Third party car insurance explained – Forbes Advisor Australia

No driver wants to think about a disaster on the road, but everyone should be prepared for it. Third-party car insurance ensures that you have financial protection to cover costs related to injuries or damage to your vehicle and property that you may cause while driving.

Both compulsory and optional levels of third party insurance generally do not cover you if your own car is scraped or rendered useless in a collision. So, be sure to assess the value of your ride and how you use it before you decide to go exclusively with third-party insurance.

If your cheap wheels don’t warrant the higher annual premium of a comprehensive policy with wider coverage, third party might just be right for you. To help you decide, here’s everything you need to know about third party car insurance.

Different types of third party car insurance

Contents

- 1 Different types of third party car insurance

- 2 What Isn’t Covered by Third Party Insurance?

- 3 Third Party Car Insurance vs Comprehensive

- 4 How to Make a Third Party Car Insurance Claim

- 5 Frequently Asked Questions (FAQs)

- 6 Does comprehensive car insurance include third party?

- 7 What third party insurance covers Australia?

- 8 What does 3rd party mean on car insurance?

- 9 How do I know if my insurance is third-party?

There are three levels of third party car insurance in Australia that cover you for different circumstances while driving: Compulsory Third Party (CTP), Third Party Property Damage and Third Party Fire and Theft. On the same subject : TikTok made me buy: Auto insurance issue. Let’s explore each:

Compulsory third party car insurance (CTP)

It is mandatory to take a CTP in Australia. Although its name varies from state to state – it’s sometimes called a ‘green slip’ or ‘motor accident insurance’ – and the precise details of the policy vary, generally speaking, it covers your liability, and anyone driving your vehicle, for injuries caused to others in motor vehicle accident. On the same subject : Sedan vs. Coupe: Which is the cheapest car to insure?. It also generally covers you for any personal injury claims arising from an accident.

See details for your country or territory here:

Third party property damage car insurance

This is the basic level of third party insurance that drivers can opt for if they want coverage for damage they may cause to other people’s cars or property while driving. On the same subject : 24 auto insurance discounts worth asking about your insurance today. For one accident, most major insurance companies set a payout limit of $20 million.

Some policies may include a smaller amount (usually around $5,000) to cover your vehicle if the accident was caused by an uninsured driver and you can prove that they were completely at fault. But generally, basic third party insurance does not cover your own car.

Third party fire and theft

As the name suggests, this level of insurance adds coverage for damages to your car that result from fire or theft. Most insurers place a limit of around $10,000 on payouts in these circumstances, but you’ll generally be able to choose the exact amount that matches the value of your car. A higher level of coverage will increase your premium.

Some providers include additional types of coverage within this broader umbrella. This can include coverage for the cost of towing a fire or thief-damaged car to a repairer, renting a car while it’s being repaired or replaced (usually up to 21 days) and coverage for certain valuables stolen or damaged in your car (usually up to $500).

What Isn’t Covered by Third Party Insurance?

Even when you have CTP coverage and a basic third-party policy, your car will generally not be covered for any damage, including wear and tear, electrical or mechanical breakdowns, and any damage caused during illegal activities (eg driving under the influence )—unless do not opt for fire and theft protection and the request matches those parameters. If you want extra peace of mind, consider comprehensive car insurance.

Third Party Car Insurance vs Comprehensive

In short, comprehensive car insurance includes everything in a third party policy and adds coverage for your own wheels for a higher premium. What’s included will depend on your provider, policy and any optional extras you agree to add (for an additional fee). This could range from total replacement cover if your vehicle is written off, to cover for towing, travel and accommodation after an accident.

Like third party cover, comprehensive policies still don’t cover costs related to general wear and tear or breakdowns, and there are likely to be other exclusions: be sure to check your Product Disclosure Statement (PDS) for details.

