UK car insurance companies feel pressure from rapidly rising repair costs

We’ve detected unusual activity from your computer network

Contents

- 1 We’ve detected unusual activity from your computer network

- 2 How often do you pay car insurance UK?

- 3 What is the 50 30 20 budget rule?

- 4 Is car insurance yearly or monthly?

- 5 Is car insurance in the UK expensive?

To continue, click the box below to let us know you’re not a robot. Read also : Is Geico owned by Allstate?.

Why did this happen?

Make sure your browser supports JavaScript and cookies and that you are not blocking them from being loaded. To see also : Which insurance share is best?. For more information, you can review our Terms of Use and Cookie Policy.

Need Help?

For queries regarding this message please contact our support team and quote the reference ID below. To see also : Which company has the cheapest option for full coverage?.

How often do you pay car insurance UK?

Most insurers will allow you to pay for your car insurance in one of two ways: a lump sum payment covering the next 12 months, or in 12 (or sometimes 11) monthly installments. If you choose the monthly payment option, you are essentially taking out a 12-month loan from the insurance company.

How often is car insurance paid? Premiums are usually paid monthly, every six months or annually and are determined by a variety of factors, including your driving record, age and the coverage you choose as part of your policy.

Do you pay car insurance once a month?

Most people either pay in full or choose monthly instalments, but your insurer may also offer quarterly payment plans, meaning you’ll pay every three months (four times a year). However, you might want to think twice before choosing one of the more common payment options.

Is insurance paid every month?

Insurance can be paid monthly or annually depending on your policy. Auto and home insurance usually come with multiple payment options based on the length of the policy, which can be one month, six or 12 months. You usually pay a monthly premium for health insurance.

Is it cheaper to pay car insurance annually or monthly?

Paying your insurance premiums annually is almost always the cheapest option. Many companies give you a discount for paying in full because it costs the insurance company more if the insured pays their premiums monthly because it requires manual processing each month to keep the policy active.

Is car insurance once a month?

Insurance companies sell car insurance policies in one-year or six-month increments. Insurers do not offer temporary insurance policies for those looking for coverage for a day, a few weeks or even a month.

How often is car insurance paid in UK?

Since salaries are often paid monthly, paying for car insurance in monthly installments usually fits well with people’s finances. In these cases, the annual premium is divided by 12, and then an additional fee can be added to pay in monthly installments.

How often does car insurance get paid?

Paying for car insurance on an annual basis is the standard payment option offered by most providers, but some may offer the option of splitting that annual cost into monthly payments.

Is car insurance paid annually or monthly?

Most major car insurance companies provide coverage for six months. This means that you will pay twice a year, at the beginning of each new term. This allows for easy policy changes on the policyholder side and also allows the carrier to increase premiums twice a year.

Do you pay car insurance yearly or monthly?

Most major car insurance companies provide coverage for six months. This means that you will pay twice a year, at the beginning of each new term. This allows for easy policy changes on the policyholder side and also allows the carrier to increase premiums twice a year.

Is car insurance every month or year?

Car insurance premium is another word for your car insurance bill. This is the amount you must pay to keep your auto insurance valid. Premiums can be paid in six-month or annual increments, although many insurance providers offer quarterly or even monthly premium options.

Is car insurance paid monthly or every 6 months?

When you buy an auto insurance policy, it remains valid for a certain period of time. The most common insurance periods are six months and 12 months. Depending on the car insurance company, you may be able to choose the policy period, but not all providers give you the option.

Can you pay for car insurance annually?

When shopping for car insurance, most carriers will give you multiple options for paying your policy premiums – monthly, every six months, or paying for the whole year at once.

What is the 50 30 20 budget rule?

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide the income after taxation and allocate it to consumption: 50% to needs, 30% to desires, and 20% to savings.

What are the three categories in the 50 30 20 budget? Our 50/30/20 calculator divides your take-home income into suggested spending into three categories: 50% of net pay for needs, 30% for wants, and 20% for savings and paying down debt.

When following the 50 20 30 budget Plan What does the 50 represent?

The 50/30/20 rule budget is a simple way of budgeting that does not include detailed budgeting categories. Instead, you spend 50% of your after-tax salary on needs, 30% on wants, and 20% on savings or paying down debt.

