The map shows the states with the most expensive car insurance

Why is Florida no fault?

Contents

When did Florida become flawless? According to the Florida Senate, Florida became a no-fault state on January 1, 1972. See the article : Car insurance | Average North Carolina car prices increase 4.5% annually.

Who pays for no-fault car damage in Florida? Florida is a no-fault state, meaning that all drivers carry their own insurance to cover medical bills and car repairs up to a certain amount. Specifically, Florida Statutes § 627.736 requires drivers to carry PIP and property damage coverage policies up to $10,000.

What makes Florida a no-fault state?

Florida is a no-fault auto insurance state. See the article : What are different types of insurance?. This means that drivers must carry personal injury protection (PIP) insurance to cover their medical expenses and other damages related to an accident, regardless of who caused the collision.

Is Florida getting rid of no-fault insurance? Although the Florida legislature passed an auto insurance reform bill that would have eliminated the State’s No Fault insurance system, Florida drivers do not currently have to obtain new insurance policies since the bill was not passed.

Who pays for no-fault car damage in Florida? Florida is a no-fault state, meaning that all drivers carry their own insurance to cover medical bills and car repairs up to a certain amount. Specifically, Florida Statutes § 627.736 requires drivers to carry PIP and property damage coverage policies up to $10,000.

What are two types of required insurance to comply with Florida’s no-fault law?

No Fault Insurance Law in Florida requires that you have both Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance.

What are the two types of insurance in Florida? Florida auto insurance laws require two types of insurance for all drivers: a $10,000 minimum personal injury protection (PIP) and a $10,000 minimum property damage liability.

What are the two auto insurance laws in Florida? General information. Before registering a vehicle with at least four wheels in Florida, you must show proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) auto insurance.

Why is Florida not prone to earthquakes?

Because Florida is not located near any tectonic plate boundaries, earthquakes are very rare, but not completely unknown. In January 1879, a shock occurred near St. See the article : Car insurers limit who they sell policies to. Augustine. There were reports of heavy shaking that knocked plaster from walls and articles from shelves.

Why are earthquakes rare in Florida? Although an earthquake in the Sunshine State is extremely rare, it is not entirely impossible. “Earthquakes in Florida are extremely rare because there are no active fault zones or plate boundaries,” said WFLA Max Defender 8 Meteorologist Amanda Holly.

Is Florida likely to have an earthquake? The Pacific Plate is considered to be, geographically, the largest plate in the world. USGS: Frequency of earthquakes in the US. The probability of seeing any type of substantial earthquake is very low throughout Florida, as the frequency of damaging events is calculated to be less than 2 times per 10,000 years.

Why are there so many earthquakes in California but not in Florida?

Florida is located on the passive edge of the plate, which is the transition from land to ocean that is not seismically active. But there is a very active margin at the western end of the plate, in California, which is sliding under the Pacific plate, and that is what triggers many of the Golden State’s earthquakes.

Is there a danger of an earthquake hitting Florida why or why not if there was one what damages would occur?

The probability of a major earthquake causing significant damage in the State of Florida is extremely low. According to USGS, Florida is classified as a geologically stable area, which means that there is expected to be little damage from any shakingor tremors felt from an earthquake.

Why don’t earthquakes happen in Florida? Earthquakes are caused by the sudden movement of tectonic plates that release energy in waves that travel through the earth’s crust and shake the surface. However, Florida is not located near any tectonic plate boundaries. (It’s not New Jersey either, although the area has minor faults.)

Is car insurance cheaper in FL or CA?

You should expect to pay less on car insurance when you move. The average annual rate for car insurance in California is $113 cheaper than the average cost in Florida. The exact cost will depend on your coverage, driving history, and your auto insurance company.

Is it more expensive to insure a car in Florida?

Full coverage auto insurance in Florida costs 51 percent more than the average cost of auto insurance nationwide. Minimum coverage auto insurance in Florida costs about 69 percent more than the national average.

How to save money on auto insurance in Florida? 10 Easy Ways to Save on Florida Car Insurance

- Raise Your Deductible. …

- Collision Hit. …

- Update Your Address. …

- Search for Discounts. …

- Business Deduction. …

- Combining Policies. …

- Think Before You Buy. …

- Driver training course.

What is the basic car insurance in Florida? Minimum Insurance Requirements in Florida Regardless, it is important for Florida drivers to know the mandatory insurance requirements for each state. The minimum requirements for auto insurance coverage are: $10,000 for personal injury protection (PIP) $10,000 for property damage liability (PDL)

Who typically has the cheapest car insurance?

USAA, Nationwide, Travelers, Erie, Geico and Progressive are the cheapest auto insurance companies nationwide, according to our analysis.

What is the #1 auto insurance in the US? Based on our research, Geico offers the best auto insurance in California. Progressive, USAA, State Farm and Allstate are reliable choices for most drivers. *Our research team considers national factors when rating suppliers. The ranking order of the providers in this table is specific to car insurance in California.

Who on average has the cheapest car insurance? The 10 cheapest auto insurance companies are Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers and USAA.

Who is cheaper Geico or Progressive?