How to Make a Third Party Car Insurance Claim

Be sure to record as many details as possible at the time of the accident – this provides evidence to support your insurance claim. After ensuring the safety of everyone involved and reporting the incident to the police, be sure to collect:

For a CTP claim, get medical help as soon as possible (keep all documentation) and then go through the relevant CTP provider or government authority to make the claim. If you are making a third party property claim, call your provider at the time of the incident to see if there are any steps you need to take (such as towing damaged cars to a specific repairer). Then submit your claim with supporting evidence as soon as possible.

Frequently Asked Questions (FAQs)

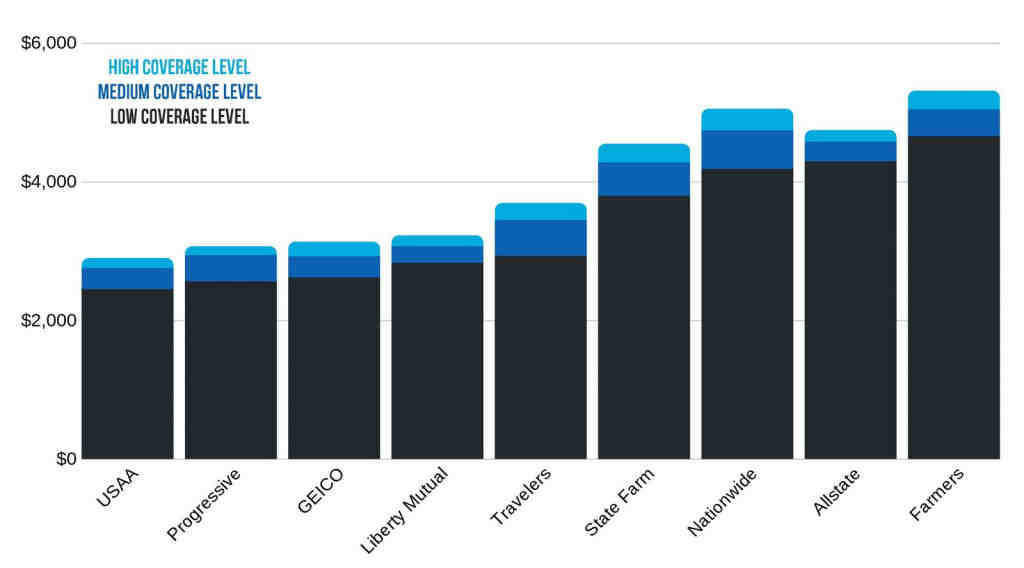

How much does third party car insurance cost?

CTP premiums depend on your location (state and zip code) and the size of your vehicle. There is a flat rate in states and territories where CTP is organized through government bodies, while premiums vary somewhat when private insurance companies administer the policy (although competition is still monitored by the government).

Other third-party policies may take additional factors into account when setting premiums, such as your age, gender, driving history, insurance history, and the make and model of your car. You may be able to access discounts if you stay loyal to the same insurance provider or don’t make any claims on your policy, so be sure to research what you’re eligible for.

How much third party car insurance do I need?

Every driver must take a CTP, but the rest is optional. Even if your car is on its last legs, it’s advisable to keep at least basic third-party property protection so you don’t rack up a huge repair bill for other people’s vehicles and property. If you live or drive in areas with a higher crime rate, you may want to consider a fire and theft policy, especially if you park your car on a street where it’s more prone to vandalism.

What are the disadvantages of third party insurance?

Like any insurance policy, there are always circumstances where your coverage may not apply. But the most obvious disadvantage is that your own car is generally not protected with this type of insurance.

There are three levels of car insurance: Fully comprehensive. Third party. Third party, fire and theft.

Does comprehensive car insurance include third party?

Comprehensive car insurance covers damage to your car, while third party, fire and theft does not cover when the accident is deemed to be your fault. Casco is a higher level of insurance and therefore you have more covered against fire and third party theft.

What is not covered by comprehensive car insurance? Comprehensive policies do not cover damage to another person’s property, any medical expenses or the value of items stolen from your car. Damage that is covered by collision insurance is not covered by comprehensive insurance.

