The cost of auto insurance has increased dramatically every month this year

The BLS has car insurance data but it is not seasonally adjusted. Nevertheless, let’s take a look at what’s going on.

CPI data from BLS, calculation and chart by Mish

CPI Car Insurance Percentage Change from Year Ago

Over the past year, the cost of car insurance is up 8.72 per cent and rising fast.

CPI Car Insurance Index Details

CPI Car Insurance Index Since 2012

Between 2018 and 2020 the growth in car insurance rates leveled off. From the end of the pandemic, and especially starting in 2022 (leading chart) the cost of insurance is on a tear with no end in sight.

The New York Time reports ‘I Honestly Think It’s a Game’: Why Carjacking Is on the Rise Among Young People

“I honestly believe it’s a game,” said Mr. Majeed. Stolen cars used to be stripped down, with the parts sold for cash, he said. Nowadays people are carjacked, and the cars are often found afterwards, in an accident or just left on the street. “It’s a game.”

In the strange mathematics of the last two pandemic years, as various types of crime have increased and plummeted, carjacking has made an alarming resurgence. The number of reported incidents nearly quadrupled in Philadelphia between 2019 and 2021 and is on track to double this year; Chicago had more than 1,900 carjackings last year, the highest number in decades. Two months into 2022 the number of armed carjackings in New Orleans was already at two-thirds of the total for the entire year in 2019. Washington, DC, where 426 carjackings were reported last year, is no exception.

But none of this fully explains what officials say is the most troubling part of the trend: the age of so many who have been arrested. Fourteen-year-olds, some 12-year-olds, even some 11-year-olds have been accused of armed murder or in some cases.

“It has been interesting during my career to watch the mix of crime change without appearing to be an explanation,” said Professor Ferrer. “Many of these are crimes of opportunity, people looking for that kind of low-hanging fruit.”

What is clear, he says, is that the long-term impact of the individual and traumatic pandemic years on young people’s development cannot be overstated. Although schools are back to personal learning and leisure centers are reopening, that effect – and the increase in carjackings – has not gone away.

Car insurance is like a rental. Mostly it increases once a year or possibly every six months. Then it jumps in one big adjustment that the BLS slices and dices into 12 buckets.

For August, the BLS says that car insurance was 2.4 percent of the CPI. At the rate it is rising it adds a little bit to the overall index every month.

Inelastic item insurance. Unless you’re willing to give up your car, there’s nothing you (or the Fed) can do to influence this cost.

Stocks Get Hammered as CPI Rises Just 0.1 Percent More Than Expected

On 13 September, I noted Stocks Hammered as CPI rose Just 0.1 per cent more than expected

The CPI rose 0.1 per cent in August and that was 0.1 per cent more than economists expected.

This post started at MishTalk.Com

Like these reports? I hope so, and if you do, Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as it happens. Read the ones you like and you can unsubscribe at any time.

If you are subscribed and not getting email alerts, please check your spam folder.

How much of a discount will you get? All insurance companies have their own no claims discount scale, but a typical example might include: 30% discount after 1 year of no claims cover. 40% discount after 2 years.

Contents

- 1 Is insurance premium increase in 2022?

- 2 Is now a good time for an auto loan?

- 3 Can you tell how fast a car was going by the damage?

- 4 What happens if you don’t exchange information after an accident?

A survey on health insurance facilities in the country has revealed that almost 62 percent of health insurance policy holders surveyed have seen their premiums increase by 25 percent or more in 2022. See the article : How much is average car insurance?.

Are insurance premiums rising? NEW DELHI: Health insurance premiums have increased between 10 and 25% recently, thanks to higher average claims and rising healthcare inflation. Sources from the health insurance sector say that over the last two years average claims have risen from Rs 40,000-50,000 to Rs 80,000.

Will auto rates go up in 2022?

