What does auto insurance cost?

Contents

Car insurance is one of those annoying things every driver should have, but hopefully they never have to use it. At a basic level, auto insurance provides financial protection against damage to a vehicle or personal injury resulting from collisions and other automobile accidents. (You can get custom auto insurance quotes here.)

There are many types of auto insurance policies available for the benefit of drivers including third party liability, collision insurance, comprehensive and uninsured motorist, medical payment coverage, personal injury and gap insurance. On the same subject : CAR INSURANCE CAN BE CHEAPER IN NEW JERSEY. Depending on where a driver resides, state laws can dictate the type of coverage required.

According to the Federal Reserve, the national average monthly insurance premium for private passenger auto insurance is $ 186 per month. “That said, a national average doesn’t tell us much because of everything underwriting such as age, sex and marital status of the driver, not to mention the variation by state and location, plus the differences in insurance of different vehicles.” says Michael Giusti, an analyst at InsuranceQuotes.com.

Bankrate’s 2022 study of average premiums reveals that full coverage auto insurance costs $ 1,771 per year and minimum coverage costs $ 545 per year in the United States.

* Average car insurance rates from Bankrate

You can get personalized auto insurance quotes here.

Why do car insurance averages vary by location?

Each state has its own minimum requirements for coverage. “Some states require liability only, while others require personal injury protection or coverage for uninsured motorists. This may interest you : Ask Amy: Turning car insurance companies in the middle of a policy, buying the best rates. Your insurance company usually provides this information when you are purchasing your policy or you can consult your local DMV, ”says Michael Orefice, senior vice president of operations for SmartFinancial, a digital insurance comparison engine.

One of the most important factors in determining auto insurance rates is your zip code, says Angele Doakes, property and casualty insurance expert at Policygenius. “This is because insurers are determining how risky it is to insure your car based on what it is likely to experience. For example, if your area has a large population, you are likely to encounter multiple drivers who could pose a risk to you, “says Doakes. Likewise, if you find yourself somewhere facing many natural disasters that could damage your car, you may be looking at higher rates.

Because insurance is state-regulated and laws vary by jurisdiction, when you move to another state, Scott Holeman of the Insurance Information Institute says, “be prepared to change your auto insurance requirements and rate.” .

Insurance is regulated by each state’s insurance commissioner and the main thing regulators do to set insurance prices, according to Giusti, is to see how much insurers have paid in the past for insurance claims in that state. . “It gets more nuanced when you try to break that number down. Many experts point to state insurance laws, particularly how those laws handle things like compensation claims and whether they limit payments for particular types of cases. Community risk also comes: Are break-ins and thefts common in your community? And do drivers in your state just have multiple accidents? Giusti says.

You can get personalized auto insurance quotes here.

There is no clear answer to this question because every company has different overhead costs and pricing models, and Giusti adds that proprietary structures can also affect costs. “That’s not to mention that everyone might consider different factors for the same driver – let’s say credit score versus age. That’s why it’s so important to shop around and get different quotes rather than hoping for a general rule of thumb that will always apply. “says Giusti.

If you look around, Orefice says you’ll see that auto insurance prices can fluctuate by hundreds of dollars. “If you have a flawless driving record and haven’t done a full comparison, you can save up to 40%. The average policy on a sedan costs $ 1,400 (according to a 2021 AAA study), so that’s a $ 560 saving. “, says Orefice. Also note that discounts will also vary and eligibility for discounts may result in a lower monthly payment.

Some states don’t use gender as a factor when calculating insurance rates, but others do. In fact, gender is banned as an auto insurance rating factor in California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania, “says Bankrate.com analyst Cate Deventer.” According to some statistics, women pay less, but there is no hard and fast rule and reality varies in every state, “says Orefice. One reason for the discrepancy: an IIHS study found that male drivers of all ages have 63% more more likely than female drivers to be involved in a fatal accident, with men between the ages of 16 and 19 nearly twice as prone to fatal accidents, thereby increasing their insurance premiums.