Which policy is better comprehensive or third party?

Insurance companies in India offer two types of policies – comprehensive and third party policies. While third party cover is cheaper and only covers third party damages, comprehensive cover offers wider coverage and is therefore a bit expensive.

Why is third party more expensive than comprehensive?

This is because many high-risk drivers tend to seek third-party coverage as a way to reduce insurance costs. As a result, the statistics begin to skew towards more third-party policy claims. This means that the total cost of third party coverage could rise.

Is comprehensive or third party cheaper?

Not only could comprehensive insurance be cheaper than paying for third-party coverage, but if you’re in an accident, your insurance company may pay for the damage to your vehicle. You can get compensation when fault cannot be proven.

Which type of car insurance is best?

Which is the better car insurance? Taking out comprehensive car insurance is always advisable as it provides full protection not only for someone else’s car like third party insurance, but also for your own damage to your car as well as any injury to the driver owner.

What is the difference between 3rd party and comprehensive?

Compare: Comprehensive Insurance vs Third Party Insurance The main difference between third party insurance and comprehensive insurance is the type of cover it offers. While third party insurance only covers you against third party damages and losses, comprehensive car insurance will also cover your own damages.

What is included in comprehensive insurance?

Comprehensive coverage helps you pay to repair or replace your car if it’s stolen or damaged in something other than a collision. Comprehensive usually helps cover theft and damage caused by vandalism and natural disasters, falling objects, fire, hail, flood or animals.

What is comprehensive insurance vs collision?

Comprehensive coverage protects your vehicle from unexpected damage, such as a tree branch falling on it or hitting an animal, while collision coverage protects against collision with another vehicle or object.

Is Comprehensive same as full coverage?

The difference between comprehensive coverage and comprehensive insurance is that comprehensive coverage is a car insurance policy that includes both comprehensive and collision coverage along with the minimum state requirements. Comprehensive insurance covers damage to the car from things other than accidents, such as theft or fire.

What third party insurance covers Australia?

Compulsory Third Party Insurance (CTP), also known as Green Slip in New South Wales, provides cover for people who may be injured or killed in a motor vehicle accident involving your vehicle. This may include the driver of your vehicle, other drivers, passengers, pedestrians, cyclists and motorcyclists.

What does the third party cover? What is third party insurance? Third party only insurance (TPO), sometimes called third party insurance, should cover any damage caused to someone else’s vehicle if the accident is your fault. Third party coverage means you are also covered for any possible personal injury claims against you.

How much is 3rd party insurance in Australia?

How much does third party insurance cost? Third-party car insurance costs around $31 a month, according to our calculations based on 10 Australian insurers.

Is third party the cheapest?

No, people often assume that third party insurance will be the cheapest because it offers the least coverage, but this is not always the case. The cost of your premium will depend on your personal circumstances. For example, how old you are and where you live.

Why is third party insurance so expensive?

Insurers said premiums were higher on third-party policies because people who took them out were more likely to make a claim and claim higher amounts. Many of them have no choice but to accept this type of coverage.

What is third party insurance in Australia?

Compulsory Third Party Insurance (CTP), also known as a ‘Green Slip’ in NSW, is mandatory. If the driver of your car causes an accident in which someone else is injured, it will cover the cost of a claim. It does not cover any damage to your car or other people’s vehicles or property.

What does 3rd party mean on car insurance?

What is Third Party Car Insurance? Third party car insurance is the minimum level of cover you can take out for your vehicle. The policy covers you if you injure a third party or damage their property while driving. This includes the passengers in your car and any injuries they may sustain.

What is an example of third party insurance? Third party insurance covers an individual or business against loss caused by a third party. An example is car insurance that will compensate the insured if another driver causes damage to the insured’s car. The two main categories of third party insurance are liability coverage and property damage coverage.

What is called a Third Party liability?

Third party liability coverage is the part of an insurance policy that protects you if you are sued (or threatened to be sued) for physical injury or damage to someone else’s property.

