This is why your car insurance is about to get more expensive

Why is my insurance renewal so high?

Contents [hide]

Why did my car insurance go up when nothing changed?

As unfair as it may seem, you may experience an automatic rate increase due to insurance claims data in your zip code. On the same subject : Car insurance costs keep rising and it’s likely to get worse – here’s why. If your area has a high rate of theft, accidents or weather-related claims, it becomes riskier for an insurance company to cover drivers there.

Why are car insurance rates increasing in California? Newbill said that during the pandemic, many insurers paused increases because people were driving less. But now, because of the losses they have had, they are not taking new customers and in some cases they are dropping customers. Newbill also said some insurers have taken more drastic measures.

What is the best car insurance?

Why did my car insurance expire in Florida? More expensive accident claims, rising vehicle prices, repairs and uninsured drivers have led to the increases from insurance companies. Insurify data manager Chase Gardner explains what Florida can do to lower its insurance rates.

Why is my car insurance suddenly so high?

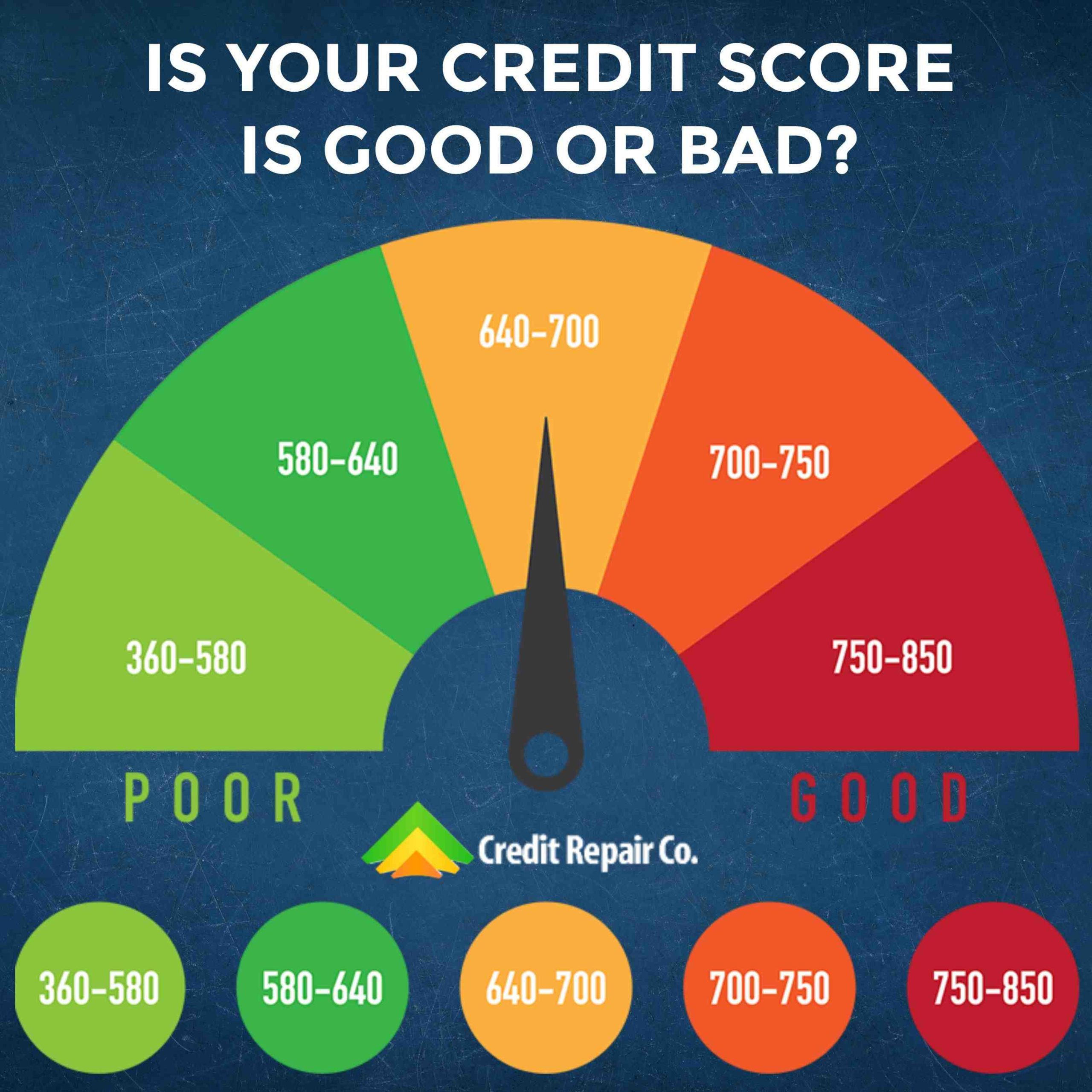

Auto insurance rates can change based on factors like claims, driving history, adding new drivers to your policy and even your credit score.

Why is car insurance so expensive right now? A confluence of forces was to blame: the Covid pandemic disrupted supply chains, pushed used car prices to record highs and made spare parts hard to come by; out-of-practice drivers emerging from lockdowns caused more serious wrecks; and technological advances like motion sensors made even the simplest parts, like a … On the same subject : New bill signed by Governor Murphy could raise car insurance costs.

Why did my car insurance go up in 2024? With costs rising across various parts of the auto industry, from higher average repair costs to continued supply chain issues, auto insurers have had to raise prices to make a profit.

Can car insurance randomly go up?

While it may seem arbitrary, there are actual reasons why you may see your price go up and down. Read also : Even after auto insurance reform, Detroit drivers have higher rates. Auto insurance rates can change based on factors like claims, driving history, adding new drivers to your policy and even your credit score.

Why did my car insurance go up when nothing changed? If you’re wondering why your car insurance went up, you’re not alone. One of the most common reasons is simply because your insurance company raised its rates. Whether to account for inflation, recover funds after a natural disaster or cover higher claims, many insurers raised rates in 2022.

Why is my car insurance so high? Your car insurance can be expensive because of your driving history, location, vehicle or credit history. Recent insurance claims and violations can increase your rates for three to five years. On the other hand, it is possible that you also just have a more expensive car insurance company.

Can insurance raise rates in the middle of a policy?

If you are in the middle of your term and decide to set e.g. optional towing and rental reimbursement coverage on your policy, this change will likely come at a price—and one you’ll have to pay before your term ends. By increasing your coverage, you may see an increase in your car insurance rate take effect immediately.

Can insurance companies raise premiums? Insurers must now publicly explain any rate increase of 15% or more before raising your premium. This does not apply to grandfathered plans. Look up your insurance plan to see its proposed and final rate increase.

Why did my car insurance go up when nothing changed? Why did my car insurance go up when nothing changed? Your car insurance may increase if the cost of repairs, labor or health care increases. This is because car insurance companies raise rates to account for higher costs in these areas.

Why did my insurance go up for no reason in 2024?

Your particular driver profile, which includes factors such as where you live, your age and your driving record, affects what you pay for car insurance. But rising auto repair costs and an increase in disaster-related claims are major reasons why auto insurance rates are rising for many drivers.

Is it normal for the insurance to increase every year? Annual increases are typical across the industry, but the way your risk factors are viewed by a particular company can vary. Understand your coverage and discounts to make sure you get the best price for the coverage you need.

Did auto insurance rates go up in 2024?

According to a report from Bankrate, average premiums for full coverage auto insurance hit $2,543 in 2024, up 26% from 2023. Not surprisingly, drivers across the United States are looking for ways to save. Nearly half (49%) of auto insurance customers are actively shopping for a new plan, according to J.D. Power.