Meanwhile age is almost always used. Teenagers and new drivers pay the highest rates, so the rates slowly decrease as you get older and then rise again for the elderly, Orefice says. Typically, drivers aged 25 and under have the highest rates, followed by those aged 65 and over.

Age and gender often interact to create insurance rates as well. “A married 40-year-old woman will pay much less than a 16-year-old male. This is a fact, “says Giusti. For insurers, age and gender are indicators of risky behavior.” According to their actuarial tables, that 40-year-old woman is far less likely to participate in an endurance contest or make donuts. or engage in other risky behaviors that could lead to complaints, “says Giusti.

Some insurance companies in some states use credit-based insurance scores – these rely at least in part on a consumer’s credit information – to assess a driver’s risk profile. “The general theory behind insurance scores is that those who manage their finances responsibly are more likely to drive responsibly. Therefore, drivers with higher credit scores generally receive lower insurance premiums, while those with lower insurance scores are more likely to pay higher premiums, “says Orefice. Credit-based insurance scores are used to determine the likelihood that a insured person has a claim and keeps track of their credit report Insurance companies have often used credit-based insurance scores as one of many indicators in their risk assessment process.

However, the credit score is not always used to determine the cost of insurance. Ben Moore, an insurance specialist at NerdWallet, says using a credit-based insurance score to evaluate rates is prohibited in California, Hawaii, Massachusetts, and Michigan.

One of the most important factors in determining your rates is the Motor Vehicle Report (MVR), which lists any driving violations or accidents you’ve had, says Deventer.

Insurance companies use driving records to assess a customer’s risk and typically look at most of the past 3-5 years of driving. “Drivers with the most accidents and accidents in their history are more likely to drive recklessly and file an insurance claim. Insurance companies charge higher premiums to reflect the increased driver risk, ”says Orefice. Fortunately, good drivers can earn a safe driver discount if their carrier offers it, but typically you need to have a record of clean driving for a number of years to qualify.

You can get personalized auto insurance quotes here.

Some cars are safer than others, and insurers consider this when you are being evaluated for auto insurance. Additionally, some cars are stolen or parts stolen more than others and therefore pose a greater risk to a claim for full coverage.

Holeman says, “Insurers not only consider how safe a particular vehicle is to drive and how well it protects occupants, but also how much potential damage it can inflict on another car. If a specific vehicle model has a greater chance of inflicting damage in In the event of an accident, an insurer may charge a higher amount for liability insurance. “

Here are some common cars and how much they might cost to insure.

If you have insurance coverage, even if you weren’t driving during this time period, you will likely pay more for auto insurance. You may want to consider maintaining auto insurance even if you are only carrying a non-proprietary auto insurance policy to avoid paying more when you need coverage.

Driving is inherently risky, so the more you do it, the more risk you represent. “There are some usage-based policies that use onboard sensors that only require the driver to pay for the miles they drive, which is the extremely low-end. At the higher end, used cars for commuting are more expensive than one. reconstruction as a hobby that is found in a garage 98% of the time “, says Giusti.

If you no longer commute because you work from home, it would be wise to tell your agent. They may have an award tier that rewards the fact that you are driving fewer miles each day.

You can get personalized auto insurance quotes here.

Look around! The best auto insurance company varies depending on the driver. “Start by understanding your needs and wants. Are you looking for the cheapest policy possible or do you need specific optional coverage? Do you appreciate the high level claims service? Do you want a company that has a solid mobile app? Once you know what you’re looking for, you can do some research to find an auto insurance company that might work for your situation, ”says Deventer. You can get personalized auto insurance quotes here.

Start by going to the insurers’ websites and entering your information. Holeman recommends getting at least 3 quotes from different companies and different types of companies: those that sell through their own agents, those that sell through independent agents, and those that sell directly to consumers via the phone, app, or the Internet. “You can also work with an independent insurance agent who can collect quotes from multiple insurers for you so you can find the cheapest rate,” says Moore.

