No driver wants to think about a disaster on the road, but everyone should be prepared for it. Third-party auto insurance ensures that you have financial protection to cover costs related to injuries or vehicle and property damage you may cause while driving.

Both mandatory and optional levels of third-party liability insurance generally won’t cover you if your own car is wrecked or rendered useless in an accident. So make sure you assess the value of your ride and its use before you opt for third-party liability insurance only.

If your budget-friendly wheels don’t justify the higher annual premium of a comprehensive policy with wider coverage, then a third party could be just the thing for you. To help you decide, here’s everything you need to know about third-party auto insurance.

Different types of third party car insurance

Contents

There are three tiers of third-party car insurance in Australia that cover you for a variety of driving conditions: mandatory third party (CTP), third-party property damage, and third-party fire and theft. Let’s explore each:

Compulsory third party car insurance (CTP)

It is mandatory to conclude CTP in Australia. While the name varies between states — sometimes referred to as “green slip” or “motorcycle damage insurance” — and precise policy details vary, it broadly covers your liability, and anyone who drives your vehicle, for injuries caused to others in a motor vehicle accident. This may interest you : UK car insurance companies feel pressure from rapidly rising repair costs. It also generally covers all personal injury claims arising from the accident.

Check out the details for your state or territory here:

Third party property damage car insurance

This is the basic level of third-party liability insurance that drivers can opt for if they want coverage for damage they may cause to other people’s cars or property while driving. On the same subject : What happens if you have 2 insurance policies?. For a single accident, most major insurance companies set a $20 million payout limit.

Some policies may include a smaller amount (usually around $5,000) to cover your own vehicle if the accident was caused by an uninsured driver and you can prove that they were completely at fault. But in general, the basic third-party insurance does not cover your own car.

Third party fire and theft

As the name suggests, this level of insurance adds coverage for damage to your car resulting from fire or theft. Most insurance companies put a limit of about $10,000 on payouts in these circumstances, but you can generally choose the exact amount that matches the value of your car. On the same subject : What Are Car Insurance Premiums? – Forbes Advisor. With a higher coverage ratio, your premium will go up.

Some providers include additional coverage within this broader umbrella. This may include the cost of towing your fire or car damaged by thieves to a repairer, a rental car while it is being repaired or replaced (usually up to 21 days), and coverage for certain valuables stolen from or damaged in your car (usually up to $500).

What Isn’t Covered by Third Party Insurance?

Even if you have CTP coverage and a third-party base policy, your car is generally not covered for damage, including wear and tear, electrical or mechanical breakdown, and damage caused during illegal activities (e.g., drunk driving)—unless you choose fire – and theft coverage and the claim meets those parameters. If you want extra peace of mind, consider comprehensive car insurance.

Third Party Car Insurance vs Comprehensive

In short, comprehensive car insurance includes everything in a third-party liability policy, plus cover for your own wheels at a higher premium. What’s included depends on your carrier, policy, and any optional extras you want to add (for an additional fee). This can range from total replacement coverage if your vehicle has been written off, to towing, travel and accommodation after an accident.

Like third-party coverage, comprehensive policies still don’t cover costs associated with general wear and tear or defects, and there are likely to be other exclusions: check your Product Disclosure Statement (PDS) for details.

How to Make a Third Party Car Insurance Claim

Be sure to record as much detail as possible at the time of the accident – this provides evidence to support your insurance claim. After ensuring the safety of everyone involved and reporting the incident to the police, make sure to collect the following:

For a CTP claim, seek medical attention as soon as possible (keep any documentation) and then go to the relevant CTP provider or government agency to file a claim. If you’re making a third-party property claim, call your provider at the time of the incident to see if there are steps you need to take (such as having damaged cars towed to a specific repairer). Then submit your claim with accompanying supporting documents as soon as possible.

Frequently Asked Questions (FAQs)

How much does third party car insurance cost?

