The multi-car insurance market could experience a major shift: major giants AXA, Allianz, AIG, Generali, PICC

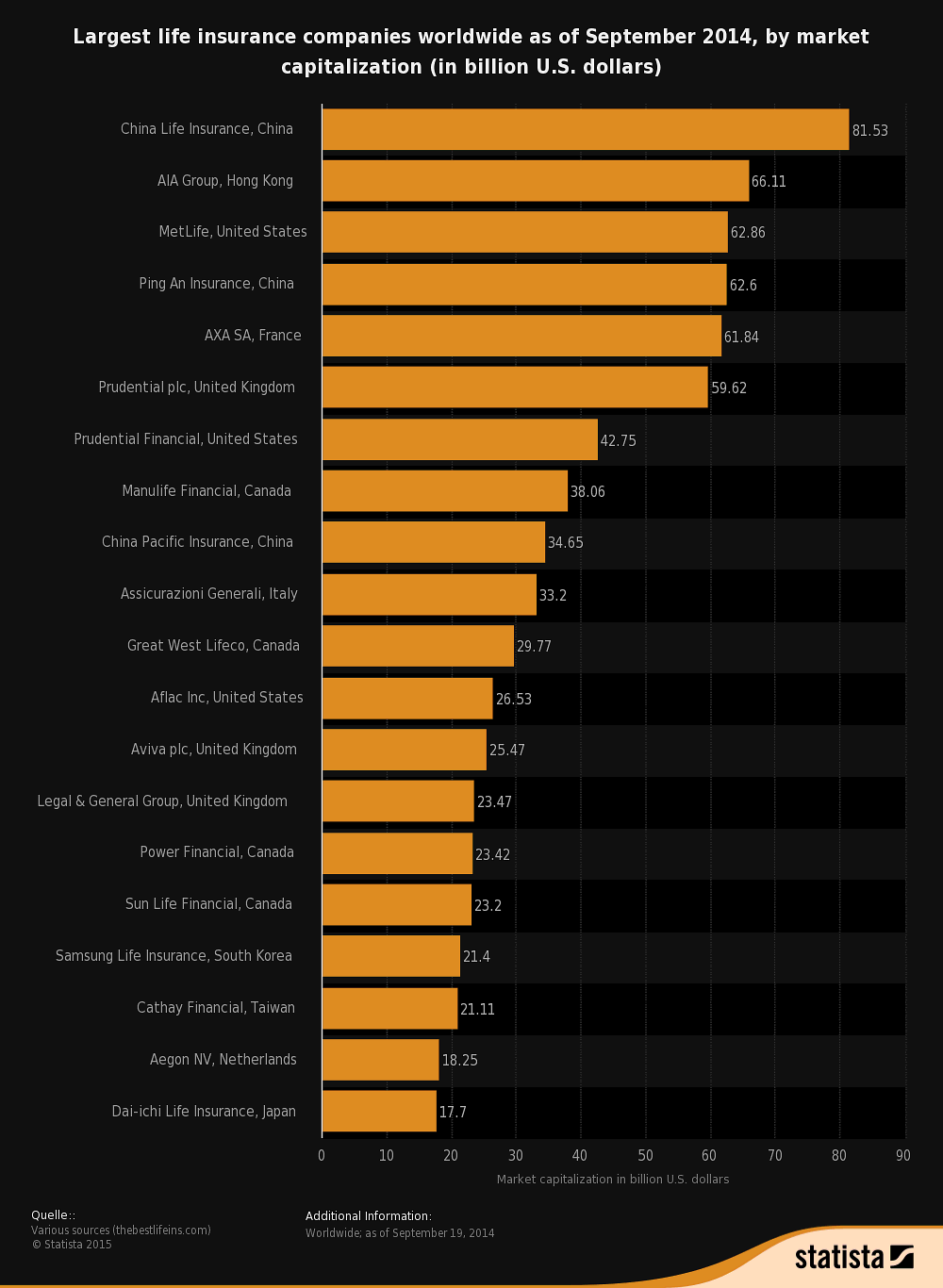

New Jersey, NJ — (SBWIRE) — 6/26/2022 — Worldwide Multiple Car Insurance Market In-Depth Research Report 2022, Forecast to 2027 is the latest research study released by HTF MI evaluating the analysis of the side of market risk, highlighting opportunities and leveraged with strategic and tactical support for decision making (2022-2027). The study is a perfect blend of qualitative and quantitative market data collected and validated primarily through primary data and secondary sources. The report provides information on market trends and development, growth drivers, technologies and the changing investment structure of the global multi-car insurance market. Some of the main study participants are AXA, Allstate Insurance, Berkshire Hathaway, Allianz, AIG, Generali, State Farm Insurance, Munich Reinsurance, Metlife, Nippon Life Insurance, Ping An, PICC, China Life Insurance.