Another way to save is to bundle your auto insurance with other types of insurance like homeowners, condos, and renters, says Jason Fromm, general manager and vice president of insurance at Caribou, an auto loan refinancing company. “Take advantage of various discounts such as improving your credit to save on your premium, completing advanced driver training courses in states that offer related discounts, insuring all your cars with the same carrier to get a discount for multiple cars and if it makes sense for you, change your coverage to increase your deductible and lower premiums, ”says Fromm.

The recommendations, recommendations or rankings expressed in this article are those of MarketWatch Picks and have not been reviewed or approved by our trading partners.

The average rate hike request for 2022 is around 4.9%, S&P Global reported. This may interest you : GoAuto car insurance company, bought by a private equity firm in Pennsylvania. “This means that with the average cost of auto insurance at $ 1,771 per year for full coverage, consumers could soon pay up to $ 1,858 per year for the same coverage,” Bankrate said.

How much has health insurance increased in 2022? Key points As has been the case in recent years, the average changes in individual and family health insurance rates for 2022 are mostly modest. The national average increase is around 3.5% and there are new insurers joining the markets in most states.

There are a few things that are beyond your control but could still affect your premium including: increased repair costs, increased distracted drivers on the road, more drivers on the road, higher speed limits in your geographic area and an increase in uninsured drivers.

Rate level increases occur when an insurance company finds that their overall rates are too low given the expenses (losses) incurred by recent claims filed and industry trends towards more expensive repairs and medical costs.

Why did my homeowners insurance go up 2022?

Insurance companies are raising rates to offset billions of dollars in losses from worsening climate disasters, and rising inflation means homes require more housing coverage to pay for rebuilding costs. The combination of these factors led to some fairly drastic rate hikes in 2022.

Why did my homeowners insurance go up 2022?

Insurance companies are raising rates to offset billions of dollars in losses from worsening climate disasters, and rising inflation means homes require more housing coverage to pay for rebuilding costs. The combination of these factors led to some fairly drastic rate hikes in 2022.

How hard is the Etape du Tour?

It is very easy when surrounded by thousands of bikers, and full of adrenaline, to start too fast. It is a good idea to stay in the first third of the run, where a power meter or heart rate monitor is useful, as you can set a rev limit to be respected during the first ascent.

What is a cycling Etape?

An étape or etape generally refers to a stage or leg of some kind, often in the context of cycling. Étape may also refer to: Etape du Dales, a cycling sport event. L’Étape du Tour, a cycling sport event.

Where is Etape du Tour 2022?

The Etape du Tour will take place on Sunday 10 July 2022 in a splendid setting of the French Alps. The chosen Tour de France stage will be repeated during the Etape du Tour for amateur runners.

Will auto rates go up in 2022?

Like nearly all consumer purchases right now, the average cost of auto insurance is likely to increase for many drivers over the course of 2022. Nationwide, auto insurance rates are increasing by an average of 4.9 percent, according to rate storage data approved by S&P Global Market Intelligence.

Did Geico raise their rates?

According to S&P Global, the approved rate hikes for GEICO during the period should have resulted in $ 1.06 billion in additional premiums, while Progressive, Allstate and State Farm were expected to make increases of $ 363 million, $ 351.5 million and $ 351.5 million, respectively. $ 321.9 million.

One of the best ways to keep car insurance costs low is to have a good driving record.

- Look around. …

- Before buying a car, compare the costs of insurance. …

- Ask for higher deductibles. …

- Reduce coverage on older cars. …

- Buy your homeowners and auto coverage from the same insurer. …

- Maintain a good credit record.

Does Progressive insurance raise rates after 6 months?

Yes, in some cases Progressive increases rates after 6 months. If you are a new Progressive customer, you will see your car insurance premium increase after your first 6 month policy period if you file a claim or if traffic violations are added to your driving record during that period.