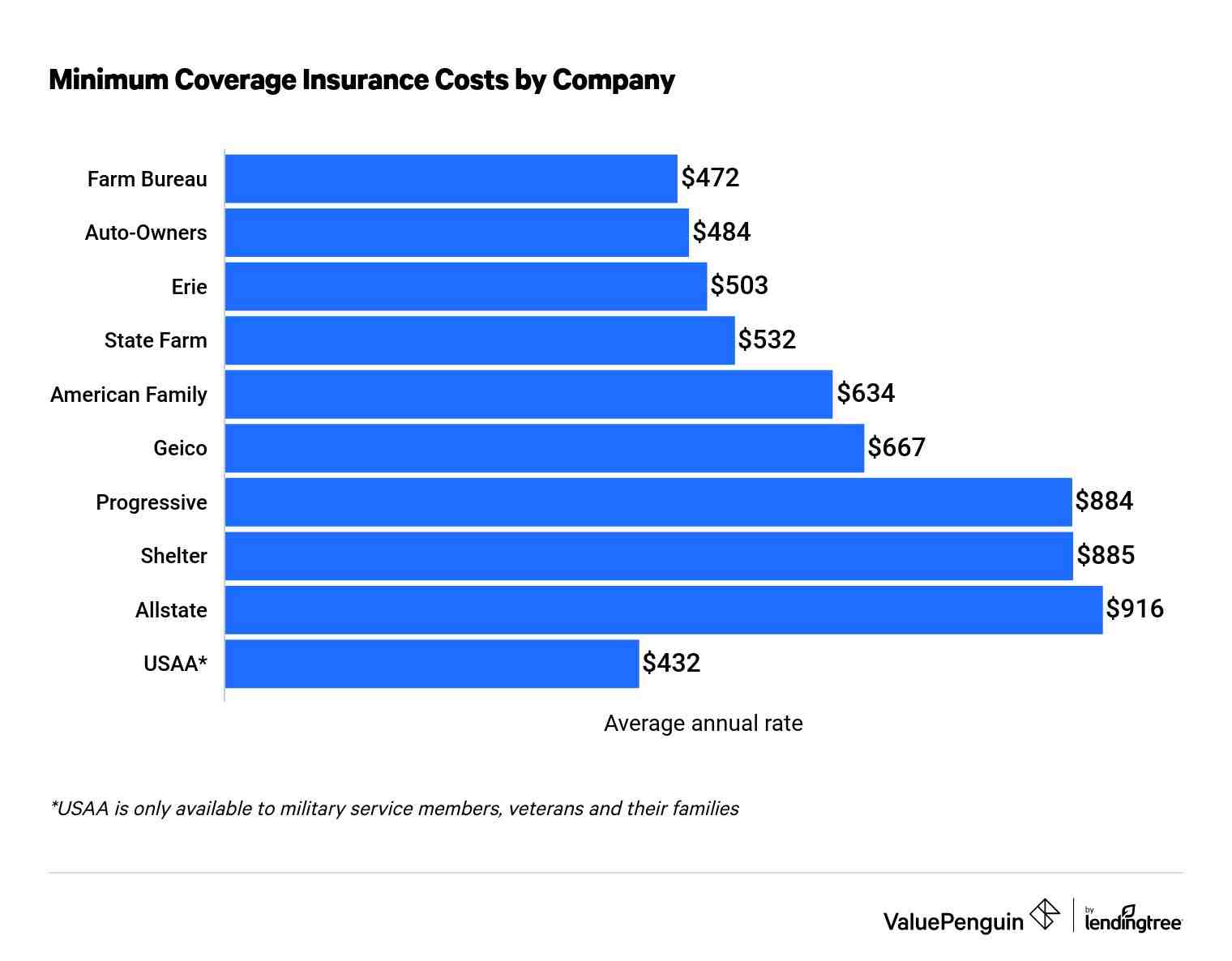

CTP premiums depend on your location (state and zip code) and the size of your vehicle. There is a flat rate in states and territories where CTP is organized by government agencies, while premiums vary slightly when private insurance companies administer policies (although the government still oversees competition).