Why is the 50 20 30 rule easy for people to follow especially those who are new to budgeting and saving?

Flexible: Different people have different essential expenses, non-essential expenses and financial goals. The 50-20-30 budget can help people organize their finances regardless of these individual factors, making it a flexible personal budgeting choice.

Is the 50 30 20 rule weekly or monthly?

The 50/30/20 rule is a popular budgeting method that divides your monthly income into three main categories. Here’s how it breaks down: Monthly income after taxes. This figure is your income after taxes.

What is the 50% method?

The 50% rule is a guideline used by real estate investors to estimate the profitability of a given rental unit. As the name suggests, the rule involves deducting 50 percent of the property’s monthly rental income when calculating the potential profit.

How does the 50 30 20 rule distribute your income?

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you manage your money effectively, simply and sustainably. A basic rule of thumb is to divide your monthly income after taxes into three spending categories: 50% for needs, 30% for wants, and 20% for savings or paying off debt.

What percentage of your income should go to what?

At least 20% of your income should go to savings. Meanwhile, another 50% (maximum) should go to necessities, while 30% goes to discretionary items. This is called the 50/30/20 rule and it gives you a quick and easy way to budget your money.

How do I divide my paycheck?

Let’s break it down: first the basics, second savings and investments, and third entertainment.

- Keep essentials to about 50% of your salary. …

- Dedicate 20% to saving and paying off debt. …

- Use the remaining 30% as you wish – but don’t track expenses.

Is the 50 30 20 rule weekly or monthly?

The 50/30/20 rule is a popular budgeting method that divides your monthly income into three main categories. Here’s how it breaks down: Monthly income after taxes. This figure is your income after taxes.

Why is the 50 20 30 rule easy for people to follow especially those who are new to budgeting and saving?

Flexible: Different people have different essential expenses, non-essential expenses and financial goals. The 50-20-30 budget can help people organize their finances regardless of these individual factors, making it a flexible personal budgeting choice.

What is the easiest budgeting method?

1. Budget 50/30/20. The 50/30/20 budget – sometimes known as the balanced money technique or written as the 50.20/30 rule – is easily one of the most widely used budgeting methods.

Should the 50 30 20 rule apply to every budget Why or why not?

Some experts say that 50/30/20 is not a good rule of thumb at all. “This budget is restrictive and does not take into account your values, lifestyle and financial goals. For example, 50% for needs is not enough for those in high cost of living areas.

What are the rules for saving money?

How the 80/20 rule works. The first 20% of your salary should automatically go toward investments, savings, or paying down debt, starting with an emergency fund that covers three to six months of your expenses. By doing this, you pay yourself first by putting money aside for your long-term financial goals.

Is car insurance yearly or monthly?

Most insurance companies allow you to choose between paying your car insurance premium monthly, every six months, or annually. You can get a discount if you choose to pay the full amount upfront for a six-month or annual policy.

Is car insurance monthly or yearly? Car insurance premium is another word for your car insurance bill. This is the amount you must pay to keep your auto insurance valid. Premiums can be paid in six-month or annual increments, although many insurance providers offer quarterly or even monthly premium options.

Are insurance rates monthly or yearly?

An insurance premium is a monthly or annual payment you pay to an insurance company to keep your policy active. Premiums are required for every type of insurance, including health, disability, auto, renters, homeowners and life insurance.

annual premiums. Monthly premiums are paid once a month, on the day of your billing cycle. While splitting premiums is better for some budgets, missing payments can risk a policy lapse. With annual premium payments, you only pay one lump sum to your insurer each year.

Is insurance cheaper if you pay yearly?

Paying your insurance premiums annually is almost always the cheapest option. Many companies give you a discount for paying in full because it costs the insurance company more if the insured pays their premiums monthly because it requires manual processing each month to keep the policy active.

Is insurance yearly or monthly?

Insurance can be paid monthly or annually depending on your policy. Auto and home insurance usually come with multiple payment options based on the length of the policy, which can be one month, six or 12 months. You usually pay a monthly premium for health insurance.

Do you pay insurance on a car monthly?

