UK motor insurance premiums in first quarter at highest level since 2020 – survey

Vehicles sitting in traffic near the Blackwall Tunnel, in London, England, November 18, 2020. REUTERS/Simon Dawson

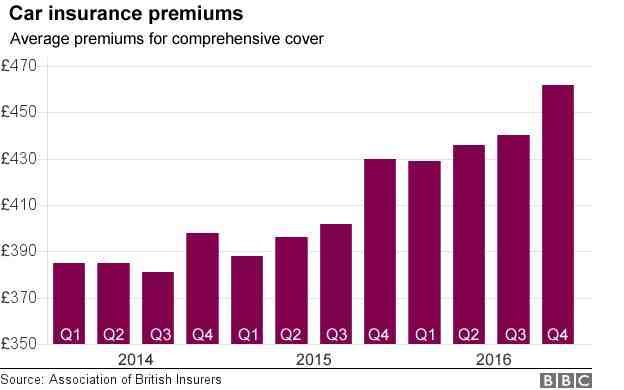

April 21 (Reuters) – The cost of a comprehensive car insurance policy in Britain touched an 18 -month high in the first quarter and will continue to increase on the back of rising inflation and regulatory changes, a survey showed on Thursday.

UK motorists now have to pay about 550 pounds ($ 718.08) for a comprehensive car insurance premium, according to the latest index from price comparison site Confused.com in association with insurance broker Willis Towers Watson.

Car insurance premiums have been down for a year until the fall of 2021 as the stalls hinder motorists on the road and competition in the UK car insurance industry increases.

Register now for FREE unlimited access to Reuters.com

Contents

- 1 Register now for FREE unlimited access to Reuters.com

- 2 Register now for FREE unlimited access to Reuters.com

- 3 Is it cheaper to insure an older car?

- 4 What is the lowest insurance group?

- 5 What is the most common car insurance policy?

- 6 How many types of car insurance is there?

“As people return to a more normal work and life pattern, we see this premium reduction gradually subsiding,” said Tim Rourke, Head of UK P&C Pricing, Products, Claims and Underwriting at WTW. On the same subject : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have.

Rourke also hopes premiums will continue to rise through 2022 as Britain battles high inflation and insurers face new rules by the Financial Conduct Authority that ensure consumers renewing policies are not charged more than new customers. read more

The British annual inflation rate rose to 7% in March, the highest since 1992. read more

“Prices could continue to increase simply because insurers will likely face more claims than last year, as people start running more frequently, and this just means insurers need to be as competitive as possible,” said Louise O’Shea, CEO. on Confused.com.

“And it’s the turn of consumers to keep shopping, because the assumption that renewal prices won’t increase is clearly incorrect.”

Eighteen -year -old drivers continue to pay most of all demographics, taking their average premiums to 1,419 pounds, the survey showed.

Register now for FREE unlimited access to Reuters.com

Reporting by Sinchita Partners in Bengaluru; Edited by Devika Syamnath To see also : How auto insurance claims are deposited.

Our Standards: Thomson Reuters Trust Principles.

Is it cheaper to insure an older car?

Older cars are cheaper for insurance than newer cars, all the same. To see also : Car insurance costs are now higher for many Michigan drivers than in 2019 – and less fair for Detroit drivers. Older vehicles are cheaper to insure because older cars are less valuable, so insurance companies don’t have to pay more if there is a total loss.

Why are older cars more expensive insurance? Older Cars Are Less Expensive to Repair That’s because newer model cars are usually made of more expensive materials, which is why prices are more common. Because older cars cost less to repair, insurers factor those repair prices down into their premiums.

What is the lowest insurance group?

Each car belongs to one of 50 car insurance groups, which are used by insurers to help determine the premiums you pay. Cars in group one are the cheapest to insure, while those in group 50 are the most expensive – and the more powerful and luxurious your car is, the higher the group will be.

Is 9e low insurance group? Cars in Group 9 insurance are still among the cheapest cars in the market for insurance. Category 9 can be a good match for having a good insurance deal as well as a stronger vehicle than in a lower insurance group.