Get free access to sample report @ https://www.htfmarketreport.com/sample-report/3701153-worldwide-multi-car-insurance-market-1

Global Multi-Car Insurance Market Overview:

The study provides a comprehensive overview, vital to keep up-to-date knowledge of the market segmented by Insurance Broker, Insurer, Bank, Insurance Broker & Others, , Multi-car insurance markets by type, theft insurance, fire & Other and more than 18 countries around the world, along with insights on emerging and; big players. If you want to analyze different companies involved in the worldwide multiple car insurance industry according to your objective or geography, we offer customization as per your requirements.

Worldwide Multicar Insurance Market: Demand Analysis & Outlook 2027 Opportunity

Worldwide multicar insurance research study defines the market size of various segments and; countries by historical years and predict the values for the next 6 years. The report is assembled to include both qualitative and quantitative elements of the Worldwide Multi-Car Insurance industry including: market share, market size (value and volume 2017-2021, and forecast to 2027) which each concerned country in the competitive market looks forward to. In addition, the study also addresses and provides detailed statistics on the crucial elements of Worldwide Multicar Insurance, which includes drivers & constraining factors that help estimate the market’s future growth prospects.

Global Multi-car Insurance market segments and subsections are shown below:

The study is segmented according to the following product/service type: multi-car insurance markets by type, theft insurance, fire & Others

The main end-user applications/industry are as follows: Insurance Intermediaries, Insurance Company, Bank, Insurance Broker & Others

Some of the main players involved in the market are: AXA, Allstate Insurance, Berkshire Hathaway, Allianz, AIG, Generali, State Farm Insurance, Munich Reinsurance, Metlife, Nippon Life Insurance, Ping An, PICC, China Life Insurance

Inquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/3701153-worldwide-multi-car-insurance-market-1

Important years considered in the Worldwide Multi-car Insurance study:

Historic year – 2017-2021; Base year – 2021; Forecast period** – 2022 to 2027 [** unless otherwise stated]

If you opt for the Global version of the Worldwide Multi-car Insurance Market; so below country analysis would be included:

– North America (USA, Canada and Mexico)

– Europe (Germany, France, UK, Netherlands, Italy, Nordic Nations, Spain, Switzerland and Rest of Europe)

– Asia Pacific (China, Japan, Australia, New Zealand, South Korea, India, Southeast Asia and Rest of APAC)

– South America (Brazil, Argentina, Chile, Colombia, other countries, etc.)

– Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Turkey, Nigeria, South Africa, Rest of MEA)

Buy Worldwide Multi-car Insurance Research Report @ https://www.htfmarketreport.com/buy-now?format=1&report=3701153

Key questions answered with this study

Media Relations Contact

Contents

- 1 Media Relations Contact

- 2 Is Progressive or Geico cheaper?

- 3 Does Progressive raise rates after 6 months?

- 4 What is the difference between insurance and general insurance?

- 5 Which is a type of insurance to avoid?

1) What makes the global multi-car insurance market viable for long-term investment? Read also : How To Buy Car Insurance For Your New Car.

2) Do you know the areas of the value chain where players can create value?

Is Progressive or Geico cheaper?

3) Territory that can see a sharp increase in CAGR & Y-O-Y growth? This may interest you : 7 Brutal Reasons Your Car Insurance Is More Expensive (Don’t Blame Inflation!).

4) Which geographic region would have the best demand for products/services?

Is Progressive Insurance really cheaper?

5) What opportunity would the emerging territory offer both established and new entrants in the global Multi-car Insurance market? This may interest you : What do you do if someone scratches your car while parked?.

Why does Progressive charge so much?

6) Risk-side analysis related to service providers?

How are Progressive rates so low?

7) How do the factors that drive the demand for Multicar World Insurance influence the coming years?

Is Progressive expensive car insurance?

8) What is the impact analysis of various factors on the growth of the Worldwide Multi-car Insurance market?

What is the difference between Progressive and GEICO?

9) Which strategies of major players help them to acquire mature market share?

Why is Progressive better?