Auto insurance premiums are usually paid monthly, semi-annually or annually. This payment system means that your car insurance is always paid in advance and you have cover for your vehicle until the next billing cycle.

How much is a monthly payment for car insurance?

The national average cost of car insurance is $1,630 per year, according to NerdWallet’s rate analysis for 2022. That works out to an average car insurance rate of about $136 per month.

Is it cheaper to pay car insurance annually or monthly?

Paying your insurance premiums annually is almost always the cheapest option. Many companies give you a discount for paying in full because it costs the insurance company more if the insured pays their premiums monthly because it requires manual processing each month to keep the policy active.

Do I pay car insurance every month?

Car Insurance Premium Overview Car insurance premium is another word for your car insurance bill. This is the amount you must pay to keep your auto insurance valid. Premiums can be paid in six-month or annual increments, although many insurance providers offer quarterly or even monthly premium options.

Is car insurance monthly or quarterly?

The full premium may not be in one month’s budget. Sometimes even low-rate drivers who aren’t high-risk drivers need to split it up a bit, and that’s where payment plans come in. You can pay monthly, quarterly, bi-annually and more.

How do you create an auto-entrepreneur in the US?

Information you need to obtain auto-entrepreneur status in the United States

- Pieces of identity. Copy of passport or CIN.

- Payment terms. Payment 50% according to the order.

- Processing time. Obtaining the status within 5 working days.

What is auto-entrepreneur in English?

An auto-entrepreneur, now officially called a micro-entrepreneur, is a sole trader or independent activity, registered under the name of an entrepreneur. As such, there is no distinction between an owner and a business, meaning that the entrepreneur is responsible for the debts the business creates.

What is the difference between auto-entrepreneur and micro entrepreneur?

Auto-entrepreneur: with maximum annual turnover, without VAT and a fixed rate of social benefits based on turnover. Micro-enterprise: with maximum annual turnover, without VAT and social benefits based on losses.

Is car insurance in the UK expensive?

According to MoneySupermarket (Opens in new window), the average cost of car insurance in the UK for comprehensive cover was £412 a year at the end of 2021. While this may seem like a lot, car insurance is actually falling and this is 10.4% lower than at the end of 2020