Is Insurance Group 1 high or low?

Cars that are found in Group 1 are usually the cheapest for insurance, because they score well on the series of factors used to calculate the group. These cars are usually the cheapest to buy, but, importantly, they are also some of the cheapest to repair if they are damaged in an accident.

Is insurance group 7 high?

Cars in insurance group 7 are the cheapest cars for insurance in the market. They usually have less powerful engines and lower known repair costs.

What cars are in the group 1 insurance?

Cars in Insurance Group 1

- Hatchback Vauxhall Corsa. Pros – a solid small car, well made and has been popular with young drivers for over a decade. …

- Fiat Panda. …

- Citroén C1. …

- Nissan Micra. …

- Smart ForFour. …

- Chevrolet Spark. …

- Skoda Citigo. …

- Volkswagen Up.

What is the top insurance group?

| Ranked | Name of Insurance Company | domicile |

|---|---|---|

| 1 | UnitedHealth Group Incorporated (1) | United States |

| 2 | Ping An Ins (Group) Co. of China Ltd. | CHINESE |

| 3 | AXA S.A. | France |

| 4 | China Life Insurance (Group) Company | CHINESE |

Is Insurance Group 7 high?

Cars in insurance group 7 are the cheapest cars for insurance in the market. They usually have less powerful engines and lower known repair costs.

What is the most common car insurance policy?

Personal injury liability (BI) coverage is the most common type of car insurance because it is required in almost every country.

What is the best level of car insurance? Fully comprehensive This is the highest level of insurance you can have. It covers you, your car and others who were involved in the accident. It includes all third party fire and theft policy coverage, but also protects you as a driver and can pay for damage to your car.

What is the cheapest car insurance type?

State minimum liability coverage is the cheapest type of car insurance. Liability insurance is only $ 1,333 cheaper on average than a full coverage policy.

What are the 3 types of car insurance?

The three types of car insurance that are universally offered are liability, comprehensive, and collision insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured motorcycles, but they are not available in every country.

What is the most basic car insurance coverage?

While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured / underinsured motorist.

What is the basic car insurance called?

Basic car insurance is often known as liability insurance. Terms vary based on circumstances, but basic car insurance can be broken down into two main types of liability insurance: personal injury and property damage.

What is the most important insurance for car owners?

Currently, there are several types of car insurance. The most important is responsible, comprehensive and collision coverage. We would call them the Big Three. Think of them as basicallyâ € ”coverage that you cannot afford without.

What is the important of car insurance?

Having car insurance is required by law in most states. If you are at fault in a car accident, the auto liability coverage required in your car insurance policy helps pay for covered losses, such as the other party’s medical bills and damage to the vehicle or other property caused by the accident.

What is the most important coverage for car insurance?

The most important coverage should be your state’s minimum liability and property damage coverage. More than anything else, you need to maintain car insurance to protect yourself legally driving. You risk losing your driver’s license and driving fines without it.

What are 3 types of insurances you should buy when owning a car?

The three types of car insurance that are universally offered are liability, comprehensive, and collision insurance. Drivers can still purchase other types of car insurance, such as personal injury protection and uninsured motorcycles, but they are not available in every country.

How many types of car insurance is there?

The six common car insurance options are: auto liability coverage, uninsured and uninsured motorist coverage, comprehensive coverage, collision coverage, medical payment coverage and personal injury protection. Depending on where you live, some coverages are mandatory and some options.

What are the 8 types of car insurance? Main 8 Types Of Car Insurance Coverage To Know

- Liability-Only coverage.

- Collision coverage.

- Property Damage Liability.

- Responsible for your injuries.

- Comprehensive Coverage.

- Uninsured/Underinsured Motorist coverage.

- Medical Payment Coverage.

- Personal injury protection.

What are the 5 basic types of auto insurance?

The most common types of car insurance coverage include liability, collision, personal injury protection, uninsured and underinsured motorists, comprehensive, and medical payments.

What are the 4 basic coverages of the standard auto policy?

While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured / underinsured motorist.