Other third-party policies may consider additional factors when determining premiums, such as your age, gender, driving history, insurance history, and the make and model of your car. You may be able to get discounts for staying loyal to the same insurance company or not making claims on your policy, so be sure to research what you’re entitled to.

How much third party car insurance do I need?

Each driver must exit CTP, but the rest is optional. Even if your car is on its last legs, it is advisable to have at least basic third-party property coverage so that you don’t end up with a huge repair bill for the vehicles and property of others. If you live or drive in higher crime areas, consider a fire and theft policy, especially if you park your car on the street where it is more vulnerable to vandalism.

What are the disadvantages of third party insurance?

As with any insurance, there are always circumstances where your coverage may not apply. But the most obvious drawback is that your own car generally has no protection under this type of insurance.

Compulsory Third Party Insurance (CTP), also known as Green Slip in New South Wales, provides coverage for people who may be injured or killed in a motor vehicle accident involving your vehicle. Think of the driver of your vehicle, other drivers, passengers, pedestrians, cyclists and motorcyclists.

What are the 3 main types of insurance?

After that, we’ll take a closer look at the three main types of insurance: property, liability and life.

What are the 3 most important insurance policies?

What is the difference between 3rd party insurance and comprehensive?

Comprehensive car insurance protects your car and passengers and the car and passengers of the third party against financial loss as a result of an accident. Standalone third party auto insurance only covers financial and legal liabilities arising from a third party claim.

Which type of car insurance is best? What is better car insurance? It is always advisable to take out comprehensive car insurance as it not only fully protects someone else’s car like a third party car insurance policy but also your own damage to your car as well as any injuries suffered by the driver owner .

Can you change from third-party to comprehensive?

Overview. You can change the third-party liability car insurance into a comprehensive car insurance after you have had the inspection carried out and have paid the necessary premium for the comprehensive car insurance.

Can you upgrade to fully comp?

If you find that your third-party policy isn’t giving you the coverage you need, you can upgrade to full comprehensive coverage. All you need to do is contact your auto insurance company around the time of renewal and follow the necessary steps.

Is it worth getting comprehensive?

Comprehensive coverage can be a worthwhile investment if you have a newer car and want to help protect your finances in the event of theft or damage. Consider whether you can afford to pay for expensive repairs on your car or replace it. If not, comprehensive coverage may be worth the cost to you.

Is third party better than comprehensive?

The main difference between liability insurance and comprehensive insurance is the type of coverage that is provided. While third party liability insurance only covers you against damage and losses from third parties, comprehensive car insurance also covers your own damage.

Why is third-party more expensive than comprehensive?

That’s because many high-risk drivers tend to opt for third-party coverage as a way to lower their insurance costs. As a result, the statistics are beginning to skew toward a higher number of claims on third-party policies. This means that the total cost of third-party liability coverage may increase.

Is comprehensive or third party cheaper?

Not only can comprehensive insurance be cheaper than paying for third-party coverage, but if you have an accident, your insurance company can cover the damage to your vehicle. Even if the error cannot be proven, you can be compensated.

Is Comprehensive better than third party?

What is the difference between comprehensive and third-party car insurance against fire and theft? Comprehensive coverage protects your vehicle from accidental damage claims, but not fire and theft from third parties.

What is the difference between comprehensive car insurance and third party?

Comprehensive car insurance covers damage to your car, while third parties, fire and theft do not when an accident is considered your fault. Extensive is a higher insurance and therefore you have more covered than third-party liability, fire and theft.

Which is better fully comprehensive or third-party insurance?

The main difference between liability insurance and comprehensive insurance is the type of coverage that is provided. While third party liability insurance only covers you against damage and losses from third parties, comprehensive car insurance also covers your own damage.

What is the difference between comprehensive car insurance and third party?

Comprehensive car insurance covers damage to your car, while third parties, fire and theft do not when an accident is considered your fault. Extensive is a higher insurance and therefore you have more covered than third-party liability, fire and theft.

Does third party insurance cover other cars?