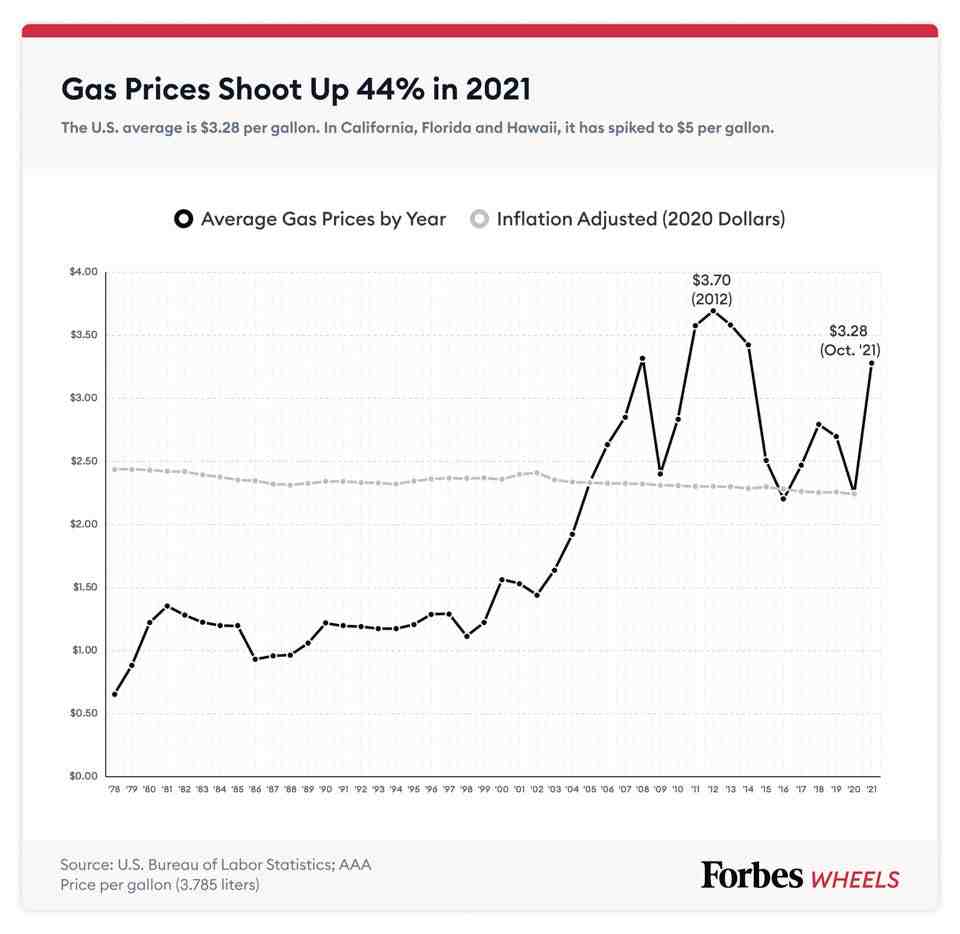

Why is car insurance expensive in the UK? The number of requests for motor vehicles and payments has also decreased. However, as the roads become busier again, and other factors such as rising vehicle repair costs and personal injury costs, car insurance premiums could rise again. Learn more about how the coronavirus has affected car insurance.

Is car insurance cheaper with UK driving Licence?

It’s also worth noting that insurance ends up being cheaper when you have a full driver’s license as opposed to an automatic-only license.

Do insurance companies check your license UK?

Although providing a copy of your driving license and other documents may be a minor hassle, insurers have a legitimate reason to check the DVLA licence. In fact, ensuring that all policyholders provide complete and accurate information about past convictions and penalties can actually save you money.

Can I get car insurance in the UK with a foreign license?

Can I get car insurance with an international driver’s license? You can take out UK car insurance with a foreign driving licence, although this is often more expensive as insurers tend to view international drivers as a higher risk.

Can I get insured in Ireland with a UK licence?

Q. I have a UK driving license will this affect my insurance? Yes. In the event of a no-deal Brexit, the National Driving Licensing Service (NDLS) in Ireland advises that if you have a UK driving license and live here in Ireland, you will not be able to continue driving in Ireland on that licence.

How much is car insurance UK for a year?

What is the average cost of car insurance in the UK? The average price for comprehensive car insurance in the UK is £430 per year (Association of British Insurers data Q2 2021). For drivers under the age of 25, the price can jump significantly higher, to around £851 a year, according to the Statista study.

How much is car insurance for a new driver UK average?

Car insurance for new drivers can be expensive. For the youngest new drivers between the ages of 17-20, annual insurance premiums average around £1,800 and while car insurance for 21-25 year olds isn’t as expensive, it still costs more than £1,000 on average.

How much do you spend on car insurance a year?

Drivers in the United States pay an average of $1,771 a year for full coverage auto insurance, or about $148 a month, according to Bankrate’s Quadrant Information Services analysis of average quoted premiums in 2022. Minimum coverage costs an average of $545 per year.

How much is car insurance per month UK?

The average cost of car insurance in the UK was £526 in 2020, according to our data. That’s the equivalent of £43.83 a month, although interest will be added to that if you choose to pay monthly, so everything will cost more. But what’s surprising is that higher levels of coverage are actually cheaper.

Is London expensive for car insurance?

According to our research, Londoners pay the most for car insurance. On average, quotes from the capital resulted in a whopping 78% increase, compared to the typical policy price. This means you could be paying up to £362 more than the average UK driver – a shocking £792 in total – simply by living in London.

How much does it cost to drive a car in London?

A congestion charge costs £15 if you pay in advance or on the day. It costs £17.50 if you pay by midnight on the third day after travel. You can pay the congestion charge online, by automatic payment, by app or by phone. If you don’t pay the congestion charge, you’ll be fined £160.

Does it cost more to insure a car in London?

According to our research, Londoners pay the most for car insurance. On average, quotes from the capital resulted in a whopping 78% increase, compared to the typical policy price.

Why is car insurance expensive in London?

Drivers in London pay almost a penny more per liter of petrol than drivers in Scotland. This trend continues for car insurance costs.