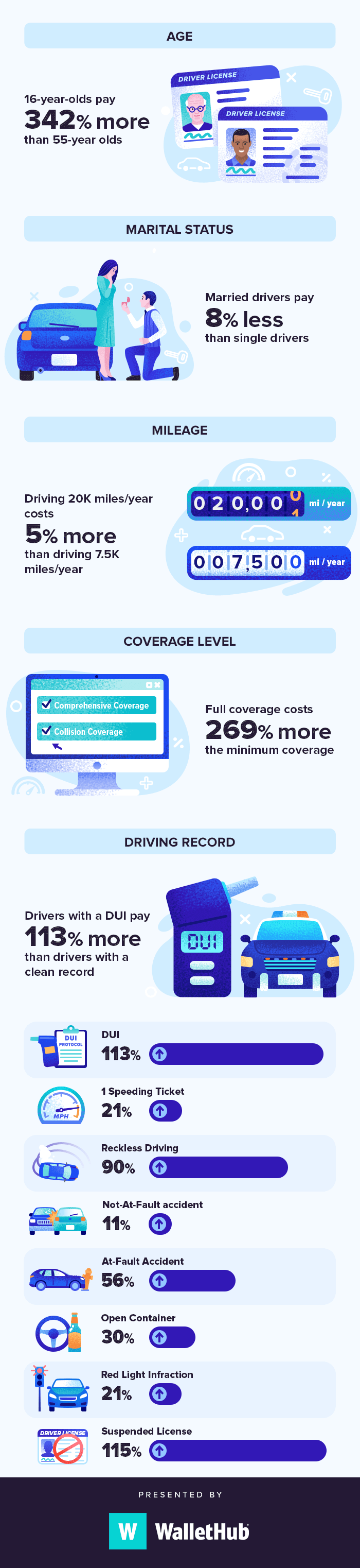

Like almost every purchase that consumers make right now, the average cost of car insurance is likely to rise for many drivers throughout 2022. Nationally, car insurance rates are increasing by an average of 4. To see also : What Are Car Insurance Premiums? – Forbes Advisor.9 percent , according to approved rate filing data from S&P Global Market Intelligence.

Are new car interest rates going up?

According to CNBC, “this won’t affect borrowers already locked into fixed-rate financing, but new auto loans or those with variable-rate financing will likely increase in cost. Fed policy rate to range from 2.25 to 2.5%. How much will it go up?

Will auto loan rates go down in 2023?

San Francisco Federal Reserve president Mary Daly said Thursday morning that raising interest rates by either half or three-quarters of a percentage point in September would be a “reasonable” way to bring down inflation.

Why are auto loan rates going up?

“The Federal Reserve is just one factor likely to make buying a car more expensive this year.” The combined factors of the chip shortage and the pandemic caused very high prices for both new and used vehicles. 2021 and into 2022.

If your credit score goes down due to more debt, less income, missed or late payments, too many credit inquiries, or some other reason, your insurance company may choose to increase your premiums to protect themselves . This may interest you : Car insurance: a domino effect that increases your premiums.

Generally, when you make a claim against your insurance policy for more than a certain amount due to an event that is primarily at fault, an insurer will increase your premium by a certain percentage.

Health insurance premiums and drug costs will rise slightly more than usual next year. Ed Kaplan, senior vice president of The Segal Group, expects health insurance premiums to rise 7% to 8% in 2023, slightly more than the 6% average annual increase seen over the past few years.

Will health insurance increase in 2023?

US employers expect medical plan costs per employee to rise an average of 5.6 percent in 2023, HR consultancy Mercer reported.

What is the ACA affordability percentage for 2023?

This means that non-calendar year plans will continue to use 9.61% to determine affordability in 2023 until their new plan year begins. As described above, non-calendar year plans will not be able to calculate the FPL safe harbor contribution limit for plan years beginning after January.

Americans spend a great deal on health care each year, and the cost continues to rise. In part, this increase is due to government policy and the initiation of national programs such as Medicare and Medicaid. There are also short-term factors, such as the financial crisis of 2020, that push the cost of health insurance up.

Is now a good time for an auto loan?

The Clock Is Ticking on Low Auto Loan Rates As the federal reserve repeatedly increases rates, you will begin to see auto loan rates go higher as 2022 progresses. At the moment, many credit unions are still saving money for their members and have not increased rates.

Will car loan rates rise in 2022? The Federal Reserve is said to expect as many as 7 interest rate hikes by the end of 2022, setting up the likelihood of much higher financing rates for both new and used vehicles. The speed of this progress can vary, with some coming faster than others.

Are auto loan rates high or low right now?