10) How is technology and customer-centric innovation bringing about big changes in the global multi-car insurance market?

Who can beat Progressive Insurance?

Browse the executive summary and full table of contents at https://www.htfmarketreport.com/reports/3701153-worldwide-multi-car-insurance-market-1

Is GEICO bigger than Progressive?

| There are 15 chapters to display the worldwide multiple car insurance market | Chapter 1, Overview to Describe the Definition, Specifications, and Classification of the Worldwide Multi-Car Insurance Market, Applications [Insurance Intermediaries, Insurers, Banks, Insurance Brokers & Other], Market Segment by Types, Multi-Car Insurance Markets by Type, Theft Insurance, Fire & Others; | Chapter 2, purpose of the study. |

|---|---|---|

| Chapter 3, Research Methodology, Measurements, Assumptions, and Analytical Tools | Chapter 4 and 5, Worldwide Analysis of Multicar Insurance Market Trends, Factors, Challenges by Consumer Behavior, Marketing Channels, Value Chain Analysis | Chapter 6 and 7, to show Worldwide Multicar Insurance Market Analysis, Segmentation Analysis, Features; |

| Chapter 8 and 9, to show Five forces (buyers/suppliers’ bargaining power), Threats to new entrants and market conditions; | Chapter 10 and 11, to show analysis by region segmentation [United States, Canada, Germany, France, United Kingdom, Italy, Russia, China, Japan, Korea, Southeast Asia, India, Australia, Brazil, Mexico, Argentina, Chile, Colombia , Egypt, Saudi Arabia, UAE, Nigeria & South Africa], comparison, leading countries and opportunities; customer behavior | Chapter 12, to identify key decision structures accumulated by industry experts and strategic decision makers; |

| Chapter 13 and 14, on the competition landscape (classification and market classification) | Chapter 15 deals with Worldwide Auto Insurance Market sales channel, research findings and conclusion, appendix and data source. | Thank you for showing interest in the Worldwide Multicar Insurance Industry Research Publication Worldwide; You can also get individual chapters section or region report version such as North America, Latin America, United States, GCC, Southeast Asia, Europe, APAC, UK, India or China etc. |

| About the author: | HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower companies with growth strategies, offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that help decision-making. | Contact Us: |

Who typically has the cheapest insurance?

Craig Francis (Public Relations and Marketing Manager)

Who usually has the lowest car insurance?

HTF Market Intelligence Consulting Private Limited

What insurance company is usually the cheapest?

| Unit #429, Parsonage Road Edison, NJ | New Jersey USA – 08837 | Phone: +1 (206) 317 1218 |

|---|---|---|

| [protected email] | Connect with us on LinkedIn | Facebook | twitter | For more information on this press release, please visit: http://www.sbwire.com/press-releases/multi-car-insurance-market-may-see-a-big-move-major-giants-axa- allianz-aig -generali-picc-1359587.htm |

| Nidhi bhawsarPR & Marketing ManagerHTF Market Intelligence Consulting Unip. Ltd.Phone: 2063171218Email: Click to email Nidhi bhawsarWeb: https://www.htfmarketreport.com/reports/3701153-worldwide-multi-car-insurance-market-1 | Geico is so cheap because it sells insurance directly to consumers and offers many discounts. Direct-to-consumer insurance sales eliminate the cost of intermediaries and allow Geico to have significantly fewer local offices and agents than companies like State Farm and Allstate. | Progressive pricing. Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico’s rates are generally lower overall, but Progressive tends to offer better prices for those with a recent DUI, culpable accident, or speeding ticket on their driving record. |

| Is GEICO cheap or expensive? Geico has the cheapest car insurance for most drivers in California. The company charges $390 per year on average for a minimum liability policy. That’s 35% cheaper than the state average. The average cost of car insurance with minimum coverage in California is $604 a year, or $50 a month. | In our Progressive insurance review, we on the Home Media review team found that the company’s full coverage rates tend to be about 19% cheaper than the national average for good drivers. We rank Progressive as one of the best auto insurers of 2022. | Progressive is so expensive because car insurance is expensive in general, due to rising costs for insurers. But at $649 a year, the average Progressive car insurance policy is actually cheaper than most competitors’ coverage. |

| Progressive is so cheap because it offers a wide range of discounts and gives consumers tools to get the best rates possible, like Progressive’s price comparison tool and its Name Your Price® program. | Is Progressive Car Insurance Good? Progressive’s average car insurance premiums are slightly below the national average. But compared to the other insurers on our 2022 Best Car Insurers list, Progressive’s average rates are relatively expensive. | We compared a variety of GEICO and Progressive insurance products and found Progressive to be the superior carrier in most categories. Progressive has more coverage options and more discounts overall. However, many consumers will find that GEICO policies are cheaper, even though coverage is limited. |

What is the lowest I can pay for car insurance?