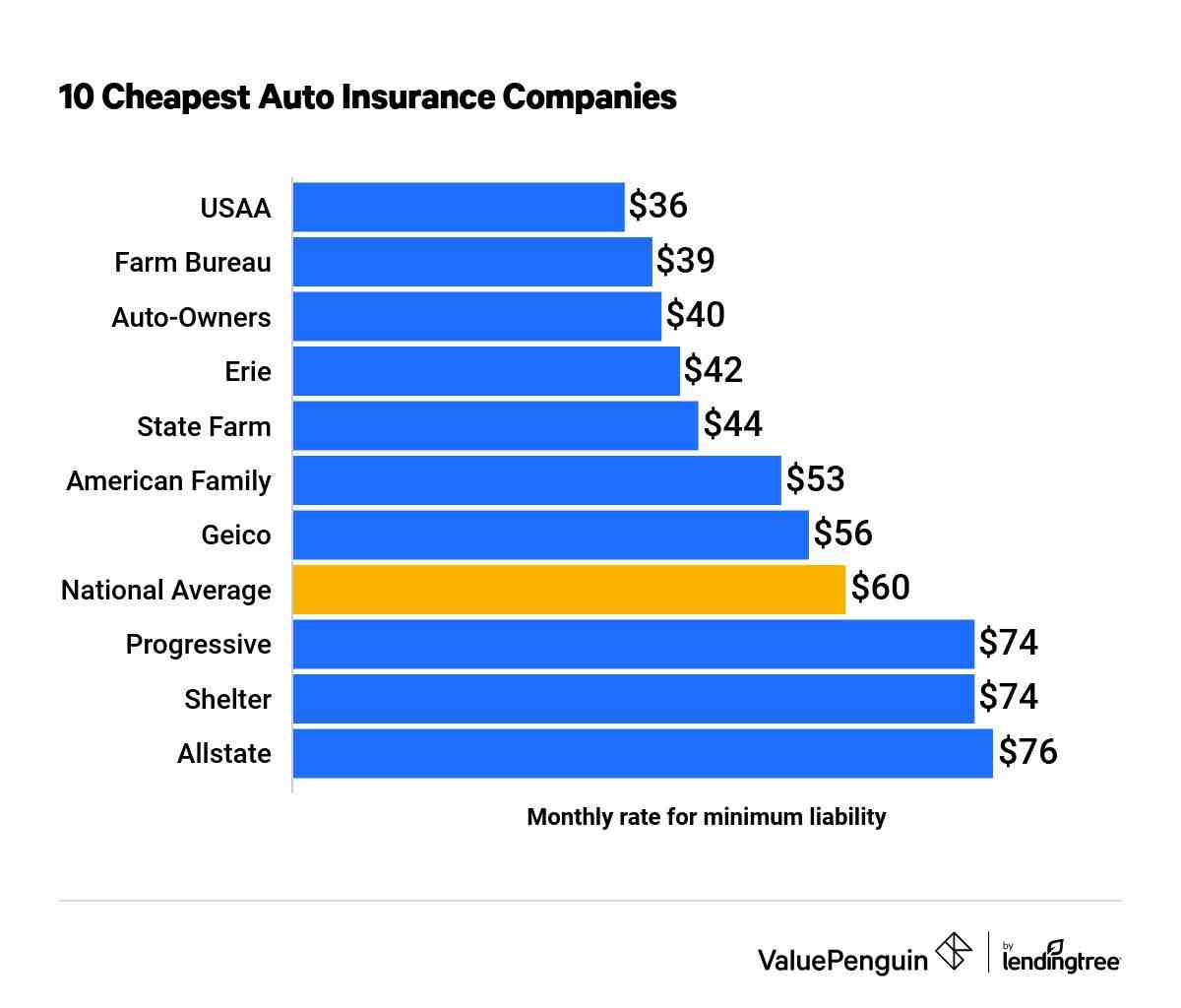

Geico is the nation’s leading cheapest auto insurance company, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $ 354, or about $ 29 per month.

What is the cheapest type of auto insurance? The state minimum liability coverage is the cheapest type of auto insurance. Liability-only insurance averages $ 1,333 less than a full coverage policy.

Ways to Reduce Your Car Insurance Costs

- Choose the right coverage.