Interest rates are largely based on credit score, whether the car is new or used, and loan terms. The average rates fell since the first quarter of 2021, down by 4.15% for new and 8.82% for new use.

What are car loan interest rates right now?

For the most creditworthy lenders, APRs start at 3.59% for new vehicles. Used vehicle loans start at 3.79% APR, while refinancing starts at 4.79% APR.

What is a good car loan rate 2022?

| Credit Score | Average New Car April | Average Used Car APR |

|---|---|---|

| 661 to 780 | 3.56% | 5.58% |

| 601 to 660 | 6.70% | 10.48% |

| 501 to 600 | 10.87% | 17.29% |

| 300 to 500 | 14.76% | 20.99% |

Why are auto loan rates so high right now?

“The Federal Reserve is just one factor likely to make buying a car more expensive this year.” The combined factors of the chip shortage and the pandemic caused very high prices for both new and used vehicles. 2021 and into 2022.

Is 2022 a good time to buy a car?

While increasingly high prices for used cars are bad for those who can’t afford a new car, they can make 2022 a good time to buy a car for those who have a vehicle to trade in. A high exchange price means additional capital that can do that. help reduce the finance portion of buying a new car.

Will car prices go down in 2022?

Used car prices are already starting to fall as the market cools, having apparently peaked in early 2022. On the other hand, new vehicle prices are unlikely to fall in 2022 due to continued inflationary pressures. âA lot of inflation is still building up in the new vehicle supply chain.

Should I buy a used car now or wait until 2022?

Kelley Blue Book says the latter half of 2022 looks better for car buying. KBB says “if you can afford to wait, the second half of 2022 is starting to look better for buying a vehicle. The inventory is slowly starting to recover, especially in the used market.

Is 2022 good year to buy a car?

2022 is another bad year to buy a new car because there are few, if any, incentives offered on new cars by dealers or manufacturers.

Will car prices drop in 2022?

Used car prices are already starting to fall as the market cools, having apparently peaked in early 2022. On the other hand, new vehicle prices are unlikely to fall in 2022 due to continued inflationary pressures. âA lot of inflation is still building up in the new vehicle supply chain.

Will car prices go back to normal in 2022?

As new car inventory begins to stabilize, JD Power predicts that used vehicle values will begin to fall to more normal levels by the end of 2022 and into 2023. We expect used prices to cool once vehicle production new and inventory starts. to get better, said Paris.

Will it be cheaper to buy a car in 2022?

When new car production resumes, new car prices should fall. According to recent industry data, this could happen as early as 2022, with the market returning to normal by the end of this year or early next year.

Will used car prices drop in 2023?

There’s a good chance that used cars will become more affordable in 2023, as prices seem to have already peaked earlier this year. But new cars could be expensive if the chip shortage is not addressed.

Can you tell how fast a car was going by the damage?

The severity of the damage can provide important information to investigators. A small dent can indicate that a driver is traveling at a low speed or that the driver has almost enough time to finish braking. Severe damage can tell investigators how fast a vehicle may have been traveling or how hard the car was hit.

What do investigators look for in a car accident? Collecting Evidence The types of evidence that a car accident investigator looks for at the scene of the accident may include: Pools of gasoline, blood or oil. Debris such as pieces of glass, fenders, torn or blown tires. Skid, scrub or gouge marks on pavement, ground, or stationary objects.

How does a crash at 60 mph compared to a crash at 30 mph?

Pedestrian Accidents If a pedestrian is hit by a car traveling at 20 mph there is only a 5% chance of being killed, but a pedestrian hit by a car traveling at 30 mph has a of 45% of being killed. That risk rises to around 100% at 60 mph.

What happens if you get hit by a car at 30 mph?

A pedestrian hit at 30mph has a very significant chance (one in five) of being killed. This rises significantly to a one in three chance if they are hit at 35mph. Even a small increase in speed can lead to an increase in the severity of an impact. The risk of injury increases exponentially with the speed of the impact.

Why is it better to crash at a slower speed?

Higher driving speeds lead to higher collision speeds and therefore more serious injuries. A higher driving speed also provides less time to process information and act on it, and the braking distance is longer. So the possibility of avoiding a collision is less.

What is the force of a 30 mph crash equivalent to?