The car you want to drive must be covered by existing insurance and you must be authorized to drive it. The coverage for driving other cars is usually only available on comprehensive auto insurance, so if you have third party (or third party, fire and theft) coverage, you are not covered for driving other cars.

Can someone borrow my car and be insured? When you allow a friend, relative, or babysitter to borrow your vehicle, your insurance takes primary coverage. Even if the person borrowing your car has the best coverage available, your insurance will cover your vehicle. The borrower’s insurance policy may be able to provide backup coverage in certain situations.

What happens if someone else is driving my car and gets in an accident in CA?

If you allow someone else to take your car and they have an accident, your insurance company will be liable to pay the claim, based on your policy’s coverage. The claim will be flagged on your insurance file, which may affect your future insurance costs.

Who is liable in a car accident owner or driver?

The rule of thumb for the average driver is that the driver of the car that crashes into the back of another is always at fault. This means that 100% of the blame would then be attributed to the driver who was riding on the back of another vehicle. However, keep in mind that there are exceptions to this rule.

Who is liable in a car accident the driver or owner in California?

Who is responsible for the accident? California Vehicle Code Section 17150 states that civil liability for the accident rests with the other owner. The owner pays for the insurance. The coverage therefore also follows the vehicle and not the person.

Can someone drive my car if they are not on my insurance California?

Driving someone else’s car without car insurance California law requires one to have proof of financial responsibility or insurance to drive a vehicle. You cannot drive a vehicle in California without insurance, and you or the person you borrow from must have insurance to legally drive.

What is called a Third Party liability?

Civil liability coverage is the part of an insurance policy that protects you if you are charged (or at risk of being charged) for bodily harm or damage to someone else’s property.

Is there a difference between liability insurance and legal liability? For example, a liability insurance pays out if you cause damage or injury to another person in a way other than with a motor vehicle. The third-party liability insurance reimburses all damage or injury that you cause to someone else with your car.

Why called third party liability?

It is referred to as “third party cover” as the beneficiary of the policy is someone other than the two parties involved in the contract (the car owner and the insurance company). The policy offers no benefit to the insured.

Why is liability insurance sometimes called third party coverage?

Third-party liability insurance is essentially a form of liability insurance. Third party liability insurance is taken out by the insured (first party) with the insurance company (second party) to protect against the claims of another (third party).

What does it mean by third party liability?

Third party liability (TPL) refers to the legal obligation of third parties (for example, certain individuals, entities, insurers, or programs) to pay some or all of the expenses for medical assistance provided under a Medicaid state plan.

What is third party insurance called?

A liability insurance claim is sometimes referred to as a liability claim; if you have to file one, the driver’s liability coverage kicks in to cover damages and injuries. Nearly every state requires drivers to carry liability coverage, but minimum coverage amounts vary by state.

What are third party liabilities?

Third Party Liability means an insurance policy, or part of an insurance policy, which protects the first party (you – the policyholder) against legal liability to a third party (the other person/property involved, i.e. the other car involved in a traffic accident) .

What does liability to third parties mean?

(Insurance: General) Civil liability is insurance against money that an insured may be required to pay to third parties if they accidentally cause injury, loss or damage. Travel agents must provide cover against legal liability for damages to their customers and service providers.

What is an example of a third party claim?

A liability insurance claim is a claim made with someone else’s insurance company. For example, if a drunk driver runs a red light and collides with your vehicle, you will likely file a claim with the drunk driver’s insurance company. This would be a third party claim.

What is another name for third party insurance?

Third-party liability insurance, also known as ‘act-only’ insurance, is a legal obligation for all car owners under the Motor Vehicle Act. It is a type of insurance coverage where the insurer provides protection against damage to the vehicle from third parties, personal property and bodily injury.

What are the 3 parties in insurance?

There are three parties to a liability insurance. The first party is the insured. The second party is the insurance company. The third party is another person.

What is third party insurance called?

A liability insurance claim is sometimes referred to as a liability claim; if you have to file one, the driver’s liability coverage kicks in to cover damages and injuries. Nearly every state requires drivers to carry liability coverage, but minimum coverage amounts vary by state.