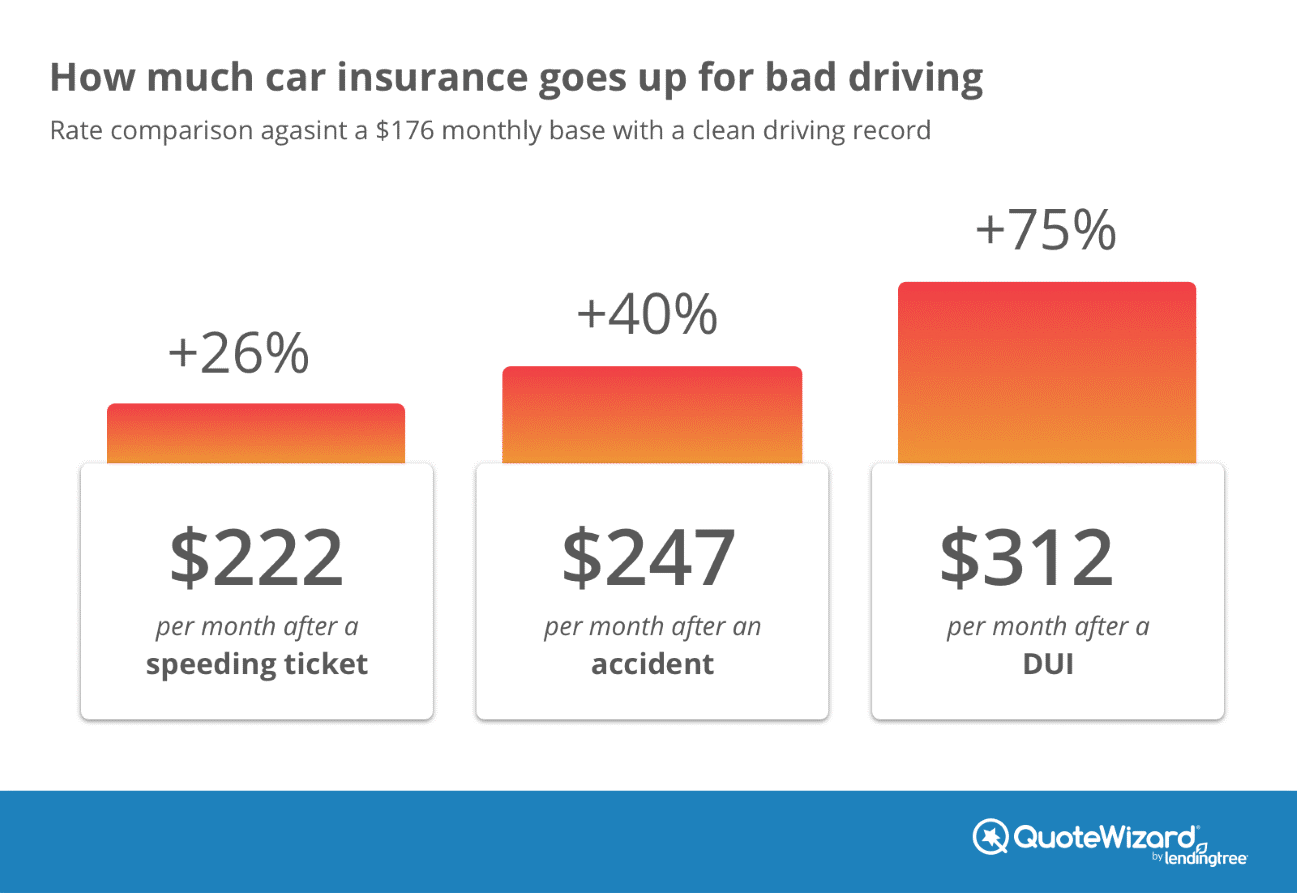

Geico and Progressive offer cheap auto insurance for drivers nationwide. Geico rates are generally lower overall, but Progressive tends to offer better rates for high-risk drivers. High-risk drivers are those who have a recent DUI ticket, crash or accident on their driving record.

Who is cheaper Geico or Progressive? Key Takeaways: Geico is better for you if you’re looking for the cheapest option, as the provider has a cheaper average rate estimate in 82% of states across the U.S. Progressive is your favorite if you’re looking for more coverage options . , plugins and customizations.

What car insurance group is the cheapest?

So it’s important to understand insurance groups – after all, there are 50 of them in total. The cars in group 1 are the least risky from the underwriter’s point of view and the cheapest to insure. Those in the 50 group are the riskiest and most expensive – usually higher performance models and luxury SUVs.

What is the lowest category for car insurance? Group 1 insurance cars can be a great choice for younger drivers as they tend to be the cheapest to insure and the cheapest to buy and repair. They also tend to have less powerful engines.

What type of car insurance is cheapest? The cheapest type of auto insurance is liability insurance, with an average cost of $671 per year. It does not include coverage for your own car or injuries and instead covers injuries to others and property damage if you are responsible for an accident, making it much cheaper than full coverage.

What city in the US has the highest car insurance?

Major Takeaways: On average, Detroit has the most expensive car insurance of any major city in the country.

Which state has high car insurance?

Which cities have the lowest car insurance rates? Drivers in Old Orchard Beach, Maine, pay the lowest total coverage rates on average. These rates represent a staggering 302 percent difference from the average annual total coverage premium in Roosevelt. Miami is the most expensive city in Florida for auto insurance, at an average total coverage rate of $3,483 per year.