If you are not wearing a seat belt when the front end of your car hits something like another vehicle or a tree at 30 mph, your body will continue to move forward at 30 mph until your body hits something hard enough to stop you moving forward . The effect is roughly equivalent to falling from a three-storey building.

How do investigators know how fast a car that was involved in an accident was going?

Looking at skid marks and damage to vehicles, investigators determine how fast the vehicles were traveling, who swerved or who applied the brakes. Analyze photographic evidence.

What measurements are taken at the scene of a car accident?

Currently, accident scene measurements are taken using physical measuring devices, such as 100-foot fiberglass tapes, LASAR radar measuring devices and measuring wheels.

How an automobile accident is evaluated?

The most important factors to consider (not necessarily in order of importance) when assessing the value of a car accident personal injury claim are: (1) liability (can it be argued who is at fault?), (2) injuries / damage suffered by the plaintiff, (3) the extent of the property damage, (4) where the case could ultimately…

Which step in the accident investigation helps to determine how the accident occurs?

Explanation: Professional Reconstruction is the step in the accident investigation that helps us determine how the accident happened from the available data. It is also referred to as determining behavior or accident causes.

How do you figure out how fast a car was going in an accident?

How Do I Calculate Speed and Distance in the Case of a Car Accident? The formula for speed and distance is the same for a car as for any other object: distance ÷ time. So if you want to calculate the speed of a car at sixty miles per hour, the math is (60 x 5280) ÷ (60 x 60) = 88 feet per second.

Do cars record your speed?

EDR car has much less memory and constantly overwrites data. It also does not record audio or video, according to USA Today. Unless you crash, no data will be recorded. However, EDR can provide investigators with valuable data from the moments before, during and after a crash.

Which Mark reveals information about the car speed?

A car speedometer reveals information about the instantaneous speed of your car. It shows your speed at a specific instant in time. On average, your car was moving at a speed of 25 miles per hour.

Can skid marks determine speed?

The police use a formula to estimate the speed a car was traveling before an accident by measuring its skid marks. Here is the formula. Sis the speed the car was traveling (in mph). dice the distance the car slid (in his feet).

What happens if you don’t exchange information after an accident?

Exchange information with the other driver However, you must exchange information with the other person involved in the accident. If you don’t, you could be fined. You must exchange the following information: the name and address of the drivers involved in the accident.

Do you have to exchange insurance details after an accident in Texas? Section 550.023 of the law lists the information that is necessary to exchange after a car accident in Texas. The operator of the motor vehicle must give this information to anyone injured or the operator or occupant of the other vehicle involved in the accident.

Do insurance companies contact each other after accident?

You are not legally required to speak to a representative of the other insurance company. The first time an insurance adjuster for the other driver’s insurance company contacts you, it will probably be fairly soon after your car accident. But they don’t check in to see how you are, or to have a chat.

Do insurance companies talk to each other after accident?

You are not required to speak to the other driver’s insurance company. You are not legally required to speak to a representative of the other insurance company. The first time an insurance adjuster for the other driver’s insurance company contacts you, it will probably be fairly soon after your car accident.

Why is the other insurance company calling me?

It’s all about the money. One of the main reasons the other driver’s insurance company calls you is to try to trick you into providing evidence that the accident was your fault, that any injuries you may have suffered were minor or that you had no injuries at all.

Do insurance companies talk to each other about claims?

Yes. There are specialized consumer reporting agencies that collect information about the insurance claims you’ve made on your property and casualty insurance policies, such as your homeowners and auto policies.

When exchanging information with anyone involved in the collision you should?

You must report the collision to your insurance company, the Department of Motor Vehicles, and local police authorities. Consult your state’s Driver’s Handbook for details. Exchange information with other people involved in the accident as soon as possible.

When involved in a collision a driver should Alberta?

If you are involved in a collision, give assistance where you can, protect the scene, and notify emergency services if necessary. Exchange names, contact information and insurance details with the other driver(s) involved. Record the names and contact information of all witnesses.

What do you do in case of collision?

What to do following a collision

- Stay calm.

- Turn on your hazard lights.

- Check for injuries to yourself or other passengers; call 911 if anyone is hurt.

- If the accident is minor, move the vehicle to a safe place out of traffic; install cones or traffic markers if necessary.