- Choose the best vehicle insurance provider.

- Merge the insurance together.

- Pay your car insurance in advance.

- Take a defensive driving course.

- Get a low mileage discount.

- Improve your credit score.

- Participate in a usage-based insurance program.

Who has the cheapest auto and home insurance?

The two widely available companies that are most likely to have the cheapest home and auto insurance packages are State Farm and Allstate. When you combine home and auto insurance, the costs average $ 2,739 per year, while unbundled policies cost an average of $ 3,288 per year.

Is Geico really the cheapest?

The Cheapest Auto Insurance Company Ever: Geico Geico is the nation’s leading cheapest auto insurance company, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $ 354, or about $ 29 per month.

What type of insurance is the least expensive?

The state minimum liability coverage is the cheapest type of auto insurance.

Is it cheaper to have home and car insurance together?

With this in mind, many offer discounts when you sign up for multiple policies. The most common and most beneficial combination is car and home insurance. According to a study by InsuranceQuotes, the average consumer saves 16.1% on premiums when combining these two products.

Is Progressive or Geico cheaper?

Is Progressive cheaper than Geico? Both Geico and Progressive offer affordable auto insurance to drivers across the country. Geico’s rates are typically lower overall, but Progressive tends to offer better prices to those with a recent DUI, fault-based accident, or speeding fine on their driving record.

What is the difference between Progressive and Geico?

We compared a variety of insurance products from GEICO and Progressive and found Progressive to be the top carrier in most categories. Progressive has more coverage options and more discounts overall. However, many consumers will find that GEICO’s policies are cheaper, although coverage is limited.

Is Geico really the cheapest?

The Cheapest Auto Insurance Company Ever: Geico Geico is the nation’s leading cheapest auto insurance company, according to NerdWallet’s most recent analysis of minimum coverage rates. Geico’s average annual rate was $ 354, or about $ 29 per month.

Is Progressive Insurance really cheaper?

In our progressive insurance review, Home Media’s review team found that the company’s full coverage rates tend to be around 7% lower than the national average for good drivers. We rated Progressive as one of the best auto insurance and cheapest auto insurance companies of 2022.

Why does car insurance increase every year?

More risk for insurers. If there has been an increase in car crime, road fatalities, or other factors you could claim about, the risk to the insurer increases. As such, they can raise insurance prices to protect themselves.

Can you negotiate car insurance rates? The simple answer is that you cannot negotiate rates as prices and the insurance industry are heavily regulated by each state. The insurer cannot change its range of rates without a state review along with proof that the change is necessary.

GEICO negotiate? You need to keep in mind that GEICO claims adjusters are experts in negotiation. Their job is to keep the money in GEICO’s pockets. On the other hand, the GEICO claims that should be resolved will likely be resolved. Each party may need to give a little to reach an agreement, but that is the nature of the negotiation.

5 ways to lower your insurance premiums

- Review your policy coverage. Check your policies every year, as prices can change from year to year. …

- Check your deductibles. …

- Make home improvements. …

- Stop the extra coverage. …

- Ask for discounts.

Some factors that can affect your car insurance premiums are your car, your driving habits, demographics and the coverage, limits and deductibles you choose. These factors can include things like your age, the anti-theft devices in your car, and your driving record.

Common reasons for high car insurance costs include your driving record, age, coverage options, where you live, the car you drive, your credit history, or not taking advantage of discounts. The average car insurance premium has also gotten more expensive as it has risen by more than 50% over the past 10 years.

Can you ask to lower your car insurance?

Don’t call your insurance company and ask for a lower car rate. You have to enter the conversation with logic and civility, even if the initial answer is no. Be prepared to support why you are asking for a lower rate, whether you are driving less, are in financial trouble, or for another reason.

Can insurance rates be negotiated?

Can You Negotiate Car Insurance? Many people ask, “Are auto insurance rates negotiable?” Drivers often wonder if they can submit a lower quote to their insurer and match the price of coverage. The answer is clear: no, you cannot negotiate a lower auto insurance premium.