfaction using data from the National Association of Insurance Commissioners, AM Best, J.D. Power rankings and auto insurance premium data from Bankrate .com.

The average annual premium figures are based on a 40-year-old driver with an unblemished driving record and good credit. The driver insures a 2020 Toyota Camry, drives five days a week and drives 12,000 miles annually with the following full coverage limits:

After reviewing the features above, we’ve ranked our recommendations by Best for High Value Coverage, Best Overall, Best for Broad Coverage, Best for Customer Satisfaction, Best for Discounts, and Best for Military & Veterans.

Please note that premiums and policy structures advertised for auto insurance companies may fluctuate according to company policies.

Check out Select’s in-depth information on personal finance, technology and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up-to-date.

Editor’s Note: The opinions, analyses, ratings or recommendations expressed in this article are those of the Select editorial staff and have not been reviewed, approved or otherwise endorsed by any third party.

Who usually has the lowest car insurance?

Cheapest car insurance – December 2022

- Geico is the cheapest auto insurance company overall with an average rate of $29 per month for minimum coverage.

- Geico is also the cheapest for drivers with bad credit or a recent accident.

- American Family is the cheapest after DUI.

Is insurance cheaper at 25? Usually yes. At Progressive, interest rates drop an average of 9% at age 25. However, there are other cost factors that affect your car insurance, such as your claims history. So if you’re in an accident right before you turn 25, your rate may not drop.

Who typically has the cheapest car insurance?

State Farm and Geico are the most affordable large auto insurers in the country. State Farm offers an average rate of $44 per month for a minimum liability policy, which is 26% below the national average.

What’s the cheapest kind of car insurance?

What is the cheapest type of car insurance? Public liability coverage is the cheapest type of auto insurance. Liability-only insurance costs an average of $1,333 less than a full-coverage policy.

Is Geico more expensive than progressive?

Geico is cheaper for adults Both Geico and Progressive offer average prices for adult men that are below the national average. However, Geica rates are still lower than Progressive rates. Progressive’s average adult female rate is higher than the national average and higher than adult male rates.

What age group has the cheapest car insurance?

Costs continue to generally decline with each birthday. Once drivers turn 50, they will see their best rates. Around age 60, however, auto insurance costs begin to rise and compare to what drivers see in their 40s.

Which age group pays most for car insurance?

18-year-old drivers pay the highest auto insurance premiums among the age groups Bankrate analyzed. Men can expect to pay $5,694 a year for full coverage, while women pay an average of $4,964 a year.

Is insurance cheaper when you turn 25?

In general, younger drivers tend to pay more for car insurance, but once you turn 25, the cost of your insurance policy can drop. According to CarInsurance.com, the average annual premium for a 24-year-old male with full coverage is $2,273. At age 25, that average drops to $1,989, a decrease of about 12.5%.

At what age is car insurance cheapest?

Experienced drivers are less likely to have claims in the event of an accident, which means their insurance costs less. With Progressive, the average premium per driver typically drops significantly from 19 to 34 and then stabilizes or decreases slightly from 34 to 75.

Is Allstate good at paying claims?

According to our survey data, Allstate is tied with Progressive and Travelers with a score of 4.1 out of 5, well behind No. 1 USAA. Forty-six percent of customers who filed a complaint say that they are completely satisfied with the ease of filing a complaint and the service provided.

. Once the matter is settled, you’ll usually get a check much faster than if you negotiated and got a firm offer in the first place. The time it takes for Allstate to send a check is usually between 20 and 45 days.

Does life insurance give you money?

What is life insurance? Life insurance is a contract between you and the insurance company. Basically, in exchange for your premium payments, the insurance company will pay your beneficiaries a lump sum after your death, known as a death benefit. Your beneficiaries can use the money for any purpose.

How much does life insurance typically pay out? What is the average life insurance payout? The average life insurance payout is $168,000. Many life insurance experts recommend purchasing a policy with a death benefit of seven to ten times your annual salary. If your salary is $60,000, the death benefit would equal $420,000 to $600,000.

Does life insurance pay you back?

An insurance policy is generally not something you can get your money back for. But there is one exception: life insurance with return of premium. Also known as ROP life insurance, this type of cover pays you back the money you paid in premiums if you don’t die during the term.

Is State Farm good about paying claims?

Is State Farm good at paying claims? State Farm is generally good at paying claims. The company received a score of 892 out of 1000 in the J.D. Satisfaction Study. Power Auto Claims Satisfaction Study, ranking it sixth.

.