After a DUI, Progressive becomes the insurer with the cheapest rates when compared to Geico. Progressive charges drivers with a DUI lower than the national average and less than they charge a driver with an accident. Meanwhile, Geico’s rate for drivers after a DUI is among the highest in our study.

- Insurance buyers with exceptional credit — a score of 800 or better — should also consider USAA, which typically beats Progressive’s average rates by about $500 a year. Below you will find the average insurance rates by credit tier for Progressive and USAA below.

- Classification

- Company

Does Progressive raise rates after 6 months?

Premiums written in billions

1

Does Progressive raise their rates?

State Farm

Why did my Progressive bill double?

$40.4

Does Progressive increase rates after 6 months?

two

Why is Progressive charging more?

geico

Does Progressive offer 12 month policies?

$33.9

Can you pay 1 year car insurance?

3

What is a 12-month policy?

Progressive

Are Progressive auto policies 6 months?

$33.2

What is the difference between insurance and general insurance?

4

the whole state

What is general insurance and example?

$25.9

What is the meaning of general insurance?

Of the largest insurers in the country, Geico has the cheapest auto insurance rates on average. But rates vary greatly from one person to another based on factors like gender, the car you drive, and your location.

What is the use of general insurance?

Geico is the country’s largest and cheapest auto insurer, according to NerdWallet’s latest analysis of minimum coverage rates. Geico’s average annual fee was $354, or about $29 a month.

What is general insurance and explain its features?

cheap car insurance company

What general insurance means?

cost rating

What is general insurance in the UK?

Average Annual Cost Estimate*

What does General mean in insurance?

1. USAA

Who is the number 1 insurance company?

| 10.0 | $1,013 | 2. Erie Insurance |

|---|---|---|

| 9.9 | $1,113 | 3. State Farm |

| 9.0 | $1,339 | 4. Geico |

| 9.4 | $1,352 | The cheapest car insurance companies |

| US – $94/month. At just $94 a month, USAA’s average rates are the cheapest in the industry. … | GEICO – $102/month. GEICO’s average monthly fee is $102, and the company’s customer service is well regarded. | Nationwide – $106/month. |

Which is a type of insurance to avoid?

Yes, Progressive increases rates after 6 months in some cases. If you are a new Progressive customer, you will see your auto insurance premium increase after the first 6 month policy period if you file a claim or if traffic violations are added to your driving record during that period.

Does insurance get cheaper after 6 months? Even after age 25, your insurance premiums tend to decrease as you get older, so checking in every six months can still save you money.

What types of insurance should you avoid?

Most insurers can increase your rate if you have an accident or claim. At Progressive, a faulty accident can increase your rate by an average of 28% nationwide.

- Even drivers with a clean record can see an increase in their insurance renewal price. As mentioned above, automatic rate increases are sometimes based on factors outside of your control, such as claims in your zip code. Or, if you’ve added a new driver or vehicle to your policy, your rate may also increase at the time of renewal.

- Some progressive insurance reviews report rate increases after the first six-month period of the policy. This can happen for a variety of reasons including new driving infractions, bad driving behavior when using the Snapshot app, or even general rate increases for the area that have nothing to do with the individual driver.

- We charge a higher rate for customers with a higher probability of claims and a cheaper car insurance rate for customers with a lower probability of claims. Progressive also determines fees based on acquisition and operating costs.

- Progressive does not offer 12-month policies if you purchase directly from Progressive, but if you purchase through a Progressive agent, you may qualify for a 12-month option.

- While most car insurance policies last for six months, some companies offer policies for 12 months. In theory, a 12-month policy guarantees your car insurance rates and prevents your insurer from increasing your premium for an entire year.

What are the 4 types of insurance everyone should have?

A 12-month insurance policy allows you to lock in your rates for one year. While this may not be ideal for all drivers, some drivers prefer it. You may need to research to find a provider that offers it, as well as make sure you meet the policy’s minimum requirements.

What is the most important insurance to have?

Premiums are usually paid monthly, every six months or annually and are determined by a number of factors, including your driving record, age and the coverages selected as part of your policy.