What is another name for third party insurance?

Third party insurance, sometimes called works-only insurance, is a legal requirement for all vehicle owners under the Motor Vehicle Act. It is a type of insurance where the insurer offers protection against third party vehicle damage, personal property and physical injury.

Is there a difference between liability insurance and a third party liability?

For example, personal liability insurance pays if you cause damage or injury to someone else in any way other than using a motor vehicle. Third party insurance pays for any damage or injury you may cause to someone else with your car.

What are third party liabilities?

Liability to third parties means insurance, or part of insurance, that protects the first party (You – the policyholder) from legal liability to a third party (another person / property involved, ie another car involved in a traffic accident).

What is the difference between third party insurance and normal insurance?

Comprehensive car insurance protects your car and passengers and the car and passengers of a third party against financial losses caused by an accident. Independent third-party auto insurance covers only financial and legal liabilities arising from third-party claims.

What is full insurance and third-party insurance?

The main difference between third party insurance and comprehensive insurance is the type of coverage it offers. While third party insurance only covers you against third party damages and losses, comprehensive car insurance will also cover your own damages.

Which type of car insurance is best?

Which is the better car insurance? Taking out comprehensive car insurance is always advisable as it provides full protection not only for someone else’s car like third party insurance, but also for your own damage to your car as well as any injury to the driver owner.

Which policy is better comprehensive or third-party?

Insurance companies in India offer two types of policies – comprehensive and third party policies. While third party cover is cheaper and only covers third party damages, comprehensive cover offers wider coverage and is therefore a bit expensive.

Is there a difference between liability insurance and a third party liability?

For example, personal liability insurance pays if you cause damage or injury to someone else in any way other than using a motor vehicle. Third party insurance pays for any damage or injury you may cause to someone else with your car.

What liability is also called third party liability?

Third-party liability coverage – generally, any type of insurance that covers the legal liability of one party to another. For example, general commercial, business auto, and errors and omissions (E&O) liability policies provide third-party liability coverage.

What does liability to third parties mean?

(Insurance: General) Third party liability is insurance for money that the insured may have to pay to third parties if they accidentally cause injury, loss or damage to them. Travel agencies must carry third-party liability coverage for damages caused to their clients and service providers.

How do I know if my insurance is third-party?

The main difference between third party insurance and comprehensive insurance is the type of coverage it offers. While third party insurance only covers you against third party damages and losses, comprehensive car insurance will also cover your own damages.

Is the insurance company considered a third party? In the case of third party insurance, there are three parties. The first party is the insured. The other party is the insurance company. A third party is another person.

What is the difference between 1st party and 3rd party?

The compensation for first and third party insurance is different. A person submits a first party claim to their insurance company. In contrast, a person files a third-party claim with the insurance company of the driver who caused the accident.

What is a 1st party?

first party (not comparable) or relating to someone (first party) who is directly involved in a given transaction, such as a buyer or seller. Of or relating to a plaintiff in a suit.

What is 1st 2nd and 3rd party?

The first party is a person who self-certifies that they are competent. The other party is someone associated with the person (trainer/instructor/employer) who declares that the person is competent. A third party would require a completely independent party to declare the person competent.

What is the difference between first party and second party?

Examples of first-party data include user feedback, poll and survey results, purchase history, website and app activity, social media profiles and interactions, and customer relationship management systems. Second-party data comes from trusted brand partners (ie, other organizations).

What is a third-party in insurance?

A third party is someone other than the insured and the insurer. In liability insurance, the insurer provides a defense against third-party claims or lawsuits – hence the term “third-party insurance.”

What is difference between first and third party insurance?

The compensation for first and third party insurance is different. A person submits a first party claim to their insurance company. In contrast, a person files a third-party claim with the insurance company of the driver who caused the accident. Third party claims are also called liability claims.

What is mean by third party insurance?

Third-party insurance is basic insurance that only covers third-party damages. The recipient of the damage is not the policyholder but another person or vehicle affected by the first party’s insured car.